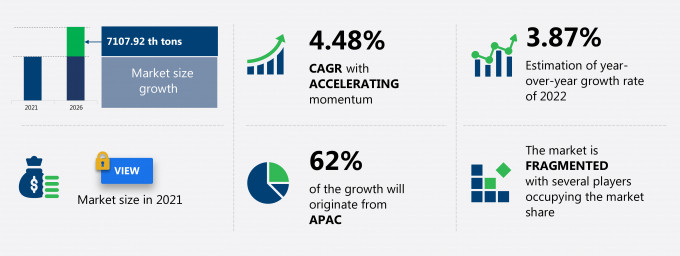

The airfreight forwarding market share is expected to increase by 7107.92 thousand tons from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 4.48%.

This market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers market segmentation by application (manufacturing industry, retail industry, and other industries) and geography (APAC, North America, Europe, the Middle East, Africa, and South America). The market report also offers information on several market vendors, including AP Moller Maersk AS, Agility Public Warehousing Co K.S.C.P, Aramex International LLC, C.H. Robinson Worldwide Inc., CEVA Logistics AG, CJ Logistics Corp, Deutsche Bahn AG, Deutsche Post DHL Group, DSV Panalpina AS, FedEx Corp., Gati Ltd, GEODIS, Kerry Logistics Network Ltd., Kuehne Nagel International AG, Nippon Express Holdings Inc, Omni Logistics LLC, Singapore Post Ltd, SINO Group, United Parcel Service Inc., and XPO Logistics Inc. among others.

What will the Airfreight Forwarding Market Size be During the Forecast Period?

Download Report Sample to Unlock the Market Size for the Forecast Period and Other Important Statistics

Airfreight Forwarding Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The growing e-commerce sector is notably driving the market growth, although factors such as the growing global rail logistics market may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the airfreight forwarding industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Market Driver

The growing e-commerce sector is notably driving the global market growth. The growing Internet penetration and improving purchasing power parity across all the regions are primarily bolstering the development of the global e-commerce market. The US and China are the key contributing countries to the global e-commerce market. For instance, in 2018, the business-to-customer (B2C) e-commerce industry in the US accounted for more than 10% of the overall retail sales in the US. Furthermore, the US e-commerce market is expected to grow significantly during the forecast period. The augmented online sales are expected to positively influence the volume of global airfreight during the forecast period.

Key Market Trend

Increasing US agricultural export to China is the key market trend driving global market growth. The US exports of agricultural products to China recovered in 2016 after a fall in 2015. In 2020, agricultural products from the US worth about $26.5 billion were exported to China. The products included meat, cut flowers, seafood, and others. In 2017, China reduced the value-added tax on primary agricultural products to 11% from 13%. The tax reduction is further expected to enhance the imports of agricultural products in China. This, in turn, is expected to increase the demand for airfreight forwarding service because quick delivery is required to prevent the spoilage of agricultural products.

Key Market Challenge

The growing global rail logistics market is the major challenge impeding the global market growth. The global rail logistics market is expected to register moderate growth during the forecast period. The growing rail infrastructure and low transportation costs are the main factors triggering the growth of the market. The freight volumes, especially that of the dry cargo, are exhibiting an upward trend since 2009. For instance, in 2018, about 19% of cereal grains transported within the US were through intermodal rail. In Europe, the demand for rail logistics services is from pharmaceutical and electronic component manufacturers. The rise in rail freight volumes is primarily because of its lower operating cost compared with sea freight and air freight. The growth of rail logistics operations is expected to be a threat to the vendors of the global market during the forecast period.

This market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global airfreight forwarding market as a part of the global air freight and logistics market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the market during the forecast period.

Who are the Major Airfreight Forwarding Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AP Moller Maersk AS

- Agility Public Warehousing Co K.S.C.P

- Aramex International LLC

- C.H. Robinson Worldwide Inc.

- CEVA Logistics AG

- CJ Logistics Corp

- Deutsche Bahn AG

- Deutsche Post DHL Group

- DSV Panalpina AS

- FedEx Corp.

- Gati Ltd

- GEODIS

- Kerry Logistics Network Ltd.

- Kuehne Nagel International AG

- Nippon Express Holdings Inc

- Omni Logistics LLC

- Singapore Post Ltd

- SINO Group

- United Parcel Service Inc.

- XPO Logistics Inc.

This statistical study of the market encompasses successful business strategies deployed by the key vendors. The market is concentrated and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- A.P. Moller Maersk AS - Freight forwarding business is handled by Damco.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Airfreight Forwarding Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Airfreight Forwarding Market?

For more insights on the market share of various regions Request PDF Sample now!

62% of the market's growth will originate from APAC during the forecast period. China, Japan, and India are the key markets for airfreight forwarding in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Increasing demand in the retail and electronics industries in the region will facilitate the market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Application Segments in the Airfreight Forwarding Market?

To gain further insights on the market contribution of various segments Request a PDF Sample

The market share growth by the manufacturing industry segment will be significant during the forecast period. The rising demand for consumer electronics, automotive products, and medical devices is the key market growth driver in the manufacturing industry. With these developments in the manufacturing industry of electronics, automobiles, and healthcare, the demand for fast and efficient logistics will also increase. Thus, the demand for air freight forwarding will increase during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the market size and actionable market insights on post COVID-19 impact on each segment.

|

Airfreight Forwarding Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.48% |

|

Market growth 2022-2026 |

7107.92 thousand tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.87 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 62% |

|

Key consumer countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AP Moller Maersk AS, Agility Public Warehousing Co K.S.C.P, Aramex International LLC, C.H. Robinson Worldwide Inc., CEVA Logistics AG, CJ Logistics Corp, Deutsche Bahn AG, Deutsche Post DHL Group, DSV Panalpina AS, FedEx Corp., Gati Ltd, GEODIS, Kerry Logistics Network Ltd., Kuehne Nagel International AG, Nippon Express Holdings Inc, Omni Logistics LLC, Singapore Post Ltd, SINO Group, United Parcel Service Inc., and XPO Logistics Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Airfreight Forwarding Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive market growth during the next five years

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behaviour

- The growth of the airfreight forwarding industry across APAC, North America, Europe, Middle East, Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch