Antioxidant Cosmetic Products Market Size 2024-2028

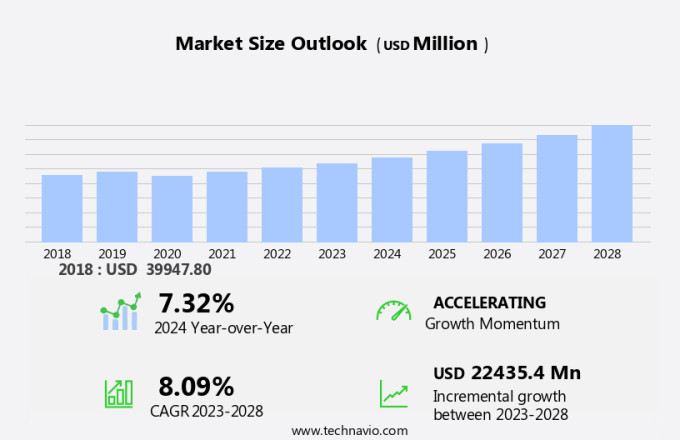

The antioxidant cosmetic products market size is forecast to increase by USD 22.44 billion at a CAGR of 8.09% between 2023 and 2028. The antioxidant cosmetic products market is experiencing significant growth due to the increasing awareness of the aging process and the desire to combat signs of aging such as sunspots and fine lines. With rising living standards and a focus on self-care, the demand for premium skincare and hair care products is on the rise. The young generation is particularly influenced by social media and the desire for perfect selfies, leading to a surge in demand for cosmetics with natural ingredients. Antioxidants, both naturally derived and chemically derived, are popular ingredients in these products due to their ability to neutralize free radicals and protect the skin from environmental damage. The market is competitive, with companies engaging in price wars and product innovation and portfolio extension being key growth strategies. The report provides an in-depth analysis of these trends and the challenges facing the antioxidant cosmetics market.

What will be the Size of the Market During the Forecast Period?

The cosmetic industry continues to evolve, with an increasing focus on antioxidant-infused products. Antioxidants play a crucial role in counteracting free radicals and oxidative stress, contributing to the maintenance of healthy skin. This market dynamic is driven by the growing awareness of the damaging effects of environmental factors and the aging process. Oxidative stress, resulting from the presence of free oxygen radicals, can lead to various skin issues, including premature aging, loss of texture, and uneven appearance. Antioxidant cosmetic products offer protection against these oxidation reactions, safeguarding the skin from the detrimental effects of free radicals.

Similarly, the market for antioxidant cosmetics is characterized by a diverse range of ingredients. These include proteins, lipids, and various plant-derived antioxidants, such as those found in fruits, herbs, and spices. Fruits like acai, goji berry, and pomegranate, as well as herbs like green tea and turmeric, are popular choices for their antioxidant properties. The performance of antioxidant cosmetics extends beyond anti-aging and anti-wrinkle benefits. They also offer anti-inflammatory properties, helping to soothe skin affected by infection, itching, or environmental irritants. UV protection is another essential aspect of antioxidant cosmetics, with many products incorporating antioxidants to enhance the efficacy of sunscreens.

Moreover, regulatory requirements play a significant role in the antioxidant cosmetics market. Brands must adhere to strict guidelines to ensure the safety and efficacy of their products. This includes rigorous testing for potential allergens and irritants, as well as ensuring the stability and shelf life of antioxidant ingredients. Brand recognition is a critical factor in the antioxidant cosmetics market. Consumers are increasingly seeking out trusted brands that offer high-quality, effective products. This has led to a growing trend of collaborations between cosmetic brands and the scientific community, as well as increased investment in research and development. In conclusion, the antioxidant cosmetics market represents a significant growth opportunity for companies looking to address the damaging effects of oxidative stress and environmental factors on the skin. With a diverse range of ingredients and applications, antioxidant cosmetics offer consumers a powerful solution for maintaining healthy, youthful-looking skin.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Skincare

- Haircare

- Color cosmetics

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. Antioxidant cosmetic products are primarily sold through offline distribution channels, which encompass retail formats such as specialty stores, hypermarkets, supermarkets, convenience stores, and warehouse clubs. In the United States, this distribution channel also includes drugstores, salons and spas, department stores, and medical clinics and institutes. These retail outlets generate a significant portion of the global revenue for antioxidant cosmetic products. The role of medical clinics in driving sales is noteworthy, as they provide customized, professional solutions for various beauty concerns, including hair growth, volume enhancement, and color improvement. In 2023, specialty stores accounted for the largest revenue share in the US market through offline distribution channels. Propyl gallate, a common antioxidant used in cosmetics, is derived from renewable sources such as plants and food.

However, its safety concerns, including potential carcinogenic effects and allergic reactions, necessitate careful concentration control and individual sensitivity assessment. Bacteria extracts and live bacteria are emerging trends in antioxidant cosmetic products, as they offer additional skin benefits by enhancing skin microbe activity. These innovative products are gaining popularity due to their natural origin and potential health benefits. When purchasing antioxidant cosmetic products, it is essential to consult a doctor or dermatologist for personalized recommendations based on your unique skin type and concerns.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 32.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

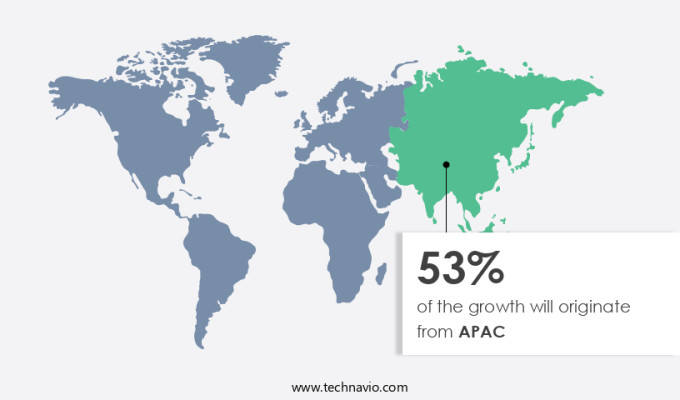

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Antioxidant cosmetic products have gained significant popularity in the global market due to their ability to combat free radicals and reduce oxidative stress, which can negatively impact the appearance and texture of the skin. The market for these products is driven by consumer demand for ingredients that provide superior performance, longer shelf life, and adherence to regulatory requirements. The use of both synthetic and natural antioxidants, such as vitamin C, vitamin E, and green tea extract, adds to the product's compatibility and stability. APAC is the largest market for antioxidant cosmetic products, accounting for over 40% of the global revenue in 2023.

Further, the region's demand is fueled by a growing awareness of personal hygiene and wellness, as well as the popularity of antioxidant skincare, haircare, and color cosmetic products. Key consumers in the region include China, Japan, South Korea, Australia, and India. Social media campaigning and celebrity endorsements have significantly influenced the buying behavior of consumers, particularly the millennial demographic, in APAC. The market is expected to continue its growth trajectory, with increasing demand from regions such as Europe and North America. To meet this demand, manufacturers are focusing on research and development to create innovative products that cater to diverse consumer preferences and regulatory requirements.

Also, the use of advanced technologies, such as nanotechnology and encapsulation, is also gaining popularity to enhance the effectiveness and stability of antioxidant cosmetic products. In conclusion, the market is poised for continued growth, driven by consumer demand for products that combat free radicals and reduce oxidative stress. APAC is the largest market for these products, with China, Japan, South Korea, Australia, and India being key consumers. Social media campaigning and celebrity endorsements have significantly influenced consumer behavior, and manufacturers are focusing on research and development to create innovative products that cater to diverse consumer preferences and regulatory requirements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Product innovation and portfolio extension are the key drivers of the market. The market is driven by the increasing consumer preference for cosmetics that offer multiple benefits in a short time. Free radicals and oxidative stress are major causes of skin and hair damage, leading to concerns such as aging, skin diseases, hair fall, and UV damage. To address these issues, cosmetic manufacturers introduce antioxidant-rich ingredients like vitamins, carotenoids, polyphenols, enzymes, and synthetic antioxidants such as butylated hydroxytoluene (BHT), butylated hydroxyanisole (BHA), and propyl gallate (PG). Natural antioxidants from plants, fruits, herbs, and spices are also gaining popularity due to their safety and compatibility with various skin and hair types. Regulatory requirements, shelf life, performance, and compatibility are crucial factors influencing the market's growth.

Additionally, antioxidant cosmetics offer anti-aging, anti-wrinkle, anti-inflammatory, and UV protection benefits, making them essential in skincare, hair care, and make-up applications. The aging population, increasing living standards, and the young generation's focus on selfies and social media have fueled the demand for these products. However, safety concerns, individual sensitivity, and potential allergic reactions necessitate careful consideration of concentration levels and compatibility with other ingredients. The market includes skin care, hair care, and body care products, with a growing trend towards natural ingredients and brand recognition. Environmental effects, infection, itching, and animal testing are some environmental and ethical concerns that companies must address. The market is expected to continue growing due to the increasing demand for premium skincare and hair care products and the availability of online shopping platforms. However, the market also faces challenges such as counterfeit cosmetic products and the need for balanced microbiomes in skin and hair care.

Market Trends

The growing popularity of private-label brands is the upcoming trend in the market. The market is witnessing significant growth as consumers increasingly seek out products that protect against free radicals and oxidative stress. Antioxidants, such as vitamins, carotenoids, polyphenols, and enzymes, are key ingredients in various cosmetic product categories, including skin care, hair care, make-up, and body care. Retailers are capitalizing on this trend by introducing private-label brands of antioxidant cosmetics, which offer cost advantages and cater to individual sensitivities and preferences. Major retailers, including supermarkets, hypermarkets, drugstores, and online stores, are expanding their private-label offerings. These distribution channels are popular due to their affordability and accessibility, especially for discount stores that prioritize value pricing.

Antioxidant cosmetic products are available in various forms, such as synthetic antioxidants like butylated hydroxytoluene (BHT), butylated hydroxyanisole (BHA), and propyl gallate (PG), and natural antioxidants derived from plants, fruits, herbs, and spices. Regulatory requirements, compatibility, stability, and safety are crucial factors in the development and production of antioxidant cosmetic products. Synthetic antioxidants, while effective, have raised concerns regarding their potential carcinogenic and allergic reactions. Natural antioxidants, on the other hand, offer a more natural and gentle alternative, but their stability and compatibility with other ingredients can be challenging. The aging population, skin diseases, hair fall, and the desire for anti-aging, anti-wrinkle, anti-inflammatory, UV protection, and moisturizing benefits are driving the demand for antioxidant cosmetic products.

Environmental effects, infection, itching, and other skin and hair concerns are also addressed by these products. Brands are recognizing the importance of using natural ingredients and balancing the skin microbiome to cater to consumer preferences. Online shopping and counterfeit cosmetic products are also influencing the market dynamics. In summary, the market is experiencing growth due to the increasing demand for products that combat free radicals and oxidative stress. Retailers are introducing private-label brands to cater to this trend, and various distribution channels are making these products accessible and affordable to consumers. Regulatory requirements, compatibility, stability, and safety are key considerations in the development and production of antioxidant cosmetic products, which are available in various forms and cater to various concerns.

Market Challenge

Growing price wars among market vendors is a key challenge affecting market growth. The market in the US is experiencing intense competition as more companies enter the market to capitalize on the growing demand for antioxidant-infused cosmetics. These products, which include skin care, hair care, make-up, and body care, offer protection against free radicals and oxidative stress, contributing to improved appearance, texture, and performance. Antioxidants, such as Butylated hydroxytoluene (BHT), Butylated hydroxyanisole (BHA), Propyl Gallate (PG), Tert-butylhydroquinone (TBHQ), Vitamins, Carotenoids, Polyphenols, Enzymes, and natural ingredients like plants, fruits, herbs, and spices, are used to formulate these products. Regulatory requirements and compatibility with various ingredients, as well as stability and shelf life, are crucial considerations for cosmetic manufacturers. Synthetic antioxidants, while effective, have raised concerns regarding safety, including carcinogenic and allergic reactions.

In response, there is a growing trend towards natural antioxidants and bacteria extracts, which offer potential benefits for skin microbe activity and address conditions like acne, eczema, dryness, wrinkles, and skin diseases. The aging population and increasing living standards have fueled the demand for anti-aging, anti-wrinkle, anti-inflammatory, UV protection, and moisturizing cosmetics. Consumers are increasingly turning to premium skincare, hair care products, and natural ingredients for selfies and social media, further driving market growth. However, the market is also plagued by challenges, including price wars among companies and the proliferation of counterfeit cosmetic products. Brands must ensure brand recognition and maintain safety standards while catering to individual sensitivity and preferences. Online shopping offers convenience, but consumers must be vigilant against counterfeit products. Environmental effects, infection, itching, and animal testing are other concerns that companies must address to maintain market competitiveness.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Air Liquide SA: The company offers different types of antioxidant cosmetic products, especially Sepitone.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- Archer Daniels Midland Co.

- Ashland Inc.

- Barentz International BV

- BASF SE

- BIOTECNOLOGIAS APLICADAS SL

- Camlin Fine Sciences Ltd.

- Croda International Plc

- Eastman Chemical Co.

- Evonik Industries AG

- Givaudan SA

- IMCD NV

- Industrias Asociadas S.L.

- Koninklijke DSM NV

- Lonza Group Ltd.

- LOreal SA

- Merck KGaA

- NATURAL SOLTER SL

- Provital SA

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Antioxidant cosmetic products combat the damaging effects of free radicals and oxidative stress, enhancing appearance and texture. Ingredients like vitamins, carotenoids, polyphenols, and enzymes neutralize free oxygen radicals, protecting proteins, lipids, and skin cells from oxidation reactions. Regulatory requirements ensure safety, compatibility, and stability. Synthetic antioxidants such as butylated hydroxytoluene (BHT), butylated hydroxyanisole (BHA), and tert-butylhydroquinone (TBHQ) or natural alternatives from plants, fruits, herbs, and spices offer antioxidant benefits. Skin care, hair care, and make-up products all benefit from antioxidants. The aging population seeks anti-aging solutions for sunspots, fine lines, and wrinkles.

In summary, natural ingredients appeal to the young generation, with premium skincare and selfies driving demand on social media. Safety, concentration, and individual sensitivity are crucial considerations. Cosmetic manufacturers focus on balanced microbiomes, counterfeit product prevention, and fragrance. Environmental effects, infection, itching, and allergic reactions are addressed through antioxidant use. Online shopping offers convenience, but buyers must beware of counterfeit cosmetics. Antioxidants offer anti-inflammatory, UV protection, and moisturizing benefits.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 22.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 53% |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Air Liquide SA, Archer Daniels Midland Co., Ashland Inc., Barentz International BV, BASF SE, BIOTECNOLOGIAS APLICADAS SL, Camlin Fine Sciences Ltd., Croda International Plc, Eastman Chemical Co., Evonik Industries AG, Givaudan SA, IMCD NV, Industrias Asociadas S.L., Koninklijke DSM NV, Lonza Group Ltd., LOreal SA, Merck KGaA, NATURAL SOLTER SL, Provital SA, and Wacker Chemie AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch