Automated Industrial Quality Control (Qc) Market Size 2024-2028

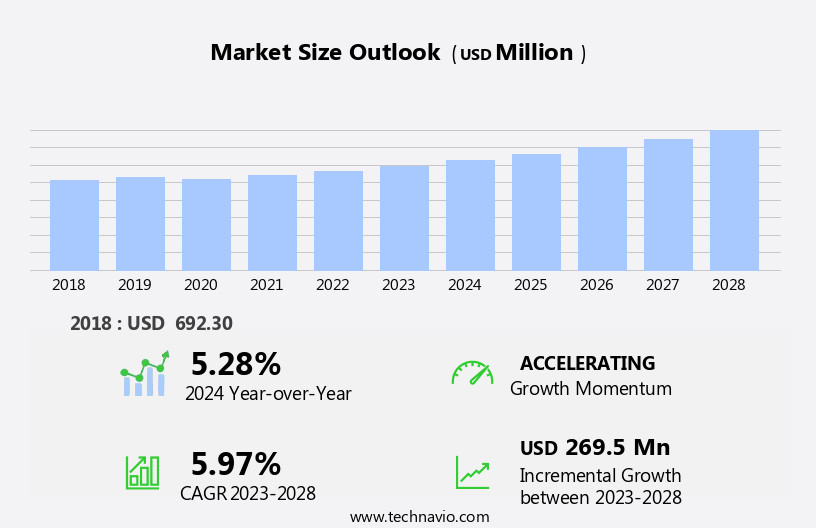

The automated industrial quality control (qc) market size is forecast to increase by USD 269.5 million at a CAGR of 5.97% between 2023 and 2028.

What will be the Size of the Automated Industrial Quality Control (Qc) Market During the Forecast Period?

How is this Automated Industrial Quality Control (Qc) Industry segmented and which is the largest segment?

The automated industrial quality control (qc) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive industry

- Metal industry

- Electronics industry

- Others

- Solution

- Hardware and software

- Service

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By End-user Insights

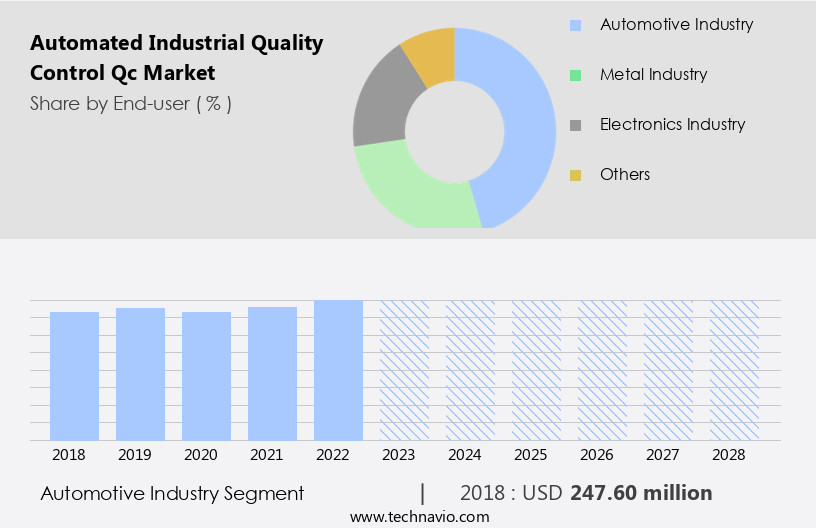

The automotive industry segment is estimated to witness significant growth during the forecast period. Automated industrial quality control systems play a crucial role In the manufacturing sector, particularly In the automotive industry, where continuous production and high-quality standards are essential. These systems optimize the performance of assembly and material handling equipment, conveyor systems, industrial robots, and welding equipment. By implementing machine learning algorithms, physics-based modeling, and augmented reality technologies, manufacturers can enhance production rates, minimize errors, and ensure consistent product quality. Cloud computing and SCADA (Supervisory Control and Data Acquisition) systems facilitate remote supervision and data management, enabling real-time monitoring and analysis. Industrial sensors and digital technology further integrate with these systems to provide advanced quality control solutions.

The defense industry, pharmaceuticals, oil and gas, and electrical power sectors also benefit from automated industrial quality control systems, which support digital transformation and improve overall efficiency. Key applications include in vitro diagnostics, immunochemistry, molecular diagnostics, clinical chemistry, hematology, coagulation and hemostasis, microbiology, and various chronic diseases and cancer diagnosis. Automated industrial quality control systems contribute to reducing the burden of diseases and improving the availability of fast diagnosis systems, ultimately leading to better patient outcomes.

Get a glance at the market report of various segments Request Free Sample

The Automotive industry segment was valued at USD 247.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

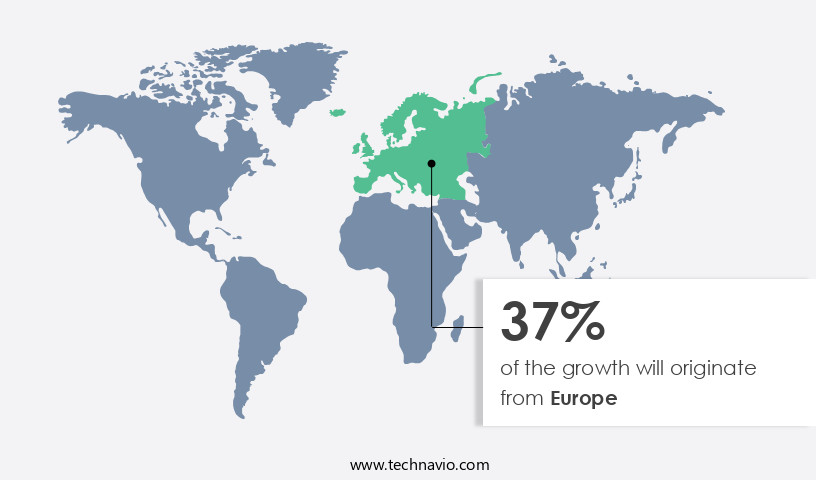

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Automated industrial quality control is a critical aspect of manufacturing processes in various industries, including pharmaceuticals, oil and gas, electrical power, and defense. With the integration of advanced technologies such as Augmented Reality (AR), Machine Learning, Physics-based Modeling, Cloud Computing, SCADA, and HMI, industrial automation market has witnessed significant growth. Industrial sensors play a pivotal role in ensuring product quality and consistency. In the healthcare sector, in vitro diagnostics, immunochemistry, molecular diagnostics, HIV, infectious illnesses, autoimmune disorders, chronic diseases, and cancer require stringent quality control. Quality control products, data management solutions, quality assurance services, self-testing kits, IVD devices, reagent kits, clinical chemistry, immunochemistry/immunoassay, hematology, coagulation and hemostasis, microbiology, and burden of diseases are major areas of focus.

Digital transformation and remote supervision are key trends in this market. Pharmaceutical, oil and gas, electrical power, and other industries are increasingly adopting industrial control systems, automation devices, and cloud-based services for efficient and accurate quality control. The integration of digital technology, industrial robots, and remote terminal units enhances productivity and reduces human error. The market for automated industrial quality control is expected to continue its growth trajectory due to the increasing demand for fast diagnosis systems and the need for high-quality products in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automated Industrial Quality Control (Qc) Industry?

- Growing importance of accuracy in quality control processes is the key driver of the market.In the manufacturing industry, ensuring product quality is paramount for sustainable business growth. Manual quality control processes, however, may not be sufficient for large-scale production and complex processes, potentially compromising overall profitability. Automated industrial quality control systems have emerged as a solution to address these challenges. These systems leverage advanced technologies such as Machine Learning, Augmented Reality (AR), and Physics-based Modeling, integrated with Industrial Automation Market components like SCADA, HMI, and industrial sensors. Cloud Computing plays a crucial role in data management and remote supervision. The defense industry, healthcare sectors including In Vitro Diagnostics, Immunochemistry, Molecular Diagnostics, Hospitals, Home Care, and various clinical applications such as HIV, Infectious Illnesses, Autoimmune Disorders, Chronic Diseases, and Cancer, are increasingly adopting automated quality control solutions.

Industrial control systems, automation devices, and digital technology are transforming the manufacturing landscape, with digital transformation driving the demand for automation, self-testing kits, IVD devices, reagent kits, clinical chemistry, immunochemistry/immunoassay, hematology, coagulation and hemostasis, microbiology, and more. The burden of diseases and the need for fast diagnosis systems further accentuate the importance of these solutions. Industrial robots and cloud-based services are integral to this digital transformation. Automation, digital technology, and remote supervision are key to enhancing manufacturing standards and practices while maintaining cost-effectiveness.

What are the market trends shaping the Automated Industrial Quality Control (Qc) market?

- Reshoring of manufacturing industry is the upcoming market trend.The market is experiencing significant growth due to the integration of advanced technologies such as Machine Learning, Augmented Reality (AR), and Physics-based Modeling in industrial automation. Cloud Computing and SCADA systems with Human-Machine Interfaces (HMI) are becoming increasingly popular for data management and remote supervision. Industrial control systems are undergoing digital transformation with the adoption of automation devices, digital technology, and industrial robots. In various industries, including Pharmaceutical, Oil and Gas, and Electrical Power, there is a growing demand for Quality Control Products and Quality Assurance Services. In the Healthcare sector, there is a focus on In Vitro Diagnostics, Immunochemistry, Molecular Diagnostics, HIV, Infectious Illnesses, Autoimmune Disorders, Chronic Diseases, and Cancer.

Self-Testing Kits, IVD Devices, Reagent Kits, Clinical Chemistry, Immunochemistry/Immunoassay, Hematology, Coagulation and Hemostasis, Microbiology, and Burden of Diseases are some of the key areas of application. The Defense Industry also utilizes these technologies for quality control and assurance in manufacturing processes. The integration of these advanced technologies leads to Fast Diagnosis Systems and improved efficiency, accuracy, and productivity. The market's growth is driven by the need for fast and reliable quality control, increasing demand for automation, and the digital transformation of industries. Cloud-based services offer cost savings, scalability, and flexibility, making them an attractive option for businesses.

What challenges does the Automated Industrial Quality Control (Qc) Industry face during its growth?

- Lack of effective interoperability is a key challenge affecting the industry growth.The market integration poses challenges for end-users due to interoperability issues. With the increasing deployment of diverse devices and systems in industrial facilities, ensuring compatibility among them becomes essential. In industries such as automotive, electronics, metal, and food and beverage, where legacy systems are prevalent, integrating automated industrial quality control solutions becomes particularly complex. Replacing these legacy systems can also be cost-prohibitive. Interoperability problems hinder automated industrial quality control companies from providing software upgrades, as these upgrades can impact the performance of their systems and may not be recognized by field instruments. Machine Learning, Augmented Reality (AR), Physics-based Modeling, Cloud Computing, SCADA, HMI, and Industrial Automation Market technologies are transforming industrial processes.

Industrial Sensors, Digital technology, Automation devices, and Cloud-based services are integral components of this transformation. In the Defense Industry, In Vitro Diagnostics, Immunochemistry, Molecular Diagnostics, Hospital, Home Care, HIV, Infectious Illnesses, Autoimmune Disorders, Chronic Diseases, and Cancer sectors benefit from Quality Control Products, Data Management Solutions, and Quality Assurance Services. Self-Testing Kits, IVD Devices, Reagent Kits, Clinical Chemistry, Immunochemistry/Immunoassay, Hematology, Coagulation and Hemostasis, Microbiology, and Burden of Diseases are key areas of application. Interoperability concerns persist, necessitating the need for standardized communication protocols and open systems architecture.

Exclusive Customer Landscape

The automated industrial quality control (qc) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automated industrial quality control (qc) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automated industrial quality control (qc) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The automated industrial quality control market encompasses advanced technologies, such as Network Platform 800 measurement scanners, which streamline and enhance manufacturing processes. These solutions ensure consistent product quality through real-time monitoring and analysis of production data. By integrating automation into quality control procedures, manufacturers can minimize errors, increase efficiency, and improve overall product consistency. The adoption of these technologies is driven by the growing demand for high-quality goods and increasing competition in global markets. Automated industrial quality control systems offer significant benefits, including increased accuracy, reduced labor costs, and improved product traceability. By implementing these solutions, manufacturers can gain a competitive edge and meet the evolving demands of their customers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ATS Automation Tooling Systems Inc.

- Carl Zeiss Stiftung

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- IVISYS

- KEYENCE CORP.

- MasterControl Solutions Inc.

- Mitsubishi Electric Corp.

- NANOTRONICS IMAGING INC.

- OMRON Corp.

- Renishaw Plc

- RNA Automation Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Shelton Machines Ltd.

- Siemens AG

- Texas Instruments Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as industries seek to enhance their production processes and ensure the consistent delivery of high-quality goods. This trend is driven by several factors, including the integration of advanced technologies such as augmented reality (AR), machine learning, and physics-based modeling into industrial applications. Augmented reality technology is revolutionizing the way QC is performed in various industries. AR systems overlay digital information onto the physical world, enabling operators to visualize data in real-time and make informed decisions. This technology is particularly useful in complex manufacturing processes where precise measurements and inspections are required. Machine learning algorithms are another key technology driving the growth of the automated industrial QC market.

These algorithms enable systems to learn from data and improve their performance over time. In the context of QC, machine learning can be used to analyze data from sensors and identify patterns that indicate quality issues or anomalies. Cloud computing is also playing a significant role In the automated industrial QC market. Cloud-based services enable remote access to data and real-time monitoring of production processes. This is particularly important in industries where production facilities are geographically dispersed or where real-time data analysis is critical. SCADA (Supervisory Control and Data Acquisition) and HMI (Human-Machine Interface) systems are essential components of industrial automation systems.

These systems enable operators to monitor and control production processes in real-time, ensuring that quality standards are met. Cloud-based SCADA and HMI solutions offer the added benefit of remote access and real-time data analysis. Industrial sensors are another critical component of automated industrial QC systems. These sensors provide real-time data on various production parameters, enabling operators to quickly identify and address quality issues. The market for industrial sensors is expected to grow significantly In the coming years due to the increasing demand for real-time monitoring and data analysis. The defense industry is one of the major consumers of automated industrial QC systems.

These systems are used to ensure the quality of components and finished products, particularly In the production of complex weapons systems. The integration of advanced technologies such as machine learning and AR is expected to further enhance the capabilities of defense industry QC systems. The healthcare industry, including in vitro diagnostics, immunochemistry, molecular diagnostics, hospitals, and home care, is another major consumer of automated industrial QC systems. These systems are used to ensure the quality of reagents, IVD devices, and self-testing kits. The integration of digital technology, including machine learning and cloud-based services, is enabling faster diagnosis systems and more efficient data management solutions.

The pharmaceutical industry is also adopting automated industrial QC systems to ensure the quality of their products. These systems are used to monitor production processes and ensure compliance with regulatory requirements. The integration of digital technology, including machine learning and cloud-based services, is enabling more efficient data management and remote supervision. The oil and gas industry, electrical power, and other heavy industries are also adopting automated industrial QC systems to enhance their production processes and ensure the consistent delivery of high-quality products. The integration of digital technology, including industrial robots and cloud-based services, is enabling more efficient and effective production processes.

In conclusion, the automated industrial QC market is experiencing significant growth due to the integration of advanced technologies such as augmented reality, machine learning, and cloud computing. These technologies are enabling real-time monitoring, data analysis, and remote supervision, leading to more efficient and effective production processes and the consistent delivery of high-quality goods. The market for industrial sensors is also expected to grow significantly In the coming years due to the increasing demand for real-time monitoring and data analysis. Industries such as defense, healthcare, pharmaceuticals, oil and gas, and electrical power are major consumers of automated industrial QC systems, and the integration of digital technology is enabling more efficient and effective production processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.97% |

|

Market growth 2024-2028 |

USD 269.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.28 |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automated Industrial Quality Control (Qc) Market Research and Growth Report?

- CAGR of the Automated Industrial Quality Control (Qc) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automated industrial quality control (qc) market growth of industry companies

We can help! Our analysts can customize this automated industrial quality control (qc) market research report to meet your requirements.