Automotive Engine Oil Level Sensor Market Size 2025-2029

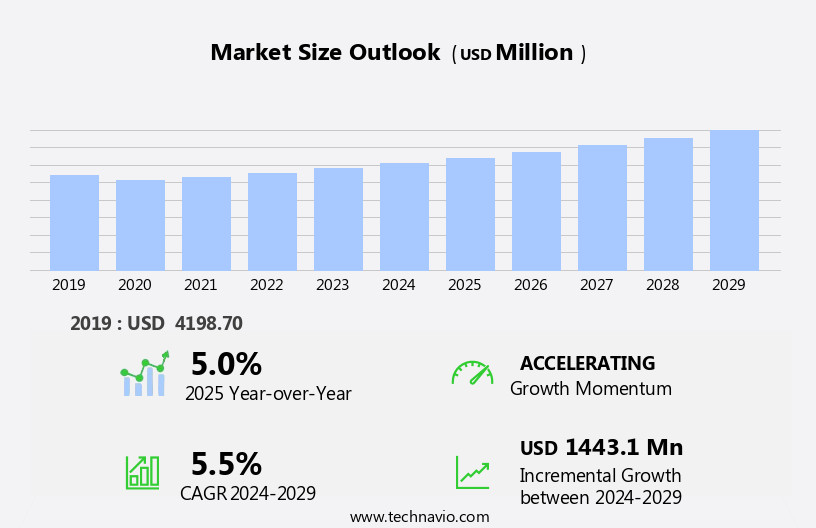

The automotive engine oil level sensor market size is forecast to increase by USD 1.44 billion at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing penetration of automotive electronics and the rising demand for engine efficiency. Ultrasonic sensors, a popular technology in engine oil level sensing, provide accurate and reliable measurements. Additionally, the use of automotive engine oil coolers helps maintain optimal engine temperature, ensuring the sensors function effectively. Biodiesel, an alternative fuel source, is gaining popularity, driving market demand. Wireless sensors are also emerging, enabling real-time monitoring and reducing the need for manual checks. However, the market faces challenges, including the potential for sensor failure and increasing competition from low-cost manufacturing countries, which may lose their cost advantage due to rising labor and material costs. In summary, the market is poised for growth, driven by the need for engine efficiency and the adoption of advanced sensor technologies, while addressing challenges related to sensor reliability and cost competition.

What will be the Size of the Automotive Engine Oil Level Sensor Market During the Forecast Period?

- The market encompasses the production and sale of components that monitor and measure engine oil levels in automobiles. These sensors play a crucial role in maintaining engine health and efficiency by ensuring adequate lubrication and timely oil changes. The market's growth is driven by the increasing demand for real-time engine monitoring systems, which enable early detection of potential performance issues and contribute to reduced emissions.

- Automakers continue to invest in advancements and innovations to enhance engine performance and improve brand recognition. Capital investments in research and development are expected to fuel market growth, as technology evolves to provide more accurate and reliable oil level sensing solutions. The economic and political landscapes also influence market dynamics, with regulatory requirements and consumer preferences shaping the competitive landscape.

How is this Automotive Engine Oil Level Sensor Industry segmented and which is the largest segment?

The automotive engine oil level sensor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- OEMs

- Aftermarket

- Application

- Microcar

- Economy car

- Mid-size car

- Full-size car

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

By End-user Insights

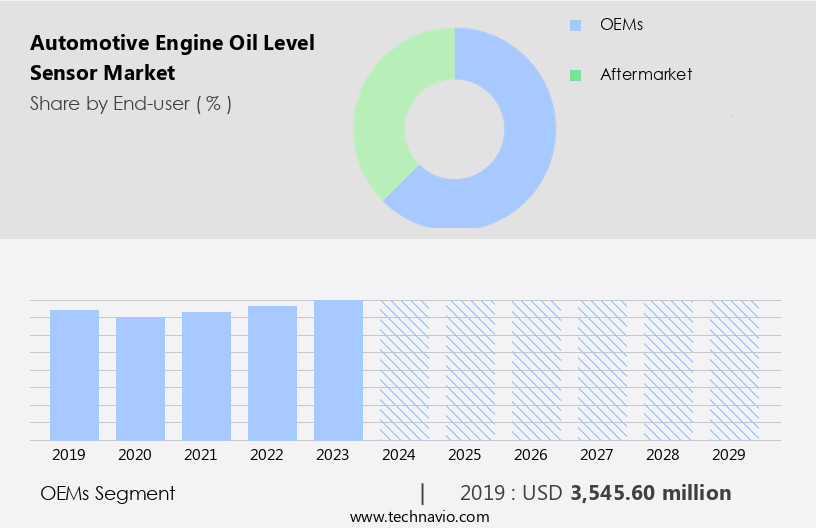

- The OEMs segment is estimated to witness significant growth during the forecast period.

The market is driven primarily by Original Equipment Manufacturers (OEMs), who accounted for the largest market share in 2024. The global automotive industry witnessed the sale of approximately 75 million cars in 2023, leading to an increased demand for exhaust systems and engine oil level sensors. While advancements in the aftermarket segment, particularly in material and design, are noteworthy, OEMs will maintain their dominant position due to the continuous sales of new vehicles. The market is expected to experience significant growth in the forecast period, with key factors including engine health, efficiency, emissions, and real-time monitoring and measurement for diagnosis.

Get a glance at the market report of share of various segments Request Free Sample

The OEMs segment was valued at USD 3.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

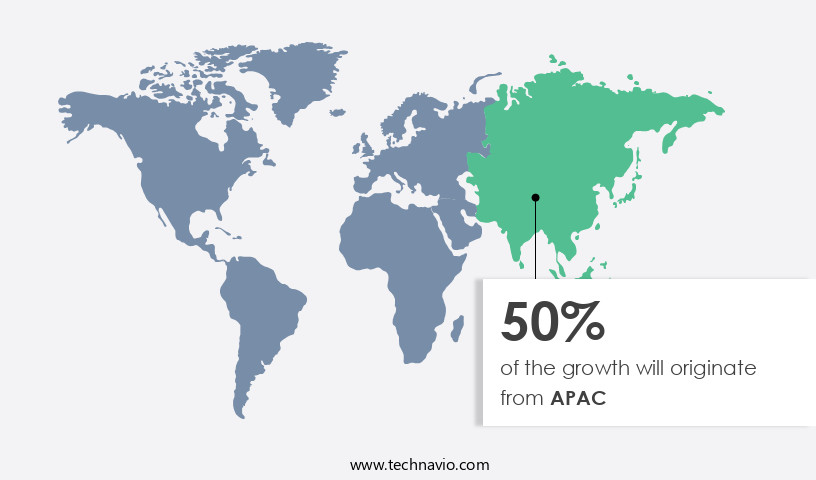

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the high demand and sales volume of automobiles in countries such as China, Japan, South Korea, and India. APAC's dominance in the global automotive market is attributed to its rapid population growth, economic expansion, and infrastructure development. The region's advancements in automotive powertrain technology are driving revenue growth in the market. With the increasing focus on engine health, efficiency, emissions, and real-time monitoring, automakers are investing in innovations and advancements to improve performance and sustainability. External factors such as government regulations, customer orientation, and competitive pressures are also influencing market dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Engine Oil Level Sensor Industry?

Increasing penetration of automotive electronics is the key driver of the market.

- The market is driven by the increasing integration of electronics in automobile manufacturing. Over the past decade, the use of electronic components in automobiles has significantly increased, leading to a heightened demand for engine oil level sensors. This trend is primarily attributed to advancements and innovations in the automotive industry, which have made electronics an essential part of modern vehicles. In fact, the cost of automotive electronics and auto parts, which was previously a small fraction of the total vehicle cost, now accounts for approximately half of it. As a result, engine health, engine efficiency, emissions, and real-time monitoring have become critical factors for automakers.

- The market for engine oil level sensors is expected to experience both short-term and long-term trends, with potential opportunities arising from the need for precise measurement, diagnosis, and sustainable supply. However, competitors, strategic positioning, external factors, and the threat of substitution are pivotal factors that may impact market dynamics. Capital investments, performance issues, brand recognition, market visibility, consumer orientation, and profitability are all essential considerations for stakeholders in this market. The political landscape and investment avenues are also crucial factors that may influence the market's growth trajectory.

What are the market trends shaping the Automotive Engine Oil Level Sensor Industry?

Rising demand for engine efficiency is the upcoming market trend.

- The market experiences significant growth due to the increasing focus on engine health and efficiency. With escalating fuel prices and rigorous emissions standards, automakers and consumers prioritize vehicles that offer superior fuel economy and lower emissions. Proper engine lubrication is crucial for efficient performance, making advanced oil level sensors indispensable in modern vehicles. These sensors enable real-time monitoring of oil levels, preventing issues such as engine overheating, increased friction, and excessive wear and tear. The benefits include improved fuel efficiency, reduced maintenance costs, and extended engine lifespan. Market dynamics are influenced by factors such as engine performance issues, threat of substitution, bargaining power, volume analysis, consumption power, profitability, and margin declines.

- Strategic positioning, external factors, brand recognition, market visibility, capital investments, and sustainable supply also play pivotal roles. Short-term and long-term trends offer potential opportunities for market expansion.

What challenges does the Automotive Engine Oil Level Sensor Industry face during its growth?

Low-cost manufacturing countries to lose low-cost advantage is a key challenge affecting the industry growth.

- The market has experienced significant shifts in recent years, with original equipment manufacturers (OEMs) transferring liability for warranty costs and price pressures to component manufacturers. In response, there has been a focus on cost optimization across the industry to maintain profitability. One strategy has been to outsource manufacturing to countries with lower operational costs, such as Taiwan, China, South Korea, and India, which are major producers of automotive components. This trend towards outsourcing and cost reduction is driven by the need to maintain engine health, efficiency, and emissions compliance, while also addressing performance issues and the threat of substitution from alternative technologies.

- As automakers continue to invest in advancements and innovations, real-time monitoring, measurement, and diagnosis have become essential for maintaining a competitive strategic positioning. External factors, such as brand recognition, market visibility, and capital investments, also play a pivotal role in shaping the market landscape. Short-term trends include the increasing importance of customer orientation and sustainable supply, while long-term trends point towards the potential opportunities for increased consumption power and profitability, despite the risk of margin declines. Bargaining power, volume analysis, and performance issues are key factors that will continue to influence the market dynamics.

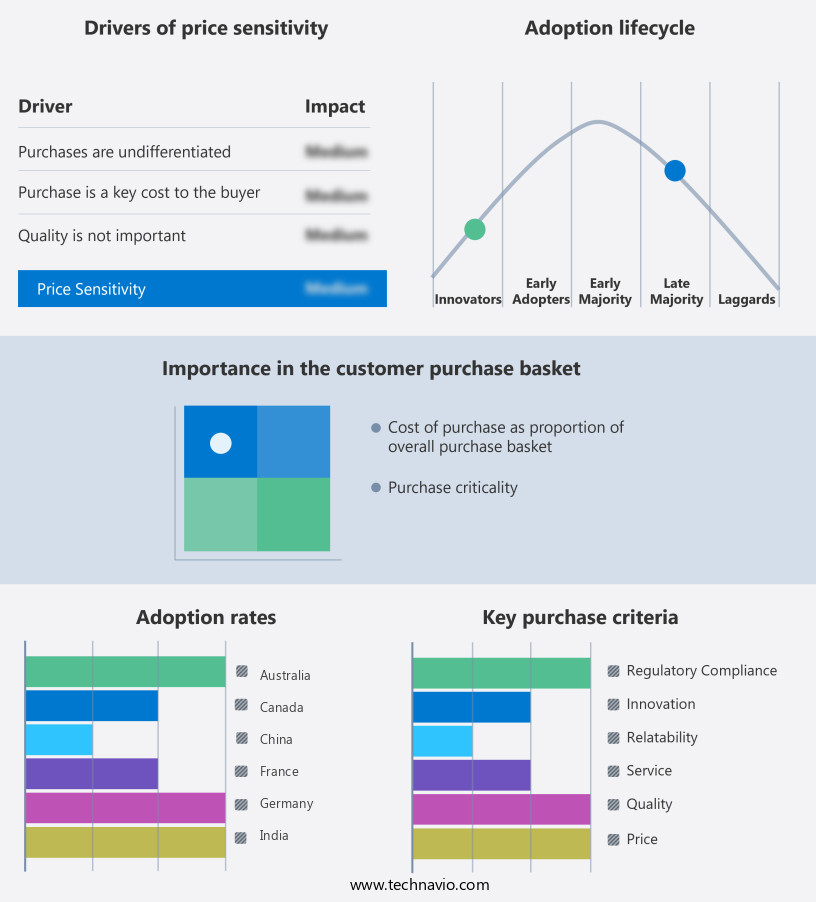

Exclusive Customer Landscape

The automotive engine oil level sensor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive engine oil level sensor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive engine oil level sensor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Continental AG - The company offers an automotive engine oil level sensor to monitor correct engine oil level to avoid overfill or under filling during driving or at key-on.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cebi International SA

- Cummins Inc.

- DENSO Corp.

- FEP Fahrzeugelektrik Pirna GmbH and Co. KG

- General Motors Co.

- Gill Sensors and Controls Ltd.

- HELLA GmbH and Co. KGaA

- Holykell Sensor Inc.

- Honeywell International Inc.

- ifm electronic gmbh

- Niterra Co. Ltd.

- Porsche Automobil Holding SE

- Robert Bosch GmbH

- Rochester Sensors

- Sensata Technologies Inc.

- SMD Fluid Controls

- TDK Corp.

- TE Connectivity Ltd.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role in ensuring the optimal performance and health of automobile engines. These sensors enable real-time monitoring and measurement of engine oil levels, facilitating timely diagnosis and maintenance. The integration of engine oil level sensors in modern vehicles is a significant advancement in automotive technology, contributing to improved engine efficiency, reduced emissions, and enhanced automaker brand recognition. Innovations in engine oil level sensors continue to emerge, driven by the need for more accurate and reliable measurement. Real-time monitoring capabilities enable automakers to diagnose performance issues promptly, reducing the likelihood of costly repairs and downtime. Additionally, the integration of these sensors into vehicle diagnostics systems allows for comprehensive engine health assessments, providing valuable data for automakers and consumers alike.

In addition, the market is influenced by various pivotal factors. External factors, such as regulatory requirements and consumer preferences, play a significant role in shaping market dynamics. For instance, stricter emissions regulations may drive demand for more efficient engines, leading to increased adoption of engine oil level sensors. Competitors in the market are constantly positioning themselves to capitalize on emerging trends and opportunities. Capital investments in research and development, as well as strategic partnerships, are essential for maintaining a competitive edge. Brand recognition and market visibility are also critical factors, as consumers increasingly demand reliable and high-performing sensors. Performance issues and the threat of substitution are significant challenges facing the market.

Moreover, performance issues may arise due to factors such as sensor accuracy, reliability, and durability. Substitution threats may come from alternative technologies or market trends, such as the growing popularity of electric vehicles. Short-term trends in the market include the increasing adoption of wireless sensors and cloud-based monitoring systems. Long-term trends include the integration of sensors into more comprehensive vehicle monitoring systems and the development of sensors that can provide real-time data on other engine parameters, such as temperature and pressure. The political landscape also plays a role in the market. Government regulations and policies may impact market growth and competitiveness.

Furthermore, investment avenues in this market may include partnerships with automakers, research collaborations, and the development of new sensor technologies. Volume analysis and consumption power are essential metrics for understanding market dynamics in the market. Factors such as vehicle production volumes, market penetration rates, and consumer preferences can significantly impact demand for these automotive radar sensors. Profitability and margin declines are ongoing concerns for market participants in the market. Competitive pricing and increasing raw material costs can erode profit margins, necessitating strategic pricing and cost management. Customer orientation is a critical success factor in the market. Meeting customer needs and expectations for reliability, accuracy, and ease of use is essential for market success. Additionally, sustainability and environmental considerations are increasingly important to consumers, making sustainable supply chains and eco-friendly production processes essential for long-term market success.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 1.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

China, US, Japan, India, Canada, South Korea, Germany, Australia, UK, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Engine Oil Level Sensor Market Research and Growth Report?

- CAGR of the Automotive Engine Oil Level Sensor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive engine oil level sensor market growth of industry companies

We can help! Our analysts can customize this automotive engine oil level sensor market research report to meet your requirements.