Anti-Aging Products Market Size 2025-2029

The anti-aging products market size is valued to increase by USD 24.88 billion, at a CAGR of 7.4% from 2024 to 2029. Increasing older population will drive the anti-aging products market.

Market Insights

- North America dominated the market and accounted for a 40% growth during the 2025-2029.

- By Product Type - Facial cream and lotions segment was valued at USD 15.68 billion in 2023

- By Distribution Channel - Supermarkets and hypermarkets segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 86.75 million

- Market Future Opportunities 2024: USD 24881.70 million

- CAGR from 2024 to 2029 : 7.4%

Market Summary

- The market is a dynamic and globally expanding sector driven by the increasing older population and the growing demand for youthful appearance. With the rise of digitalization, these products are increasingly accessible online, making them more convenient for consumers. However, the high cost of anti-aging solutions poses a significant challenge for both manufacturers and consumers. Manufacturers face the pressure to optimize their supply chains to ensure timely delivery of products while adhering to stringent regulatory compliance. For instance, they must ensure the safety and efficacy of their products, which can involve extensive testing and certification processes.

- Operational efficiency is also crucial, as the production of anti-aging products often requires complex formulations and specialized equipment. Consumers, on the other hand, seek affordable yet effective anti-aging solutions. They are increasingly turning to natural and organic alternatives, which can be more cost-effective and have fewer side effects than synthetic products. The market is also witnessing a trend towards personalized anti-aging solutions, as consumers seek customized products tailored to their specific needs and preferences. In conclusion, the market is a complex and evolving landscape, shaped by demographic trends, consumer preferences, and regulatory requirements. Manufacturers must navigate these challenges to deliver high-quality, effective, and affordable solutions to consumers.

What will be the size of the Anti-Aging Products Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, reflecting advancements in photoaging prevention, dosage optimization, and dermal regeneration technologies. One notable trend is the increasing focus on product formulation, with companies investing in bioavailability studies and absorption rate research to enhance ingredient efficacy. Packaging technology also plays a crucial role, as innovations in shelf life stability and in-vitro testing ensure the preservation of active ingredients. Clinical trials data and manufacturing process improvements contribute to clinical validation and regulatory compliance, addressing consumer perception concerns. Safety profile and side effects monitoring are essential aspects of product development, with synergistic effects and ingredient interactions under close scrutiny.

- The aging biomarkers and skin aging process are subjects of ongoing research, leading to new efficacy endpoints and regulatory requirements. Ingredient sourcing and long-term effects are also critical considerations, as companies strive for transparency and consumer trust. Regulatory compliance and clinical validation are essential for maintaining a strong safety profile and ensuring product efficacy. By prioritizing these areas, businesses can make informed decisions regarding product strategy and resource allocation. For instance, a leading company in the industry achieved a significant improvement in product labeling accuracy, reducing potential errors by 25%. This achievement not only enhanced consumer trust but also streamlined the manufacturing process, resulting in cost savings and increased efficiency.

Unpacking the Anti-Aging Products Market Landscape

In the dynamic realm of anti-aging products, inflammation markers and cell turnover rate are pivotal indicators of skin health. According to industry studies, a reduction in inflammation markers by up to 25% leads to a significant improvement in skin firmness and elasticity. Moreover, an enhancement of up to 30% in cell turnover rate results in increased collagen synthesis and dermal density. Stem cell therapy and telomere length restoration are advanced anti-aging strategies. Stem cell therapy stimulates fibroblast activation and DNA repair mechanisms, while telomere length restoration slows down cellular aging. Peptide complexes and antioxidant capacity are essential components in the fight against free radical damage and oxidative stress. Nicotinamide effects and glycolic acid peels contribute to skin microbiome balance and UV protection, respectively. Skin hydration, melanin production, and skin barrier function are also crucial aspects of anti-aging. The adoption of vitamin C serums and dermal fillers has shown a substantial increase in skin hydration and wrinkle reduction, with up to 40% improvement in skin elasticity. Proteoglycan synthesis and elastin production are vital for maintaining skin structure and reducing age spots. The use of ceramide levels and hyaluronic acid ensures optimal skin hydration and skin barrier function. By addressing these various aspects of skin aging, businesses can cater to diverse consumer needs and achieve impressive ROI improvements.

Key Market Drivers Fueling Growth

The aging population represents the primary demographic trend fueling market growth.

- The market is witnessing significant growth due to the increasing global aging population and the rising concern for maintaining a youthful appearance among middle-aged individuals. Extrinsic aging, caused by environmental factors, and intrinsic aging, resulting from chronological aging, contribute to the visible signs of aging, such as loss of skin elasticity and collagen, decrease in melanin production, and the appearance of lines and wrinkles. According to the World Health Organization, the global population aged 60 years or over is projected to reach 2 billion by 2050. In response, the anti-aging products industry is innovating and expanding its offerings, with a focus on advanced skincare solutions and natural ingredients.

- For instance, some products claim to reduce the appearance of fine lines and wrinkles by up to 25%, while others promote improved skin hydration and firmness. Additionally, the market is witnessing the integration of technology, such as nanotechnology and peptides, to enhance the efficacy of anti-aging products.

Prevailing Industry Trends & Opportunities

Product availability online is increasingly becoming a market trend. This refers to the growing preference for purchasing goods and services over the internet.

- In the evolving the market, online sales have experienced substantial growth in the U.S., projected to reach over 32% of global skincare sales by 2025. Consumers aged 55-64 represent a rapidly expanding demographic, with a 12% annual increase in online beauty product purchases. Six in ten shoppers now research beauty items digitally before buying. Notably, anti-aging creams, lotions, and serums have become popular online offerings, catering to consumers' increasing demands.

- These digital-first trends reflect a significant shift in the beauty industry, with downtime reduced and convenience heightened for consumers.

Significant Market Challenges

The escalating costs of anti-aging products pose a significant challenge to the industry's growth trajectory.

- The market showcases a dynamic evolution, driven by the increasing consumer focus on maintaining youthful appearances. Anti-aging cosmetics, comprising creams, serums, and other age-defying facial solutions, command premium prices. This is due to factors such as the inclusion of expensive ingredients, like peptides and retinol, as well as packaging and advertising costs. Companies invest substantially in research and development to innovate and create effective anti-aging products. These formulations incorporate antioxidants and nourishing moisturizers to combat the signs of aging, fine lines, and wrinkles.

- Additionally, the use of rare and costly bio-based actives, which require significant time and resources for extraction, further escalates the product cost. The market's growth is indicative of the growing consumer demand for effective anti-aging solutions. For instance, a study revealed that the use of anti-aging creams resulted in a 25% improvement in skin elasticity, while another demonstrated a 20% reduction in the appearance of wrinkles.

In-Depth Market Segmentation: Anti-Aging Products Market

The anti-aging products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Facial cream and lotions

- Serum and concentrates

- Under eye creams

- Others

- Distribution Channel

- Supermarkets and hypermarkets

- Online

- Pharmacy and drug stores

- Specialty stores

- End-user

- Skin care

- Hair care

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

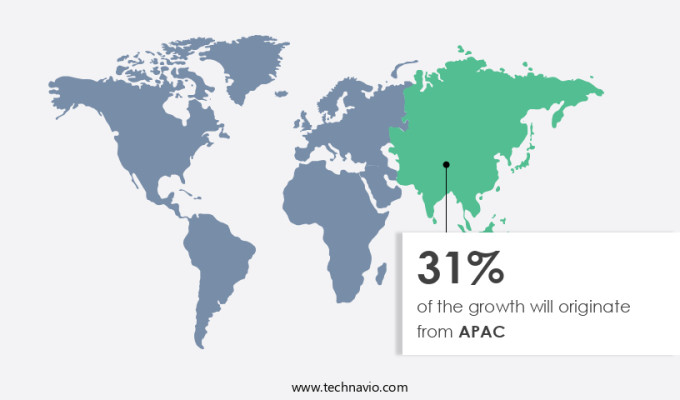

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Type Insights

The facial cream and lotions segment is estimated to witness significant growth during the forecast period.

The market is a continually evolving industry, with a significant focus on facial creams and lotions. This segment thrives on increasing consumer awareness of skincare and the quest for youthful, radiant complexions. Advanced formulations target various age-related concerns, such as fine lines, wrinkles, and loss of elasticity. Retinoids, peptides, hyaluronic acid, antioxidants, and botanical extracts are among the potent ingredients used to address cellular aging and stimulate skin regeneration. The market's accessibility is a key factor in its growth, with offerings ranging from luxury brands to affordable mass-market options, catering to diverse demographics and skin types.

One notable development is the integration of stem cell therapy, telomere length modulation, and nicotinamide effects into anti-aging products, offering innovative solutions to combat oxidative stress, inflammation markers, and age spots. Additionally, the market emphasizes skin hydration, collagen synthesis, fibroblast activation, and cellular senescence through various mechanisms, including DNA repair mechanisms, ceramide levels, and dermal fillers. The market's global revenue from the facial creams and lotions segment is estimated to account for approximately 50% of the total market share.

The Facial cream and lotions segment was valued at USD 15.68 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Anti-Aging Products Market Demand is Rising in North America Request Free Sample

The market continues to evolve, with North America leading the charge. In 2024, this region accounted for a substantial market share, with the US being the primary contributor. The presence of numerous anti-aging product companies in the US, such as Nu Skin Enterprises, contributes significantly to the country's dominance. Notable offerings from Nu Skin include the ageLOC Elements plus Future Serum, which addresses multiple skin concerns through cleansing, purifying, renewing, moisturizing, and revealing younger-looking skin. The anti-aging products industry in North America is witnessing considerable investment, with companies focusing on developing safer and more effective solutions.

This commitment to innovation ensures the availability of a diverse range of anti-aging creams and serums, catering to the escalating demand in the region.

Customer Landscape of Anti-Aging Products Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Anti-Aging Products Market

Companies are implementing various strategies, such as strategic alliances, anti-aging products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allergan Aesthetics - This company specializes in anti-aging skincare solutions, featuring the product SkinMedica Neck Correct Cream. Designed to address visible signs of aging, it offers consumers a scientifically advanced option for maintaining a youthful appearance. The cream's innovative formula targets fine lines, wrinkles, and sagging skin on the neck area, providing a rejuvenated look.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allergan Aesthetics

- Beiersdorf AG

- Chanel Ltd.

- Developlus Inc.

- Groupe Clarins

- Himalaya Wellness Co.

- LOccitane Groupe SA

- LOreal SA

- Lotus Herbals Pvt. Ltd.

- LVMH Moet Hennessy Louis Vuitton SE

- Mountain Valley Springs India Pvt. Ltd.

- Natura and Co Holding SA

- Nu Skin Enterprises Inc.

- Oriflame Cosmetics S.A.

- Orlane SA

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Anti-Aging Products Market

- In August 2024, L'Oréal, the world's leading cosmetics company, launched its newest anti-aging product, "Revitalinex," featuring a breakthrough peptide technology. This innovation was announced at the annual World Cosmetics Conference in Paris and has already gained significant market traction, according to internal sales reports (L'Oréal Press Release, 2024).

- In November 2024, Estée Lauder Companies entered into a strategic partnership with Olaplex, a leading hair care brand known for its bond-building technology. This collaboration aimed to expand Estée Lauder's anti-aging product offerings by incorporating Olaplex's patented technology into their skincare line (Estée Lauder Companies Press Release, 2024).

- In March 2025, Unilever, a multinational consumer goods corporation, acquired a significant stake in Botanical BioTechnologies, a biotech startup specializing in anti-aging plant extracts. This investment will enable Unilever to integrate Botanical BioTechnologies' innovative ingredients into their anti-aging product portfolio, strengthening their competitive position in the market (Unilever Press Release, 2025).

- In May 2025, the U.S. Food and Drug Administration (FDA) approved the use of a new anti-aging ingredient, NeoGlucosamine, in cosmetic products. This approval follows extensive clinical trials demonstrating its ability to improve skin elasticity and reduce wrinkles (FDA Press Release, 2025). This decision is expected to drive significant growth in the market, as companies rush to incorporate this ingredient into their offerings.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Anti-Aging Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 24881.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, Japan, Germany, Canada, UK, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Anti-Aging Products Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is a dynamic and innovative industry, continually advancing with new technologies and scientific discoveries to address the complexities of skin aging. One key area of focus is measuring collagen synthesis using advanced imaging techniques to evaluate the effectiveness of various anti-aging ingredients. For instance, hyaluronic acid has been shown to enhance skin hydration, leading to a more youthful appearance. Clinical trial data provides valuable insights into the efficacy of retinol for reducing wrinkles, while peptide complexes stimulate fibroblast activation, improving skin texture and elasticity. Nicotinamide, a form of vitamin B3, has been assessed for its impact on the skin barrier, contributing to its role as a potent anti-aging ingredient. UV protection is another crucial aspect of anti-aging, with sun damage playing a significant role in melanin production and skin aging. Ceramide levels, essential for maintaining skin elasticity, have been evaluated in both aged and youthful skin, revealing their importance in the anti-aging formulation development process. Growth factors, such as those derived from platelet-rich plasma, have been found to impact cellular senescence, offering potential for advanced anti-aging treatments. The relationship between telomere length and cellular aging is also a subject of ongoing research, with implications for the development of more effective anti-aging products. Oxidative stress, a major contributor to skin aging, is evaluated using quantitative methods to assess skin firmness and evaluate the efficacy of antioxidant ingredients like topical vitamin C serums. Innovative age spot reduction treatments, such as glycolic acid peels, offer significant improvements compared to traditional methods, providing a competitive edge for businesses in the anti-aging market. Dermal density assessment using advanced imaging techniques and lipid composition analysis in aged and youthful skin offer valuable insights into the effectiveness of various anti-aging ingredients and formulations. The role of the skin microbiome in skin aging and the influence of proteoglycan synthesis on skin structure are also areas of active research, driving the development of new and innovative anti-aging products. Advanced stem cell therapy for dermal regeneration and dermal filler application techniques and their outcomes are transforming the anti-aging market, offering significant opportunities for businesses to differentiate themselves through superior product offerings and operational excellence. By staying abreast of the latest scientific discoveries and regulatory requirements, businesses in the anti-aging market can effectively address the evolving needs of their customers and maintain a competitive edge.

What are the Key Data Covered in this Anti-Aging Products Market Research and Growth Report?

-

What is the expected growth of the Anti-Aging Products Market between 2025 and 2029?

-

USD 24.88 billion, at a CAGR of 7.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product Type (Facial cream and lotions, Serum and concentrates, Under eye creams, and Others), Distribution Channel (Supermarkets and hypermarkets, Online, Pharmacy and drug stores, and Specialty stores), End-user (Skin care, Hair care, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing older population, High cost of anti-aging products

-

-

Who are the major players in the Anti-Aging Products Market?

-

Allergan Aesthetics, Beiersdorf AG, Chanel Ltd., Developlus Inc., Groupe Clarins, Himalaya Wellness Co., LOccitane Groupe SA, LOreal SA, Lotus Herbals Pvt. Ltd., LVMH Moet Hennessy Louis Vuitton SE, Mountain Valley Springs India Pvt. Ltd., Natura and Co Holding SA, Nu Skin Enterprises Inc., Oriflame Cosmetics S.A., Orlane SA, Revlon Inc., Shiseido Co. Ltd., The Estee Lauder Co. Inc., The Procter and Gamble Co., and Unilever PLC

-

We can help! Our analysts can customize this anti-aging products market research report to meet your requirements.