Automotive Coolant Market Size 2024-2028

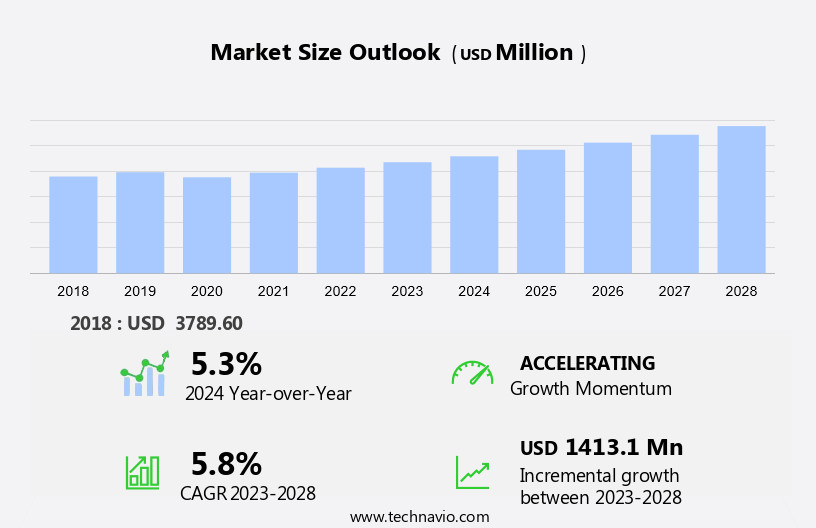

The automotive coolant market size is forecast to increase by USD 1.41 billion at a CAGR of 5.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expanding transportation sector and increasing vehicle production. Fire-resistant brake and engine cooling solutions are gaining popularity due to their enhanced safety features. The environmental concern is another key factor fueling market growth, with coolant solutions that are free of heavy metals like chromium and cadmium becoming increasingly preferred. In addition, they act as corrosion inhibitors, extending the life of the cooling system and other engine components. Fleet maintenance and commercial vehicle operators rely on coolants for cost-effective preventive maintenance. Additionally, the need for de-icing planes and other heavy-duty vehicles is driving demand for advanced coolant technologies. However, compliance with stringent regulations poses a challenge for market players, requiring continuous innovation and investment in research and development. Inorganic growth strategies, such as mergers and acquisitions, are also being adopted to expand market presence and increase production capacity.

What will be the Size of the Market During the Forecast Period?

- The market plays a significant role In the efficient operation of an automotive cooling system. This system is crucial for maintaining engine performance and preventing engine damage caused by overheating or freezing temperatures. The market encompasses various types of coolants, including antifreeze and coolant, high-performance coolant, and eco-friendly coolants. Automotive coolants serve multiple functions. They prevent engine overheating by absorbing heat from the engine and transferring it to the radiator, allowing the engine to operate within an optimal temperature range. Additionally, coolants protect against freeze damage during cold weather conditions.

- Furthermore, regular coolant replacement and maintenance, such as radiator repair and coolant testing, ensure the cooling system functions optimally and reduces the need for costly repairs or engine replacements. In the context of fuel efficiency and sustainability, coolants contribute to thermal management, which is essential for optimizing engine performance and reducing emissions. High-performance coolants can enhance fuel efficiency by allowing engines to operate at higher temperatures, while eco-friendly coolants, such as those based on ethylene glycol alternatives, minimize environmental impact.

How is this Automotive Coolant Industry segmented and which is the largest segment?

The automotive coolant industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- M and HCV

- LCV

- End-user

- Aftermarket

- OEM

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By Application Insights

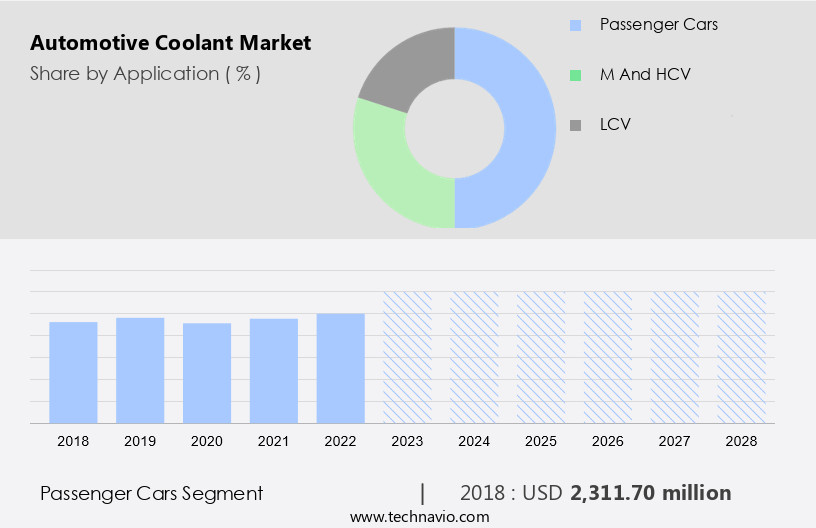

- The passenger cars segment is estimated to witness significant growth during the forecast period. The market caters to various automotive applications, with passenger cars being a significant segment. In March 2024, FUCHS SE and Mercedes-Benz Global Customer Service and Parts entered into a strategic business partnership to advance innovation, technology, and sustainability In the automotive after-sales sector. This collaboration prioritizes the importance of premium coolant solutions in preserving the efficiency and durability of passenger vehicles. Passenger cars necessitate superior coolants to ensure optimal engine functionality, prevent overheating, and shield against corrosion. This partnership between FUCHS SE and Mercedes-Benz is poised to boost the innovation and distribution of coolant products designed specifically for passenger cars.

Get a glance at the market report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 2.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

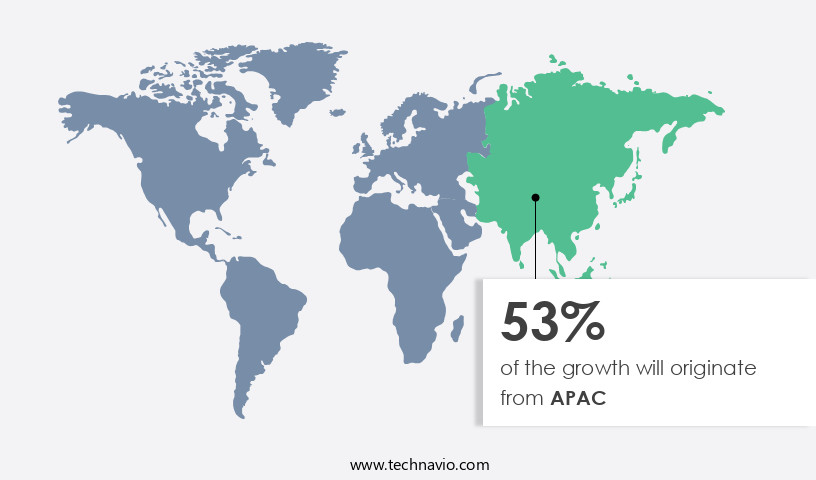

- APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market In the Asia Pacific (APAC) region is experiencing significant growth due to the region's rapid industrialization and expanding automotive sector. This growth is marked by increasing vehicle production and sales, particularly in countries like India and China. In response to this expanding market, Lumax Auto Technologies introduced a new line of automotive coolants in India's aftermarket in May 2023. These coolants cater to various vehicle segments, reflecting the growing demand for high-performance and energy-efficient cooling solutions. The introduction of advanced coolant products underscores the potential for innovation In the region, as the automotive market continues to evolve. Automotive coolants play a crucial role In the cooling system components of motor vehicles, ensuring optimal engine performance and longevity.

For more insights on the market size of various regions, Request Free Sample

Coolants help prevent freezing in cold temperatures and protect rubber parts from corrosion. With the increasing popularity of aluminum engines, coolants must also be compatible with this material to maintain engine efficiency. The e-commerce industry has also influenced the sales of automotive coolants, making them more accessible to consumers. Recycling and cost-effectiveness are essential considerations In the market, as consumers and industries seek sustainable and economical cooling solutions. The industrial cooling applications segment is another growing market for automotive coolants, as industries rely on efficient cooling systems for their operations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Coolant Industry?

- Introduction of new products is the key driver of the market. The market is experiencing growth due to the introduction of advanced base fluids that cater to the demands of modern vehicles. One such innovation is Valvoline's glycol-based full-antifreeze coolant, Valvoline Advanced Coolant, launched in August 2023. This coolant is suitable for both cars and commercial vehicles and utilizes Organic Acid Technology (OAT). OAT provides extended service life, up to five years or 500,000 kilometers, making it a popular choice for vehicle owners seeking long-term reliability and cost savings on maintenance. The market's emphasis on advanced formulations that improve vehicle performance and longevity is evident In the adoption of OAT technology, which offers superior corrosion protection and extended drain intervals.

- Valvoline's new product underscores the industry's commitment to delivering high-performance coolants that meet the evolving needs of automobiles under various climatic and socio-economic conditions.

What are the market trends shaping the Automotive Coolant Industry?

- Strategies for inorganic growth is the upcoming market trend. The market is undergoing substantial changes due to strategic corporate actions. An illustrative instance is Recochem's acquisition of KIK Consumer Products' Auto Care business in June 2024. This deal signifies a prevailing industry trend, as businesses adopt inorganic growth strategies to broaden their market reach and enrich their product offerings.

- Recochem's acquisition encompasses prominent brands like Prestone in North America and Holts In the UK. These brands have a long-standing reputation In the production, fabrication, and distribution of antifreeze/coolant, as well as other essential automotive fluids and car appearance products. This strategic move will enable Recochem to strengthen its market position and diversify its product portfolio.

What challenges does the Automotive Coolant Industry face during its growth?

- Compliance with stringent regulations is a key challenge affecting the industry growth. The market is experiencing significant changes as the transportation sector transitions towards electric vehicles (EVs). Regulatory developments, such as the GB29743.2 standard introduced by Chinese authorities, are driving these changes. This regulation sets stringent conductivity requirements for coolants to ensure battery safety and prevent leaks in EVs. Traditional coolants, which are primarily designed for internal combustion engine vehicles, do not meet these low conductivity standards. As a result, coolant manufacturers must develop new formulations to comply with these regulations. This shift towards EV-compatible coolants presents a significant challenge, but also an opportunity for innovation In the market. Ensuring engine cooling while adhering to environmental regulations and prioritizing human health, particularly in relation to the elimination of heavy metals like chromium cadmium, is crucial for coolant solutions moving forward.

- The automotive industry's evolution towards electric vehicles necessitates the development of advanced coolant technologies that cater to the unique requirements of these vehicles, while also addressing concerns related to fire-resistant brakes and de-icing planes.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Manufacturing Co.

- AMSOIL Inc.

- BASF SE

- Castrol Ltd.

- Chevron Corp.

- Cummins Inc.

- Engine Ice

- Evans Cooling Systems Inc.

- Exxon Mobil Corp.

- FUCHS SE

- Gandhar Oil Refinery India Ltd.

- Indian Oil Corp. Ltd.

- MOTUL SA

- Old World Industries LLC

- PETRONAS Chemicals Group Berhad

- Prestone Products Corp.

- Recochem Inc.

- Royal Super

- TotalEnergies SE

- Valvoline Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production and sales of coolant solutions used in various automotive applications. Coolant plays a crucial role In the engine cooling system by absorbing the heat generated during the combustion process and preventing overheating. Both light and heavy commercial vehicles, including passenger cars, utility vehicles, and vehicles In the transportation sector, utilize coolant In their engines. Manufacturing industries and dealership networks are significant consumers of automotive coolant due to the high demand for cooling solutions in production units and maintenance of vehicle fleets. The market offers a range of coolant types, such as those based on ethylene glycol, propylene glycol, glycerin, and organic acid technology.

In addition, coolant is essential for hvac equipment and industrial cooling applications, with the e-commerce industry also contributing to the market's growth due to the convenience of online sales. The market is witnessing an increasing trend towards phosphate-free products and the adoption of greenhouse gas emission-reduction technologies. The cost-effectiveness of coolant solutions, along with their long-lasting properties, makes them a preferred choice for maintenance and after-sales servicing In the automotive aftermarket. The market is also witnessing advancements in organic additive technology, which offers improved freeze protection and longevity. Coolant solutions are used in various cooling system components, including car radiators, and are suitable for aluminum engines.

Furthermore, climatic conditions and socio-economic factors significantly impact the demand for coolant in different regions. The market is also witnessing the recycling of waste antifreeze and the production of fire-resistant brake fluid. However, concerns regarding the use of heavy metals, such as cadmium and chromium cadmium, in coolant solutions and their potential impact on human health and the environment are driving the development of alternative, eco-friendly coolant solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2024-2028 |

USD 1.41 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

China, US, India, Japan, South Korea, Brazil, Germany, UK, France, and Russia |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Automotive Coolant industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.