Airport Non-Aeronautical Revenue Market Size 2025-2029

The airport non-aeronautical revenue market size is forecast to increase by USD 43.99 billion, at a CAGR of 8.4% between 2024 and 2029.

- The market is witnessing significant growth, driven by the evolution of sophisticated airport terminals and the emergence of airport cities and aerotropolis concepts. These developments offer extensive opportunities for retail, food and beverage, and advertising sectors, among others. However, the market penetration in this cost-intensive industry poses a considerable challenge for new entrants. Airport authorities and businesses must invest heavily in infrastructure, security, and regulatory compliance to establish a presence. Furthermore, the competition from existing players, who have already built a strong customer base, adds to the complexity of market entry.

- To capitalize on the opportunities and navigate these challenges effectively, companies need to focus on offering unique value propositions, leveraging technology, and building strategic partnerships with airport authorities and other stakeholders. The potential rewards for those who successfully navigate this dynamic market are substantial, as the demand for non-aeronautical revenue streams continues to grow alongside passenger traffic.

What will be the Size of the Airport Non-Aeronautical Revenue Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ongoing need for improved operational efficiency, enhanced passenger experience, and increased revenue generation. Yield management strategies are employed to optimize revenue streams from various sectors, including retail concessions, rental cars, and advertising contracts. Security protocols and space optimization are integral to risk management, ensuring a safe and efficient airport environment. Supply chain and inventory management systems enable seamless operations, while queue management and parking management systems address passenger flow and convenience. Automation technology, such as self-service kiosks and mobile applications, streamline processes and enhance the passenger experience. Maintenance services and revenue management systems ensure optimal performance and cost optimization, while cleaning services and safety standards maintain a clean and secure airport.

Sustainability initiatives, including energy management and environmental standards, are increasingly important in today's business landscape. Key performance indicators, IT services, and service level agreements are essential for effective customer relationship management and business intelligence. Regulatory compliance and lease negotiation are critical components of airport operations, as are marketing campaigns and passenger flow management. Airport hotels, airport lounges, and ground transportation offer additional revenue opportunities, while waste management and passenger amenities contribute to overall passenger satisfaction. Digital transformation and data analytics are key drivers of innovation, with predictive modeling and pricing strategies playing a crucial role in optimizing airport operations and revenue generation.

How is this Airport Non-Aeronautical Revenue Industry segmented?

The airport non-aeronautical revenue industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Concessionaries

- Parking and car rentals

- Land rentals

- Terminal rent by airlines

- Other services

- Business Segment

- Commercial development

- Advertising

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The concessionaries segment is estimated to witness significant growth during the forecast period. Airports are experiencing significant growth and transformation, with a focus on enhancing the passenger experience and maximizing non-aeronautical revenue. Airport operators are capitalizing on increasing passenger traffic by partnering with concessionaires to lease out retail and dining spaces in terminals and surrounding areas. These partnerships generate substantial revenue through lease agreements, service level agreements, and various fees. Brand management and tenant mix are crucial elements in attracting and retaining passengers. Risk management and security protocols ensure a safe and secure environment. Automation technology, inventory management, and pricing strategies optimize operational efficiency and cost savings. Cleaning services, maintenance, and IT services maintain the airport's infrastructure and support digital transformation.

The Concessionaries segment was valued at USD 20.29 billion in 2019 and showed a gradual increase during the forecast period. Key performance indicators monitor the financial performance of these partnerships and services. Yield management and revenue management systems maximize revenue from passenger traffic. Sustainability initiatives, advertising contracts, and customer loyalty programs contribute to a positive passenger experience and environmental standards. Advertising revenue from digital signage, mobile applications, and marketing campaigns complements traditional retail offerings. Duty-free shops, self-service kiosks, and rental cars cater to passengers' needs and preferences. Supply chain and queue management ensure seamless passenger flow. Parking management systems and ground transportation options provide convenient access to the airport. Safety standards, airport lounges, and passenger amenities enhance the overall passenger experience.

Regulatory compliance and concession agreements govern the partnerships and lease negotiations. In the digital age, airports are integrating technology to optimize revenue, improve passenger flow, and create a more personalized experience. Energy management, baggage handling, and commercial real estate development are essential aspects of airport growth and modernization. The goal is to create a harmonious balance between operational efficiency, customer satisfaction, and a strong return on investment. Airport non-aeronautical revenue is a dynamic and evolving market, requiring continuous adaptation and innovation.

Regional Analysis

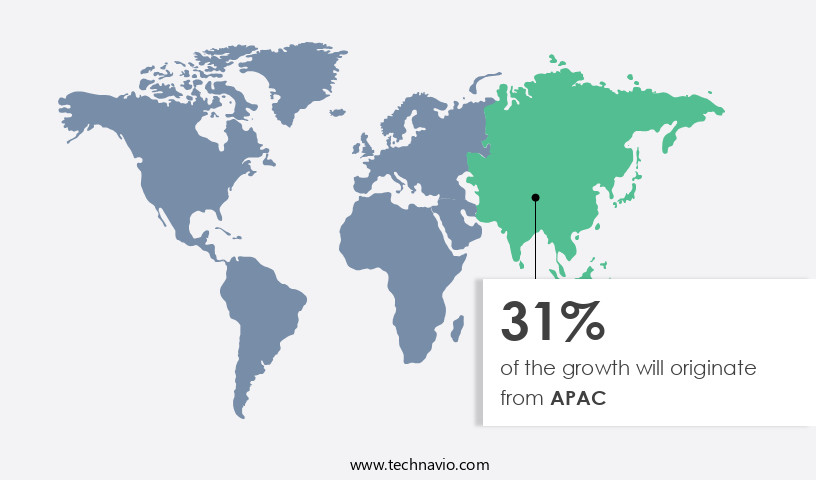

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic aviation industry, APAC stands out as a significant region of growth, with airport infrastructure expansion and commercialization becoming a key focus. Airport authorities, real estate agents, and commercial organizations are increasingly investing in new airport projects, expanding existing facilities, and developing airport cities. These initiatives aim to capitalize on the increasing demand for air travel and generate substantial non-aeronautical revenue streams. Airport signage, financial performance, predictive modeling, tenant mix, brand management, risk management, cleaning services, automation technology, key performance indicators, IT services, customer relationship management, advertising revenue, duty-free shops, self-service kiosks, yield management, security protocols, space optimization, supply chain, queue management, parking management systems, operational efficiency, maintenance services, revenue management systems, rental cars, customer loyalty, retail concessions, sustainability initiatives, advertising contracts, occupancy rates, digital transformation, energy management, airport hotels, safety standards, airport lounges, inventory management, pricing strategies, cost optimization, lease agreements, marketing campaigns, passenger flow management, security services, mobile applications, business intelligence, data analytics, regulatory compliance, concession agreements, lease negotiation, car parking, ground transportation, waste management, passenger experience, passenger amenities, environmental standards, return on investment, and customer satisfaction are all integral components of this evolving market.

Automation technology, digital transformation, and revenue management systems are essential elements that contribute to operational efficiency and cost optimization. Airport authorities and commercial organizations are also prioritizing sustainability initiatives, including energy management and waste management, to minimize their carbon footprint and cater to the growing demand for eco-friendly practices. The integration of IT services, such as IT infrastructure, data analytics, and business intelligence, plays a crucial role in enhancing passenger experience, optimizing airport operations, and improving customer satisfaction. Service level agreements, marketing campaigns, and passenger flow management are essential aspects of customer relationship management, ensuring a seamless and enjoyable airport experience for travelers.

Security protocols, including queue management, passenger flow management, and safety standards, are of utmost importance to maintain a secure and efficient airport environment. Airport lounges, retail concessions, and rental cars provide additional revenue streams and contribute to the overall commercialization of airports. The non-aeronautical revenue market in APAC's aviation industry is a thriving and complex ecosystem that encompasses a wide range of components, from airport signage and financial performance to passenger experience and sustainability initiatives. The integration of these elements is crucial for airport authorities, real estate agents, and commercial organizations to optimize revenue streams, enhance operational efficiency, and cater to the growing demand for air travel in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various income streams for airports beyond traditional aviation activities. These include retail and dining, advertising, car parking, and ground transportation. Airports offer a diverse range of retail options, from duty-free shops and bookstores to fashion boutiques and specialty food outlets. Advertising opportunities abound, from digital displays and billboards to branded spaces and sponsorships. Car parking generates substantial revenue through short-term and long-term options, while ground transportation services such as taxis, buses, and trains cater to travelers' mobility needs. Airport real estate, including property leasing and development, is another significant contributor to non-aeronautical revenue. Additionally, airport services like lounges, Wi-Fi, and baggage handling contribute to this market. Airports continually innovate to offer unique experiences, such as art installations, spas, and gardens, to enhance the passenger experience and generate additional revenue.

What are the key market drivers leading to the rise in the adoption of Airport Non-Aeronautical Revenue Industry?

- The development of advanced airport terminals is a primary catalyst for market growth.

- Airport non-aeronautical revenue generation has become a significant focus for airport operators, transforming terminal spaces into commercial hubs that attract passengers and yield substantial income. This shift includes the addition of conference rooms for business travelers, reducing their need to leave the airport for business engagements. Airport terminals now offer more than just food courts, magazine shops, and duty-free stores. They feature shopping galleries and streets with specialty retail, high-end boutiques, upscale restaurants, and a variety of entertainment, live music, arts, and cultural attractions. To optimize financial performance, airport operators employ predictive modeling, tenant mix analysis, and brand management strategies.

- They also prioritize risk management, ensuring the provision of essential services such as cleaning services and automation technology. Key performance indicators, including it services, service level agreements, customer relationship management, and advertising revenue, are closely monitored. Additionally, airport operators incorporate self-service kiosks to enhance the passenger experience and streamline operations. These strategies contribute to the overall success and growth of the markets.

What are the market trends shaping the Airport Non-Aeronautical Revenue Industry?

- The airport cities and aerotropolis concepts are currently experiencing significant growth and are becoming prominent market trends. These developments represent a new era in urban planning and transportation infrastructure.

- The markets have experienced significant growth due to the transformation of airports into multi-functional business hubs. This evolution, often referred to as airport cities or aerotropolis, has been driven by the availability of land for expansion and improved surface transportation. Commercial functions, such as retail concessions, dining, and office spaces, are now common features within airport boundaries and beyond. Yield management plays a crucial role in optimizing revenue, with security protocols ensuring operational efficiency. Space optimization is essential for supply chain management, while queue management systems streamline passenger flow. Parking management systems generate additional revenue, and maintenance services ensure a harmonious airport experience.

- Revenue management systems enable data-driven decision-making, while rental cars offer customers convenience. Customer loyalty programs foster repeat business, and sustainability initiatives enhance airport reputation. Advertising contracts provide essential revenue streams, and occupancy rates indicate market demand. The market is a dynamic and essential component of the modern airport infrastructure. Its growth is driven by the integration of various commercial functions, advanced technologies, and a focus on enhancing the passenger experience.

What challenges does the Airport Non-Aeronautical Revenue Industry face during its growth?

- Market penetration, which can be cost-intensive, poses a significant challenge to industry growth. This challenge refers to the process of expanding a business in an existing market by increasing market share, often through aggressive pricing or marketing strategies. Effective market penetration is crucial for businesses seeking to grow and remain competitive in their respective industries. However, the resources required to successfully penetrate a market can be substantial, making it a key consideration for industry growth.

- Airport non-aeronautical revenue is experiencing significant growth due to the digital transformation of airports and increasing passenger traffic. This market encompasses various revenue streams, including energy management, airport hotels, safety standards, airport lounges, inventory management, pricing strategies, cost optimization, lease agreements, marketing campaigns, passenger flow management, security services, mobile applications, business intelligence, and data analytics. Despite these opportunities, challenges persist. Limited terminal space at airports, particularly at regional or domestic facilities, restricts the deployment of additional concessionaires, such as sleeping pods or rest areas. Passenger flow patterns also impact the demand for certain non-aeronautical offerings.

- For instance, passengers transiting through smaller airports may not require extended stays, reducing the need for extensive amenities. Airport expansion and modernization projects, coupled with the integration of advanced technologies like mobile applications and business intelligence, offer potential solutions to these challenges. By optimizing terminal space and enhancing the passenger experience, airports can effectively monetize non-aeronautical revenue streams while ensuring safety and security standards.

Exclusive Customer Landscape

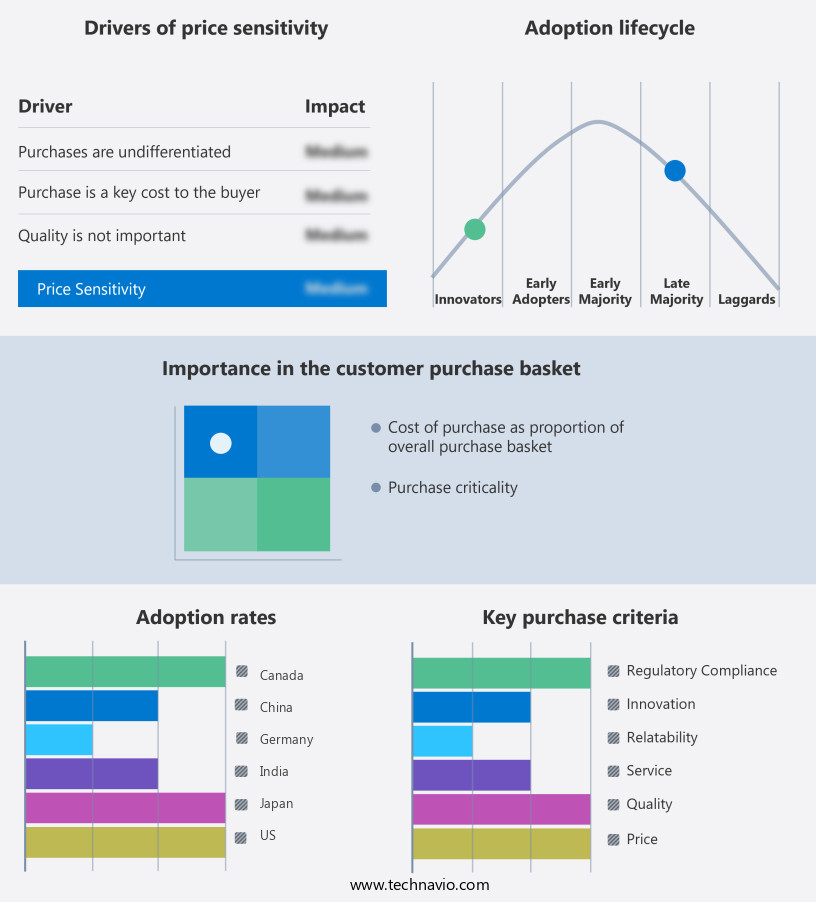

The airport non-aeronautical revenue market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the airport non-aeronautical revenue market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, airport non-aeronautical revenue market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aena S.M.E. SA - This company specializes in optimizing non-aeronautical revenue at airports through innovative technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aena S.M.E. SA

- Aeroports de Paris SA

- Airport Authority Hong Kong

- Airports Authority of India

- Airports of Thailand Public Co.,Ltd.

- Brazilian Airport Infrastructure Co.

- Changi Airport Group Singapore Pte. Ltd.

- Copenhagen Airports AS

- Fraport Group

- GMR Infrastructure Ltd.

- Guangzhou Baiyun International Airport

- Heathrow SP Ltd.

- Japan Airport Terminal Co. Ltd.

- Korea Airports Corp.

- Malaysia Airports Holdings Berhad

- Metropolitan Airports Commission

- Oman Airports

- Royal Schiphol Group

- The Port Authority of New York and New Jersey

- Vinci

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Airport Non-Aeronautical Revenue Market

- In January 2024, Changi Airport Group (CAG) and Google announced a strategic partnership to develop a contactless travel experience for passengers at Changi Airport. The collaboration aimed to integrate Google technologies into the airport's infrastructure, enhancing the passenger experience with touchless check-in, wayfinding, and real-time flight information (Changi Airport Group Press Release, 2024).

- In March 2024, Helsinki Airport and Finnair signed a joint venture agreement to establish a new company, Helsinki Airport Services, focusing on non-aeronautical revenue generation. The partnership aimed to offer a broader range of services to passengers, including retail, food and beverage, and ground handling (Helsinki Airport Press Release, 2024).

- In April 2025, Aeroports de Paris (ADP) and Mastercard unveiled a contactless payment system across all Paris-Charles de Gaulle and Paris-Orly airports. The implementation of the system enabled passengers to make purchases using their contactless cards, smartphones, and wearables, streamlining the payment process and reducing transaction times (Mastercard Press Release, 2025).

- In May 2025, Dubai Airports announced the successful implementation of a new biometric-enabled automated border control system at Dubai International Airport. The system, which processed over 1 million passengers in its first month, aimed to reduce processing times and improve passenger experience while enhancing security measures (Dubai Airports Press Release, 2025).

Research Analyst Overview

- The non-aeronautical revenue market at airports is witnessing significant growth and transformation, driven by various strategies to enhance revenue streams and improve overall airport operations. Expansion strategies, such as tenant management and space allocation, are key focus areas for airport authorities. Corporate social responsibility and community engagement are increasingly important, with public relations efforts reflecting a commitment to health and safety, emergency procedures, and disaster recovery. Financial reporting and revenue forecasting rely on market research and strategic planning to inform contract negotiation and concessionaire selection.

- Technology adoption, process improvement, and legal compliance are essential for maintaining international standards and addressing stakeholder expectations. Best practices in employee training and customer feedback ensure a positive airport experience, while risk assessment and business development help airports stay competitive. Sustainability reporting and stakeholder management are critical components of long-term success in the non-aeronautical revenue market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Airport Non-Aeronautical Revenue Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 43.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

US, China, Germany, Japan, Canada, Brazil, UK, India, Mexico, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Airport Non-Aeronautical Revenue Market Research and Growth Report?

- CAGR of the Airport Non-Aeronautical Revenue industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the airport non-aeronautical revenue market growth of industry companies

We can help! Our analysts can customize this airport non-aeronautical revenue market research report to meet your requirements.