Ammonium Chloride Market Size 2024-2028

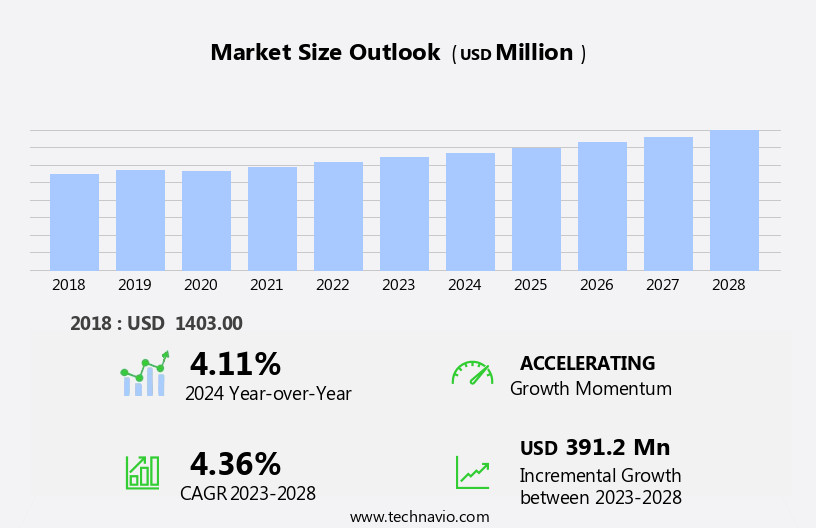

The ammonium chloride market size is forecast to increase by USD 391.2 million at a CAGR of 4.36% between 2023 and 2028.

- The market: Dynamic Landscape and Opportunities the market is experiencing significant growth, driven by its extensive applications in various industries. The primary driver for market expansion is the increasing demand from the fertilizer industry, where ammonium chloride is a crucial ingredient due to its high nitrogen content. This demand is further fueled by the rising agricultural productivity and the global population growth, which necessitates an increase in food production. Moreover, the chemical-etching process in semiconductor manufacturing is another burgeoning application for ammonium chloride. This process involves using ammonium chloride as a reagent to etch silicon wafers, creating intricate patterns for the production of advanced microchips.

- As the semiconductor industry continues to innovate and expand, the demand for ammonium chloride in this application is expected to grow. However, it is essential to acknowledge the potential side-effects of ammonium chloride. Its production and use can lead to environmental concerns, such as the release of harmful gases and the generation of solid waste. Additionally, the handling and transportation of ammonium chloride can pose safety risks due to its corrosive nature. Therefore, companies must invest in sustainable production methods and effective safety measures to mitigate these challenges and ensure regulatory compliance. In , the market presents significant opportunities for growth, driven by the increasing demand from the fertilizer and semiconductor industries.

- Companies seeking to capitalize on these opportunities must address the environmental and safety challenges associated with its production and use, while also staying informed of regulatory developments and market trends. By doing so, they can effectively navigate the dynamic market landscape and position themselves for long-term success.

What will be the Size of the Ammonium Chloride Market during the forecast period?

- Ammonium chloride, a critical component in various industries, plays a significant role in enhancing soil fertility as a nitrogen fertilizer. In agriculture, it is used to improve the pH balance and increase the availability of essential nutrients for crops, particularly for fertilizing pastures for livestock such as sheep and goats. Beyond agriculture, ammonium chloride finds applications as an electrolyte in various industries. In metal treatment, it is used as an essential ingredient in the Solvay process for producing sodium carbonate, which is further employed in the manufacturing processes of various products, including galvanizing and soldering fluxes. Moreover, ammonium chloride has gained traction in the veterinary medicine sector due to its usage as a substitute for sal ammoniac.

- It is also used in the electronics manufacturing industry as a component in food-grade ammonium chloride, which is employed as a soldering flux. Additionally, ammonium chloride's biotechnological applications extend to the production of oxide layers, making it a valuable resource in green agriculture initiatives. The versatility of ammonium chloride in various industries underscores its importance as a key player in the market. Manufacturing processes in the metals industry, particularly those involving galvanizing and tinning, rely on ammonium chloride as a crucial ingredient. The evolving trends in sustainable agriculture practices further highlight the significance of ammonium chloride as a vital input for maintaining soil fertility and improving crop productivity.

- In summary, ammonium chloride's diverse applications in various industries, including agriculture, metal treatment, and electronics manufacturing, underscore its importance as a critical market player. Its role as a vital component in manufacturing processes, sustainable agriculture practices, and biotechnological applications positions it as a key ingredient in numerous industries, making it an essential consideration for businesses seeking to optimize their operations and remain competitive.

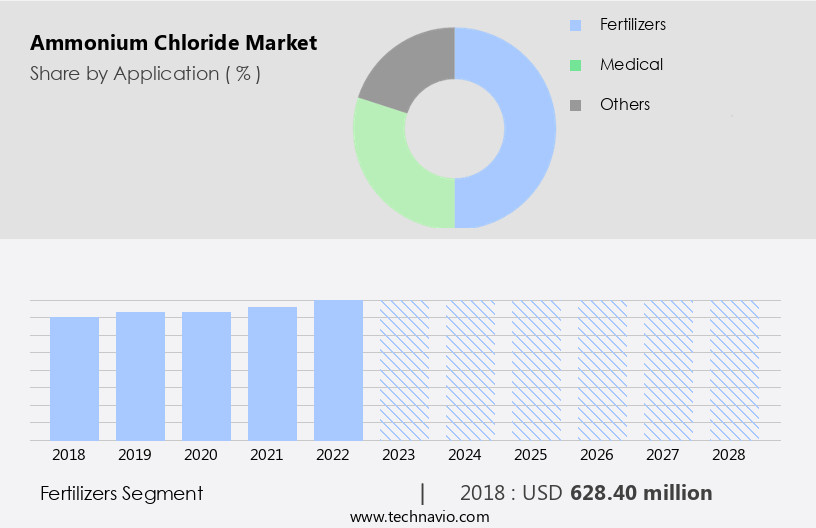

How is this Ammonium Chloride Industry segmented?

The ammonium chloride industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Fertilizers

- Medical

- Others

- Type

- Agricultural grade

- Industrial grade

- Food grade

- Geography

- APAC

- China

- North America

- US

- Canada

- Europe

- France

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

The fertilizers segment is estimated to witness significant growth during the forecast period.

Ammonium chloride, a crucial compound in various industries, holds significant importance in sectors such as fertilizers, electronics manufacturing, and pharmaceuticals. In the fertilizer industry, ammonium chloride functions as a medium-strength nitrogen fertilizer, with a 25% nitrogen content, promoting plant growth and preventing wilting and rotting. This compound is an integral component of nitrogenous fertilizers, enriching the soil with essential elements like chlorine and nitrogen, which are vital for crop productivity, particularly in rice and wheat cultivation. In the electronics sector, ammonium chloride is employed in the production of dry cell batteries, catalysts, and as a stabilizer in the Solvay process.

In the pharmaceutical industry, it is used in medicines for treating conditions such as pyloric stenosis, metabolic alkalosis, and chloride loss, including cough treatments, cold medicines, and veterinary medicine. Furthermore, ammonium chloride is used in various industrial applications, including textiles, metals, and cleaning agents, as well as in the production of rosin resin, cooling baths, and oxide layers. The fertilizer segment, driven by the agricultural industry's increasing demand for nitrogen-rich fertilizers, is the largest and most dominant application segment in The market. The segment's growth is attributed to the compound's role in enhancing crop yield, soil fertility, and sustainable agriculture practices.

The pharmaceutical industry also contributes significantly to the market's growth due to the increasing demand for medicines and drugs that utilize ammonium chloride in their formulation. Additionally, the compound's applications in electronics manufacturing, precision farming practices, and other industries further expand the market's potential.

Get a glance at the market report of share of various segments Request Free Sample

The Fertilizers segment was valued at USD 628.40 million in 2018 and showed a gradual increase during the forecast period.

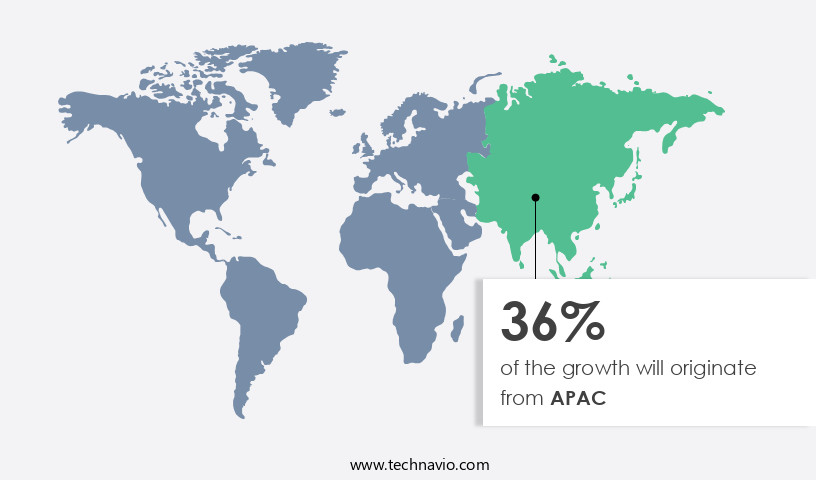

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Ammonium chloride is a versatile chemical compound with various applications in numerous industries. In agriculture, it plays a significant role as a nitrogen source in fertilizers, contributing to increased crop yield in Asia Pacific (APAC), particularly in countries like India, Japan, and China, where the population growth and rising per capita income fuel the demand. The agricultural sector's expansion in these regions drives the consumption of ammonium chloride, which amounts to approximately 7600 metric tons annually in India alone. Beyond agriculture, ammonium chloride finds extensive use in industries such as electronics manufacturing, where it acts as a catalyst and stabilizer.

In the pharmaceutical sector, it is employed in the production of cough treatments, cold medicines, and drugs for medicinal use, including those for veterinary medicine and human applications like pyloric stenosis and metabolic alkalosis. Additionally, it is used as a pH regulator, chloride loss compensator, and in gastric fistula drainage. Ammonium chloride's applications extend to industries like textiles, where it functions as a mordant in dyeing processes, and in the production of aluminum chloride for use in galvanizing and as a catalyst in the Solvay process. It is also utilized in the production of sodium carbonate, soldering fluxes, and cleaning agents.

Furthermore, it is an essential component in the manufacturing of dry cell batteries, rosin resin, cooling baths, and in the production of ferric chloride for soil fertility enhancement. In the chemical industry, ammonium chloride is employed in various chemical reactions, including those used in the production of nitrogen fertilizers, food crops, and food grade ammonium chloride. It is also used as a stabilizer in electronics and as a substitute for other chemicals in various applications. In the production of fireworks, ammonium chloride serves as a contact explosive, while in the fossil industry, it is used for oxide layers formation. In summary, ammonium chloride is a multifaceted chemical compound with applications spanning various industries, from agriculture to electronics, pharmaceuticals, and the chemical industry.

Its versatility and wide range of uses make it an indispensable component in numerous applications, contributing to the growth and development of various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ammonium Chloride Industry?

- Increasing demand for ammonium chloride in fertilizer industry is the key driver of the market.

- Ammonium chloride serves a crucial role in agriculture as a primary fertilizer for various crops, including rice, wheat, fruits, vegetables, lawns, and gardens. The global population growth and increasing construction activities have led to a significant reduction in available arable land. In response, substantial investments are being made in fertilizer production to ensure optimal plant growth and increased crop yields on limited land. For instance, in March 2022, the United States Department of Agriculture (USDA) announced plans for a USD250 million investment in grants to support additional fertilizer production.

- This investment underscores the importance of fertilizers in addressing the land scarcity issue and maintaining agricultural productivity.

What are the market trends shaping the Ammonium Chloride Industry?

- Increasing demand for ammonium chloride in chemical-etching process is the upcoming market trend.

- Ammonium chloride is a crucial chemical used extensively in various industries, particularly in photo-chemical and electrochemical etching processes. These techniques are integral to the production of components in sectors such as automotive, aerospace, electronics, and semiconductors. Ammonium chloride plays a significant role in these processes, enabling the dissolution of unwanted material to create desired shapes for final products. The demand for etching chemicals, including ammonium chloride, is driven by their applications in manufacturing printed circuit boards (PCB), integrated circuits, microprocessors, semiconductors, miniature antennas, lead frames, and optical apertures.

- The global market for ammonium chloride is expected to experience substantial growth due to the increasing demand for these products in various industries. The etching process is essential for the fabrication of intricate components, making ammonium chloride an indispensable chemical in modern manufacturing processes.

What challenges does the Ammonium Chloride Industry face during its growth?

- Side-effects of ammonium chloride is a key challenge affecting the industry growth.

- Ammonium chloride, a vital inorganic compound, is used extensively in various industries due to its unique properties. However, the market growth is challenged by the potential health risks associated with its use. Prolonged exposure to ammonium chloride can lead to side effects such as metabolic acidosis, rashes, seizures, EEG abnormalities, mental confusion, irritability, and drowsiness. Overdosage, whether from food, medicinal products, or other sources, can result in high chloride levels in the blood, causing nausea, vomiting, hyperventilation, and abdominal pain.

- These health concerns necessitate a thorough examination and consultation with a physician before consuming medicines and cough syrups containing ammonium chloride. Despite its applications, ensuring safety measures is crucial to mitigate potential health risks and promote market growth.

Exclusive Customer Landscape

The ammonium chloride market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ammonium chloride market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ammonium chloride market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apollo Fertilizer - Ammonium chloride serves as essential nitrogen and chloride sources in fertilizers, enhancing crop growth for rice, coconut, oil palm, and kiwi fruit production. These nutrients contribute significantly to the health and development of these crops, ensuring optimal yield and productivity. Our company provides top-tier ammonium chloride solutions, contributing to sustainable agriculture and enhanced food security worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Fertilizer

- Arkema Group.

- BASF SE

- Central Glass Co. Ltd.

- Chemcon Speciality Chemicals Ltd.

- China National Chemical Engineering Co. Ltd.

- FUJI KASEI Co. Ltd.

- GFS Chemicals Inc.

- HELM AG

- Honeywell International Inc.

- Jiangsu Debang Chemical Industry Group Co. Ltd

- Jiangsu Huachang Chemical Co. Ltd.

- Merck KGaA

- Nanoshel LLC

- ProChem Inc.

- Star Grace Mining Co. Ltd.

- The Dallas Group of America Inc.

- Tinco Industries

- Tuticorin Alkali Chemicals and Fertilizers Ltd

- Zaclon LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ammonium chloride is a versatile inorganic compound with the chemical formula NH4Cl. This white crystalline substance is widely used in various industries due to its unique properties. In the realm of agriculture, ammonium chloride finds application as a nitrogen source for soil fertility enhancement. It is also used as a basal dressing for paddy cultivation, contributing to improved crop yield. In the pharmaceutical sector, ammonium chloride is employed as a catalyst in the Solvay process for producing sodium carbonate. It is also used in the production of certain medications, particularly those intended for treating coughs and colds. The compound's role extends to laboratory applications, where it serves as a pH regulator and an electrolyte in various chemical reactions.

Ammonium chloride is an essential component in electronics manufacturing, particularly in the production of dry cell batteries. It is also used as a catalyst in the production of rosin resin, which is employed in the tinning process for electronics. In the realm of textiles, ammonium chloride is used as a mordant, enhancing the dyeing process. Furthermore, ammonium chloride is used in the production of nitrogen fertilizers, making it a crucial player in the agricultural industry. It is also used in the manufacturing of sodium carbonate, which is employed as a cleaning agent in various industries, including food and beverages.

In the field of medicine, ammonium chloride is used in various applications, including as a substitute for sodium chloride in certain medical procedures. It is also used in veterinary medicine and in the treatment of metabolic alkalosis. In the production of medicines, ammonium chloride is used as a stabilizer, ensuring the efficacy and safety of the final product. Ammonium chloride is also used in the production of fireworks, contributing to their vibrant colors and explosive effects. In the fossil industry, ammonium chloride is used in the extraction of fossils, making it an essential tool for paleontological research. In the realm of metals, ammonium chloride is used as a flux in soldering and galvanizing processes.

It is also used in the production of ferric chloride, which is employed as a mordant in the textile industry and as a coagulant in water treatment. Ammonium chloride is used in various industrial processes, including in the production of aluminum chloride, which is employed in the production of various chemicals and in the treatment of metals. It is also used in the production of pharmaceutical-grade chloride salts, which are used in the treatment of hypokalemic patients. The market for ammonium chloride is driven by its diverse applications across various industries. The increasing demand for nitrogen fertilizers, electronics, and pharmaceuticals is expected to fuel the growth of the market.

The trend towards sustainable agriculture practices and green initiatives is also expected to create new opportunities for the market. In , ammonium chloride is a versatile inorganic compound with a wide range of applications across various industries, including agriculture, electronics, pharmaceuticals, and metals. Its unique properties make it an essential component in various processes, from soil fertility enhancement to the production of medicines and electronics. The market for ammonium chloride is expected to grow due to the increasing demand for its applications in various industries and the trend towards sustainable agriculture practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 391.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, US, Germany, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ammonium Chloride Market Research and Growth Report?

- CAGR of the Ammonium Chloride industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ammonium chloride market growth of industry companies

We can help! Our analysts can customize this ammonium chloride market research report to meet your requirements.