Automotive Carbon Monocoque Chassis Market Size 2024-2028

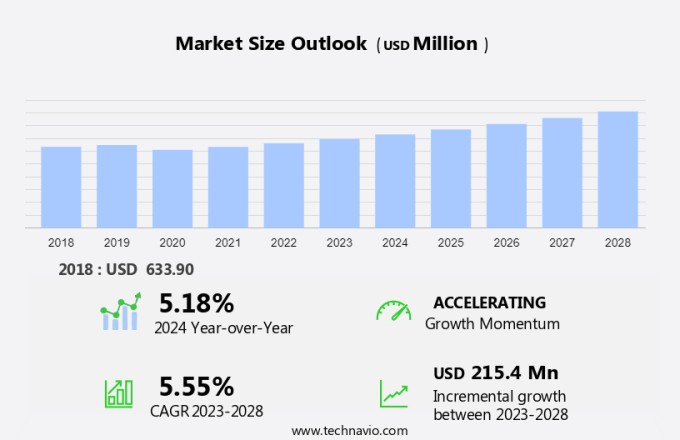

The automotive carbon monocoque chassis market size is forecast to increase by USD 215.4 million at a CAGR of 5.55% between 2023 and 2028. The market is experiencing significant growth due to several key trends. Advanced robotics manufacturing is driving the mass production of monocoque chassis, enabling automakers to produce these lightweight and strong structures more efficiently. Another trend is the focus on the development of pure electric supercars by automotive manufacturers, as monocoque chassis are ideal for electric vehicles due to their ability to house batteries and provide structural integrity. However, the high cost of research and development remains a challenge for market growth. Manufacturers must balance the investment in new technologies with the need to keep production costs competitive. Despite this challenge, the market is expected to continue its upward trajectory, driven by the benefits of monocoque chassis in terms of weight reduction, improved fuel efficiency, and enhanced vehicle performance.

The market is witnessing significant growth due to the increasing demand for lightweight and strong chassis designs in passenger cars, light commercial vehicles, and heavy commercial vehicles. Monocoque chassis, also known as backbone chassis, is gaining popularity over traditional ladder chassis due to its ability to integrate the engine, gearbox, and other components into the chassis structure, reducing weight and improving vehicle dynamics. High-strength steel, aluminum alloy, and carbon fiber composite are the primary materials used in monocoque chassis production. The use of advanced materials like carbon fiber composite in monocoque chassis is expected to increase in luxury cars, passenger vehicles, and hybrid vehicles, including battery electric vehicles and hybrid electric vehicles.

Further, the integration of artificial intelligence, machine learning, and robotic efficiency in the manufacturing process is improving the production efficiency and reducing costs. Level 2 automation and active safety systems are also driving the demand for advanced chassis designs in the automobile industry. The market for chassis in internal combustion engines, hybrid vehicles, pick-up trucks, and other vehicle types is expected to grow significantly in the coming years.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- ICE vehicles

- Electric vehicles

- Type

- OEM

- Aftermarket

- Geography

- North America

- US

- Europe

- Germany

- Italy

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

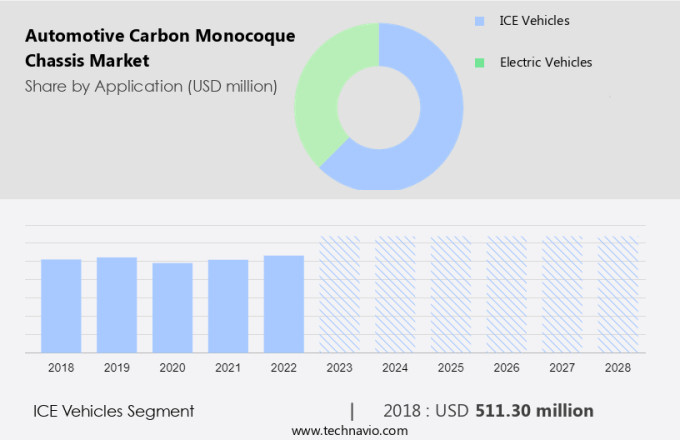

The ice vehicles segment is estimated to witness significant growth during the forecast period. The market encompasses various types, including Backbone, Ladder, Monocoque, Modular, and Skateboard designs. Monocoque chassis, which integrates the vehicle's body and frame into a single structure, has gained popularity due to its benefits in safety, fuel efficiency, and weight reduction. High-performance vehicle manufacturers, particularly those in the Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle segments, are increasingly focusing on carbon fiber composite chassis. This shift is driven by the need to reduce exhaust emissions and improve vehicle efficiency, as well as the growing demand for electric vehicles, such as Battery Electric Vehicles and Hybrid Electric Vehicles.

Moreover, carbon fiber composites, including Aluminum Alloy and Mild Steel, offer significant weight savings without compromising reliability and durability. Notable automotive OEMs, like McLaren Group, have adopted carbon monocoque chassis in their high-performance vehicles, even manufacturing them in-house. The use of robotics and advanced manufacturing techniques has further reduced production costs, making carbon fiber composite chassis a viable option for various vehicle types, including Luxury cars, Passenger vehicles, Light commercial vehicles, Pick-up trucks, Heavy-duty vehicles, Sports cars, and Sedans. The future of automotive chassis systems lies in the adoption of modular frame chassis and the integration of electric vehicle technologies, such as single-hull chassis, to address challenges like traffic congestion and the shift towards shared mobility.

Get a glance at the market share of various segments Request Free Sample

The ICE vehicles segment was valued at USD 511.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to the increasing demand for lightweight and fuel-efficient vehicles. Hatchbacks, station wagons, sports utility vehicles (SUVs), and multi-utility vehicles (MUVs) are major applications of carbon monocoque chassis. The OEM segment holds a dominant market share, with automakers continuously investing in research and development to incorporate advanced technologies such as artificial intelligence (AI) and machine learning for robotic efficiency and Level 2 automation. Active safety systems and driver assistance features are becoming standard in passenger cars, driving the demand for carbon monocoque chassis. Moreover, the adoption of Level 4 autonomous vehicles and public transport systems is expected to further boost the market growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Automotive Carbon Monocoque Chassis Market Driver

The advanced robotics manufacturing spurring mass production of monocoque chassis is the key driver of the market. In the evolving automotive landscape, automakers and component suppliers are increasingly adopting advanced carbon fiber technologies to enhance vehicle performance and sustainability. Monocoque chassis, a single-piece structure that forms the vehicle's overall design, is a significant advancement in automotive chassis systems. This design contrasts with traditional ladder and backbone chassis, which only define the stress-bearing components and require the vehicle body to be built around them. Monocoque chassis, made by welding various parts together, offer improved safety, fuel efficiency, and weight reduction. High-strength steel, aluminum alloy, mild steel, carbon fiber composite, and other materials are used in the production of these chassis types.

Additionally, the automotive industry's shift towards electric vehicles, including battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), is driving the demand for lightweight and strong chassis solutions. Modular frame chassis, such as skateboard chassis, are gaining popularity in the passenger car, light commercial vehicle (LCV), and heavy commercial vehicle (HCV) segments. As automotive OEMs focus on producing environmentally friendly and fuel-efficient vehicles, carbon fiber chassis are becoming an essential component in the production of luxury cars, passenger vehicles, light commercial vehicles, pick-up trucks, heavy-duty vehicles, sports cars, and more. The integration of robotics and automation in the manufacturing process further enhances the production efficiency and precision of carbon fiber chassis. The rise of shared mobility and the challenges posed by traffic congestion in urban areas also highlight the need for lightweight and efficient chassis designs.

Automotive Carbon Monocoque Chassis Market Trends

The focus on development of pure electric supercars by automotive manufacturers is the upcoming trend in the market. The automotive industry is witnessing a significant shift towards the development of lightweight and strong chassis systems for various vehicle segments, including passenger cars, light commercial vehicles, and heavy commercial vehicles (HCV). Traditional chassis designs, such as Backbone Chassis and Ladder Chassis, are being replaced by advanced Monocoque Chassis and Modular Chassis, which offer improved safety, fuel efficiency, and reduced emissions. High-strength steel, aluminum alloy, and carbon fiber composite are the primary materials used in the production of these chassis types. Automotive OEMs are increasingly adopting these materials to manufacture vehicles that cater to the evolving consumer preferences for environment-friendly and high-performance vehicles.

Similarly, the Passenger Car and Light Commercial Vehicle segments are leading the adoption of these advanced chassis systems, with Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs) being the key focus areas. The HCV segment is also witnessing a wave in demand for modular frame chassis and skateboard chassis, which offer better load-carrying capacity and improved fuel efficiency. Robotics and automation are playing a crucial role in the mass production of these chassis systems, ensuring precision and consistency in the manufacturing process. Single-hull chassis designs are gaining popularity in the development of luxury cars, sports cars, sedans, pick-up trucks, and heavy-duty vehicles.

In conclusion, the shift towards electric vehicles is expected to further accelerate the demand for these advanced chassis systems in the coming years. The focus on shared mobility and traffic congestion reduction is also driving the adoption of these chassis systems in the development of autonomous vehicles and public transportation systems. With the increasing emphasis on safety, fuel efficiency, and dynamic design concepts, the automotive chassis systems market is poised for significant growth in the future.

Automotive Carbon Monocoque Chassis Market Challenge

The high cost of R&D is a key challenge affecting the market growth. The automotive industry is undergoing a significant transformation with the adoption of advanced chassis technologies, such as Monocoque Chassis, Backbone Chassis, and Modular Chassis, to enhance safety, fuel efficiency, and reduce emissions. Monocoque Chassis, which integrates the passenger compartment and load-bearing structure into a single unit, is gaining popularity due to its lightweight and high-strength properties. High-performance automobiles, including luxury cars, sports cars, and passenger vehicles, frequently use carbon fiber composite, aluminum alloy, and high-strength steel for their chassis. In contrast, traditional chassis designs, such as Ladder Chassis and Single-hull Chassis, are commonly used in light commercial vehicles and heavy commercial vehicles.

However, the shift towards electric vehicles (BEVs and HEVs) and shared mobility is driving the demand for new chassis designs, such as skateboard chassis, which accommodate the battery pack, engine, gearbox, and other components. The automotive OEMs are investing in research and development to create modular frame chassis that can be used across various vehicle segments, including passenger cars, light commercial vehicles, and heavy commercial vehicles. The high costs associated with the design, development, and manufacturing of advanced chassis materials, such as carbon fiber composite, limit their widespread adoption. However, the benefits, including improved safety, fuel efficiency, and reduced emissions, make them an attractive option for the automotive industry.

As the industry moves towards electric vehicles and shared mobility, the demand for lightweight and strong chassis is expected to increase, driving the growth of the automotive chassis systems market. The integration of robotics and automation in the manufacturing process is also expected to reduce costs and increase production efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bayerische Motoren Werke AG: The company offers automotive carbon monocoque chassis such as multi-material Carbon Cage with 2022 iX vehicle line for new battery-electric iX sports activity vehicle, BMW combines CFRP strategies from previous i3, i8 and 7-Series designs and adds CFRTP for a lightweight, rigid frame.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Dallara Group Srl

- Dr. Ing. h.c. F. Porsche AG

- Ferrari NV

- Horacio Pagani S p A

- Koenigsegg Automotive AB

- Magna International Inc.

- McLaren Group Ltd.

- Muhr und Bender KG

- Multimatic Inc.

- Rimac Automobili

- RUF Automobile GmbH

- SGL Carbon SE

- Toyota Motor Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for lightweight, safe, and fuel-efficient chassis systems in passenger cars, light commercial vehicles, and heavy commercial vehicles. Monocoque chassis, made of high-strength steel, aluminum alloy, and carbon fiber composite, are gaining popularity due to their ability to provide better safety and improved fuel efficiency compared to traditional ladder chassis and modular frame chassis. Passenger cars and luxury vehicles are the major consumers of monocoque chasises, but their adoption is also increasing in battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs) to reduce vehicle weight and improve overall performance.

Moreover, monocoque chassis are also increasingly being used in battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs) to reduce vehicle weight and improve overall performance. The heavy commercial vehicle (HCV) segment is also expected to witness significant growth due to the increasing demand for environment-friendly and fuel-efficient vehicles. The use of high-strength steel, aluminum alloy, and carbon fiber composite in monocoque chassis is helping to reduce vehicle weight and improve fuel efficiency, making them an attractive option for HCV manufacturers. The growing trend of shared mobility and the increasing traffic congestion in urban areas are also driving the demand for lightweight and efficient chassis systems.

In conclusion, the automotive chassis market is witnessing significant growth due to the increasing demand for lightweight, safe, and fuel-efficient chassis systems in passenger cars, light commercial vehicles, and heavy commercial vehicles. Monocoque chassis, made of high-strength steel, aluminum alloy, and carbon fiber composite, are gaining popularity due to their ability to provide better safety and improved fuel efficiency. The use of robotics in the manufacturing of chassis is also increasing to improve production efficiency and reduce costs. The market is also witnessing the emergence of skateboard chassis, which integrate the powertrain, battery pack, and other vehicle components into a single platform, reducing the number of components and improving vehicle design flexibility.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.55% |

|

Market Growth 2024-2028 |

USD 215.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.18 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, Germany, Italy, Japan, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bayerische Motoren Werke AG, Dallara Group Srl, Dr. Ing. h.c. F. Porsche AG, Ferrari NV, Horacio Pagani S p A, Koenigsegg Automotive AB, Magna International Inc., McLaren Group Ltd., Muhr und Bender KG, Multimatic Inc., Rimac Automobili, RUF Automobile GmbH, SGL Carbon SE, Toyota Motor Corp., and ZF Friedrichshafen AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch