Aseptic Packaging Market Size 2024-2028

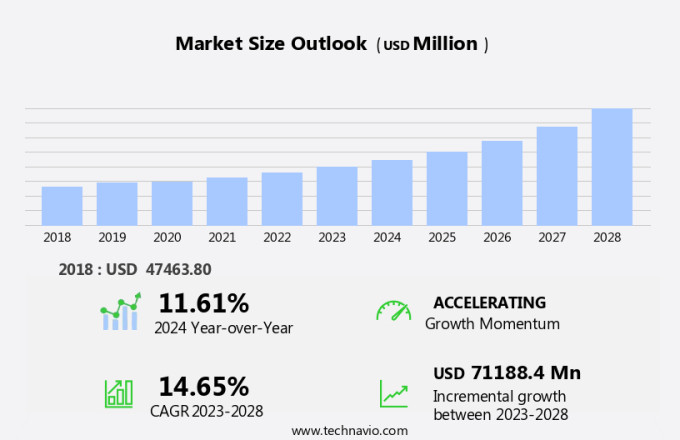

The aseptic packaging market size is forecast to increase by USD 71.19 billion at a CAGR of 14.65% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing sterility requirements for various pharmaceutical and biotech products. Self-administration of injectable drugs is another key factor driving market expansion. Advanced technologies, such as electrical resistance heating techniques, are being adopted to enhance the sterility and safety of packaging solutions. However, the high initial investment required for implementing these technologies poses a challenge to market growth. Additionally, the stringent regulations and quality standards set by regulatory bodies further add to the complexity and cost of production. Overall, the market is expected to experience steady growth due to the increasing demand for safe and sterile packaging solutions In the healthcare industry.

What will be the Size of the Aseptic Packaging Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to the increasing demand for high-quality, safe, and convenient food and beverage products. Aseptic packaging offers several advantages, including protection against viral contamination and the use of preservatives to ensure longer shelf life. Sustainability is also a key trend In the market, with the growing popularity of recyclable cartons and eco-friendly pouches. Single use plastic, however, remains a concern for consumers and regulators alike. The beverage industry, including ready-to-drink coffee, energy drinks, and nutraceutical beverages, is a major application area for aseptic packaging. Urbanization and the rise of online retail have further fueled demand for these products, particularly for essential food items and single-serve packaging.

- In the dairy beverages market, aseptic packaging is increasingly used for products such as tinned meat and convenience food items to prevent bacterial contamination. Overall, the market is expected to continue growing due to its ability to meet the evolving needs of consumers and industries for safe, sustainable, and convenient packaging solutions.

How is this Aseptic Packaging Industry segmented and which is the largest segment?

The aseptic packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Healthcare

- Food and beverage

- Others

- Type

- Bottles

- Vials and ampules

- Prefilled syringes

- Cartons

- Others

- Geography

- APAC

- China

- Europe

- Germany

- UK

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

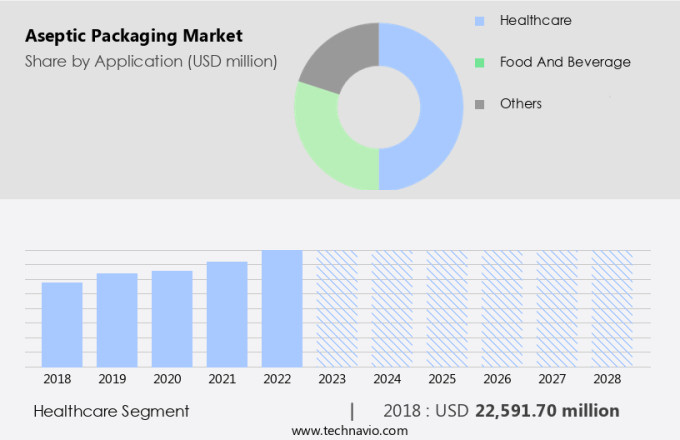

- The healthcare segment is estimated to witness significant growth during the forecast period.

The healthcare packaging market encompasses primary and secondary packaging solutions, utilizing materials such as plastic, glass, cardboard, aluminum foils, and more. Driven by the increasing trend towards self-medication and over-the-counter (OTC) drugs, this market experiences growth. Pharmaceutical manufacturers represent the primary customer base, while customized packaging caters to point-of-purchase pharmacies. The aseptic healthcare packaging market demonstrates fragmentation, with numerous global players. Easy-to-use packaging for medications and OTC products is essential to maintain sterility and prevent bacterial contamination. While food preservatives, both artificial and natural food ingredients, play a role in food packaging, healthcare packaging prioritizes germ protection. SEO Best Practices: healthcare packaging, aseptic packaging, pharmaceutical manufacturers, OTC drugs, sterility, bacterial contamination.

Get a glance at the Aseptic Packaging Industry report of share of various segments Request Free Sample

The Healthcare segment was valued at USD 22.59 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

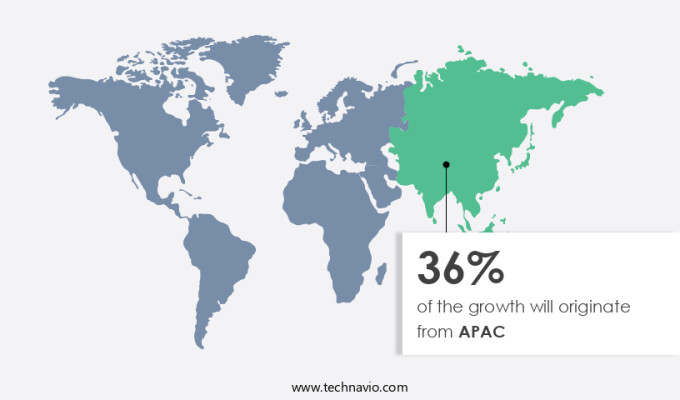

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Aseptic packaging has gained significant traction in various industries, particularly in food and beverages, pharmaceuticals, and non-cyclic markets, due to its ability to prevent viral contamination and offer longer shelf life. The Asia Pacific region dominates the market, driven by increasing demand in populous countries like India, China, and Indonesia. This growth can be attributed to expanding production capabilities in pharmaceuticals, rising exports, and government initiatives to improve product quality and integrity. Sustainable packaging solutions, such as recyclable cartons and eco-friendly pouches, are also gaining popularity due to their environmental benefits. Major investments from foreign banking companies further fuel the market's growth In the region.

Market Dynamics

Our aseptic packaging market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Aseptic Packaging Industry?

Sterility requirements and self-administration of injectable drugs is the key driver of the market.

- Aseptic packaging plays a crucial role in preserving quality food products and essential beverages, particularly in urbanization and emerging economies. With the rise of online retail and the convenience of single use plastic, sustainable packaging solutions have gained prominence. Aseptic cartons, bags, and pouches offer longer shelf life and protection against viral contamination, making them ideal for essential food items and the beverage industry. RTD coffee, energy drinks, nutraceutical beverages, and functional beverage market are major application industries. The food industry, including dairy beverages and tinned meat, also benefits from aseptic packaging to prevent bacterial contamination. Food preservatives, both natural and artificial, are used to extend shelf life and maintain product quality.

- However, consumer preferences are shifting towards eco-friendly packaging made from biodegradable materials. Recyclable cartons, eco-friendly pouches, and sustainable containers are gaining popularity due to environmental mandates and increasing recycling rates. Container deposits and packaging levies are incentives for consumers to return used packaging for recycling. Importers and exporters also benefit from aseptic packaging as it reduces the risk of spoilage during transportation. The packaging industry, including raw material suppliers, packaging users, retailers, and consumers, is adapting to these trends. Electronic business processing and supply chain management systems facilitate efficient production and distribution. The use of aseptic packaging is expected to continue growing due to its benefits in preserving food and beverages while reducing environmental impact.

What are the market trends shaping the Aseptic Packaging Industry?

Adoption of electrical resistance heating techniques is the upcoming market trend.

- Aseptic packaging, a critical component of the food and beverage industry, is gaining significant traction due to its ability to prevent viral contamination and extend shelf life. Preservatives, whether natural or artificial, are essential in maintaining product quality and safety. Sustainable packaging, including recyclable cartons and eco-friendly pouches, is increasingly preferred by consumers and essential for environmental mandates. The beverage industry, including RTD coffee, energy drinks, and nutraceutical beverages In the functional beverage market, heavily relies on aseptic packaging. Urbanization and emerging economies fuel the demand for convenience food products, leading to an increase In the application of aseptic packaging in dairy beverages and tinned meat.

- Ohmic heating methods, such as electrical resistance heating, are used to sterilize thicker foods, preserving their nutrient value. The supply chain, from raw material suppliers to packaging users, retailers, importers, and exporters, benefits from the longer shelf life offered by aseptic packaging. Recycling rates, container deposits, and packaging levies are essential considerations for the industry's sustainability. Despite the advantages, challenges, such as bacterial contamination and the use of food preservatives, must be addressed. The shift towards natural food ingredients and eco-friendly alternatives is a significant trend In the market. The electronic business processing and logistics sectors also impact the market's dynamics.

What challenges does Aseptic Packaging Industry face during the growth?

High initial investment is a key challenge affecting the industry growth.

- The market faces significant investments for companies due to the high cost of acquiring and implementing the necessary equipment. Inefficiencies during implementation can lead to additional expenses and increased overhead costs. Proper installation and maintenance require highly skilled technicians, adding to the overall cost. Despite these challenges, companies conduct cost-benefit analyses to determine if the advantages of aseptic packaging, such as longer shelf life and protection against viral contamination, outweigh the initial investment. Sustainable packaging solutions, like recyclable cartons and eco-friendly pouches, are gaining popularity In the market, driven by consumer preferences for healthier, quality food products and the growing health and wellness trend.

- Urbanization and emerging economies contribute to the increasing demand for convenience food products and beverages, including dairy beverages, tinned meat, RTD coffee, energy drinks, and nutraceutical beverages In the functional beverage market. However, concerns over bacterial contamination and the use of food preservatives, including artificial preservatives and natural food ingredients, impact consumer preferences and regulatory requirements. As environmental mandates continue to evolve, biodegradable materials, recycling rates, container deposits, and packaging levies are becoming essential considerations for importers, exporters, retailers, and consumers alike.

Exclusive Customer Landscape

The aseptic packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aseptic packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aseptic packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - The company specializes In the production of aseptic packaging solutions for the US sports industry. Our offerings ensure product preservation and safety through advanced sterilization techniques and innovative packaging designs. By utilizing our aseptic packaging, sports product manufacturers can extend their product shelf life and maintaIn the integrity of their brand. Our commitment to quality and innovation sets us apart In the market, making us a trusted partner for businesses seeking superior packaging solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Becton Dickinson and Co.

- CAPAK CAPITAL CO. LTD.

- CDF Corp.

- DS Smith Plc

- DuPont de Nemours Inc.

- Elopak ASA

- Gehl Foods LLC

- Glanbia plc

- Goglio S.P.A.

- Greatview Aseptic Packaging Co. Ltd.

- Krones AG

- Mondi Plc

- Printpack Inc.

- Pyramid Laboratories Inc.

- Scholle IPN Corp.

- SCHOTT AG

- SIG Group AG

- Syntegon Technology GmbH

- Tetra Laval SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

A Deep Dive into the market: Trends, Challenges, and Opportunities the market is a significant sector withIn the broader packaging industry, gaining increasing attention due to its role in ensuring the safety and longevity of various food and beverage products. This market is driven by several factors, including the need for extended shelf life, consumer preferences for convenient and sustainable packaging solutions, and the growing demand for essential food items in urbanized areas and emerging economies. Aseptic packaging is a vital solution for maintaining the quality of food and beverage products, particularly in industries such as the beverage sector, which includes ready-to-drink coffee, energy drinks, nutraceutical beverages, and functional beverages.

This packaging technology prevents viral contamination, ensuring that these products remain safe for consumption even without refrigeration. Sustainability is another critical factor influencing the market. Consumers are increasingly conscious of the environmental impact of packaging and are seeking eco-friendly alternatives to single-use plastics. As a result, there is a growing trend towards recyclable cartons, biodegradable materials, and other sustainable packaging solutions. The application industry for aseptic packaging is diverse, with various sectors, including the dairy beverages market, tinned meat, and convenience food products, adopting this technology to enhance their offerings. However, bacterial contamination remains a challenge, leading to the use of preservatives, both natural and artificial, to ensure product safety.

The supply chain for aseptic packaging is complex, involving raw material suppliers, packaging users, retailers, consumers, importers, and exporters. Electronic business processing and supply chain optimization have become essential for managing this intricate network and ensuring timely delivery of products. Environmental mandates are also playing a significant role in shaping the market. Governments and regulatory bodies are implementing policies aimed at increasing recycling rates, implementing container deposits, and imposing packaging levies to reduce waste and promote sustainable packaging solutions. In conclusion, the market is a dynamic and evolving sector, driven by factors such as consumer preferences, sustainability, and regulatory requirements.

It offers significant opportunities for growth, particularly In the beverage industry and emerging economies, where the demand for convenient, safe, and sustainable packaging solutions is on the rise.

|

Aseptic Packaging Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.65% |

|

Market growth 2024-2028 |

USD 71188.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.61 |

|

Key countries |

China, US, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aseptic Packaging Market Research and Growth Report?

- CAGR of the Aseptic Packaging industry during the forecast period

- Detailed information on factors that will drive the Aseptic Packaging growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aseptic packaging market growth of industry companies

We can help! Our analysts can customize this aseptic packaging market research report to meet your requirements.