Application Container Market Size 2024-2028

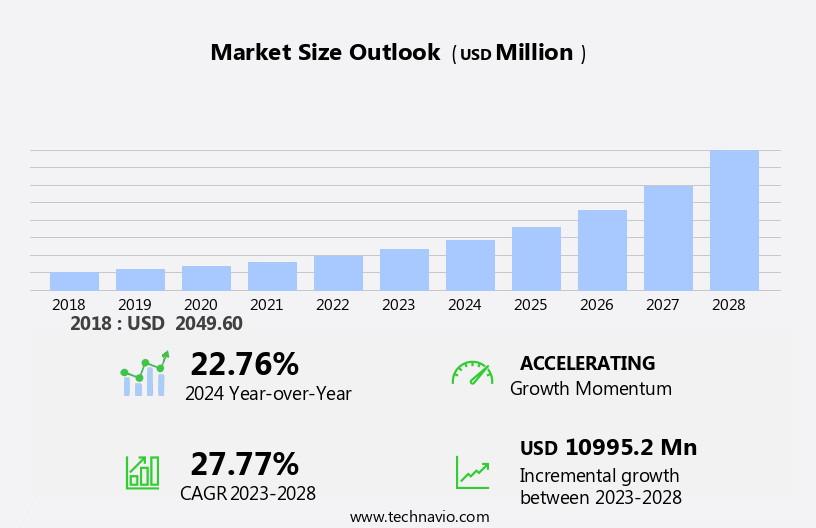

The application container market size is forecast to increase by USD 11 billion at a CAGR of 27.77% between 2023 and 2028.

- In the dynamic landscape of IT spending, application containers have emerged as a key technology for businesses undergoing digital transformation. The integration of containers with cloud computing, particularly in hybrid cloud environments, is driving market growth. Cloud computing's flexibility and automation are boosting container adoption, enabling businesses to deploy applications quickly and efficiently. However, security concerns associated with application containers are a significant challenge. As organizations continue to invest in digital initiatives, ensuring container security becomes increasingly important. Market trends include the growing popularity of containerization for microservices architecture and the integration of containers with serverless computing. Organizations must address these challenges to fully leverage the benefits of application containers In their digital strategies.

What will be the Size of the Application Container Market During the Forecast Period?

- The market is experiencing significant growth as businesses increasingly adopt containerization for deploying and managing software applications. Containers, which allow multiple applications to be run on a single OS kernel, offer increased automation, security, and scalability compared to traditional virtualization technologies. This market encompasses various activities, including container management platforms, runtime environments, and security solutions. Containerization enables the separation of applications from their underlying infrastructure, simplifying customer interactions and reducing dependencies on specific computing environments. Virtualization technology plays a crucial role in containerization, providing a layer of abstraction between applications and infrastructure. Cloud native technologies, such as Kubernetes and Docker, are driving the container market's growth, with applications in various industries, including connected homes, connected cars, and connected healthcare.

- Containerization's agility and scalability make it an ideal choice for cloud deployment, both In the cloud and on-premise. Network connection and bandwidth are essential considerations in container deployment, with network congestion a potential challenge. Container security solutions address these concerns, providing strong security features to protect against potential threats. The market's size is substantial, with continuous growth driven by the increasing demand for scalable, agile application development and deployment. Containerization's ability to address the unique needs of modern computing environments makes it a vital component of today's technology landscape.

How is this Application Container Industry segmented and which is the largest segment?

The application container industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- BFSI

- Healthcare and life sciences

- Telecom and IT

- Retail and ecommerce

- Others

- Component

- Platform

- Service

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By End-user Insights

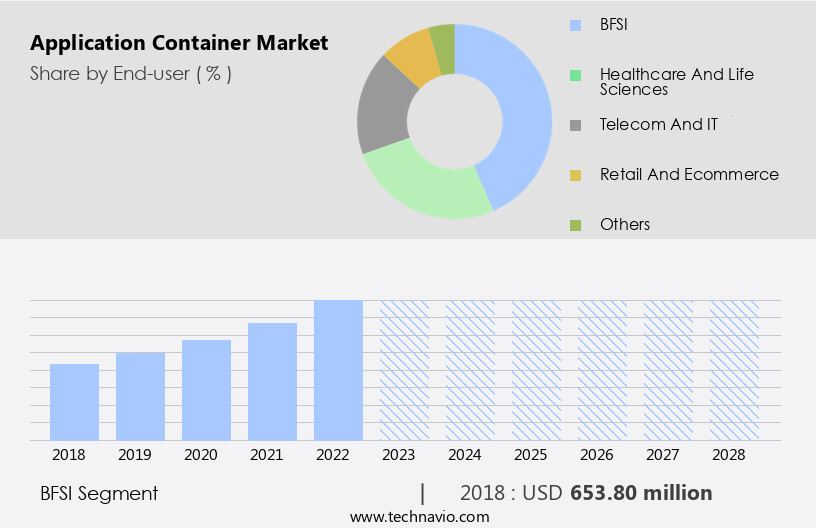

- The BFSI segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly In the BFSI sector, due to the technology's ability to enhance agility, scalability, and security in application development and deployment. Application containers, which run on a single OS kernel and offer automation, network connection, and customer interaction capabilities, are increasingly being adopted by financial organizations to streamline their IT operations. Kubernetes, an open-source container orchestration platform, is widely used In the BFSI sector for its ability to automate deployment, monitor containerized workloads, and ensure high availability and fault tolerance. This resilient infrastructure is essential for critical financial systems, which require high resource consumption and must handle workload fluctuations and IT spending on technology initiatives.

Containerization projects, including those based on microservices architecture, offer a lightweight, portable solution for organizations of all sizes, from small businesses to large enterprises, in both on-premise and cloud environments. Cloud-based infrastructure solutions, including hybrid cloud environments, offer flexibility and cost savings, while container security solutions and container runtime environments address security concerns and compliance requirements.

Get a glance at the Application Container Industry report of share of various segments Request Free Sample

The BFSI segment was valued at USD 653.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

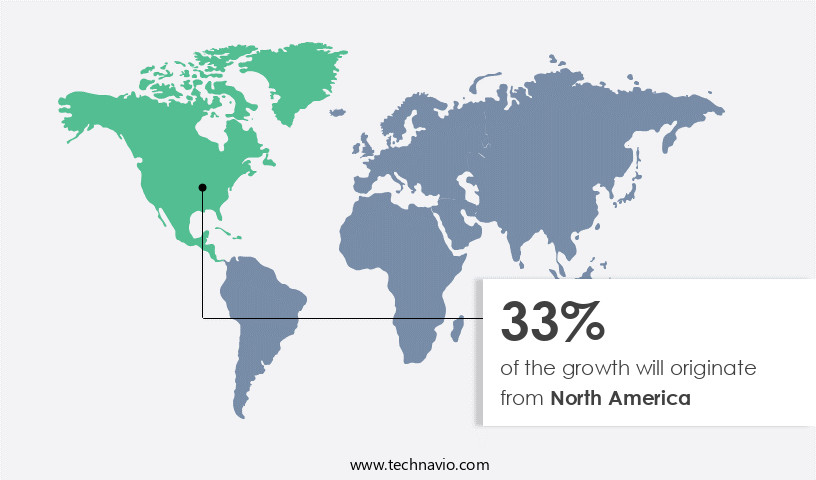

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds a substantial share In the market, driven by advanced IT infrastructure, high digitalization, and a focus on technological innovation. Cloud computing adoption is a significant factor fueling market growth. Organizations are transitioning to cloud solutions due to their cost-effectiveness, scalability, and minimal management requirements. For instance, ADS Alliance Data Systems Inc., a US-based publicly-traded loyalty and marketing services company, migrated to Oracle cloud solution, enabling agility and savings of over USD1 million annually. Application container technology facilitates automation, security, and network connectivity for customer interactions, making it an essential component of application infrastructure in hybrid and public cloud environments.

Large Enterprises in verticals like Telecom and IT & Telecom are increasingly adopting containerization projects for digital transformation, coordinating microservices-based architectures, and ensuring workload mobility and scalability in infrastructure platforms and container orchestration platforms like Kubernetes and Cloud Foundry. Security concerns, resource usage, and operating expenses are critical factors influencing the market. Container security solutions, container runtime environments, and container management platforms address security vulnerabilities, runtime threats, and compliance requirements. Container image scanning, runtime protection, and virtualization are essential security features in a production environment. Container orchestration platforms ensure efficient resource allocation, monitor containerized workloads, and mitigate performance degradation in cloud-based infrastructure.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Application Container Industry?

Growing popularity of cloud-based services is the key driver of the market.

- Application containers have gained significant traction In the IT sector as organizations strive to reduce capital expenditures and streamline application deployment and management in cloud environments. By encapsulating applications and their dependencies, application container technology offers a flexible, scalable, and portable solution that enables seamless development and consistent runtime across various cloud platforms. The standardized runtime environment provided by application containers eliminates compatibility issues and simplifies the deployment process, making it an attractive option for businesses looking to optimize their application infrastructure. Application containers offer several advantages in cloud environments. They allow for high resource usage efficiency, agility, and productivity, especially in contemporary applications and microservices-based architectures. Container orchestration tools like Kubernetes further enhance the benefits by automating deployment, scaling, and monitoring containerized workloads. The market for application container platforms is growing as more businesses adopt hybrid cloud technologies, including private and public clouds, to leverage cloud environment flexibility. Application container technology's lightweight and portable nature also makes it suitable for organizations of all sizes, from small businesses to large enterprises in verticals like Telecom and digital transformation projects. Security is a crucial consideration when deploying applications in cloud environments.

- Additionally, application container solutions offer security features like container image scanning, runtime protection, and compliance requirements to mitigate container vulnerabilities and runtime threats. Additionally, container management platforms and container security solutions help organizations manage and secure their containerized environments effectively. Application containers offer several benefits, including cost savings, resource efficiency, and agility. As businesses continue to invest in technology initiatives and containerization projects, application container technology is expected to play a significant role in enabling scalable, agile application development and efficient IT operations, even as workload fluctuations and infrastructure requirements evolve.

What are the market trends shaping the Application Container Industry?

Integration of containers with serverless computing is the upcoming market trend.

- Application container technology, integrated with serverless computing, brings substantial advantages to organizations. Containers, which package application components using a single OS kernel, enable lightweight and portable deployment. They offer agility through easy scaling and resource efficiency. Serverless computing, in turn, eliminates infrastructure management and provides automatic scaling based on usage, ensuring optimal resource allocation and cost savings. By combining containers and serverless computing, organizations can break down applications into microservices, with each service running in its container. This approach promotes scalability and agility, allowing businesses to respond quickly to workload fluctuations and IT spending requirements. Container orchestration platforms and security solutions provide coordination, cutting-edge security, and compliance, addressing concerns in public cloud environments. Containerized applications offer flexibility in hybrid cloud technologies, including private and public clouds, on-premise segments, and cloud-based infrastructure. They provide container runtime environments, container management platforms, and containerized environments with container vulnerabilities and runtime threats addressed through security solutions.

- In the IT sector, application container technology is in high demand, with productivity gains and digital transformation projects driving adoption. Containerization projects, such as microservices architecture, are essential for contemporary applications, offering agility, efficiency, and workload mobility in infrastructure platforms and container orchestration platforms like Kubernetes, Azure Container, and Cloud Foundry. Organizations of all sizes, including Large Enterprises and verticals like Telecom, benefit from the containerization trend. The technology initiatives enable automation of application deployments, monitoring containerized workloads, and managing resource contention, ensuring performance and minimizing resource overhead. In cloud environments, containerized applications offer the flexibility to run in various hosting scenarios, such as on-premise deployments, public cloud platforms, and distant data centers. Containerization projects are crucial for businesses seeking to adapt to the demands of modern IT operations, remote access, and the increasing need for security features in cloud computing, hybrid cloud solutions, SaaS, PaaS, and IaaS.

What challenges does the Application Container Industry face during its growth?

Security concerns associated with application containers is a key challenge affecting the industry growth.

- Application container technology offers businesses agility and efficiency by allowing applications to run in isolated environments with minimal resource usage. However, the use of pre-built container images poses new security challenges. Vulnerabilities and outdated software components In these images can expose applications to various risks, including malware injection and data breaches. The potential for supply chain attacks is also significant, as third-party images or repositories may be compromised. Misconfigurations and inadequate access controls are additional security concerns. Poorly configured containers may expose sensitive data or provide unauthorized access; malicious actors can exploit container privileges to gain unauthorized access or initiate lateral movement within the container environment.

- Security solutions, such as container image scanning and runtime protection, are essential to mitigate these risks. Containers offer flexibility for deployment in various computing environments, including hybrid cloud solutions and on-premise installations. IT operations teams must ensure proper automation and coordination to maintain security and optimize resource allocation In these environments. The high demand for application container technology In the IT sector, particularly in large enterprises and vertical industries like Telecom, necessitates a focus on container security. Cloud native technologies, such as container orchestration platforms like Kubernetes, offer scalability and agility for application development and deployment. Despite these benefits, organizations must address the security challenges associated with container technology to fully realize its potential for productivity and digital transformation efforts.

Exclusive Customer Landscape

The application container market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the application container market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, application container market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Aqua Security Software Ltd.

- Broadcom Inc.

- Cisco Systems Inc.

- DevFactory FZ LLC

- Docker Inc.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Palo Alto Networks Inc.

- Perforce Software Inc.

- Pure Storage Inc.

- Samsung Electronics Co. Ltd.

- Suse Group

- Sysdig Inc.

- Virtuozzo International GmbH

- VMware Inc.

- Weaveworks Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Application container technology has gained significant traction In the IT sector as organizations seek to improve productivity, agility, and efficiency In their application infrastructure. This technology enables the deployment and running of applications within a single OS kernel using an application container platform. The automation of activities such as system installations and IT operations has been a key driver of this trend. The use of application containers offers several advantages. First, it allows for greater flexibility in cloud environments, whether private or public. This flexibility is essential for businesses dealing with high demand and workload fluctuations. Additionally, container technology provides relative isolation, which can help mitigate misconfiguration and improper handling of applications. Container orchestration is another important aspect of application container technology. This technology enables the coordination of containerized applications and their underlying resources, ensuring optimal performance and resource usage. Container orchestration platforms like Kubernetes offer automated deployment and scaling capabilities, making it easier for organizations to manage their application infrastructure.

Further, container technology also offers cost savings by reducing operating expenses and resource consumption compared to traditional virtual machines. Containers boot up faster and require fewer resources, making them a lightweight and portable solution for software organizations. Security is a critical concern in any application infrastructure. Container environments offer security features such as container image scanning, runtime protection, and compliance requirements. However, container vulnerabilities and runtime threats still exist, and it is essential to monitor containerized workloads and allocate resources effectively to prevent performance degradation and resource contention. The adoption of application container technology is not limited to the cloud environment. Organizations can also host their containers on-premise, taking advantage of cloud-like traits such as scalability and agility while maintaining control over their hardware and IT network elements.

Thus, the use of application containers is not limited to large enterprises but is also popular In the verticals of telecom, digital transformation projects, and other industries undergoing IT spending and technology initiatives. The flexibility and efficiency of containerization projects make them an attractive option for organizations of all sizes. Container technology is a cutting-edge solution for running contemporary applications in various computing environments. It offers several advantages over traditional virtualization technology, including faster boot-up times, lower resource overhead, and greater agility. Container management platforms and container security solutions are essential components of any containerized infrastructure, ensuring optimal performance, security, and compliance. In conclusion, application container technology offers several advantages for organizations looking to improve their application infrastructure's productivity, agility, and efficiency. Whether deployed on-premise or In the cloud, container technology offers flexibility, cost savings, and security features that make it an attractive option for software organizations of all sizes and industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.77% |

|

Market growth 2024-2028 |

USD 11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

22.76 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Application Container Market Research and Growth Report?

- CAGR of the Application Container industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the application container market growth of industry companies

We can help! Our analysts can customize this application container market research report to meet your requirements.