Artificial Intelligence (AI) Market In Education Sector Size 2025-2029

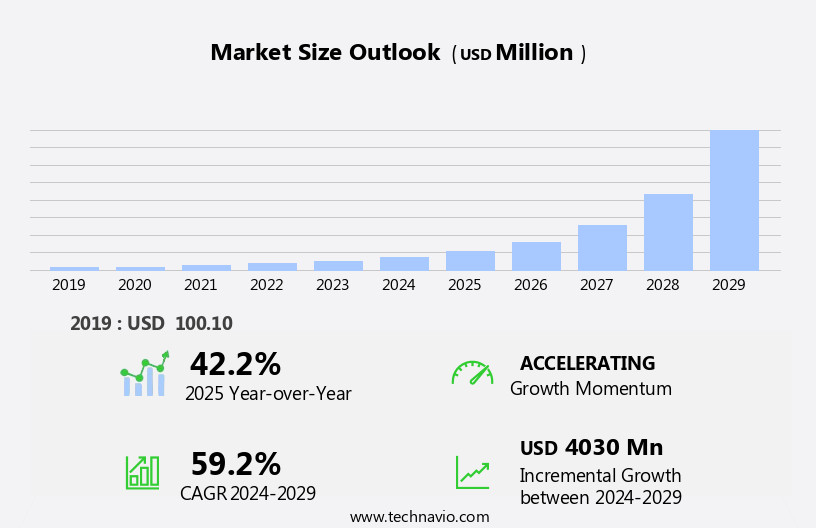

The artificial intelligence (ai) market in education sector size is forecast to increase by USD 4.03 billion at a CAGR of 59.2% between 2024 and 2029.

- The Artificial Intelligence (AI) market in the education sector is experiencing significant growth due to the increasing demand for personalized learning experiences. Schools and universities are increasingly adopting AI technologies to create customized learning paths for students, enabling them to progress at their own pace and receive targeted instruction. Furthermore, the integration of AI-powered chatbots in educational institutions is streamlining administrative tasks, providing instant support to students, and enhancing overall campus engagement. However, the high cost associated with implementing AI solutions remains a significant challenge for many educational institutions, particularly those with limited budgets. Despite this hurdle, the long-term benefits of AI in education, such as improved student outcomes, increased operational efficiency, and enhanced learning experiences, make it a worthwhile investment for forward-thinking educational institutions.

- Companies seeking to capitalize on this market opportunity should focus on developing cost-effective AI solutions that cater to the unique needs of educational institutions while delivering measurable results. By addressing the cost challenge and providing tangible value, these companies can help educational institutions navigate the complex landscape of AI adoption and unlock the full potential of this transformative technology in education.

What will be the Size of the Artificial Intelligence (AI) Market In Education Sector during the forecast period?

- Artificial Intelligence (AI) is revolutionizing the education sector by enhancing teaching experiences and delivering personalized learning. AI technologies, including deep learning and machine learning, power adaptive learning platforms and intelligent tutoring systems. These systems create learner models to provide personalized recommendations and instructional activities based on individual students' needs. AI is transforming traditional educational models, enabling intelligent systems to handle administrative tasks and data analysis. The integration of AI in education is leading to the development of intelligent training software for skilled professionals.

- Furthermore, AI is improving knowledge delivery through data-driven insights and enhancing the learning experience with interactive and engaging pedagogical models. AI technologies are also being used to analyze training formats and optimize domain models for more effective instruction. Overall, AI is streamlining administrative tasks and providing personalized learning experiences for students and professionals alike.

How is this Artificial Intelligence (AI) In Education Sector Industry segmented?

The artificial intelligence (ai) in education sector industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Higher education

- K-12

- Learning Method

- Learner model

- Pedagogical model

- Domain model

- Component

- Solutions

- Services

- Application

- Learning platform and virtual facilitators

- Intelligent tutoring system (ITS)

- Smart content

- Fraud and risk management

- Others

- Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Speech Recognition

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- UAE

- North America

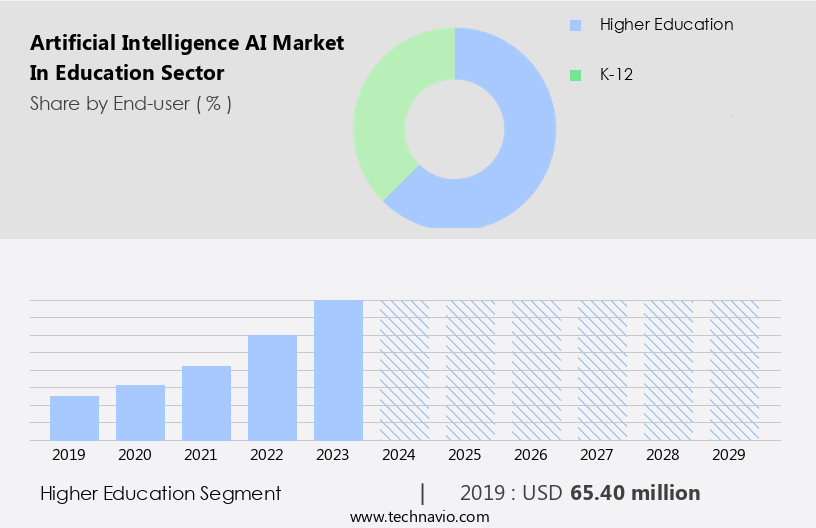

By End-user Insights

The higher education segment is estimated to witness significant growth during the forecast period.

The global education sector is witnessing significant advancements with the integration of Artificial Intelligence (AI). AI technologies, including Machine Learning (ML), are revolutionizing various aspects of education, from K-12 schools to higher education and corporate training. Intelligent Tutoring Systems and Adaptive Learning Platforms are increasingly popular, offering Individualized Instruction and Personalized Learning Experiences based on each student's Learning Pathways and Skills Gap. AI-enabled solutions are enhancing Student Engagement by providing Interactive Learning Tools and Real-time communication, while AI platforms and startups are developing Smart Content and Tailored Content for Remote Learning environments. AI is also transforming administrative tasks, such as Assessment processes and Data Management, by providing Personalized Recommendations and Automated Grading.

Universities and educational institutions are leveraging AI for Pedagogical model development and Virtual Classrooms, offering Educational Experiences and Virtual support. AI is also being used for Academic mapping and Teaching Experiences, ensuring Educational Outcomes that cater to each student's needs. In higher education, Intelligent Systems and Cloud-based Solutions are enabling Deep Learning and Instructional Activities, while Corporate training is adopting AI for On-premises Solutions and Adaptive Learning Platforms. AI is also being used for Descriptive answers, Learner model development, and Data Analysis, providing Skilled professionals with Personalized Feedback and Learning experience enhancement. AI in education is also transforming administrative workload, enabling Professional services and Virtual facilitators to offer Managed services and Personalized Learning Experiences.

AI is also being integrated into Content Delivery Systems, Peer-to-Peer Learning, and Learning Enhancement, offering a more efficient and effective educational experience. AI technologies, including Computer Vision and Natural Language Processing, are also being used to create Innovative Educational Tools, ensuring that students receive the best possible education, regardless of their location or learning style. With the increasing adoption of AI in education, the future of learning is set to be more personalized, efficient, and effective.

Get a glance at the market report of share of various segments Request Free Sample

The Higher education segment was valued at USD 65.40 billion in 2019 and showed a gradual increase during the forecast period.

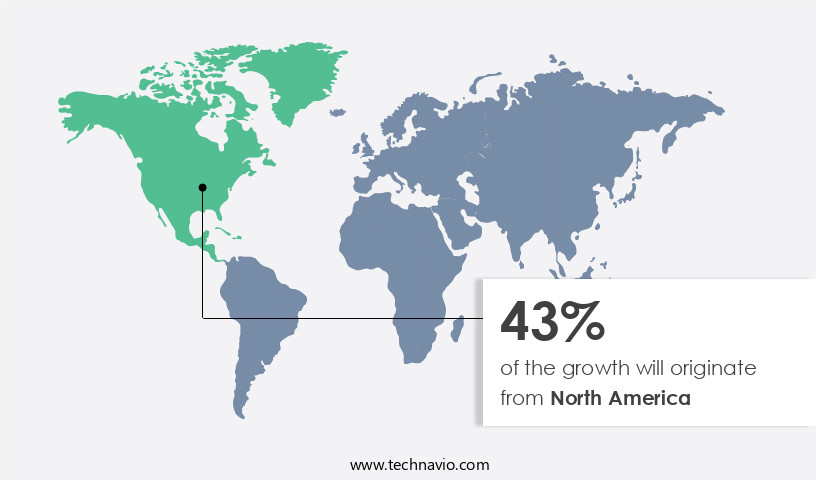

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The artificial intelligence (AI) market in North America's education sector is experiencing consistent expansion due to technological advancements and the increasing integration of AI in educational institutions. AI technologies, such as machine learning and deep learning, are being utilized to develop intelligent systems for personalized learning experiences, adaptive learning platforms, and intelligent tutoring systems. These systems cater to the unique needs of students, enhancing engagement and improving educational outcomes. Universities in the US are at the forefront of AI research, with institutions like Stanford University and Duke University leading the way. The US government and private investments are significant contributors to the growth of the AI market in education.

AI platforms are being used to automate administrative tasks, enabling educators to focus on teaching and student engagement. Moreover, AI-enabled solutions are transforming content delivery systems, enabling tailored content and real-time communication. In the K-12 sector, AI technologies are being used to identify learning gaps and provide personalized recommendations for students. Adaptive learning platforms and personalized feedback are essential components of AI-driven learning environments. AI-powered assessment processes and individualized instruction are revolutionizing the learning experience, enabling students to progress at their own pace. In higher education, AI technologies are being used to map academic paths, analyze student performance data, and provide personalized recommendations for students.

AI-enabled professional services, such as virtual facilitators and learning platforms, are enabling remote learning and educational experiences. AI is also being used to manage data and provide insights into educational outcomes, enabling educational institutions to make data-driven decisions. The use of AI in education is not limited to universities and K-12 schools. Corporate training programs are also adopting AI technologies to deliver personalized training formats and assess employee performance. AI-enabled solutions are transforming online education, enabling knowledge delivery and interactive learning tools that cater to the unique needs of learners. In summary, the AI market in education sector in North America is experiencing steady growth due to technological advancements and the increasing integration of AI in educational institutions.

AI technologies are being used to develop intelligent systems for personalized learning experiences, automate administrative tasks, and analyze data to improve educational outcomes. The use of AI is transforming the learning experience, enabling students and professionals to progress at their own pace and receive personalized recommendations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence (AI) In Education Sector Industry?

- Growing emphasis on customized learning paths using AI is the key driver of the market.

- Artificial Intelligence (AI) is revolutionizing the education sector by enabling personalized learning experiences for students. The primary driver of this market growth is the increasing need for customized learning paths based on individual student performance. Machine Learning (ML) technologies are at the forefront of this trend, allowing teachers to gather student data and derive valuable insights. ML algorithms assess academic strengths and weaknesses, providing customized materials and resources to help students progress.

- Furthermore, advanced AI applications in content delivery utilize deep learning and Natural Language Generation (NLG) to create and deliver personalized content, enhancing the learning experience. Overall, AI is transforming education by catering to the unique needs of each student, ultimately leading to improved academic outcomes.

What are the market trends shaping the Artificial Intelligence (AI) In Education Sector Industry?

- Increased emphasis on chatbots is the upcoming market trend.

- Artificial Intelligence (AI) is revolutionizing the education sector with the integration of chatbots. These intelligent bots utilize AI, Machine Learning (ML), and deep learning technologies to facilitate communication between students and educational institutions. Chatbots offer various functions, including answering queries, conducting conversations, and assessing and correcting student assignments. They employ ML and deep learning algorithms to identify patterns and provide personalized learning experiences. The increasing adoption of chatbots in education is fueled by their ability to enhance student learning through spaced repetition.

- By using deep learning technology, chatbots can identify the concepts a student has forgotten and repeat lessons at optimal intervals, thereby promoting effective learning. The applicability of chatbots in education is a burgeoning area of research, opening up new opportunities for market participants. Chatbots' versatility and ability to provide round-the-clock assistance make them an indispensable tool for educational institutions.

What challenges does the Artificial Intelligence (AI) In Education Sector Industry face during its growth?

- High cost associated with AI is a key challenge affecting the industry growth.

- The integration of Artificial Intelligence (AI) in the education sector is a significant trend, offering numerous benefits such as personalized learning and improved student outcomes. However, the high cost of building and procuring AI solutions remains a major barrier to its widespread adoption. Schools and universities require substantial funding and investments to implement AI, which includes not only the installation of software but also ongoing maintenance costs. This financial constraint hinders the adoption of AI in many educational institutions, particularly in the public sector.

- Despite the availability of various AI solutions, the high development and implementation costs continue to pose a challenge. It is essential for stakeholders to conduct extensive research on the applicability and cost-effectiveness of AI in education before making investments.

Exclusive Customer Landscape

The artificial intelligence (ai) market in education sector forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence (ai) market in education sector report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence (ai) market in education sector forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Google LLC - Artificial intelligence is revolutionizing the education sector through advanced solutions like Century AI. This technology enhances personalized learning experiences, optimizes resource allocation, and improves student outcomes. By leveraging machine learning algorithms and natural language processing, AI adapts to individual learners' needs, providing tailored instruction and feedback. This innovative approach streamlines administrative tasks, enabling educators to focus on teaching and student development. The integration of AI in education fosters a more efficient, effective, and engaging learning environment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services Inc.

- Blackboard Inc.

- Instructure Inc.

- Pearson Education Inc.

- SAP SE

- Atos SE

- Capgemini SE

- Tata Consultancy Services Ltd.

- Infosys Ltd.

- Wipro Ltd.

- Squirrel AI Learning

- Yuanfudao

- Zuoyebang

- NTT Data Corporation

- Hitachi Solutions Ltd.

- Positivo Tecnologia S.A.

- GEMS Education

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Artificial Intelligence (AI) has been making significant strides in the education sector, revolutionizing the way learning is delivered and enhancing the overall educational experience. Intelligent tutoring systems, a type of AI platform, have emerged as a promising solution to address learning gaps in digital education. These systems use machine learning algorithms to analyze student performance and provide personalized recommendations for learning enhancement. AI technologies have been instrumental in transforming traditional training software into more interactive and engaging learning tools. These tools offer personalized learning experiences, allowing students to progress at their own pace and providing real-time communication with virtual facilitators.

The use of AI in education has been particularly beneficial in K-12 schools, where individualized instruction is crucial for addressing the skills gap. The administrative workload of educational institutions has been significantly reduced with the adoption of AI platforms. These solutions offer automated assessment processes, personalized feedback, and adaptive learning platforms, freeing up time for skilled professionals to focus on more strategic tasks. Moreover, AI-enabled solutions have made education more accessible through cloud-based solutions and remote learning, making it possible for students to learn from anywhere. AI technologies have also been instrumental in creating educational experiences.

For instance, AI-powered content delivery systems can map academic content to individual learning pathways, providing tailored content that resonates with each student. AI-enabled virtual classrooms offer interactive learning tools, enabling students to engage in peer-to-peer learning and collaborative activities. The adoption of AI in education has also led to innovative educational tools, such as virtual support systems and intelligent systems that can provide personalized recommendations based on a learner model. These systems can analyze student data and provide descriptive answers to complex queries, enhancing the overall learning experience. Furthermore, AI technologies have been instrumental in improving educational outcomes.

Machine learning algorithms can analyze student performance data and provide personalized recommendations for instructional activities, helping students to perform better. Deep learning algorithms can analyze large datasets to identify trends and patterns, providing valuable insights for educational institutions. AI startups have been at the forefront of this revolution, offering a range of AI-enabled solutions for digital education. These solutions offer a pedagogical model that adapts to the needs of individual learners, providing a more effective and efficient learning experience. Moreover, AI-powered professional services offer managed services and domain models that help educational institutions to optimize their technology infrastructure and improve their overall performance.

In , the integration of AI technologies in education has led to a paradigm shift in the way learning is delivered and experienced. From intelligent tutoring systems to AI-powered content delivery systems, these solutions offer a range of benefits, from reducing administrative workload to improving educational outcomes. As AI technologies continue to evolve, we can expect to see even more innovative educational tools and solutions that will transform the way we learn and teach.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 59.2% |

|

Market growth 2025-2029 |

USD 4030 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

42.2 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence (AI) Market In Education Sector Research and Growth Report?

- CAGR of the Artificial Intelligence (AI) In Education Sector industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence (ai) market in education sector growth of industry companies

We can help! Our analysts can customize this artificial intelligence (ai) market in education sector research report to meet your requirements.