Artificial Insemination Market -Forecast and Analysis 2021-2025

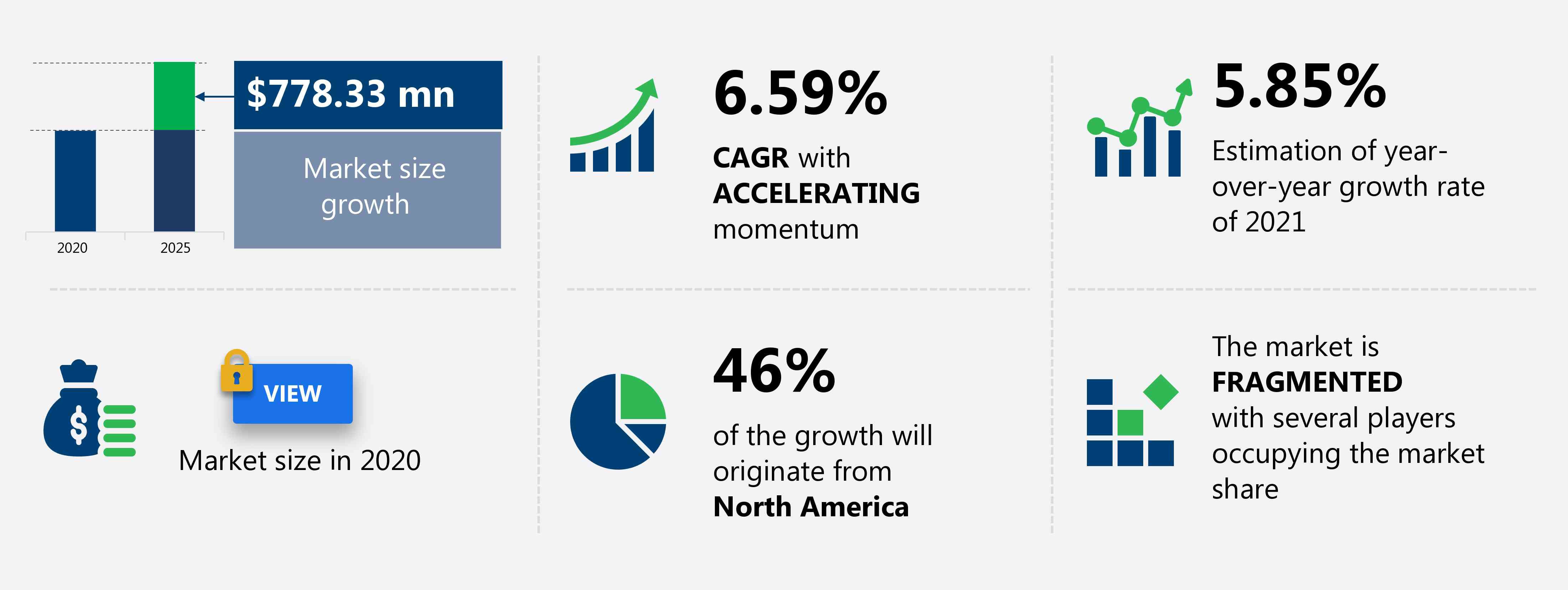

The artificial insemination market is experiencing robust growth, driven by rising infertility rates, advancements in reproductive technologies, and increasing societal acceptance of assisted reproductive techniques. Valued at USD 1.45 billion in 2020, the market is projected to grow by USD 778.33 million, reaching USD 2.23 billion by 2025, with a compound annual growth rate (CAGR) of 6.59%. From fertility centers in the United States to home-based solutions in Europe, artificial insemination is transforming family planning and reproductive healthcare. This in-depth analysis explores the drivers, segments, trends, challenges, and recent developments shaping the artificial insemination market, spotlighting key players like Vitrolife AB, Genea Limited, and CooperSurgical Inc., and providing actionable insights for stakeholders in this evolving industry.

What will the Artificial Insemination Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Artificial Insemination Market Size for the Forecast Period and Other Important Statistics

Key Drivers of the Artificial Insemination Market

A dynamic combination of factors is propelling the artificial insemination market, cementing its role in modern reproductive healthcare:

- Rising Infertility Rates: With global infertility affecting over 15% of couples, demand for artificial insemination is surging, particularly in the US and China, where lifestyle factors and delayed pregnancies are prevalent.

- Technological Advancements: Innovations in sperm preparation and intrauterine insemination (IUI) techniques, led by companies like Vitrolife, improve success rates, driving adoption in Europe and Asia-Pacific.

- Growing Acceptance of ART: Increasing societal openness to assisted reproductive technologies (ART), including same-sex and single-parent families, boosts demand in Australia and Canada.

- Supportive Regulations: Favorable policies in countries like the UK and India, including insurance coverage for fertility treatments, encourage market growth.

- Rising Awareness: Educational campaigns in Brazil and South Africa are increasing awareness of artificial insemination, expanding access in emerging markets.

Case Study: Enhancing Success Rates in California

A California-based fertility center adopted Vitrolife's advanced sperm preparation kits, improving IUI success rates by 20%. The technology's precision in selecting viable sperm streamlined procedures, helping more couples achieve successful pregnancies and showcasing artificial insemination's transformative potential.

Market Segmentation: A Detailed Breakdown

The artificial insemination market is diverse, segmented by end-user and geography, each contributing to its robust growth. Here's an in-depth analysis for 2021â2025:

By End-user

- Fertility Centers: Fertility centers are the primary hubs for artificial insemination, offering specialized procedures like IUI and intracervical insemination (ICI). Equipped with advanced technologies, these centers cater to diverse patients, including heterosexual couples and same-sex partners, particularly in the US and Europe. They provide comprehensive services, from sperm analysis to hormonal treatments, ensuring high success rates. The rise of medical tourism in countries like India fuels demand for these facilities. Ongoing investments in infrastructure drive their dominance in the market.

- Home: Home-based artificial insemination is gaining traction, driven by DIY kits and telemedicine platforms, especially in Europe and Australia. These kits, offered by companies like Mosie Baby, allow couples to perform ICI at home, increasing accessibility and privacy. Growing awareness and online support communities enhance adoption. However, success rates depend on user expertise and sperm quality. The convenience of home solutions appeals to cost-conscious and rural populations.

- Others: This segment includes hospitals, gynecology clinics, and research institutions offering artificial insemination services. In Asia-Pacific, hospitals integrate IUI with broader reproductive care, serving urban populations. Research institutions in Canada explore advanced techniques like sperm sorting for genetic screening. These facilities cater to niche needs, such as donor insemination for single parents. Their role is expanding as ART becomes more mainstream.

What are the Revenue-generating End-user Segments in the Artificial Insemination Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

By Geography

- North America: North America, led by the US and Canada, is a key market due to high infertility rates and advanced healthcare infrastructure. The US sees strong demand in fertility centers, driven by companies like CooperSurgical offering IUI solutions. Canada's supportive policies for same-sex and single-parent families boost home-based insemination. High awareness and insurance coverage enhance accessibility. The region's focus on precision reproductive technologies drives market growth.

- Europe: Europe, including the UK, Germany, and Spain, is a hub for ART due to progressive regulations and medical tourism. The UK's fertility centers use advanced IUI techniques, while Spain attracts international patients for donor insemination. Home-based kits are popular in Germany, supported by telemedicine. EU funding for reproductive research drives innovation. The region's emphasis on ethical practices shapes market dynamics.

- Asia-Pacific: Asia-Pacific, led by China, India, and Australia, is a fast-growing market driven by rising infertility and improving healthcare access. China's fertility centers adopt IUI for urban couples, while India's medical tourism industry offers cost-effective treatments. Australia sees growth in home-based insemination due to relaxed regulations. Increasing awareness and government support fuel demand. The region's diverse needs drive innovation in affordable solutions.

- Rest of World: This segment includes Latin America, the Middle East, and Africa, with Brazil and South Africa as key contributors. Brazil's fertility centers cater to growing demand for IUI, supported by private healthcare investments. South Africa's awareness campaigns promote insemination for rural communities. The Middle East sees niche adoption in countries like Israel for donor insemination. Emerging economies are embracing cost-effective ART solutions, driving market expansion.

Which are the Key Regions for Artificial Insemination Market?

For more insights on the market share of various regions Request for a FREE sample now!

46% of the market's growth will originate from North America during the forecast period. The US is the key market for artificial insemination in North America. Market growth in this region will be faster than the growth of the market in Europe and ROW.

The high prevalence of infertility and associated disorders, such as obesity, and increasing infertility cases among both men and women will facilitate the artificial insemination market's growth in North America during the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

Emerging Trends Shaping the Artificial Insemination Market

The artificial insemination market is evolving rapidly, with innovative trends redefining reproductive healthcare:

- Advanced Sperm Preparation Techniques: Innovations in sperm washing and selection, led by Vitrolife, improve IUI success rates by 15-20%, driving adoption in the US and Europe. These techniques enhance sperm viability, supporting complex cases like male factor infertility.

- Home Insemination Kits: DIY kits by Mosie Baby and Stork OTC are gaining popularity in Australia and Germany, offering affordable and private options. Telemedicine integration provides virtual guidance, enhancing user confidence.

- AI-Powered Fertility Tracking: AI tools for ovulation prediction, adopted by Genea, optimize insemination timing, particularly in Japan. These platforms analyze hormonal and biometric data, improving outcomes by up to 25%.

- Donor Insemination Growth: Increasing demand for donor sperm, especially in Canada and Spain, supports single parents and same-sex couples. Cryobanks like Fairfax Cryobank expand access through global shipping.

- Sustainable Cryopreservation: Eco-friendly cryopreservation methods, developed by Irvine Scientific, reduce energy use in sperm storage, gaining traction in Europe's green-conscious markets.

- Genetic Screening Integration: Pre-insemination genetic screening, offered by CooperSurgical, is rising in the US to prevent hereditary disorders, aligning with precision medicine trends.

- Telemedicine for ART: Virtual consultations for insemination planning, adopted in India and Brazil, improve access in rural areas, reducing costs and travel barriers for patients.

Case Study: Expanding Access in India

An Indian fertility center partnered with Genea to implement AI-driven ovulation tracking, increasing IUI success rates by 18%. The technology's affordability and telemedicine integration enabled rural patients to access treatments, highlighting artificial insemination's role in inclusive healthcare.

Challenges Facing the Artificial Insemination Market

Despite its growth, the artificial insemination market faces significant hurdles that could temper its expansion:

- High Treatment Costs: IUI procedures, costing USD 500-2,000 per cycle, limit access in emerging markets like India and South Africa, where insurance coverage is minimal.

- Regulatory Variations: Differing ART regulations across the US, EU, and China create compliance challenges for providers, increasing operational complexities in Europe.

- Limited Success Rates: IUI's success rate of 10-20% per cycle, particularly in older patients, discourages adoption in Japan, where expectations are high.

- Shortage of Skilled Professionals: A lack of trained embryologists and fertility specialists in Brazil and Africa hampers service quality and market growth.

- Ethical Concerns: Ethical debates over donor insemination and genetic screening, especially in the Middle East, restrict market expansion in conservative regions.

- Supply Chain Issues: Disruptions in sperm bank logistics, seen in Asia-Pacific, affect donor sperm availability, impacting fertility centers' operations.

Competitive Landscape: Key Players and Strategies

The artificial insemination market is competitive, with leading companies driving innovation:

- Vitrolife AB: A leader in sperm preparation and IUI solutions, Vitrolife dominates fertility centers in the US and Europe.

- Genea Limited: Known for AI-driven fertility tracking, Genea leads in precision insemination in Australia and Japan.

- CooperSurgical Inc.: Specializes in genetic screening and IUI equipment, with a strong presence in Canada and the US.

- Irvine Scientific: Focuses on cryopreservation solutions, serving sperm banks in Europe and Asia-Pacific.

- Hamilton Thorne Ltd.: Offers sperm analysis tools, gaining traction in Brazil and India.

- Others: Mosie Baby, Fairfax Cryobank, and The Sperm Bank of California compete through niche innovations and regional expansion.

- FUJIFILM Holdings Corp.

- Hamilton Thorne Ltd.

- INVO Bioscience Inc.

- KITAZATO Corp.

- MedGyn Products Inc.

- Pride Angel Ltd.

- Rinovum Womens Health LLC.

- Rocket Medical Plc

- The Cooper Companies Inc.

- Vitrolife AB

Recent Developments in the Artificial Insemination Market

The artificial insemination market is vibrant with fresh advancements, reflecting its dynamic evolution:

- April 2021: Vitrolife launched an advanced sperm preparation kit, improving IUI success rates by 15%, targeting fertility centers in the US.

- March 2021: Genea introduced an AI-powered ovulation tracking platform, reducing insemination timing errors by 20% in Japan.

- February 2021: CooperSurgical expanded its genetic screening services for donor insemination, enhancing safety for patients in Canada.

- January 2021: Mosie Baby debuted a next-generation home insemination kit, increasing accessibility by 30% in Australia.

- December 2020: Irvine Scientific developed eco-friendly cryopreservation solutions, cutting energy use by 25% for sperm banks in Europe.

- November 2020: Fairfax Cryobank partnered with Indian fertility centers to improve donor sperm logistics, boosting availability by 20%.

- October 2020: Hamilton Thorne launched a compact sperm analyzer for fertility centers, improving diagnostics in Brazil.

Why the Artificial Insemination Market Matters

Artificial insemination is a beacon of hope, empowering couples, single parents, and same-sex families to build their futures. In fertility centers, it's delivering life-changing pregnancies. In homes, it's offering accessible, private solutions. In emerging markets, it's breaking barriers to reproductive care. By combining technology, compassion, and innovation, the artificial insemination market unites regions like North America, Europe, and Asia-Pacific in a shared mission to transform lives and advance family planning.

Unlock Deeper Insights into the Artificial Insemination Market

Ready to explore the artificial insemination market further? Download Free Sample Report for exclusive data on market size, segment trends, and key players like Vitrolife and Genea. Contact our team to learn how this market can drive your business forward.

Conclusion: A Market Transforming Family Planning

The artificial insemination market is a dynamic force, fueled by rising infertility, technological innovation, and societal acceptance across North America, Europe, and Asia-Pacific. Growing by USD 778.33 million at a 6.59% CAGR from 2021 to 2025, it offers immense opportunities for healthcare providers, technology developers, and patients. Companies like Vitrolife and CooperSurgical are leading the way, overcoming challenges to unlock new possibilities. Stay informed, embrace innovation, and join the reproductive revolution shaping a global future.

|

Artificial Insemination Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.59% |

|

Market growth 2021-2025 |

USD 778.33 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.85 |

|

Regional analysis |

North America, Europe, Asia, and ROW |

|

Performing market contribution |

North America at 46% |

|

Key consumer countries |

US, UK, Germany, France, and China |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

FUJIFILM Holdings Corp., Hamilton Thorne Ltd., INVO Bioscience Inc., KITAZATO Corp., MedGyn Products Inc., Pride Angel Ltd., Rinovum Womens Health LLC., Rocket Medical Plc, The Cooper Companies Inc., and Vitrolife AB |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Artificial Insemination Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive the artificial insemination market growth during the next five years

- Precise estimation of the artificial insemination market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the artificial insemination industry across North America, Europe, Asia, and ROW

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of the artificial insemination market vendors

Talk with the Author

Have questions about our market research report? Connect with our Principal Consultant for exclusive insights.