Artificial Intelligence (AI) Chips Market Size 2025-2029

The artificial intelligence (AI) chips market size is valued to increase by USD 902.65 billion, at a CAGR of 81.2% from 2024 to 2029. Increased focus on developing AI chips for smartphones will drive the artificial intelligence (ai) chips market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By Product - ASICs segment was valued at USD 4.73 billion in 2023

- By End-user - Media and advertising segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 6.00 million

- Market Future Opportunities: USD 902649.30 million

- CAGR from 2024 to 2029 : 81.2%

Market Summary

- The market is experiencing significant growth, with global revenue projected to reach USD30 billion by 2026, according to a recent study. This expansion is driven by the increasing demand for more efficient and powerful AI solutions, particularly in sectors such as healthcare, finance, and manufacturing. The convergence of AI and the Internet of Things (IoT) is a key trend fueling market growth. As more devices become connected and require AI capabilities, the demand for specialized chips to handle complex computations increases. However, this growth comes with challenges. The dearth of technically skilled workers in AI chips development poses a significant hurdle for companies seeking to innovate and stay competitive.

- Despite these challenges, the future of the AI Chips Market looks bright. Companies are investing heavily in research and development to create chips specifically designed for AI applications. For instance, Intel and Google have announced plans to release new AI-focused chips in the near future. These advancements are expected to lead to even more powerful and efficient AI solutions, further driving market growth. In conclusion, the AI Chips Market is poised for significant expansion, fueled by increasing demand for AI solutions and the convergence of AI and IoT. However, the lack of skilled workers in this field poses a challenge that companies must address to remain competitive.

- Despite these challenges, continued investment in research and development is expected to lead to breakthroughs in AI chip technology.

What will be the Size of the Artificial Intelligence (AI) Chips Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Artificial Intelligence (AI) Chips Market Segmented ?

The artificial intelligence (ai) chips industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- ASICs

- GPUs

- CPUs

- FPGAs

- End-user

- Media and advertising

- BFSI

- IT and telecommunication

- Others

- Processing Type

- Edge

- Cloud

- Application

- Nature language processing (NLP)

- Robotics

- Computer vision

- Network security

- Others

- Technology

- System on chip (SoC)

- System in package (SiP)

- Multi chip module (MCM)

- Others

- Function

- Training

- Inference

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The ASICs segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with application-specific integrated circuits (ASICs) gaining significant traction. ASICs, a type of non-configurable chip, offer instruction sets and libraries that enable local data processing and parallel algorithm acceleration. Unlike GPUs and FPGAs, ASICs provide faster performance, but their non-reconfigurable nature sets their function once established. The preference for ASICs in cloud-based data centers is escalating, as they account for a growing market share. According to a recent report, ASIC-based AI chips are projected to reach a 40% market share by 2025. These chips excel in areas like tensor processing units, custom chip design, and high-bandwidth memory, which are crucial for AI applications.

Thermal management solutions, parallel computing architecture, and power efficiency metrics are also essential considerations for these chips. Furthermore, advancements in silicon photonics, training optimization, and AI algorithm optimization contribute to the market's ongoing development. Key components include instruction set architecture, hardware security modules, edge AI hardware, on-chip memory and gpu computing clusters.

The ASICs segment was valued at USD 4.73 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Artificial Intelligence (AI) Chips Market Demand is Rising in North America Request Free Sample

The market is experiencing significant growth, particularly in North America, due to escalating investments in autonomous vehicle technology. Advanced systems, including advanced driver-assistance systems (ADAS), heads-up displays (HUD), light detection and ranging (LiDAR), and radio detection and ranging (RADAR), are integrated into these vehicles. Electronic components, such as sensors, microcontrollers, microprocessors, and other RF components, generate and process vast amounts of data in real-time.

Consequently, chip manufacturers are allocating substantial resources towards the research and development of AI chips tailored for autonomous vehicles. The burgeoning autonomous vehicle sector, with several automotive OEMs actively working on commercialization, presents lucrative opportunities for AI chip manufacturers to capitalize on this emerging market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as the demand for more powerful and efficient AI solutions continues to rise. One of the key challenges in this market is managing thermal dissipation in AI chips, which can negatively impact performance and reliability. High-bandwidth memory for AI inference is becoming increasingly important to address this issue, as it enables faster data processing and reduces the need for frequent memory accesses. The impact of chip architecture on AI model training is another critical factor in the AI chips market. FPGA acceleration for deep learning algorithms is gaining popularity due to its flexibility and configurability, while ASIC design for specialized neural networks offers superior performance and power efficiency.

Custom chip design for edge AI applications is also a growing trend, as it allows for optimized power consumption and enhances compute density. Improving data throughput in AI computing clusters is essential for real-time AI processing. Reducing network latency in AI deployments is another key area of focus, as it can significantly impact system performance. Optimizing power consumption in AI hardware is a major concern, with low-power design techniques and fault tolerance mechanisms being employed to ensure reliability and extend battery life. Memory bandwidth limitations in AI chips are a significant challenge, with cache coherence protocols for AI accelerators being used to improve data access efficiency. Security vulnerabilities in AI chips are also a concern, with mitigation strategies being developed to protect against potential threats. AI algorithm optimization for hardware acceleration and hardware-software co-design for improved AI performance are other areas of active research and development. System-on-a-chip integration for AI workloads and AI chip packaging and interconnect technology are essential for scaling up AI systems and improving overall system performance. As the AI chips market continues to evolve, innovation in these areas will be crucial to meeting the growing demand for more powerful and efficient AI solutions.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence (AI) Chips Industry?

- The primary catalyst driving the market is the heightened emphasis on creating AI chips specifically designed for integration into smartphones.

- In the rapidly evolving technology landscape, data centers have become the backbone of businesses, housing thousands of servers powered by Central Processing Units (CPUs). With the increasing adoption of Artificial Intelligence (AI), particularly deep neural networks, companies require more computational power than CPUs can provide. Consequently, data centers are integrating AI processors to enhance their capabilities. These AI processors, such as Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs), are optimized for handling complex data processing tasks, making them indispensable for AI applications. To improve data center efficiency and reduce power consumption, AI technology is being employed in various areas.

- Energy management systems leverage AI to optimize power usage, predicting energy demands and adjusting power distribution accordingly. Infrastructure management uses AI to monitor and maintain server health, ensuring optimal performance and reducing downtime. Additionally, AI enhances security by detecting anomalous behavior and predicting potential threats. By integrating AI into their operations, data centers are able to reduce costs, improve uptime, and adapt to the evolving technology landscape.

What are the market trends shaping the Artificial Intelligence (AI) Chips Industry?

- The convergence of artificial intelligence (AI) and the Internet of Things (IoT) represents an emerging market trend. AI and IoT technologies are increasingly merging to create innovative solutions.

- IoT, or the Internet of Things, is a dynamic ecosystem of interconnected devices, objects, and machines that execute tasks autonomously, driven by data and information exchange. The market's significance stems from its versatile applications across sectors such as aerospace and defense, automotive, consumer electronics, healthcare, and more. IoT device manufacturers are integrating Human-Machine Interface (HMI) technologies into devices like cameras, drones, smart speakers, smartphones, smart TVs, and others. This integration leads to the implementation of AI chips in IoT devices, enabling power-efficient data processing and machine learning computations.

- The integration of AI in IoT devices is a significant trend, as it enhances their decision-making capabilities and improves overall system performance. This data-driven narrative underscores the continuous evolution and growing importance of IoT in various industries.

What challenges does the Artificial Intelligence (AI) Chips Industry face during its growth?

- The scarcity of technically proficient workers specializing in AI chip development poses a significant challenge to the industry's growth trajectory.

- AI chips are experiencing significant expansion in various sectors due to their potential to boost corporate revenues. However, the scarcity of professionals with specialized expertise in AI poses a significant challenge to the market's growth. Enterprise adoption of AI is influenced by numerous factors, including high research and development costs. The demand for AI professionals is high, with companies seeking experienced experts to guide their implementation efforts.

- A shortage of talent with the necessary AI knowledge is the most significant barrier to integrating AI within business operations. This talent crunch hinders the full potential of AI in transforming industries and improving operational efficiency.

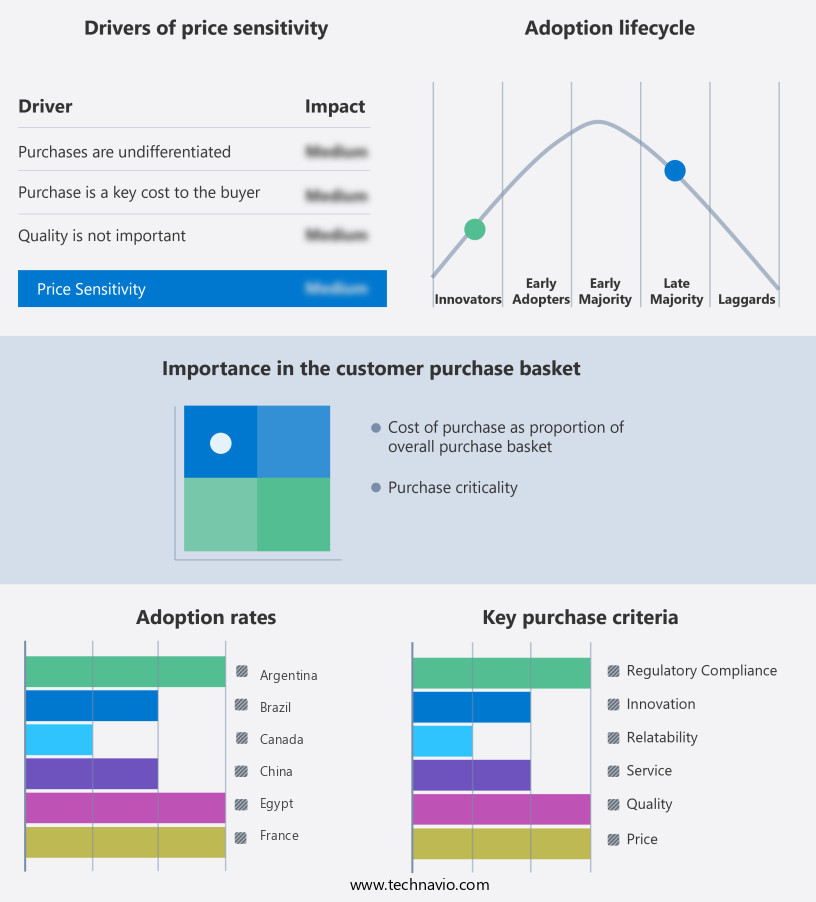

Exclusive Technavio Analysis on Customer Landscape

The artificial intelligence (ai) chips market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence (ai) chips market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Artificial Intelligence (AI) Chips Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, artificial intelligence (ai) chips market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Micro Devices Inc. - The company specializes in advanced artificial intelligence technology through its AMD Instinct product line, delivering high-performance computing solutions for various industries, including research, finance, and media. AMD Instinct chips leverage AI and machine learning capabilities to enhance efficiency and productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Baidu Inc.

- Broadcom Inc.

- Cerebras

- Fujitsu Ltd.

- Google LLC

- Graphcore Ltd.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- International Business Machines Corp.

- MediaTek Inc.

- Meta (Facebook)

- Microchip Technology Inc.

- NVIDIA Corp.

- NXP Semiconductors NV

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- SenseTime Group Inc.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Tesla Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence (AI) Chips Market

- In January 2024, Intel Corporation, a leading technology company, announced the launch of its new Neural Compute Lake (NCL) series of AI chips, designed for edge computing and designed to deliver improved performance and power efficiency for AI workloads (Intel Press Release, 2024).

- In March 2024, IBM and Samsung Electronics formed a strategic partnership to co-develop and manufacture AI chips based on IBM's AI technology, aiming to accelerate the adoption of AI in various industries (IBM Press Release, 2024).

- In April 2025, NVIDIA, a leading player in the AI chip market, raised USD2 billion in a funding round, bolstering its position and enabling further investments in research and development (Wall Street Journal, 2025).

- In May 2025, the European Union approved the Horizon Europe research and innovation program, which includes a significant focus on AI and high-performance computing, with an investment of €95.5 billion over the next seven years (European Commission Press Release, 2025). This initiative is expected to fuel the growth of the AI chips market in Europe.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence (AI) Chips Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 81.2% |

|

Market growth 2025-2029 |

USD 902649.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

61.7 |

|

Key countries |

US, Canada, China, UK, Germany, France, Japan, Italy, India, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for advanced computing solutions to support complex AI applications across various sectors. ASIC design plays a crucial role in delivering customized, high-performance chips for specific AI workloads. Thermal management solutions are essential to mitigate the heat generated by tensor processing units and parallel computing architecture. Custom chip design and FPGA acceleration are key strategies to optimize memory bandwidth and improve instruction set architecture efficiency. Silicon photonics and hardware virtualization are emerging technologies that enhance AI accelerator chips' performance and power efficiency metrics. Training optimization and AI algorithm optimization are critical to reducing power consumption and improving processing speed.

- Neural network processors and deep learning hardware are essential components of data center infrastructure, with expectations of industry growth reaching over 30% in the next five years. Edge AI hardware, such as on-chip memory and model compression techniques, enable AI applications to run locally, reducing network latency and enhancing real-time performance. Chip fabrication and chip packaging innovations continue to push the boundaries of low-power design and inference acceleration. Hardware security modules ensure data privacy and protection, while interconnect technology advances enable faster communication between parallel processing units and cache coherence. Overall, the AI chips market's continuous dynamism underscores its potential to revolutionize industries and create new opportunities.

- For instance, a leading tech company reported a 40% increase in sales by implementing custom-designed AI chips in their flagship product. This success story highlights the market's potential for significant growth and innovation.

What are the Key Data Covered in this Artificial Intelligence (AI) Chips Market Research and Growth Report?

-

What is the expected growth of the Artificial Intelligence (AI) Chips Market between 2025 and 2029?

-

USD 902.65 billion, at a CAGR of 81.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (ASICs, GPUs, CPUs, and FPGAs), End-user (Media and advertising, BFSI, IT and telecommunication, and Others), Geography (North America, Europe, APAC, South America, Middle East and Africa, and Rest of World (ROW)), Processing Type (Edge and Cloud), Application (Nature language processing (NLP), Robotics, Computer vision, Network security, and Others), Technology (System on chip (SoC), System in package (SiP), Multi chip module (MCM), and Others), and Function (Training and Inference)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased focus on developing AI chips for smartphones, Dearth of technically skilled workers for AI chips development

-

-

Who are the major players in the Artificial Intelligence (AI) Chips Market?

-

Advanced Micro Devices Inc., Baidu Inc., Broadcom Inc., Cerebras, Fujitsu Ltd., Google LLC, Graphcore Ltd., Huawei Technologies Co. Ltd., Intel Corp., International Business Machines Corp., MediaTek Inc., Meta (Facebook), Microchip Technology Inc., NVIDIA Corp., NXP Semiconductors NV, Qualcomm Inc., Samsung Electronics Co. Ltd., SenseTime Group Inc., Taiwan Semiconductor Manufacturing Co. Ltd., and Tesla Inc.

-

Market Research Insights

- The market for artificial intelligence (AI) chips is a dynamic and ever-evolving landscape. Two key areas of focus are AI workload optimization and virtualization technologies. AI chips are designed to improve data throughput, enabling faster inference engine deployment and model deployment. Fault tolerance and heterogeneous computing are essential for ensuring reliability and efficiency. One example of market growth can be seen in the increasing adoption of AI in data centers. AI workloads in these environments have grown by over 250% in the past year, leading to a significant demand for specialized processors. Furthermore, industry experts anticipate that the global AI chip market will expand at a rate of approximately 40% annually over the next decade.

- This growth is driven by the need for advanced AI capabilities in various industries, including healthcare, finance, and manufacturing. As AI applications become more prevalent, the demand for chips that can handle complex workloads, offer energy efficiency, and ensure hardware security continues to rise. The integration of machine learning accelerators, hardware-software co-design, and network optimization further enhances the performance of AI chips, making them an indispensable part of the technology landscape.

We can help! Our analysts can customize this artificial intelligence (ai) chips market research report to meet your requirements.