Europe Logistics Market Size 2025-2029

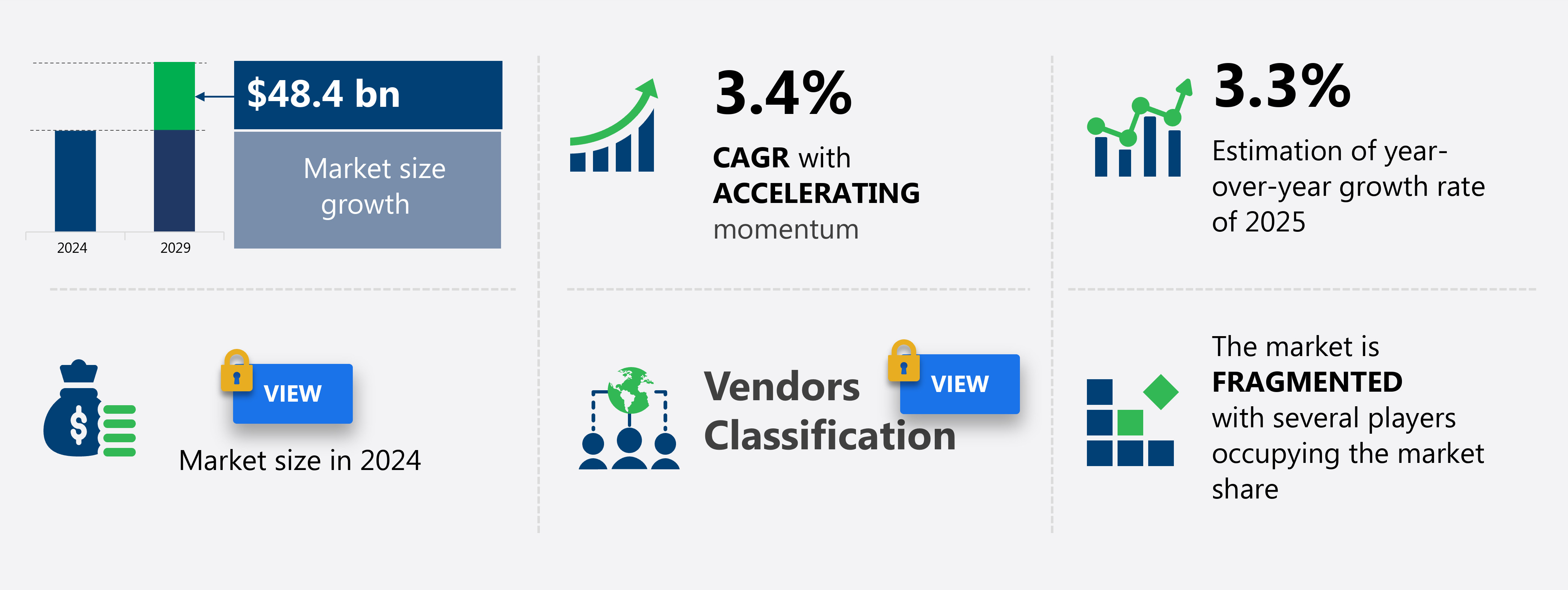

The Europe logistics market size is forecast to increase by USD 48.4 billion at a CAGR of 3.4% between 2024 and 2029.

- The European logistics market is experiencing steady growth, driven by the rapid expansion of e-commerce and advancements in technology. Rising consumer demand for fast, reliable delivery has pushed companies to rethink supply chains, while innovations like artificial intelligence and IoT are enhancing efficiency and visibility in logistics operations. These factors are reshaping how goods move worldwide, creating new opportunities for businesses to adapt.

- This report provides a clear view of the global logistics market, offering data on market size, growth forecasts through 2029, and key segments like third-party logistics (3PL). It's designed for practical use - whether refining strategy, improving client engagement, or streamlining operations. A notable trend is the shift toward customer-centric logistics, where predictive analytics helps anticipate demand, though challenges like high operational costs and pricing pressures remain significant hurdles.

- For businesses aiming to stay competitive, this report delivers actionable insights into these trends and challenges, making it a valuable tool for navigating the evolving global logistics landscape

What will be the Size of the Market During the Forecast Period?

The global logistics market is experiencing significant growth due to the rise in online purchases and trade-related activities. Roadways continue to dominate the transportation mode, but the integration of emerging technologies such as blockchain, artificial intelligence, and the Internet of Things is revolutionizing logistics management and supply chain operations. Green logistics solutions are gaining traction as companies prioritize sustainability and reduce their carbon footprint. Logistics monitoring systems enable real-time tracking and optimization of inbound, outbound, reverse and last-mile deliveries. Digital logistics, including the use of augmented reality and route optimization, are transforming the industry, particularly in sectors like defense manufacturing, petroleum, and food products. Free trade agreements and e-commerce are further driving market expansion, with an increasing emphasis on digitalization, automation, and innovation.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- 3PL

- 4PL

- End-user

- Manufacturing

- Automotive

- Consumer goods

- Retail industry

- Others

- Service

- Transportation

- Warehousing and Distribution

- Freight Forwarding

- Inventory Management

- Value-added Logistics

- Integration & Consulting

- Mode of Transport

- Roadways

- Waterways

- Airways

- Railways

- Geography

- Europe

- Germany

- UK

- France

- Europe

By Type Insights

The 3PL segment is estimated to witness significant growth during the forecast period. Third-party logistics (3PL) refers to the practice of outsourcing logistics functions to specialized service providers. This approach enhances logistics efficiency by implementing advanced supply chain management techniques. Three primary types of 3PL exist: asset-based, management-based, and integrated providers. Asset-based 3PL companies utilize their private vehicles, warehouses, and workforce to manage their clients' operations. Management-based 3PL providers offer technological and managerial support to their customers, often using the assets of other companies. Integrated providers can be either asset- or management-based, offering a comprehensive range of logistics services. By partnering with 3PL providers, businesses can streamline their operations, reduce costs, and improve overall supply chain performance.

Get a glance at the share of various segments. Request Free Sample

Market Dynamics

Our Europe Logistics Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Europe Logistics Market?

The booming e-commerce industry in Europe is the key driver of the market.

- The logistics market has been significantly impacted by the rise in e-commerce activities, with roadways playing a crucial role in ensuring timely delivery of online purchases. The implementation of green logistics solutions, such as the use of sensor technologies and route optimization, has become increasingly important for reducing carbon emissions and minimizing the environmental impact of transportation. Logistics monitoring systems, including those leveraging Artificial Intelligence (AI) and the Internet of Things (IoT), have gained traction in enhancing supply chain network efficiency and effectiveness. Moreover, the adoption of blockchain technology in logistics and transportation infrastructure is transforming the industry by improving transparency and security.

- Third-party and second-party logistics have become essential for businesses in various sectors, including industrial & manufacturing, healthcare, pharmaceuticals, and retail, to outsource their logistics operations. The digital transformation of logistics has led to the emergence of tech-driven solutions, such as augmented reality and multi-modal systems, for managing and optimizing last-mile deliveries. The transportation system's evolution is not limited to roadways. Waterways transportation has gained popularity due to its cost-effectiveness and eco-friendliness, particularly for heavy goods transportation. Inventory management and delivery process optimization are critical components of logistics management and supply chain management. The integration of AI and IoT-enabled devices in logistics operations has enabled real-time monitoring and automation, improving overall efficiency and reducing human error.

What are the market trends shaping the Europe Logistics Market?

Increasing customer-centric logistics is the upcoming trend In the market.

- The logistics market is witnessing significant advancements driven by the rise of e-commerce activities and the need for timely delivery. Roadways continue to dominate transportation infrastructure, but waterways and railways are gaining traction for cost-effective and efficient transportation of heavy goods. Logistics service providers are embracing tech-driven solutions such as Artificial Intelligence, the Internet of Things, and Blockchain to enhance supply chain management and monitoring systems. Green logistics solutions are increasingly popular as industries seek to reduce their carbon footprint. Warehouse management systems and last mile deliveries are key focus areas for logistics automation and optimization. Third-party and fourth-party logistics, as well as outsourced services, are becoming commonplace in various industries, including healthcare, pharmaceuticals, industrial & manufacturing, and retail.

- The logistics sector is undergoing digital transformation, with IoT-enabled devices and sensor technologies playing a crucial role in real-time monitoring and predictive analytics. Multi-modal transportation systems are being adopted to streamline trade-related activities and facilitate free trade agreements. The defense manufacturing, oil & gas, food products, and petroleum industries are leveraging logistics management and supply chain management for efficient operations. Inbound and outbound logistics, reverse logistics, and inventory management are critical components of an effective logistics strategy. Airways, waterways, railways, and transportation systems are all integral to the logistics network. The logistics industry is constantly evolving to meet the demands of various sectors and consumers, with a focus on timely delivery, route optimization, and customer satisfaction.

What challenges does the Europe Logistics Market face during the growth?

High cost of operation and competitive pricing is a key challenge affecting the market growth.

- The Logistics Market is characterized by the integration of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), Blockchain, and Augmented Reality (AR) to enhance efficiency and optimize costs in various sectors. E-commerce activities have significantly increased the demand for logistics solutions, leading to the adoption of tech-driven strategies like route optimization and last-mile deliveries. Green logistics solutions have gained traction due to the need for sustainability in transportation infrastructure. This includes the utilization of waterways transportation, sensor technologies, and the implementation of warehouse management systems. Third-party and second-party logistics have become essential for industrial and manufacturing sectors, healthcare logistics, pharmaceutical logistics, and retail logistics.

- Outsourcing logistics services has led to logistics standardization and the adoption of multi-modal systems. The transportation sector has seen advancements in heavy goods transportation, airways, railways, and oil & gas industries. Inventory management and supply chain management have been revolutionized through digital transformation, impacting industries such as aerospace, telecommunications, banking & financial services, media & entertainment, and trade & transportation. Fourth-party logistics, inbound logistics, outbound logistics, reverse logistics, and green logistics have become integral parts of the logistics landscape. Logistics monitoring systems and digital logistics have enabled timely delivery and improved the delivery process for e-commerce companies. Trade agreements and free trade agreements have facilitated international trade, while military logistics and reverse logistics operations ensure the smooth functioning of critical sectors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

AP Moller Maersk AS: The company offers logistics services such as Maersk Project Logistics, Maersk E-Commerce Logistics, and Cold Chain Logistics services.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BDP International Inc.

- Bertelsmann SE and Co. KGaA

- Bollore SE

- C H Robinson Worldwide Inc.

- CEVA Logistics SA

- Deutsche Bahn AG

- Deutsche Post AG

- DSV AS

- Expeditors International of Washington Inc.

- FedEx Corp.

- Hellmann Worldwide Logistics SE and Co KG

- International Distributions Services plc

- Kintetsu World Express Inc.

- Kuehne Nagel Management AG

- Nippon Yusen Kabushiki Kaisha

- Rhenus SE and Co. KG

- SDK FREJA A S

- SF Express Co. Ltd.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Logistics, a critical component of business operations, has undergone significant transformations in recent years. This sector, which encompasses the transportation, storage, and management of goods from the point of origin to the final destination, plays a pivotal role in ensuring timely delivery and maintaining an efficient supply chain network. One of the most notable trends shaping the logistics landscape is the increasing reliance on technology. Online purchases have led to a rise in e-commerce activities, necessitating advanced logistics solutions. Green logistics solutions have gained traction as businesses strive to minimize their carbon footprint.

Moreover, logistics monitoring systems, incorporating technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), have become essential tools for optimizing operations and enhancing transparency. Augmented reality (AR) and sensor technologies have revolutionized warehouse management systems, enabling real-time tracking and improved accuracy. The integration of these technologies has led to a more streamlined and efficient logistics management process. Waterways transportation, an essential part of the logistics sector, has seen a growth due to its eco-friendliness and cost-effectiveness. Third-party and second-party logistics have gained popularity as businesses look to outsource their logistics functions to specialized providers. Industries such as healthcare, pharmaceuticals, industrial & manufacturing, and aerospace have unique logistics requirements.

Furthermore, healthcare logistics, for instance, necessitates stringent temperature control and timely delivery to ensure patient safety. Pharmaceutical logistics requires adherence to strict regulations and security protocols. The logistics sector is also undergoing digital transformation, with the adoption of tech-driven solutions such as IoT-enabled devices and last mile deliveries. Route optimization and logistics automation have become essential components of a multi-modal transportation system, ensuring timely and cost-effective deliveries. Retail logistics plays a crucial role in ensuring a seamless shopping experience for customers. Heavy goods transportation requires specialized equipment and expertise, making it a niche area withIn the logistics sector. Logistics standardization and road connectivity are essential for maintaining an efficient and effective supply chain network.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market Growth 2025-2029 |

USD 48.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.3 |

|

Key countries |

Germany, UK, France, Belgium, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch