Automotive Brake Components Aftermarket Market Size 2024-2028

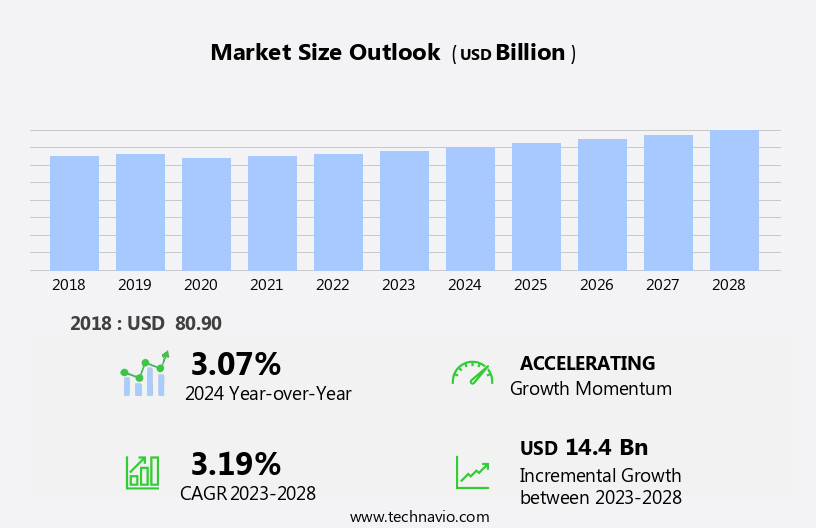

The automotive brake components aftermarket market size is forecast to increase by USD 14.4 billion at a CAGR of 3.19% between 2023 and 2028.

- The automotive brake components aftermarket is witnessing significant growth due to the increasing number of parc vehicles on the road. This trend is driven by the rising demand for replacement parts as vehicles age and wear out. Additionally, the emergence of 3D printing technology In the automotive aftermarket industry is revolutionizing the production of brake components, offering cost-effective and customizable solutions. However, the high installation costs of advanced brake systems, such as regenerative braking and electric brakes, may hinder market growth. These systems require specialized knowledge and tools, making them more expensive to install compared to traditional brake components. To stay competitive, market players must focus on offering affordable installation services and collaborating with automotive repair shops to expand their customer base. In summary, the automotive brake components aftermarket is poised for growth due to the increasing number of parc vehicles and the emergence of 3D printing technology, but high installation costs of advanced brake systems present a challenge.

What will be the Size of the Automotive Brake Components Aftermarket Market During the Forecast Period?

- The market is driven by the increasing demand for vehicle safety and the widespread adoption of advanced braking systems in both passenger and commercial vehicles. Stringent safety regulations and consumer preferences for reliable braking systems have led automakers to incorporate technologies such as disc brakes, electronic stability control, antilock braking systems, and anticollision gadgets In their vehicles. These systems help prevent skidding and ensure vehicle stability during braking. Brake components, including disc brakes, pads, calipers, and rotors, are critical replacement parts for maintaining optimal vehicle performance and safety. The market is witnessing significant growth due to the increasing popularity of luxury vehicles, which often feature high-performance braking systems from renowned brands like Brembo.

- Additionally, the increasing wear and tear of brake components due to frequent usage are driving the demand for aftermarket solutions. Passenger car models such as the Hyundai Veloster, Kia Venue, Hyundai Azera, Hyundai I40, Hyundai Elantra, Kia Tucson, Kia Sorento, Hyundai Sonata, Hyundai I20, and Kia Ix20 are among the many vehicles utilizing advanced airbag systems and robotics to enhance vehicle safety. The commercial vehicle sector is also adopting similar technologies to ensure optimal safety and efficiency. Overall, the automotive brake components aftermarket is expected to continue growing as vehicle safety remains a top priority for consumers and automakers alike.

How is this Automotive Brake Components Aftermarket Industry segmented and which is the largest segment?

The automotive brake components aftermarket industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Brake pads

- Brake shoes

- Brake calipers

- Others

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

- The brake pads segment is estimated to witness significant growth during the forecast period.

The automotive brake components aftermarket, specifically the brake pads segment, is projected to experience growth due to the continuous need for replacement parts as they wear out with every braking application. Brake pads are a crucial element In the brake system, as they generate friction against the rotating rotor to bring the vehicle to a halt. The outer surface of brake pads is lined with materials such as semi-metallic linings, which provide increased friction against the rotor but can wear down the rotors more rapidly. Commercial vehicles and luxury models, including Toyota Vellfire and Alphard, as well as compact vehicles like the Hyundai Veloster and Kia Venue, rely on these components for vehicle safety features such as disc brakes, electronic stability control, antilock braking systems, and anticollision gadgets.

OEMs and market participants engage in strategic activities, including contractual agreements, investments, and product line expansions, to meet the demand for brake components. The market encompasses various components, including brake discs, calipers, pistons, and pads, and incorporates advanced technologies like electronic parking brakes and robotics to enhance vehicle safety.

Get a glance at the Automotive Brake Components Aftermarket Industry report of share of various segments Request Free Sample

The Brake pads segment was valued at USD 37.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

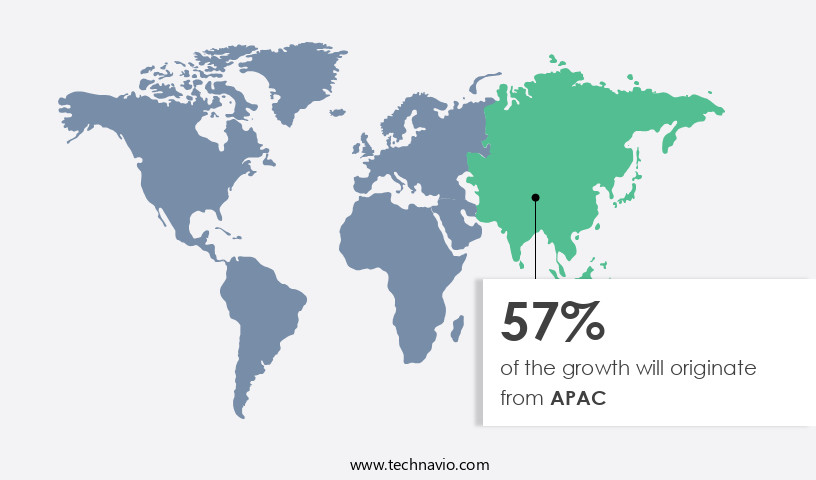

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The automotive brake components aftermarket is experiencing significant growth In the Asia Pacific (APAC) region due to increasing vehicle production and sales, as well as the presence of major automakers and suppliers. APAC's automotive industry is thriving due to various incentives from governments, such as tax exemptions on vehicle components including brakes, which are crucial for ensuring vehicle safety. Disc brakes, electronic stability control, antilock braking systems, and other advanced safety technologies are becoming increasingly popular in both luxury vehicles, such as Toyota Vellfire and Alphard, and commercial vehicles. Market participants are focusing on strategic activities, such as contractual agreements, investments, and product line expansions, to meet the rising demand for these components.

Key players In the market include Brembo, manufacturers of brake discs and calipers, and OEMs producing electronic parking brakes, pistons, calipers, and pads. The market is expected to continue growing due to the increasing importance of vehicle safety features, such as anticollision gadgets and ADAS safety systems, which rely on advanced brake technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Brake Components Aftermarket Industry?

Increasing number of parc vehicles is the key driver of the market.

- The Automotive Brake Components Aftermarket is experiencing steady growth due to the increasing demand for vehicle safety features in both commercial and luxury vehicles. Automakers are integrating advanced safety technologies such as electronic stability control, antilock braking systems, and electronic parking brakes into their product lines. These safety features rely on high-performance brake components, including disc brakes, brake calipers, and pads. In the luxury vehicle segment, brands like Toyota's Vellfire and Alphard, GR Garage, and Brembo are investing in innovative brake technologies to enhance vehicle safety and performance. OEMs are also focusing on the development of anticollision gadgets and ADAS safety features, which require robust brake systems.

- The commercial vehicle sector is also driving the demand for automotive brake components due to the increasing number of vehicles in use. The global automotive industry's growth, especially in emerging markets, is contributing to this trend. In North America and Europe, the demand for luxury sedans and performance vehicles is maintaining the market's overall growth. Market participants are engaging in strategic activities such as contractual agreements and investments to expand their product offerings and strengthen their market positions. For instance, Hyundai Motor Company offers a range of vehicles, including the Veloster, Venue, Azera, i40, Elantra, Tucson, Accent, Kona, Creta, Sonata, i20, and ix20, all equipped with Advanced Air and robotics technology, which require high-performance brake components.

- The increasing adoption of ADAS safety features and the Creta model's growing popularity In the compact SUV segment are expected to further fuel the demand for automotive brake components In the aftermarket. Overall, the Automotive Brake Components Aftermarket is poised for continued growth, driven by the increasing demand for vehicle safety and performance.

What are the market trends shaping the Automotive Brake Components Aftermarket Industry?

Emerging 3D printing in automotive aftermarket industry is the upcoming market trend.

- The Automotive Brake Components Aftermarket is witnessing significant growth due to the increasing demand for stringent vehicle safety features in luxury vehicles and commercial vehicles. Automakers are integrating advanced safety technologies such as electronic stability control, antilock braking systems, and anticollision gadgets In their product lines. These safety features rely heavily on disc brakes, which require regular maintenance and replacement of components like brake pads and calipers. Brake discs and pads are essential components that undergo wear and tear during vehicle operation. Replacing these parts with genuine OEM components ensures optimal vehicle performance and safety. Market participants are focusing on strategic activities such as contractual agreements, investments, and product development to cater to the growing demand.

- Brake components, including pistons, calipers, and pads, are critical to maintaining vehicle safety. For instance, the Toyota Vellfire and Alphard luxury vans, along with the Hyundai Veloster, Venue, Azera, i40, Elantra, Tucson, Accent, Kona, Creta, Sonata, i20, and ix20, feature advanced airbag systems and electronic parking brakes that rely on high-performance brake components. Moreover, the integration of advanced driver-assistance systems (ADAS) and robotics in vehicles necessitates the use of sophisticated brake components. These systems, such as the Advanced Air system In the Creta model, rely on precise and reliable braking to ensure optimal performance and vehicle safety. In conclusion, the Automotive Brake Components Aftermarket is poised for growth due to the increasing demand for advanced safety features and the integration of ADAS and robotics in vehicles.

- OEMs and market participants are focusing on product development, strategic partnerships, and investments to cater to this demand.

What challenges does the Automotive Brake Components Aftermarket Industry face during its growth?

High installation costs of advanced brake systems is a key challenge affecting the industry growth.

- The Automotive Brake Components Aftermarket is driven by the increasing demand for advanced safety features in both luxury vehicles and commercial applications. Stringent safety regulations and consumer preferences for vehicles equipped with disc brakes, electronic stability control, antilock braking systems, and anticollision gadgets have led to the growth of this market. Automakers continue to invest in product lines that cater to these demands, with companies like Brembo leading the way in high-performance brake systems. Brake discs, pads, calipers, pistons, and electronic parking brakes are essential components of these advanced systems. Proper maintenance, such as monitoring pad wear and timely replacement, is crucial to ensure optimal performance and vehicle safety.

- The market for automobile brakes is diverse, with various vehicle models, including the Toyota Vellfire, Alphard, and luxury vans from GR Garage, utilizing these components. OEMs and market participants engage in strategic activities, such as contractual agreements and investments, to expand their market presence and offer competitive pricing. Advanced airbags, robotics, and ADAS safety features, such as the Creta model's electronic stability control and advanced airbag system, further enhance the importance of reliable brake components. As the market continues to evolve, companies focus on innovation and technology to meet the demands of consumers and regulatory bodies. In conclusion, the automotive brake components aftermarket is a critical sector In the automotive industry, driven by the need for safety, performance, and innovation.

- The market's growth is fueled by consumer preferences, regulatory requirements, and technological advancements, making it an exciting and dynamic space for companies to operate.

Exclusive Customer Landscape

The automotive brake components aftermarket market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive brake components aftermarket market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive brake components aftermarket market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABS Friction Inc. - The aftermarket for automotive brake components encompasses a range of essential parts, including the brake master cylinder, brake wheel cylinder, brake booster, and brake pad. These components are integral to the vehicle's braking system, ensuring reliable and efficient stopping power. The brake master cylinder converts pedal pressure into hydraulic pressure, while the brake wheel cylinder applies that pressure to the brake shoes or pads. The brake booster magnifies the force applied to the brake pedal, and the brake pad, sandwiched between the brake rotor and the wheel hub, is responsible for friction and stopping the vehicle. This comprehensive offering caters to the diverse needs of the automotive aftermarket sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABS Friction Inc.

- AISIN CORP.

- Akebono Brake Industry Co. Ltd.

- Baer Inc.

- BorgWarner Inc.

- Brembo Spa

- Carlisle Companies Inc.

- Continental AG

- Cummins Inc.

- Disc Brakes Australia

- First Brands Group

- EBC Brakes

- Haldex AB

- Hyundai Motor Co.

- Nisshinbo Holdings Inc.

- Robert Bosch GmbH

- Tata Motors Ltd.

- Tenneco Inc.

- Valeo SA

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive brake components aftermarket has experienced significant growth in recent years, driven by the increasing demand for vehicle safety and the replacement needs of aging brake systems. Disc brakes, a key component in modern automotive braking systems, have gained widespread adoption due to their superior performance and durability compared to drum brakes. Commercial vehicles, including delivery vans and buses, also contribute to the market's growth as they require frequent brake system maintenance due to the heavy usage and weight of these vehicles. Automakers continue to invest in advanced safety technologies, such as electronic stability control, antilock braking systems, and electronic parking brakes, which further boost the demand for brake components.

Brake calipers, pistons, and pads are essential parts of disc brake systems and undergo frequent wear and replacement. OEMs and aftermarket manufacturers offer various product lines to cater to the diverse needs of consumers. Market participants engage in strategic activities, such as contractual agreements, investments, and product innovations, to gain a competitive edge. The automotive brake market is expected to grow at a steady pace due to the increasing demand for vehicle safety and the replacement needs of aging brake systems. The market dynamics are influenced by various factors, including technological advancements, regulatory requirements, and consumer preferences. Technological advancements In the automotive industry, such as the integration of robotics and advanced airbags, have led to the development of more sophisticated brake systems.

These systems offer improved performance, durability, and safety features, driving the demand for high-quality brake components. Regulatory requirements, such as safety standards and emissions regulations, also impact the automotive brake components aftermarket. For instance, stringent safety regulations mandate the use of specific brake components to ensure vehicle safety, while emissions regulations drive the adoption of eco-friendly brake pads. Consumer preferences for fuel efficiency, durability, and performance also influence the market dynamics. For instance, consumers are increasingly opting for longer-lasting brake pads to reduce the frequency of replacements, while others prioritize performance and opt for high-performance brake components. In conclusion, the automotive brake components aftermarket is expected to continue growing due to the increasing demand for vehicle safety, the replacement needs of aging brake systems, and the integration of advanced technologies In the automotive industry.

Market participants must stay abreast of the latest trends and regulatory requirements to remain competitive and cater to the diverse needs of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.19% |

|

Market growth 2024-2028 |

USD 14.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.07 |

|

Key countries |

US, China, Japan, Russia, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Brake Components Aftermarket Market Research and Growth Report?

- CAGR of the Automotive Brake Components Aftermarket industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive brake components aftermarket market growth of industry companies

We can help! Our analysts can customize this automotive brake components aftermarket market research report to meet your requirements.