Automotive Active Aerodynamics System Market Size 2024-2028

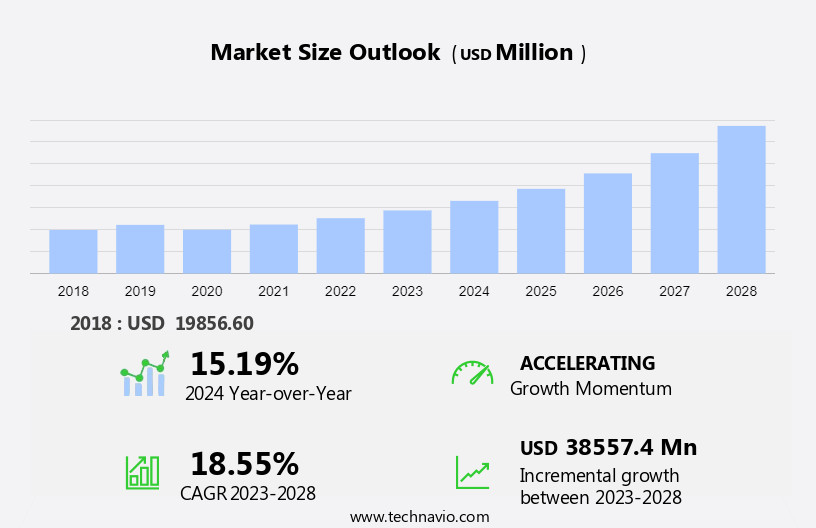

The automotive active aerodynamics system market size is forecast to increase by USD 38.56 billion at a CAGR of 18.55% between 2023 and 2028.

- The market is witnessing significant growth due to stringent regulations for emission control, which is driving the adoption of these systems. Advanced active grille shutters are increasingly being used to minimize CO2 emissions from vehicles by optimizing airflow and reducing drag. However, the increased use of aluminum and other lightweight materials, as well as the integration of complex systems, is adding to the overall weight and complexity of vehicles. Furthermore, the trend toward autonomous vehicles and public transportation is expected to boost the demand for active aerodynamics systems in the coming years. This technology, originally developed for aviation, is also finding applications in pickup trucks to improve fuel efficiency and reduce emissions. Overall, the market is poised for strong growth, with plastic components playing a crucial role in reducing weight and cost while maintaining functionality.

What will be the Size of the Automotive Active Aerodynamics System Market During the Forecast Period?

- The market encompasses technologies that optimize airflow around moving automobiles, reducing wind noise and emissions while enhancing aerodynamic stability and fuel efficiency. Active aerodynamic components, such as grille shutter systems and air grilles, adapt to changing driving conditions, enabling vehicles to minimize power losses and carbon emissions. This market's growth is driven by the increasing demand for lightweight materials and advanced aerodynamic features in passenger cars, light commercial vehicles, medium duty vehicles, and heavy-duty vehicles. Active aerodynamics systems employ principles of rocket and kite design to manipulate airflow, improving overall vehicle performance and reducing wind resistance. The market's expansion is expected to continue as automakers seek innovative solutions to address the challenges of fuel efficiency, regulatory compliance, and consumer preferences for quieter, more eco-friendly vehicles.

How is this Automotive Active Aerodynamics System Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Mid-sized vehicles

- High performance vehicles

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

- The mid-sized vehicles segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for fuel efficiency and safety features in passenger cars. The mid-sized vehicle segment holds a significant market share due to the integration of advanced technologies such as sunroofs and active aerodynamic components like grille shutters, air dams, and speed lips. These components help reduce airflow drag, improve lift force, and enhance aerodynamic stability. The automotive industry is witnessing growth in developing countries, such as China, India, and South Korea, due to increasing vehicle penetration rates and regulatory pressures for carbon-reduction and fuel efficiency regulations. OEMs are capitalizing on this trend by expanding their manufacturing facilities and workforce to meet the rising demand.

Key active aerodynamic components include grille shutters, air grilles, decorative grilles, active speed lips, and active air dams. These components not only improve fuel efficiency but also contribute to aerodynamic stability, reducing wind noise and emissions. Additionally, the adoption of lightweight materials like aluminum and polymer composites in vehicle design further enhances fuel efficiency and reduces power losses. Electric vehicles are also expected to gain traction in the market due to their carbon emission benefits. Overall, the market is poised for growth, driven by regulatory pressures, increasing demand for fuel-efficient vehicles, and technological advancements.

Get a glance at the market report of share of various segments Request Free Sample

The Mid-sized vehicles segment was valued at USD 13.74 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The US dominates the North American market due to the increasing preference for luxury cars and pickup trucks, which have high penetration of these systems. The region's market growth is driven by the higher adoption of personal vehicles for commuting compared to public transport. Incorporating aerodynamic features in automobiles offers several benefits, including powertrain improvements, weight reduction, emissions reduction, and fuel efficiency. Active aerodynamic components, such as grille shutter systems, air grilles, active speed lips, and active air dams, help manage airflow and reduce drag. Regulatory authorities' carbon-reduction regulations and the airline industry's focus on carbon emissions are also driving the market's growth.

Manufacturers invest in lightweight materials like aluminum and polymer composites to meet fuel efficiency and emission regulations. Electric vehicles and commercial vehicles are also adopting active aerodynamic systems for improved stability and fuel efficiency. The market is expected to grow further as OEMs expand their manufacturing facilities and workforce to meet increasing demand. The market's growth is further fueled by the aesthetic appeal of these systems and the trend toward fuel-efficient and lightweight vehicles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Active Aerodynamics System Industry?

Stringent regulations for emission control increase adoption of active aerodynamics systems is the key driver of the market.

- The automotive industry is focusing on reducing emissions and improving fuel efficiency to meet stringent regulatory requirements. The global market for automotive active aerodynamic systems is experiencing growth due to the implementation of these regulations. For instance, the European Union's Euro VI norms, which limit nitrogen oxide emissions to 0.4g/KWh and particulate emissions to 0.01g/KWh, have been in effect since 2014. Japan is also working towards similar emission standards. These regulations are driving the demand for active aerodynamic features in mid-sized vehicles, as they help reduce airflow drag and improve aerodynamic stability, leading to better fuel efficiency and lower carbon emissions.

- Active aerodynamic components, such as grille shutter systems, air grilles, active speed lips, and active air dams, are becoming increasingly popular in passenger cars, light commercial vehicles, medium duty vehicles, and heavy-duty vehicles. Additionally, the use of lightweight materials like aluminum and polymer composites in vehicle design is also contributing to the growth of this market. The focus on fuel-efficient vehicles and commercial vehicles is also expected to boost demand for active aerodynamic systems. However, the manufacturing facilities may face a workforce shortage to meet the increasing demand for these systems. The market for active aerodynamic systems is also influenced by the need for acoustic engineering to reduce wind noise and noise emissions, as well as the integration of thermoacoustic engine encapsulations to improve powertrain performance.

What are the market trends shaping the Automotive Active Aerodynamics System Industry?

Use of advanced active grille shutter systems to reduce CO2 emissions from vehicles is the upcoming market trend.

- Active aerodynamics systems play a pivotal role in enhancing the fuel efficiency and reducing emissions in modern automobiles. One such application is the active grille system, which optimizes airflow to the cooling system and engine compartment by opening and closing vents as needed. This mechanism contributes to a significant reduction in drag, initially operated in only two ways: open and shut. However, advanced systems have multiple operational modes based on instructions from an engine control unit. These systems not only improve powertrain performance and weight reduction but also comply with carbon-reduction regulations. The airline industry, which shares similar concerns for fuel consumption and emissions, has long employed active aerodynamics In the form of moving flaps and wings to manage airflow and reduce drag.

- Active aerodynamic components, including air grilles, active speed lips, and thermoacoustic engine encapsulations, are increasingly integrated into vehicle design to improve aerodynamic stability and reduce wind noise and noise emissions. Lightweight materials, such as aluminum and polymer composites, are also utilized to minimize power losses and carbon emissions. Electric vehicles and commercial vehicles, including passenger cars, light commercial vehicles, medium duty vehicles, and heavy-duty vehicles, are all benefiting from these advancements. The integration of active system aerodynamics not only enhances the aesthetic appearance of vehicles but also contributes to fuel efficiency and emissions reductions, making it a vital consideration for OEMs and manufacturing facilities addressing fuel efficiency and emission regulations.

What challenges does the Automotive Active Aerodynamics System Industry face during its growth?

Increased weight and complexity of vehicles is a key challenge affecting the industry growth.

- The market is gaining traction in the industry, with applications extending beyond high-end sports cars to mid-priced sedans from manufacturers like General Motors and Ford. For instance, the Chevrolet Cruze incorporates grille shutters that automatically close at highway speeds to optimize airflow and reduce drag. However, the implementation of active aerodynamics systems adds weight and complexity to vehicles due to the inclusion of electric motors and the requirement for automatic shutter adjustment. Furthermore, stricter fuel efficiency and emission regulations set by regulatory authorities worldwide pose challenges for automotive OEMs in developing lightweight and efficient active aerodynamic systems. These systems, which include components such as active speed lips, air dams, and thermoacoustic engine encapsulations, aim to enhance vehicle design, improve fuel efficiency, and reduce carbon emissions.

- The use of lightweight materials like aluminum and polymer composites in vehicle manufacturing facilities can help mitigate the weight increase. Despite these challenges, the market continues to grow as the demand for fuel-efficient and environmentally friendly vehicles increases.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Batz Group

- Bayerische Motoren Werke AG

- Burelle SA

- Ford Motor Co.

- General Motors Co.

- HBPO GmbH

- Horacio Pagani S p A

- Johnson Electric Holdings Ltd.

- Koch Industries Inc.

- Koenigsegg Automotive AB

- Magna International Inc.

- Mercedes Benz Group AG

- Plasman Plastics Inc.

- Polytec Holding AG

- Porsche Automobil Holding SE

- Rochling SE and Co. KG

- SONCEBOZ SA

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The interaction between moving objects and air is a fundamental concept in physics, with aerodynamics being a critical aspect of this relationship. Aerodynamics refers to the study of the force exerted by air on moving objects, resulting from the relative motion between the two. In the context of automobiles, aerodynamic features play a significant role in optimizing vehicle performance and reducing environmental impact. Aerodynamic systems for automobiles are designed to manage airflow around the vehicle body, minimizing drag and maximizing lift force. These systems contribute to improved fuel efficiency, reduced power losses, and enhanced vehicle stability. The integration of active aerodynamic components, such as grille shutters, active speed lips, and active air dams, enables vehicles to adapt to varying driving conditions, optimizing aerodynamic performance.

Moreover, active aerodynamic systems are essential for light duty vehicles as they help to meet fuel consumption and carbon-reduction regulations. These regulations, implemented by regulatory authorities, aim to minimize carbon emissions from the transportation sector, aligning with the global focus on sustainability and reducing environmental impact. The automotive industry's pursuit of powertrain improvements and weight reduction strategies has led to the increased adoption of lightweight materials, such as aluminum and polymer composites, in vehicle manufacturing. The market is evolving with the integration of aviation technology, utilizing lightweight plastic materials and innovative generator systems to enhance vehicle efficiency and performance. The integration of active aerodynamic systems further enhances the benefits of these materials by reducing the overall weight of the vehicle and improving its aerodynamic efficiency.

Furthermore, the acoustic properties of active aerodynamic components, such as grille shutters and thermoacoustic engine encapsulations, contribute to reduced wind noise and noise emissions, enhancing the overall driving experience for passengers. Active aerodynamic systems are not limited to passenger vehicles. Commercial vehicles, including light commercial vehicles, medium duty vehicles, and heavy-duty vehicles, also benefit from these advanced technologies. Enhanced aerodynamic stability and improved fuel efficiency contribute to reduced operational costs and increased productivity for commercial fleet operators. The integration of active aerodynamic systems in automotive design has led to a new era of aesthetically appealing, fuel-efficient vehicles. Mid-priced cars, in particular, have seen significant growth In the adoption of these technologies, catering to consumer demand for stylish, eco-friendly vehicles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.55% |

|

Market growth 2024-2028 |

USD 38.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.19 |

|

Key countries |

US, China, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Active Aerodynamics System Market Research and Growth Report?

- CAGR of the Automotive Active Aerodynamics System industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive active aerodynamics system market growth of industry companies

We can help! Our analysts can customize this automotive active aerodynamics system market research report to meet your requirements.