China Artificial Intelligence In Supply Chain Market Size and Trends

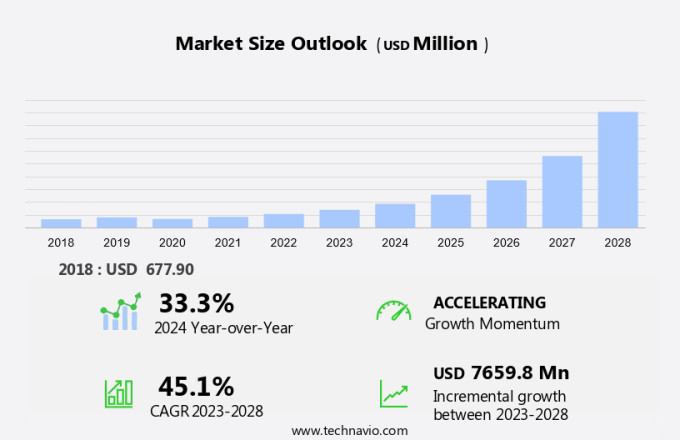

The China artificial intelligence in supply chain market size is forecast to increase by USD 7.66 billion, at a CAGR of 45.1% between 2023 and 2028. Artificial Intelligence (AI) is revolutionizing various industries, including healthcare, marketing and sales, and customer engagement, in the market. In healthcare, AI is being leveraged for next-generation computing applications such as telemedicine and remote patient monitoring. AI adoption in this sector is driven by the need to manage unstructured data and provide personalized care. In Marketing and Sales, AI is used to analyze customer behavior and preferences, enabling businesses to deliver targeted campaigns. The use of AI in Customer Engagement is increasing due to the automation of repetitive tasks and the ability to provide personalized experiences. However, the shortage of AI technology experts poses a challenge to widespread adoption. Big Data is fueling the growth of AI, as it provides the necessary data for deep learning and Artificial Neural Networks to function effectively. The use of AI in these areas is expected to continue growing, as businesses seek to improve efficiency, enhance consumer experiences, and gain a competitive edge.

Market Analysis

Artificial Intelligence (AI) is revolutionizing the supply chain market by introducing next-level efficiency and accuracy. Unstructured data, a common challenge in the industry, is being effectively processed through advanced AI techniques such as machine learning and deep learning. These technologies enable pattern recognition and predictive analytics, allowing businesses to make data-driven decisions and optimize their operations. Information scientists are developing AI solutions that utilize natural language processing and image recognition to automate various supply chain tasks. Computer vision is being employed to monitor inventory levels and track products in real-time, while speech recognition is used to streamline communication between different stakeholders. AI-based solutions are also being integrated into human intelligence simulation to create intelligent software and hardware. These systems are capable of learning and problem-solving, enabling the supply chain market to adapt to changing conditions and customer demands. The aerospace industry is benefiting from AI in various ways, including predictive maintenance and optimization of complex systems.

AI solutions are being used to analyze vast amounts of data and identify potential issues before they become critical. Artificial neural networks are being utilized to improve demand forecasting and optimize logistics networks. Generative adversarial networks are being used to create realistic simulations of supply chain scenarios, allowing businesses to test different strategies and identify potential risks. AI is transforming the way the supply chain market operates, enabling businesses to make informed decisions, optimize processes, and improve customer satisfaction. With the continued advancements in AI technology, the potential for innovation and growth in this industry is vast. In conclusion, AI is playing a pivotal role in the supply chain market by enabling efficient data processing, automating tasks, and improving decision-making capabilities. The integration of AI solutions is leading to significant improvements in areas such as inventory management, demand forecasting, and logistics optimization. As technology continues to evolve, the potential for innovation and growth in the supply chain market is vast.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Component

- Hardware

- Software

- Services

- End-user

- Automotive

- Retail

- Consumer-packaged goods

- Food and beverages

- Others

- Geography

- China

By Component Insights

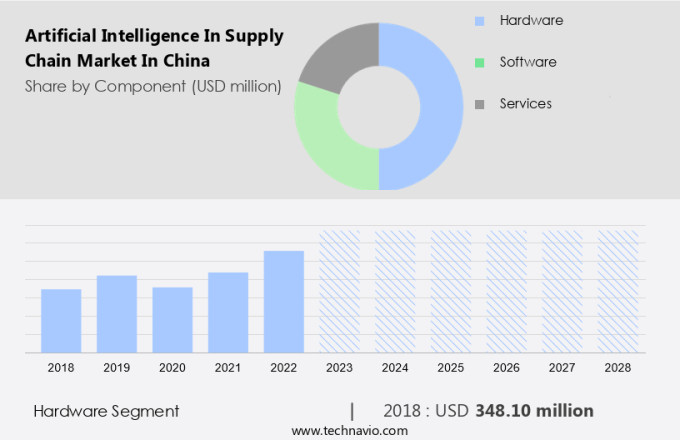

The hardware segment is estimated to witness significant growth during the forecast period. In the realm of supply chain management, Artificial Intelligence (AI) is revolutionizing various industries in China, with the hardware segment playing a crucial role in its integration. This segment involves the production of vital hardware components, such as AI chips, sensors, and computing platforms, necessary for handling massive data volumes and executing intricate algorithms.

Get a glance at the market share of various segments Download the PDF Sample

The hardware segment was valued at USD 348.10 million in 2018. As of 2023, Shenzhen leads this segment, contributing significantly to the country's hardware infrastructure, closely followed by Beijing and Shanghai. The rise in demand for sophisticated hardware solutions is fueled by the increasing utilization of AI applications in supply chain operations, including predictive analytics for demand prediction, inventory optimization, and logistics management, in sectors like healthcare, marketing and sales, and customer engagement. The adoption of next-generation computing, such as deep learning and Artificial Neural Networks, is transforming unstructured data into valuable insights in these industries. Information scientists are at the forefront of this technological evolution, ensuring seamless integration and optimal performance of these advanced systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

China Artificial Intelligence In Supply Chain Market Driver

The adoption of AI for enhancing consumer services and satisfaction is notably driving market growth. In the market, the integration of artificial intelligence (AI) is revolutionizing consumer services by introducing intelligent hardware and learning capabilities. Companies are increasingly implementing AI-based solutions to provide hyper-personalized services and improve problem-solving efficiency. Cloud adoption, particularly on platforms like Amazon Web Services (AWS), is facilitating the deployment of AI applications, such as chatbots and machine learning (ML) models, to automate responses and deliver customized recommendations. Moreover, AI is making a significant impact on public health decision-making, enabling accurate diagnosis and proactive interventions.

These advancements are improving the overall efficiency and effectiveness of supply chain operations, making them more reliable and trustworthy for consumers. In the manufacturing sector, AI adoption is expected to continue growing as businesses seek to streamline processes and enhance productivity. By leveraging AI technologies, companies can improve their ability to diagnose and address issues in real time, ensuring that production remains on track and that customers receive their orders in a timely manner. As the use of AI in the US supply chain market continues to expand, it will enable businesses to deliver more accurate, efficient, and personalized services to their customers. Thus, such factors are driving the growth of the market during the forecast period.

China Artificial Intelligence In Supply Chain Market Trends

Increased availability of cloud-based applications is the key trend in the market. Artificial Intelligence (AI) is driven by Machine Learning (ML) and deep learning neural networks, which serve as its fundamental building blocks. These advanced technologies enable the creation of cloud-based AI software and services, such as Natural Language Processing (NLP), image recognition, and predictive analytics. The implementation of AI in supply chain operations has gained significant attention due to its ability to process vast amounts of data for precise demand forecasting. AI applications in this domain encompass recommendation engines, pricing optimization, lead generation, chatbots, and supply chain optimization, among others. However, integrating AI technologies into on-premises data centers necessitates substantial computational power and data storage capacity for efficient data processing.

To harness the potential of AI in the supply chain sector, companies must invest in advanced technologies and infrastructure. AI solutions, such as deep learning, machine learning, NLP, image recognition, predictive analytics, and generative AI, are essential for enhancing operational efficiency and optimizing business processes. Training data preparation and addressing bias in AI models are crucial aspects to consider for successful implementation. Incorporating AI technologies into supply chain operations can lead to improved accuracy, reduced costs, and increased customer satisfaction. Thus, such trends will shape the growth of the market during the forecast period.

China Artificial Intelligence In Supply Chain Market Challenge

A shortage of AI technology experts is the major challenge that affects the growth of the market. In the business landscape, particularly within sectors like travel and hospitality, IT and telecom, oil and gas, and IT service management, the integration of Artificial Intelligence (AI) software has become increasingly important. However, many organizations face challenges in effectively implementing AI solutions due to a talent shortage in this specialized field. The competition among top technology companies for AI expertise is fierce, making it difficult for businesses to acquire the necessary human resources. Moreover, the deployment of AI algorithms requires substantial investment in data generation, cloud computing, and on-premises solutions.

Companies must also consider the ethical implications of AI and ensure transparency to avoid the "black box effect." Before implementing AI at scale, it is crucial to identify suitable use cases and applications. This complex process necessitates a significant financial commitment, making it a challenge for numerous businesses to fully leverage AI technology. To stay competitive and maximize the potential benefits of AI, organizations must invest in building a team of AI experts and carefully evaluate potential applications. By doing so, they can effectively address the challenges associated with AI implementation and reap the rewards of this advanced technology. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alphabet Inc. - The company offers artificial intelligence solutions in the supply chain to optimize operations and product development.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- AVEVA Group Plc

- C3.ai Inc.

- Capgemini Services SAS

- General Electric Co.

- General Vision Inc.

- Intel Corp.

- International Business Machines Corp.

- Landing AI

- Micron Technology Inc.

- Microsoft Corp

- NVIDIA Corp.

- Oracle Corp

- RapidMiner Inc.

- Rockwell Automation Inc.

- Salesforce Inc.

- Samsung Electronics Co. Ltd.

- Siemens AG

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

Artificial Intelligence (AI) is revolutionizing various industries, including supply chain management, by automating repetitive tasks, enhancing decision-making, and improving operational efficiency. Deep learning and machine learning algorithms are at the core of AI solutions, enabling pattern recognition, predictive analytics, and data processing. Natural language processing (NLP) and image recognition are essential applications, enabling effective communication with suppliers and customers and ensuring accurate inventory management. AI adoption in supply chain is driving next-generation computing, with information scientists focusing on deep learning, artificial neural networks, and generative adversarial networks. AI solutions are being integrated into software-as-a-service (SaaS) platforms for remote connectivity and big data analysis. The healthcare sector is leveraging AI for telemedicine and remote patient monitoring, while marketing and sales are utilizing conversational AI for hyper-personalized services.

AI applications in advertising and media are enabling targeted campaigns, while the aerospace industry is using computer vision for object detection and recognition. Despite the benefits, challenges such as bias in AI, the need for training data preparation, and the ethical implications of AI are being addressed by context-aware AI and human intelligence simulation. The AI talent shortage and the black box effect are also significant concerns, necessitating continuous research and development. AI hardware, such as GPUs and CPUs, is essential for processing large volumes of data, while cloud adoption and on-premises solutions are being used to meet the varying needs of different industries. The oil and gas sector is exploring AI applications for data generation and optimization. In conclusion, AI is transforming the supply chain market by automating processes, enhancing decision-making, and improving operational efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 45.1% |

|

Market Growth 2024-2028 |

USD 7.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

33.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture PLC, Alphabet Inc., AVEVA Group Plc, C3.ai Inc., Capgemini Services SAS, General Electric Co., General Vision Inc., Intel Corp., International Business Machines Corp., Landing AI, Micron Technology Inc., Microsoft Corp, NVIDIA Corp., Oracle Corp, RapidMiner Inc., Rockwell Automation Inc., Salesforce Inc., Samsung Electronics Co. Ltd., Siemens AG, and Wipro Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.