Anti-Reflective Coatings Market Size 2025-2029

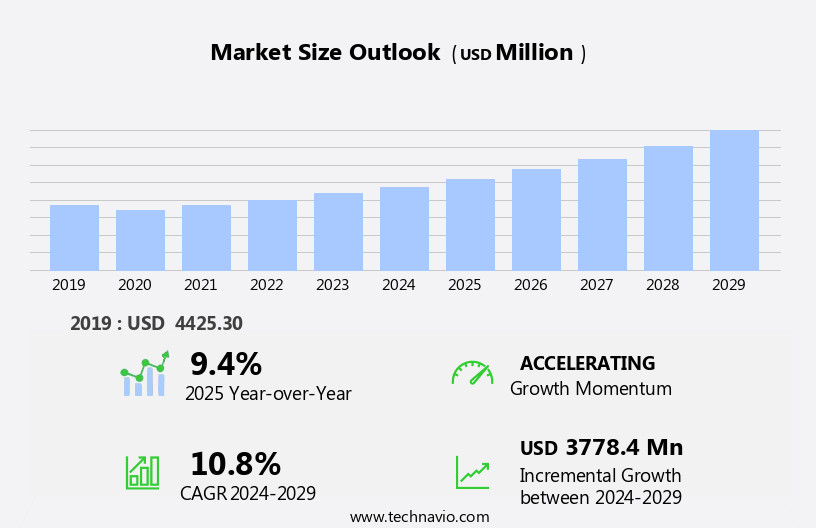

The anti-reflective coatings market size is forecast to increase by US $3.78 billion, at a CAGR of 10.8% between 2024 and 2029. The market is experiencing significant growth, driven by increasing demand in the solar industry for enhancing solar panel efficiency and reducing energy loss through reflection.

Major Market Trends & Insights

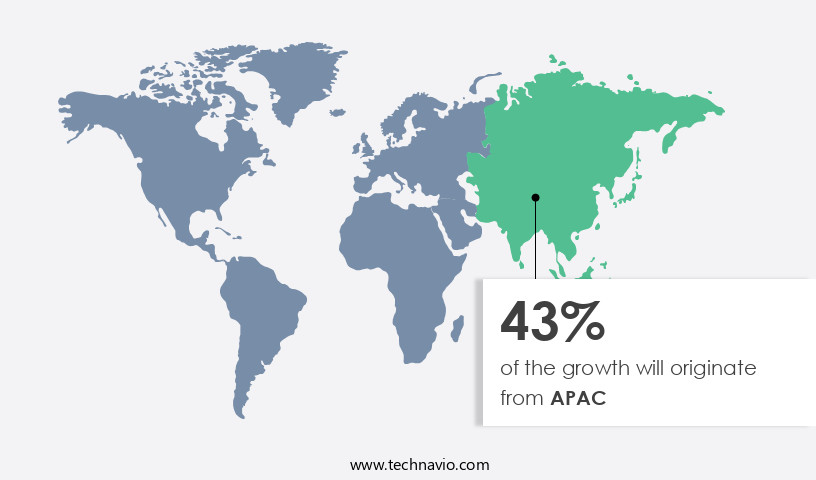

- APAC dominated the market and contributed 43% to the growth during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

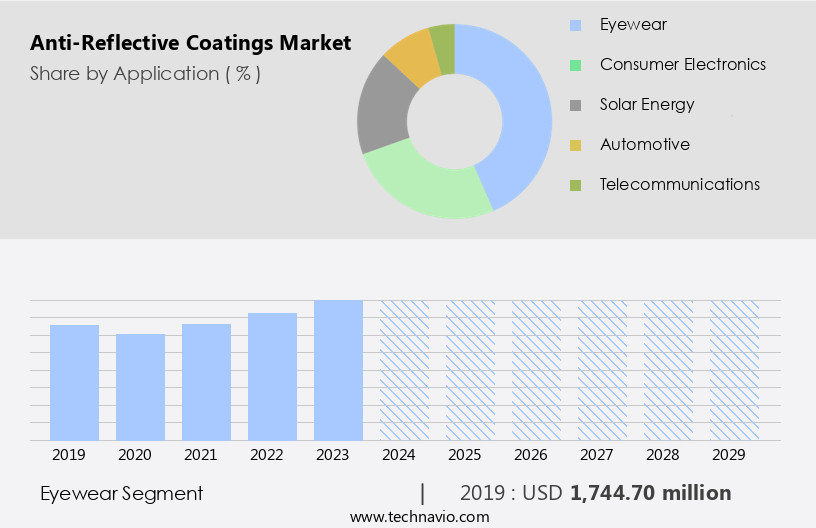

- Based on the Application, the eyewear segment led the market and was valued at USD 24.91 billion of the global revenue in 2023.

- Based on the Technology, the Vacuum deposition segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 113.31 Million

- Future Opportunities: USD 3.78 Billion

- CAGR (2024-2029): 10.8%

- APAC: Largest market in 2023

The applications of anti-reflective coatings in the eyewear sector continue to expand, offering improved visual clarity and comfort for consumers. However, market participants face challenges in the form of volatile raw material prices, which can impact production costs and profitability. Companies must navigate these price fluctuations through strategic sourcing and supply chain management to maintain competitiveness. To capitalize on the market's potential, businesses should focus on innovation, such as developing advanced coatings with enhanced properties, and exploring new applications in emerging industries. Effective supply chain management and strategic partnerships will also be crucial in mitigating the impact of raw material price volatility. In summary, the market presents significant opportunities for growth, driven by expanding applications in solar and eyewear industries, while raw material price fluctuations pose a challenge that requires strategic management. Companies seeking to capitalize on these opportunities should focus on innovation, effective supply chain management, and strategic partnerships.

What will be the Size of the Anti-Reflective Coatings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Optical performance testing plays a crucial role in ensuring the quality of these coatings, with layer thickness optimization being a key focus. Broadband antireflection coatings, for instance, offer improved optical transmission enhancement and haze measurement, making them ideal for applications in solar energy and telecommunications. Moreover, scratch resistance testing and UV degradation resistance are essential considerations for the automotive industry, where coating durability and coating adhesion strength are paramount. Environmental stability testing, such as ellipsometry analysis, is also vital in assessing the coating's performance under different conditions. The vacuum deposition segment is the second largest segment of the type and was valued at USD 1.86 billion in 2023.

Coating design software and nanostructured coatings, including dielectric multilayer stacks and narrowband antireflection, enable the creation of high-performance optical thin films. Plasma enhanced CVD and sol-gel deposition are popular methods for manufacturing these advanced coatings. For instance, a leading electronics manufacturer reported a 30% increase in sales due to the implementation of an advanced AR coating with superior surface roughness reduction and chemical durability. The market is expected to grow by over 7% annually, fueled by the continuous development of new technologies and applications.

How is this Anti-Reflective Coatings Industry segmented?

The anti-reflective coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Eyewear

- Consumer Electronics

- Solar Energy

- Automotive

- Telecommunications

- Others

- Technology

- Vacuum deposition

- Electron beam evaporation

- Sputtering

- Roll to roll

- Sputtering

- Sol-Gel Coating

- Chemical Vapor Deposition

- Others

- Substrate

- Glass

- Plastic

- Sapphire

- Layer Type

- Single-Layer

- Multi-Layer

- Distribution Channel

- Direct Sales

- Online Sales

- OEM Partnerships

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The eyewear segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 2.02 billion in 2023. It continued to the largest segment at a CAGR of 7.81%.

Anti-reflective coatings have gained significant traction in various industries, particularly in the optical sector, due to their ability to enhance optical performance and reduce unwanted reflections. These coatings are crucial in eyewear applications, improving vision clarity by preventing harmful reflections from digital devices and enhancing comfort. The effectiveness of anti-reflective coatings is more pronounced on high-index lenses, which reflect more light than regular plastic lenses. Premium anti-reflective glasses offer surface treatments that seal the anti-reflective layer, allowing up to 92% of light to enter for better vision. The optical performance of anti-reflective coatings is optimized through layer thickness adjustments and refractive index matching.

Broadband antireflection coatings are widely used due to their ability to minimize reflections across a wide range of wavelengths. Nanostructured coatings and dielectric multilayer stacks further enhance the optical properties, offering narrowband antireflection and superior haze measurement. Coating design software and advanced deposition techniques, such as sol-gel deposition, plasma enhanced CVD, and sputter deposition, facilitate the production of high-quality anti-reflective coatings. Coating thickness uniformity, adhesion strength, and environmental stability are critical factors ensuring the durability and reliability of these coatings. Anti-reflective coatings are subjected to rigorous testing, including scratch resistance, abrasion resistance, and corrosion resistance testing, to ensure their longevity and performance under various conditions.

The industry anticipates a 10% growth in demand for anti-reflective coatings due to increasing consumer awareness and the expanding application base, including solar panels, architectural glass, and automotive glass. For instance, infrared transmission and near-infrared reflection are essential properties for solar panels, while low-e coatings and film stress measurement are crucial for architectural glass.

The Eyewear segment was valued at USD 1.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the increasing demand for improved optical performance in various industries. Layer thickness optimization and refractive index matching are crucial factors in the design and production of these coatings, ensuring optimal broadband antireflection and narrowband antireflection properties. Coating durability and adhesion strength are essential for long-term performance, with sol-gel deposition and plasma enhanced CVD methods used to enhance these characteristics. Environmental stability testing, including chemical durability and corrosion resistance, is vital to ensure the coatings' performance under various conditions. Ellipsometry analysis and film stress measurement are essential tools for evaluating coating quality, while substrate surface preparation plays a significant role in achieving uniform coating thickness and reducing surface roughness.

The automotive industry's increasing demand for lightweight and fuel-efficient vehicles is driving the market's growth, with anti-reflective coatings used to enhance optical transmission and reduce light scattering. Infrared transmission and near-infrared reflection are critical for thermal management applications, while visible light transmission and specular reflectance are essential for solar panels and displays. APAC is the fastest-growing geographical segment, with a 12% expected industry growth rate, due to the region's rapid industrialization and increasing consumer electronics production. For instance, China and India's consumer electronics markets are expanding rapidly, leading to a surge in demand for anti-reflective coatings in displays and solar panels.

The automotive industry's growth in APAC is also contributing to the market's expansion, with a significant increase in automotive sales in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The anti-reflective coatings market is advancing through precision and innovation. antireflective coating layer thickness control ensures optimal performance, while UV-VIS-NIR spectroscopy for coating analysis verifies quality. enhancing optical transmission with thin films improves efficiency in antireflective coating for solar panel applications and antireflective coating for display screens. antireflective coating durability testing standards and coating adhesion strength testing methods ensure longevity, while improving scratch resistance of antireflective coatings enhances robustness. optical thin film design software for ar coatings and optimization of antireflective coating parameters drive precision. impact of surface roughness on ar coating performance and assessment of antireflective coating uniformity optimize results. testing antireflective coatings for chemical resistance and environmental stability of antireflective coatings ensure reliability across diverse applications, fueling market growth.

The market is experiencing significant growth due to the increasing demand for enhancing optical transmission in various industries. Two prominent technologies leading this market are sol-gel derived antireflective coatings and plasma enhanced CVD coating deposition. These coatings are essential in controlling the layer thickness of antireflective coatings for optimal performance. UV-Vis-NIR spectroscopy is a crucial analytical tool for coating analysis, enabling measuring specular reflectance of antireflective coatings and assessing their effectiveness in enhancing optical transmission. The durability of antireflective coatings is a critical factor in their application, particularly in solar panel and display screen industries.

Antireflective coatings for solar panels help improve efficiency by reducing energy losses due to reflection, while those for display screens enhance visual clarity. Optical thin film design software for antireflective coatings plays a vital role in the design and optimization of AR coatings. Surface roughness significantly impacts AR coating performance, and improving scratch resistance and coating adhesion strength are essential testing methods to ensure durability. Environmental stability is another essential factor, and antireflective coatings must meet various testing standards to ensure their performance under different conditions. Refractive index matching for broadband AR coatings is a complex process that requires precise control to achieve optimal performance. Nanostructured antireflective coating design is a growing area of research, offering potential for improved performance and durability. Evaluation of antireflective coating performance involves testing for chemical resistance, uniformity, and optimization of coating parameters. These tests help ensure the highest quality and reliability for various applications.

What are the key market drivers leading to the rise in the adoption of Anti-Reflective Coatings Industry?

- The solar industry's increasing requirement for anti-reflective coatings serves as the primary market driver.

- The market experiences significant growth due to the increasing emphasis on renewable energy generation, particularly in solar applications. These coatings enhance solar panel efficiency and decrease reliance on non-renewable energy sources. Solar thermal control coatings are also integral to solar cells, detectors, and panels. Government initiatives and subsidies for solar power energy generation serve as key drivers for the optical coatings market in the solar power sector. Moreover, reductions in excise and customs duties for solar components in China and India, coupled with substantial investments in the solar industry, fuel market expansion.

- For instance, the implementation of the Solar Mission in India resulted in a 30% increase in solar installations between 2014 and 2019. The optical coatings market in the solar power sector is projected to grow by over 10% annually, reflecting the industry's robust expansion.

What are the market trends shaping the Anti-Reflective Coatings Industry?

- The application of anti-reflective coatings in eyewear is becoming increasingly prevalent in the market. This emerging trend aims to enhance visual clarity and reduce glare.

- The market is experiencing significant growth due to the increasing demand for high-performance optical materials, particularly in the eyewear industry. These coatings effectively eliminate glare, allowing more light to pass through, resulting in sharper and clearer vision. The application of anti-reflective coatings on both sides of the lens minimizes glare and halos, providing numerous benefits. Compared to uncoated lenses, anti-reflective coatings offer enhanced durability and resistance to scratches, water, and dirt.

- As a result, their adoption is on the rise, making them an essential component in various industries, including electronics, solar panels, and automotive. The market is projected to continue its robust expansion in the coming years, driven by the growing need for improved optical performance and enhanced durability.

What challenges does the Anti-Reflective Coatings Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory.

- The market faces significant challenges due to the volatile pricing of key raw materials, including titanium dioxide, indium tin oxide (ITO), antimony oxide, magnesium chloride, and aluminum oxide. These materials account for a substantial portion of the total coating cost, with pigments, such as titanium dioxide, comprising approximately one-third. Titanium dioxide, an essential pigment in anti-reflective coatings, is highly valued for its superior light-scattering properties. In the optical industry, it is utilized for anti-UV lens coatings and as a photocatalyst. The refractive index of titanium dioxide nanomaterials is notably high, enabling effective light dispersion. The optical industry's reliance on titanium dioxide, coupled with its fluctuating price, poses a significant challenge for market growth.

- For instance, the price of titanium dioxide increased by 15% in 2020, leading to a corresponding rise in coating prices. Despite this hurdle, the market is projected to expand at a robust rate, with industry growth anticipated to reach 10% annually.

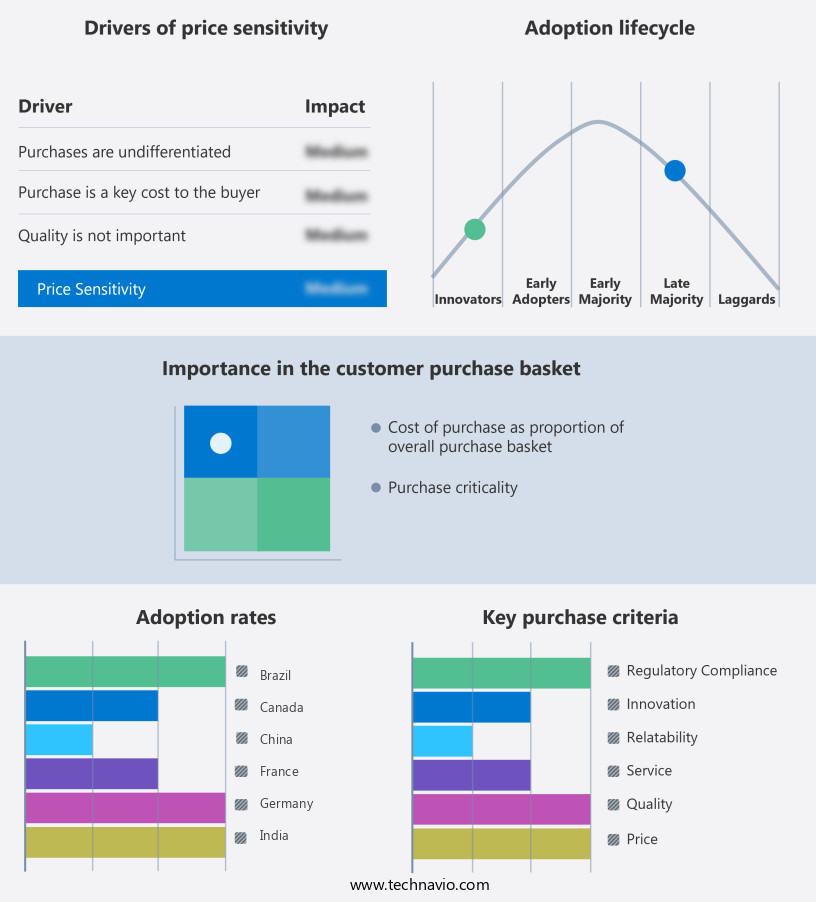

Exclusive Customer Landscape

The anti-reflective coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-reflective coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-reflective coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AccuCoat Inc. - This company specializes in producing advanced anti-reflective coatings, including high efficiency broadband, narrowband, and dual-band options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AccuCoat Inc.

- AGC Inc.

- AMETEK Inc.

- Carl Zeiss AG

- Cascade Optical Corp.

- DuPont de Nemours Inc.

- EMF Corp.

- EssilorLuxottica

- Gooch and Housego Plc

- HEF

- Honeywell International Inc.

- HOYA CORP.

- Nippon Sheet Glass Co. Ltd.

- Optical Coatings Japan

- Optics and Allied Engg. Pvt. Ltd.

- Optics Balzers AG

- PFG Precision Optics Inc.

- PPG Industries Inc.

- Viavi Solutions Inc.

- Vortex Optical Coatings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Anti-Reflective Coatings Market

- In January 2024, PPG Industries, a leading coatings manufacturer, announced the launch of its new line of advanced anti-reflective coatings for the solar industry. These coatings are designed to increase solar panel efficiency by reducing reflection and improving light absorption (PPG Industries Press Release).

- In March 2024, Corning Inc. and 3M, two major players in the market, entered into a strategic partnership to develop next-generation AR coatings for various applications, including displays and solar panels (Corning Inc. Press Release).

- In April 2025, Nanoco Group Plc, a leading nanomaterials company, raised £ 10 million in a funding round to expand its production capacity for cadmium-free quantum dots used in anti-reflective coatings for displays (Nanoco Group Plc Press Release).

- In May 2025, the European Union passed the REPowerEU Plan, which includes initiatives to boost renewable energy production and reduce dependence on fossil fuels. This plan is expected to significantly increase demand for anti-reflective coatings in the solar industry (European Commission Press Release).

Research Analyst Overview

- The market for anti-reflective coatings continues to evolve, driven by advancements in display technology and solar cell applications. Coating characterization and quality control are paramount to ensure substrate compatibility and optimal optical properties. Optical scattering, absorption, and transmittance measurements are essential for process control and design optimization. Wavelength-specific coatings and layer-by-layer deposition techniques enable improved performance modeling and cost optimization. Thin film interference and spectral reflectance play a crucial role in coating deposition and manufacturing process development. For instance, a leading optics manufacturer reported a 15% increase in sales due to the implementation of advanced coating deposition techniques and defect analysis.

- Industry growth is expected to reach 7% annually, fueled by the continuous development of application methods, coating performance metrics, and environmental testing for production scale-up. Adherence to material selection, absorptance measurement, surface texturing, and manufacturing process control remains essential for maintaining high-quality anti-reflective coatings.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Anti-Reflective Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.8% |

|

Market growth 2025-2029 |

USD 3778.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

China, US, India, Germany, Japan, France, Brazil, Canada, UAE, UK, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Reflective Coatings Market Research and Growth Report?

- CAGR of the Anti-Reflective Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-reflective coatings market growth of industry companies

We can help! Our analysts can customize this anti-reflective coatings market research report to meet your requirements.