ASIC Miner Market Size 2024-2028

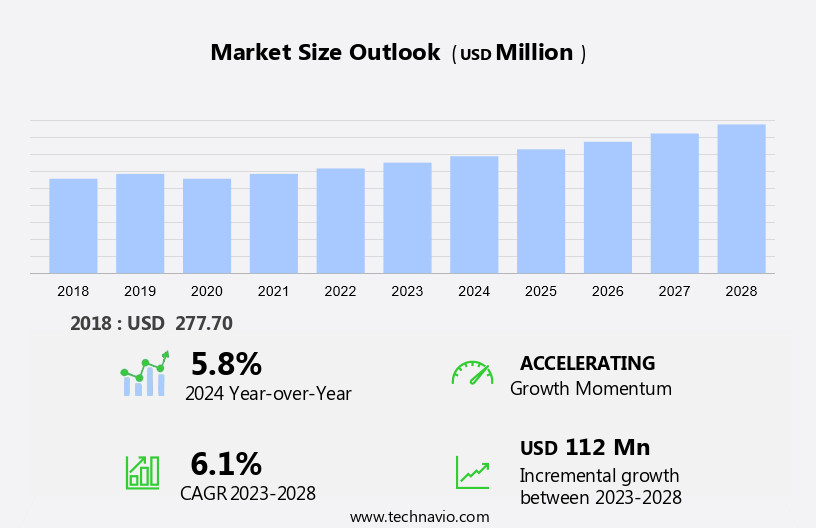

The ASIC miner market size is forecast to increase by USD 112 million at a CAGR of 6.1% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing profitability of cryptocurrency mining ventures and investments by major semiconductor companies in mining-specific hardware. The volatility In the value of cryptocurrencies adds an element of risk but also presents opportunities for substantial returns. Cryptocurrency mining is no longer limited to high-end PCs and computers; it is now possible to mine digital currencies using smartphones and laptops. However, the energy consumption requirements of ASIC miners have raised concerns, leading to a push towards renewable energy sources to power mining operations. This market analysis report provides a comprehensive study of the trends and challenges shaping the market, offering insights into the future growth prospects of this dynamic industry.

What will be the Size of the ASIC Miner Market During the Forecast Period?

- The market is a dynamic and evolving sector within the broader cryptocurrency landscape. ASICs, or Application-Specific Integrated Circuits, are specialized hardware machines designed for mining various cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, and Dashcoin, among others. These machines offer significant processing power advantages over traditional CPUs and GPUs, making them the go-to choice for efficient and profitable mining. Mining pools, which facilitate collaboration among miners to increase their collective processing power and earning potential, have become increasingly popular In the market.

- The market's size and direction are influenced by the ongoing development of more powerful and energy-efficient ASIC mining machines, cooling technologies, and noise reduction techniques. Additionally, the industry is exploring sustainable mining practices and alternative energy sources to minimize environmental impact. The digital currency market, fueled by blockchain technology, continues to evolve, leading to increased demand for specialized mining hardware. Overall, the market continues to grow as blockchain networks, such as Proof of Work (PoW) systems, rely on these machines to secure their networks and validate transactions.

How is this ASIC Miner Industry segmented and which is the largest segment?

The ASIC miner industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Enterprise

- Personal

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- North America

By Application Insights

The enterprise segment is estimated to witness significant growth during the forecast period. The enterprise sector represents a significant segment of the market, driven by the adoption of specialized hardware for cryptocurrency mining. Enterprise-level mining operations, including large-scale mining farms and mid-sized businesses, utilize ASIC miners to enhance their mining capabilities and profitability. ASIC miners offer superior performance compared to general-purpose hardware like CPUs and GPUs due to their optimization for specific algorithms. This optimization results in increased efficiency and faster processing. Enterprise-level mining requires scalable solutions to manage large volumes of mining activities. ASIC miners provide this scalability, enabling expansion without substantial cost increases. These mining machines, powered by Application-Specific Integrated Circuits (ASICs), are essential for the high-performance processing required by blockchain networks using Proof of Work (PoW) consensus mechanisms.

Get a glance at the market report of share of various segments Request Free Sample

The enterprise segment was valued at USD 197.90 million in 2018 and showed a gradual increase during the forecast period.

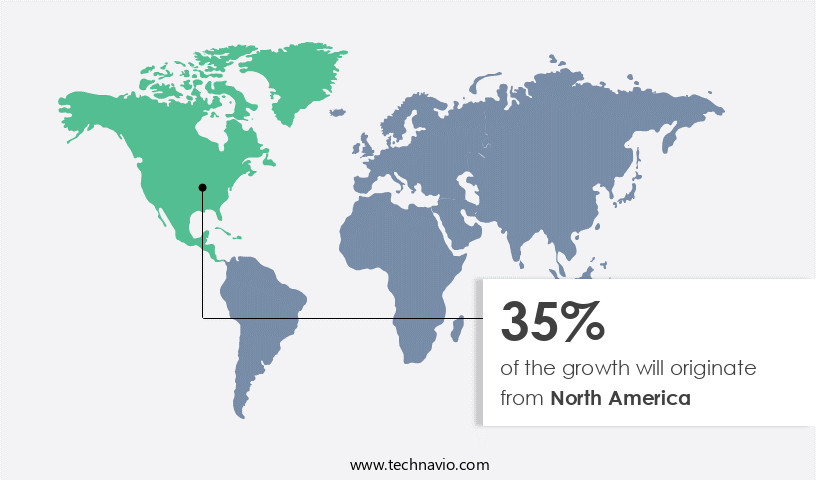

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in North America is experiencing significant growth due to the region's early adoption of blockchain technology and cryptocurrencies, particularly In the US and Canada. The demand for ASIC miners, specifically GPU-based solutions, is high in this region as both large-scale mining operations and hobbyists utilize them for mining Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, Dashcoin, Monero, and other digital currencies. Major ASIC miner manufacturers, such as BitFury, have established operations in North America to cater to this demand. The use of ASIC mining machines in data centers contributes to the processing power and energy efficiency of blockchain networks, making PoW consensus mechanisms more effective.

For more insights on the market size of various regions, Request Free Sample

Moreover, the market is also focusing on sustainable mining practices, incorporating renewable energy sources like solar and wind power to reduce energy consumption and carbon emissions. Key companies In the market prioritize energy-efficient hardware designs, cooling technologies, and noise reduction to enhance the overall mining experience.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of ASIC Miner Industry?

- The profitability of cryptocurrency mining ventures is the key driver of the market. ASIC Miners play a crucial role In the Cryptocurrency market by providing the necessary processing power for mining digital currencies such as Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, Dashcoin, and Monero. Mining involves validating transactions on blockchain networks through a process called Proof of Work (PoW), which requires significant computing power. Traditional mining hardware, including CPUs and GPUs, have been surpassed by Application-Specific Integrated Circuits (ASICs) due to their energy efficiency and specialized design. Mining operations are typically carried out in large-scale dedicated facilities, powered by energy-efficient hardware and utilizing cooling technologies and noise reduction systems for optimal performance. Mining pools, which allow miners to combine their resources to increase their chances of earning mining pool rewards, are a common practice In the industry.

- While small-scale miners can earn a modest profit, large-scale mining operations in regions with low-cost energy sources, such as wind or solar power, can generate substantial profits. The market is dynamic, with constant advancements in semiconductor technology, chip design, and power management driving the rapid obsolescence of mining machines. Miners must adopt sustainable mining practices and explore alternative energy sources to remain competitive and reduce their environmental footprint. The market for mining hardware is expected to grow as decentralized applications, decentralized finance (DeFi), and alternative cryptocurrencies continue to gain popularity.

What are the market trends shaping the ASIC Miner Industry?

- Investments by large semiconductor companies in mining-specific hardware is the upcoming market trend. ASIC (Application-Specific Integrated Circuit) miners have become the go-to hardware solution for cryptocurrency mining due to their energy efficiency and high processing power. Traditional CPUs, GPUs, and even high-end smartphones lack the necessary hash rate and energy efficiency for profitable mining. The mining landscape has evolved, with large semiconductor companies and system designers investing in ASICs for cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, Dashcoin, Monero, and others. Initially, PCs and gaming hardware were used for mining. However, the advantages of ASIC miners, such as energy efficiency and cooling technologies, have led to a significant shift. ASIC mining machines have become essential for profitable Bitcoin and other PoW (Proof of Work) cryptocurrency mining.

- While Ethereum (ETH) and other alternative cryptocurrencies have gained popularity, some do not derive significant advantages from specialized mining hardware. Consequently, there has been a reincreasence in demand for high-end graphics cards for mining these cryptocurrencies. Mining pools have become a crucial part of the mining ecosystem, offering rewards to miners based on their contribution to the network's hashing power. Power supply, cooling technologies, and noise reduction are essential considerations for mining operations, which often take place in data centers. Energy efficiency and the use of renewable energy sources, such as solar and wind power, are increasingly important for sustainable mining practices.

What challenges does the ASIC Miner Industry face during its growth?

- Volatility in value of cryptocurrencies is a key challenge affecting the industry growth. The market experiences volatility due to the inherent nature of cryptocurrencies, with Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin, Dashcoin, Monero, and other digital currencies influencing market dynamics. ASIC miners are specialized hardware used for processing transactions on blockchain networks through Proof of Work (PoW), which requires significant processing power and energy efficiency. ASIC miners outperform CPUs, GPUs, and FPGAs in mining operations, making them the preferred choice for mining popular cryptocurrencies. Mining pools, which combine the processing power of multiple miners, offer rewards based on their contribution to the mining process. However, the market faces challenges due to the volatility of cryptocurrency prices.

- Sudden declines in prices can significantly impact mining profitability, leading to financial losses. This uncertainty makes it difficult for enterprises to predict returns on their investments in ASIC miners, potentially deterring them from investing in new equipment. During periods of low cryptocurrency prices, demand for ASIC miners decreases, leading to reduced sales for manufacturers and instability In the market. Energy efficiency and cooling technologies are essential considerations for sustainable mining practices, with alternative energy sources, such as solar and wind power, gaining popularity. Energy-efficient hardware and ASIC-resistant mining algorithms are also important to mitigate the environmental impact and reduce the rapid obsolescence of mining equipment.

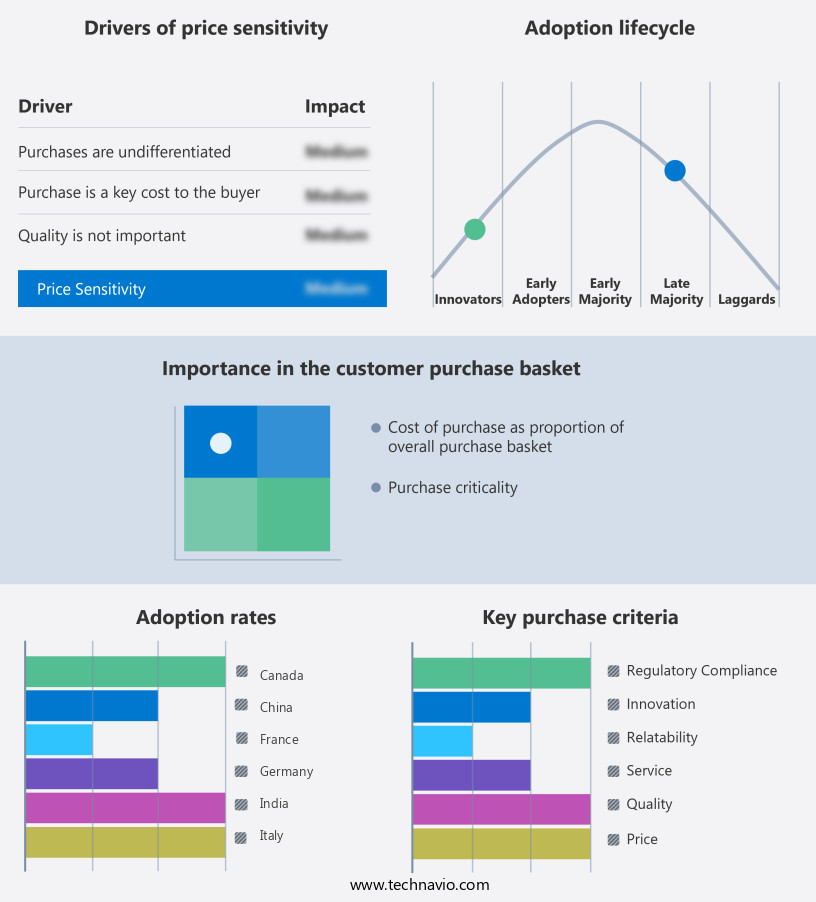

Exclusive Customer Landscape

The ASIC miner market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ASIC miner market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ASIC miner market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- BIOSTAR Group.

- Bitfury Group Ltd.

- BitMain Group

- BLOCKCHAIN HOLDING GMBH

- Canaan Inc.

- DigiByte

- DriveMining GmbH and Co. KG

- Ebang International Holdings Inc.

- NiceHash Ltd.

- Poloniex

- Shenzhen MicroBT Electronics Technology Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve as the cryptocurrency landscape expands and advances in technology push the boundaries of mining capabilities. Mining, a crucial component of digital currency networks, relies on the processing power of specialized hardware to validate transactions and secure the underlying blockchain. ASIC miners, Application-Specific Integrated Circuits, are designed specifically for the purpose of mining cryptocurrencies. They offer significant advantages over traditional CPUs and GPUs, providing increased processing power and energy efficiency. FPGAs, or Field-Programmable Gate Arrays, were once popular In the mining scene due to their flexibility, but ASICs have since surpassed them in terms of performance and energy efficiency.

In addition, mining pools, a collaborative approach to mining, have become increasingly prevalent In the cryptocurrency ecosystem. These pools enable miners to combine their resources and share the rewards, making mining more accessible to individuals and small-scale operations. Mining pool rewards are distributed based on the amount of hashing power each miner contributes to the pool. Power supply is a critical factor in mining operations. Mining machines require substantial power to operate efficiently, and energy management is essential to maximize profits and minimize costs. Alternative energy sources, such as solar and wind power, are being explored to promote sustainable mining practices.

Furthermore, noise reduction and cooling technologies are other considerations for mining operations. Mining machines generate significant heat and noise, which can be problematic for data centers and residential settings. Energy-efficient hardware and advanced cooling systems help mitigate these issues, ensuring optimal performance and reducing the environmental impact of mining. The mining machine market is driven by the constant evolution of semiconductor technology, chip design, and power management. Rapid obsolescence is a common challenge, as new, more efficient mining hardware is constantly being developed. Mining profits depend heavily on the hashrate, mining difficulty, and the specific cryptocurrency being mined. Proof of work (PoW), a consensus mechanism used by many cryptocurrencies, requires substantial processing power to validate transactions and secure the network.

In addition, ASIC miners are well-suited for PoW-based mining, making them a popular choice for mining Bitcoin, Ethereum, Litecoin, Dashcoin, Monero, and other cryptocurrencies. The integration of decentralized applications (dApps) and decentralized finance (DeFi) In the cryptocurrency space has led to an increased focus on ASIC-resistant mining algorithms. These algorithms aim to prevent the dominance of ASIC miners, allowing CPU and GPU miners to remain competitive. Cloud mining and mining pools offer alternative ways to participate In the mining process without the need for specialized hardware or the overhead of managing a mining operation. Hashing power, the collective processing power of a mining network, plays a crucial role In the security and stability of the underlying blockchain networks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2024-2028 |

USD 112 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, China, UK, France, Canada, Japan, India, South Korea, Germany, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this ASIC Miner Market Research and Growth Report?

- CAGR of the ASIC Miner industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the asic miner market growth of industry companies

We can help! Our analysts can customize this asic miner market research report to meet your requirements.