Automotive Axles Market Size 2024-2028

The automotive axles market size is forecast to increase by USD 23.54 billion at a CAGR of 5.89% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for commercial vehicles and the rise in popularity of e-axle systems. The e-axle system, which integrates the electric motor, power electronics, and transmission into a single unit, is gaining popularity due to its ability to improve vehicle efficiency and reduce emissions. Additionally, the recall of defective axles has led to increased focus on the quality and safety of axle components. These trends are driving market growth and are expected to continue shaping the market dynamics in the coming years. The increasing adoption of electric and hybrid vehicles is also expected to provide significant opportunities for market growth. However, the high cost of e-axles and the complex manufacturing process are some of the challenges that market participants may face. Overall, the market is poised for steady growth, driven by these trends and challenges.

What will be the Size of the Automotive Axles Market During the Forecast Period?

- The market is a critical component of the global vehicle manufacturing industry, serving as an integral part of wheeled vehicles, including passenger cars, commercial vehicles, and luxury models. Market dynamics are driven by increasing vehicle production, a shift towards fuel-efficient and electric vehicles, and advancements in safety and stability systems. Axles play a pivotal role in transmitting driving torque from the engine to the wheels, ensuring vehicle stability and maneuverability. Key trends include the adoption of lightweight materials, such as aluminum and carbon fiber, to reduce vehicle weight and improve fuel efficiency.

- Additionally, the market is witnessing growing demand for axles that can accommodate long trailers and oversize loads, as well as those suitable for rear-wheel drive and four-wheel drive applications. The integration of advanced technologies, such as central shafts, rotating wheels, and differential assemblies, enhances axle performance and improves overall vehicle functionality. Safety considerations, including improved handling and braking performance, are also driving market growth. As the automotive industry continues to evolve, axles will remain a vital component, enabling the efficient and safe transportation of passengers and goods.

How is this Automotive Axles Industry segmented and which is the largest segment?

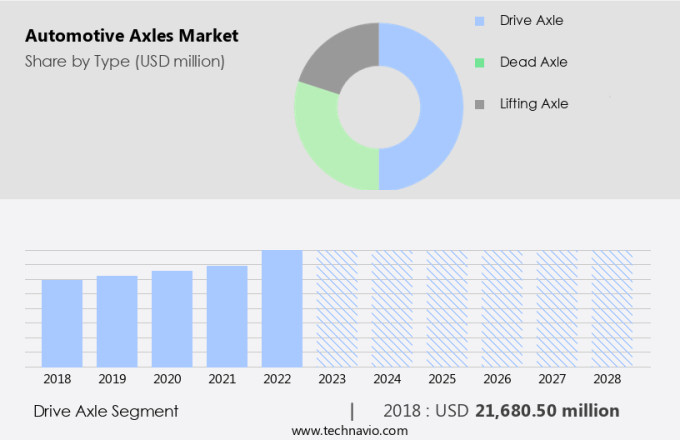

The automotive axles industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Drive axle

- Dead axle

- Lifting axle

- Vehicle Type

- Passenger cars

- SUVs

- Light commercial vehicles

- Heavy commercial vehicles

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Type Insights

- The drive axle segment is estimated to witness significant growth during the forecast period.

Drive axles are integral components of wheeled vehicles, connecting the differential to the wheels through central shafts. These axles are essential for transmitting power and enabling steering in front-wheel-drive applications. In the context of rear-wheel drive systems, drive axles deliver power from the differential to the driving wheels. Classified as semi-floating, full-floating, or three-quarter floating, drive axles vary in design to accommodate different vehicle requirements. Automotive axles play a pivotal role in vehicle production, including fuel-efficient passenger cars, electric vehicles, and heavy-duty commercial vehicles. Safety and stability systems are increasingly integrated into axle designs to enhance vehicle performance and reduce environmental repercussions. The commercial vehicle sector benefits from heavy-duty axles, such as lift axles, to handle cargo loads and improve load distribution. Incorporating lightweight materials like aluminum, steel, carbon fiber, and composite materials into axle manufacturing reduces vehicle weight and enhances fuel efficiency.

Additionally, axles are also essential in various vehicle drivetrain configurations, including all-wheel-drive systems and long-haul trailers. Manufacturers focus on optimizing axle designs for various applications, such as passenger cars, luxury vehicles, and light and heavy commercial vehicles. Drive axles and lift axles are crucial in vehicle electrification and reducing carbon emissions. The aftermarket services sector offers opportunities for axle upgrades and repairs, while powertrains and steer axles continue to evolve. Maintaining axle performance is crucial, considering the impact of road infrastructure, wheel position, driving torque, and load on axle components like shocks. Counterfeit products pose a risk to the industry, necessitating vigilance and quality control measures. The drive axle market is influenced by factors like manufacturing hubs, vehicle production, and market trends.

Get a glance at the Automotive Axles Industry report of share of various segments Request Free Sample

The drive axle segment was valued at USD 21.68 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

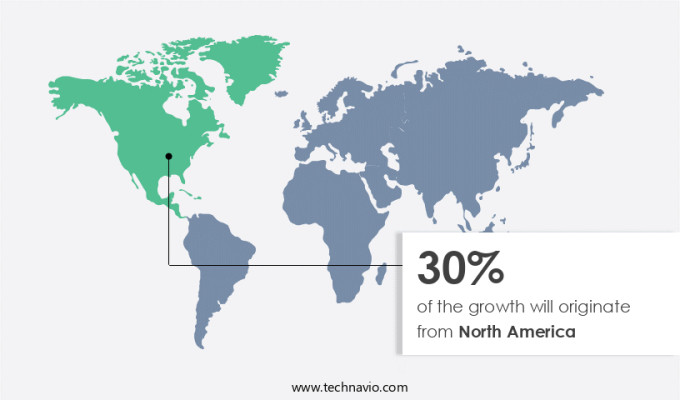

- North America is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is significantly driven by the high production volume of vehicles in the US, Canada, and Mexico. The region's preference for large utility vehicles and commercial vehicles, including light commercial vehicles (LCV) and heavy commercial vehicles (HCV), fuels market growth. The US and Canada are major contributors to the regional commercial vehicle sector, with consumers favoring personal vehicles over public transport for commuting. This trend increases the demand for automotive axles in passenger cars, light commercial vehicles, and heavy commercial vehicles. Fuel-efficient vehicles, electric vehicles, and hybrid vehicles are also gaining popularity, necessitating the use of lightweight materials such as aluminum, steel, carbon fiber, and composite materials for axle production.

Additionally, safety and stability systems, including shocks and suspension systems, are integral parts of automotive axles, ensuring optimal vehicle performance. The commercial vehicle sector, including long-haul trailers, transportation trailers, and oversize loads, also relies on strong axle systems for efficient load distribution and reduced rolling resistance. The market in North America is further influenced by manufacturing hubs, aftermarket services, and powertrains, including all-wheel-drive drivetrains and vehicle electrification. The market faces challenges such as high costs associated with drive axles and lift axles, as well as the risk of counterfeit products. The market is expected to grow, driven by the increasing demand for fuel efficiency, environmental repercussions, and the integration of advanced technologies in automotive axles.

Market Dynamics

Our automotive axles market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Axles Industry?

Increasing demand for commercial vehicles is the key driver of the market.

- The market is experiencing significant growth due to the increasing production of vehicles, particularly in the commercial vehicle sector. In the US and other developed markets, there is a high demand for fuel-efficient vehicles and electric vehicles, leading to the integration of advanced safety and stability systems that rely on strong axle designs. The need for lightweight materials, such as aluminum, steel, carbon fiber, and composite materials, in the manufacturing of axles is also driving market growth. In the commercial vehicle sector, heavy-duty vehicles require lift axles and drive axles to support heavy cargo loads. Hybrid vehicles and passenger cars also utilize front axles, rear axles, and drive axle types, including all-wheel-drive axles and front-wheel-drive axles, to optimize driving torque and improve fuel efficiency. The increasing urbanization and logistics demands have led to the development of various axle types, such as full floating axles and semi-floating axles, to enhance vehicle performance and reduce rolling resistance.

- Furthermore, the market is also influenced by factors such as load distribution, road infrastructure, and environmental repercussions. Aftermarket services and powertrains are essential for maintaining the longevity of axles, and the market for semi-finished goods is growing due to the increasing demand for customized axle solutions. However, the high cost of materials, such as copper, and the prevalence of counterfeit products pose challenges to market growth. In summary, the market is a critical component of the global transportation industry, with ongoing advancements in technology and materials driving growth in the production of various axle types for passenger cars, light commercial vehicles, and heavy commercial vehicles. The market dynamics are influenced by factors such as load, driving torque, safety, stability, and environmental considerations, making it a dynamic and evolving market.

What are the market trends shaping the Automotive Axles Industry?

Increase in popularity of e-axle system is the upcoming market trend.

- The market is experiencing significant growth due to the increasing production of fuel-efficient vehicles, including electric and hybrid models. Lightweight materials, such as aluminum, steel, carbon fiber, and composite materials, are being used to reduce vehicle weight and improve driving torque. In the commercial vehicle sector, the demand for heavy-duty commercial vehicles, such as lift axles for long-haul trailers and transportation trailers, is driving market growth. Safety and stability systems, including shocks and load distribution, are essential components of axle systems. Manufacturers are focusing on developing lightweight axles and e-axle systems, which integrate electric motors with axles to improve fuel efficiency and reduce vehicle weight. For instance, integrating electric motors into the rigid rear axle can reduce the weight of the vehicle by up to 100 kg. Moreover, the integration of e-axles into the vehicle's powertrain can improve overall efficiency and reduce carbon emissions. The market is also witnessing advancements in wheel position and wheel size, which can impact load distribution and rolling resistance. The use of aftermarket services and the increasing focus on vehicle electrification are also expected to drive market growth.

- Moreover, the manufacturing hubs in the US are investing in research and development to produce high-quality axles and components for passenger cars, light commercial vehicles, and heavy commercial vehicles. However, the high cost of developing and producing lightweight axles and e-axles is a significant challenge for market growth. Counterfeit products and the availability of semi-finished goods from overseas markets are also impacting the market's competitiveness. Despite these challenges, the market is expected to grow due to the increasing demand for all-wheel-drive drivetrains, oversize loads, and the urbanization trend, which is leading to the production of luxury passenger cars.

What challenges does the Automotive Axles Industry face during its growth?

Recall of defective axles is a key challenge affecting the industry growth.

- The market experienced a significant downturn due to the COVID-19 pandemic's impact on vehicle production. In 2020 and early 2021, automakers faced challenges from nationwide lockdowns that disrupted cross-border trade activities, leading to increased raw material and component prices. The absence of customer footfalls in automobile showrooms due to lockdowns resulted in the shutdown of production units worldwide. This negatively affected the automotive industry's growth, ultimately reducing the demand for automotive components like axles. Automotive axles are an integral part of wheeled vehicles, including passenger cars, light commercial vehicles, and heavy commercial vehicles. They come in various types, such as drive axles, front axles, rear axles, lift axles, and steer axles. These axles are essential for vehicle safety, stability systems, and load distribution. They are made of materials like aluminum, steel, carbon fiber, and composite materials. The commercial vehicle sector, including heavy-duty commercial vehicles, trailers, and buses, is a significant consumer of automotive axles. Electric vehicles and hybrid vehicles are also adopting automotive axles to improve fuel efficiency and reduce carbon emissions.

- Moroever, the use of lightweight materials, such as aluminum and carbon fiber, in axle manufacturing is increasing to enhance fuel efficiency and reduce vehicle weight. The market's growth is influenced by factors like vehicle electrification, cargo loads, and vehicle production. The market is expected to grow as the world urbanizes, leading to an increase in passenger vehicle demand. However, the high cost of raw materials, such as copper, and counterfeit products pose challenges to market growth. In summary, the market is a crucial component of the automotive industry, with applications in various vehicle types and sectors. Its growth is influenced by factors like vehicle production, fuel-efficient vehicles, safety, and stability systems. Despite the challenges posed by the COVID-19 pandemic, the market is expected to recover and grow as the world urbanizes and the demand for fuel-efficient and safe vehicles increases.

Exclusive Customer Landscape

The automotive axles market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive axles market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive axles market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Axle and Manufacturing Holdings Inc.

- BorgWarner Inc.

- Cardone Industries Inc.

- Carraro SpA

- Cummins Inc.

- Dana Inc.

- Dorman Products Inc.

- GESTAMP AUTOMOCION SA

- GNA Axles Ltd.

- Hirta Industry Co. Ltd.

- Hyundai Motor Group

- KOREA FLANGE Co. Ltd.

- Magna International Inc.

- Melrose Industries Plc

- Mercedes Benz Group AG

- Press Kogyo Co. Ltd.

- Robert Bosch GmbH

- SAF HOLLAND SE

- Talbros Engineering Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive axles market encompasses a vital component of wheeled vehicles, playing a significant role in ensuring stability, safety, and optimal performance. Axles serve as the primary means of transmitting driving torque from the powertrain to the wheels, enabling vehicles to move. This market caters to various sectors, including passenger cars, light commercial vehicles, and heavy commercial vehicles. Axles come in different types, such as drive axles and lift axles. Drive axles are responsible for transmitting power to the wheels that propel the vehicle forward, while lift axles are utilized in heavy-duty commercial vehicles to lift and support additional cargo loads. Both types of axles are integral parts of the vehicle's powertrain system. Manufacturers employ various materials, including aluminum, steel, and carbon fiber, to produce axles. Lightweight materials like aluminum and carbon fiber contribute to reducing the overall weight of the vehicle, enhancing fuel efficiency and improving vehicle performance. However, the high cost of these materials may limit their widespread use in the automotive industry. The commercial vehicle sector, including heavy-duty commercial vehicles, is a significant consumer of axles due to the increased demand for transporting oversize loads.

Additionally, long-haul trailers, transportation trailers, and long trailers rely on strong axle systems to ensure efficient cargo distribution and minimize rolling resistance. Safety and stability systems are crucial considerations in the design and manufacturing of axles. Shocks and other suspension components work in conjunction with axles to absorb road surface irregularities and maintain vehicle stability. Moreover, axles play a vital role in the vehicle's steering mechanism, allowing for precise maneuverability and handling. The automotive axle market is influenced by several factors, including the growing trend towards vehicle electrification and the increasing focus on reducing carbon emissions. Lightweight axles made from composite materials and the integration of copper components in electric vehicle powertrains are some of the emerging trends in this market.

Thus, counterfeit products pose a significant challenge to the automotive axle market, as their use can compromise vehicle safety and performance. Manufacturers and regulatory bodies are working to combat this issue through increased vigilance and enforcement of quality control measures. The manufacturing hubs for automotive axles are strategically located in regions with a strong automotive industry presence. The production process involves the assembly of various components, including the central shaft, rotating wheel, and wheel housing, to create a functional axle system. In summary, the automotive axle market plays a pivotal role in the wheeled vehicle industry by ensuring optimal performance, safety, and fuel efficiency. The market is influenced by various factors, including material trends, commercial vehicle demand, safety considerations, and emerging technologies. Manufacturers must remain agile and responsive to these trends to maintain a competitive edge in this dynamic market.

|

Automotive Axles Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.89% |

|

Market growth 2024-2028 |

USD 23.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.64 |

|

Key countries |

China, US, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Axles Market Research and Growth Report?

- CAGR of the Automotive Axles industry during the forecast period

- Detailed information on factors that will drive the Automotive Axles growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive axles market growth of industry companies

We can help! Our analysts can customize this automotive axles market research report to meet your requirements.