Audiological Devices Market Size 2024-2028

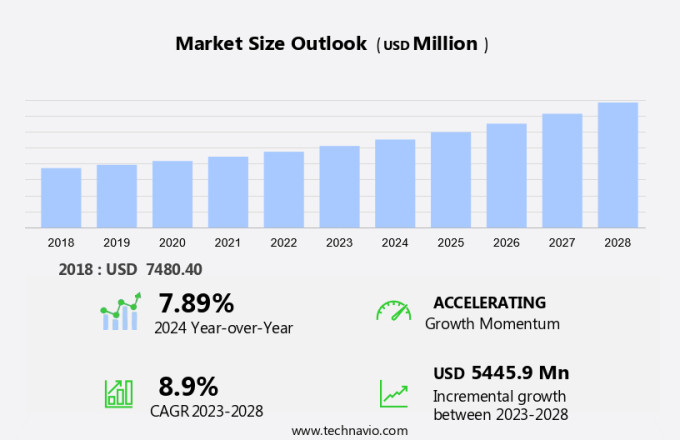

The audiological devices market size is forecast to increase by USD 5.45 billion at a CAGR of 8.9% between 2023 and 2028. The market is experiencing significant growth due to the rising prevalence of hearing impairment and the increasing focus of companies on developing advanced technologies. One of the key trends in this market is the integration of wireless technology, allowing hearing aids to connect with smartphones, televisions, and other devices for seamless usage. Additionally, the aging population and the subsequent increase in hearing rehabilitation needs are driving market growth. However, the high costs associated with these devices remain a challenge for many consumers. Furthermore, the integration of features such as hearing aid adjustments and compatibility with devices for individuals with arthritis or heart disease are becoming increasingly important.

What will the size of the market be during the forecast period?

The market for audiological devices has witnessed consistent growth, driven by the increasing prevalence of hearing loss and advancements in technology. According to the World Health Organization, approximately 466 million people worldwide have hearing loss, with nearly 34 million of these cases being due to sensorineural hearing loss. This condition, which affects the inner ear, is a significant contributor to the demand for audiological devices. Audiological devices encompass a range of products, including hearing aids, cochlear implants, diagnostic devices, audiometers, bone-anchored hearing systems, and audiological equipment. These devices cater to various types and degrees of hearing loss, ensuring improved communication and quality of life for individuals. Digital technology has revolutionized the market, enabling advanced features such as digital signal processing, noise reduction, and Bluetooth connectivity. Rechargeable batteries have also gained popularity due to their convenience and environmental benefits. The geriatric population represents a significant market for audiological devices, as age-related hearing loss is prevalent.

Further, according to the National Institute on Aging, two-thirds of adults aged 70 and older have hearing loss. This demographic trend, coupled with the availability of innovative solutions, is expected to drive market growth. Waterproof hearing devices and wireless technology have become essential features for users, enabling seamless integration with everyday devices like smartphones and televisions. Hearing aid adjustments can now be made remotely via smartphone apps, offering added convenience and flexibility. Audiological devices are essential components of the healthcare system, with audiologists playing a crucial role in their selection, fitting, and adjustment. The market for audiological devices is expected to continue growing, driven by the increasing prevalence of hearing loss and advancements in technology.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Adults

- Pediatrics

- Product

- Hearing aids

- Cochlear implants

- BAHA/BAHS

- Diagnostic devices

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- India

- Rest of World (ROW)

- North America

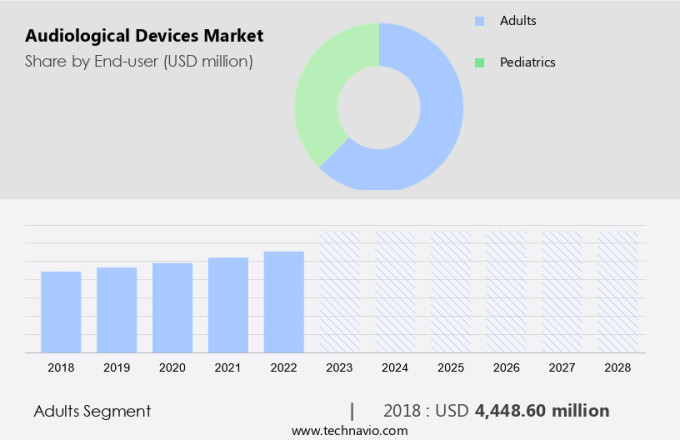

By End-user Insights

The adults segment is estimated to witness significant growth during the forecast period. The adult population holds a significant market share in the audiological devices industry due to the high incidence of age-related hearing loss and various other auditory impairments. As people grow older, they frequently experience gradual hearing decline, leading to an increased demand for sophisticated hearing aids, cochlear implants, and bone-anchored hearing aids. Adults may also face hearing difficulties due to occupational exposure to loud noise, unhealthy lifestyles, or underlying medical conditions. Adults who perceive a greater degree of hearing loss are more inclined to seek help and adopt hearing amplification solutions. However, a considerable number of adults aged 50 and above remain untreated for their hearing disabilities.

In the market, the healthcare system plays a crucial role in the purchasing of audiological devices for adults and pediatrics through various government programs and collaborations with audiologists. The healthcare sector's ongoing efforts to improve access to hearing healthcare services and advanced technologies will further fuel market growth.

Get a glance at the market share of various segments Request Free Sample

The adults segment accounted for USD 4.45 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The United States holds a significant position in the North American market, fueled by several factors. These include a large aging population, advanced healthcare infrastructure, and substantial healthcare expenditures. In 2023, approximately 18% of the US population was aged 65 and above. Healthcare spending in the country reached USD 4.5 trillion in 2022, representing a 4.1% increase from the previous year. The growing prevalence of hearing loss among the elderly, coupled with heightened awareness regarding the advantages of early detection and treatment of hearing impairments, is driving demand for audiological devices. Digital media and internet access have also played a crucial role in increasing public awareness about hearing health.

Maintenance services for these devices are essential to ensure their optimal performance and longevity, making the market for audiological devices a sustained and growing one.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing prevalence of hearing loss is notably driving market growth. Audiology devices, including hearing aids and cochlear implants, play a crucial role in addressing various types of hearing loss, such as sensorineural, conductive, and mixed. Meniere's disease, a condition causing vertigo, tinnitus, and fluctuating hearing loss, often necessitates the use of these devices. Hearing aids, available in digital and analog models, are commonly used for adults and pediatrics with hearing impairments.

Moreover, cochlear implants, a more invasive solution, are recommended for severe to profound hearing loss. Diagnostic devices, like audiometers, employ digital signal processing for accurate assessment of hearing abilities. Digital media and internet access have expanded retail sales, with e-commerce platforms and physical retail locations catering to consumers. Government purchases, healthcare systems, audiologists, and individuals with chronic health conditions. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Increasing focus of companies on new audiological product development is the key trend in the market. Audiology devices, including hearing aids and cochlear implants, play a crucial role in addressing various types of hearing loss, such as Meniere's disease, sensorineural hearing loss, conductive hearing loss, and mixed hearing loss.

Moreover, these devices have evolved significantly, with digital signal processing, noise reduction, Bluetooth connectivity, and rechargeable batteries becoming standard features. The market for audiology devices caters to both adults and pediatrics, with retail sales and e-commerce channels driving growth. Government purchases also contribute significantly to the market. Audiologists are key players in the healthcare system, utilizing diagnostic devices like audiometers to assess hearing abilities and provide appropriate solutions. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

High costs associated with audiological devices is the major challenge that affects the growth of the market. Audiology devices, including hearing aids and cochlear implants, play a crucial role in addressing various types of hearing loss, such as Meniere's disease, sensorineural hearing loss, conductive hearing loss, and mixed hearing loss. These devices have evolved significantly, with digital signal processing, noise reduction, Bluetooth connectivity, and rechargeable batteries becoming standard features.

Moreover, retail sales and e-commerce platforms dominate the market, while government purchases also contribute significantly. Audiologists are key players in the healthcare system, conducting diagnostic tests using devices like audiometers to assess hearing abilities. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amplifon SpA: The company offers Audiological Devices such as ampli mini, ampli connect, ampli energy, and ampli easy

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Audina Hearing Instruments Inc.

- Bernafon AG

- Cochlear Ltd.

- Demant AS

- Earlens Corp.

- Envoy Medical Corp.

- GN Store Nord AS

- Inventis s.r.l.

- MAICO Diagnostics GmbH

- MED EL Medical Electronics.

- MedRx Inc.

- Medtronic

- Oticon

- RION Co. Ltd.

- Siemens Healthineers AG

- Sonova AG

- Starkey Laboratories Inc.

- WS Audiology AS

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of products designed to diagnose, treat, and manage various types of hearing loss. These devices include hearing aids and cochlear implants, which are essential tools for individuals with sensorineural, conductive, or mixed hearing loss. Digital signal processing, noise reduction, Bluetooth connectivity, rechargeable batteries, and waterproof features are among the advanced technologies driving the demand for these devices. Diagnostic devices, such as audiometers, play a crucial role in identifying hearing impairments. Digital technology and sensorineural hearing loss are major growth factors in this segment. Public health campaigns, early screening programs, and genetic predispositions are key factors contributing to the increasing awareness and adoption of audiological devices.

Further, the market is influenced by various factors, including public health initiatives, environmental noise pollution, occupational hazards, age-related hearing loss, and chronic health conditions like diabetes, cardiovascular diseases, and hypertension. Audiologists and healthcare systems are significant end-users, while retail sales and e-commerce platforms cater to the growing demand for these devices. Maintenance services, physical retail locations, and social media platforms are essential channels for reaching customers and providing support. Hearing aid adjustments, hearing rehabilitation, and patient evaluations are integral aspects of the treatment options available. The geriatric population, with its higher prevalence of hearing loss, is a significant market segment. Smartphones, televisions, and other digital media are increasingly being integrated with audiological devices to enhance user experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2024-2028 |

USD 5.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.89 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, Canada, Germany, UK, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amplifon SpA, Audina Hearing Instruments Inc., Bernafon AG, Cochlear Ltd., Demant AS, Earlens Corp., Envoy Medical Corp., GN Store Nord AS, Inventis s.r.l., MAICO Diagnostics GmbH, MED EL Medical Electronics., MedRx Inc., Medtronic, Oticon, RION Co. Ltd., Siemens Healthineers AG, Sonova AG, Starkey Laboratories Inc., WS Audiology AS, and ZHEJIANG NUROTRON BIOTECHNOLOGY CO. LTD. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch