Automotive Knock Sensor Market Size 2024-2028

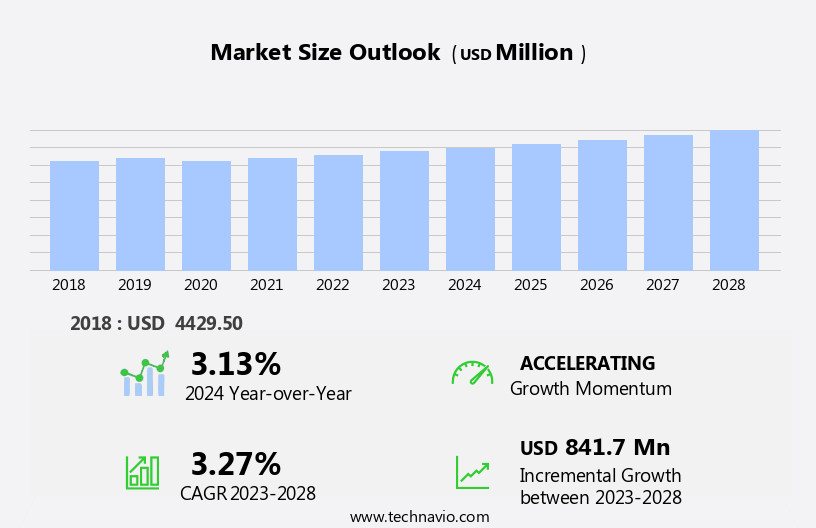

The automotive knock sensor market size is forecast to increase by USD 841.7 million at a CAGR of 3.27% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. Stringent regulations regarding emissions are driving the adoption of powertrain sensors, including knock sensors, in both internal combustion engines and hybrid vehicles. These sensors help optimize engine performance and reduce emissions, making them essential for meeting regulatory requirements.

- Additionally, the rise in demand for electrification of powertrains in commercial vehicles and the increasing trend towards autonomous vehicles is boosting the market. Advanced driver assistance systems (ADAS) and autonomous vehicles rely heavily on sensors such as LiDAR, RADAR, and piezoelectric sensors, including knock sensors, to ensure engine performance and safety.

- Furthermore, the integration of LED and semiconductor technologies in knock sensors is enhancing their accuracy and reliability. Overall, the market is expected to grow steadily In the coming years, driven by these market trends and the increasing demand for advanced powertrain technologies.

What will be the Size of the Automotive Knock Sensor Market During the Forecast Period?

- The market encompasses the production and sale of sensors designed to monitor and mitigate knocking sounds in internal combustion engines. These sensors, typically integrated with piezoelectric components, detect vibrations resulting from detonation In the combustion chamber. Knocking, also known as spark knock, can lead to reduced engine efficiency, increased hydrocarbon emissions, and potential engine damage. The market for knock sensors is driven by the widespread use of gasoline engines in passenger cars and commercial vehicles. As engines become more complex and leaner air-fuel mixtures are employed to improve fuel economy, the need for precise engine control, including accurate ignition timing, becomes increasingly important.

- Knock sensors play a crucial role in this regard, providing electric signals to the engine control unit to adjust ignition timing and prevent damaging engine knock. The automobile sector, including production houses catering to both the premium and mass markets, is a significant contributor to the growth of the knock sensor market. With the advent of autonomous vehicles, the demand for advanced sensor technology, including knock sensors, is expected to escalate further. Overall, the market for knock sensors is poised for continued growth, driven by the increasing importance of engine efficiency, emissions reduction, and engine life extension.

How is this Automotive Knock Sensor Industry segmented and which is the largest segment?

The automotive knock sensor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

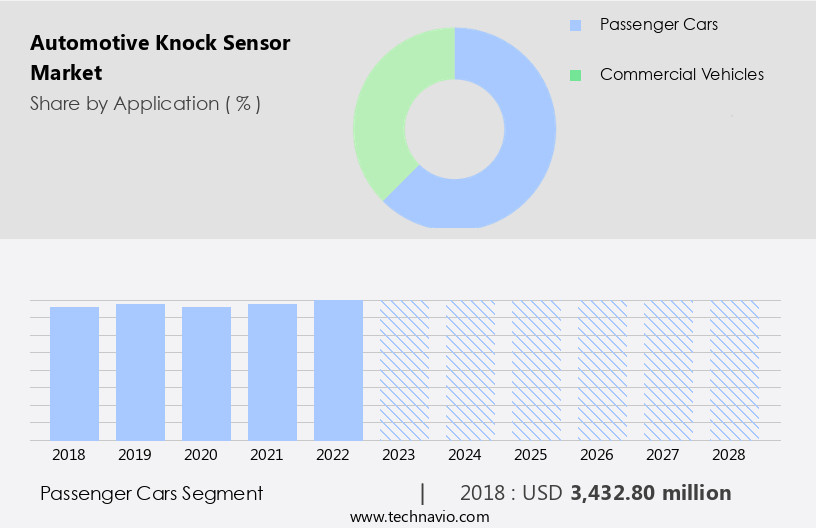

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The global knock sensor market is primarily driven by the increasing production of passenger cars and commercial vehicles. Knock sensors, which are essential components of internal combustion engines, help monitor engine performance by detecting detonation or knocking sounds In the combustion chamber. These sensors utilize piezoelectric components to convert mechanical vibrations into electric signals, which are then processed by the engine control unit to adjust ignition timing and maintain a leaner air-fuel mixture for optimal engine performance and fuel efficiency. The market for knock sensors is expected to grow significantly due to the increasing demand for improved engine performance, fuel economy, and emissions management in both passenger cars and medium commercial vehicles.

However, the market may face challenges from the increasing adoption of electric vehicles and hybrid vehicles, which do not require knock sensors. Key players in the market include various production houses and sensor manufacturers, offering linear frequency sensors, multi-frequency detection, and advanced sensor technology with digital signal processing and AI algorithms. The market's growth is also influenced by government regulations aimed at reducing nitrogen oxides emissions and improving fleet efficiency.

Get a glance at the Automotive Knock Sensor Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 3.43 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

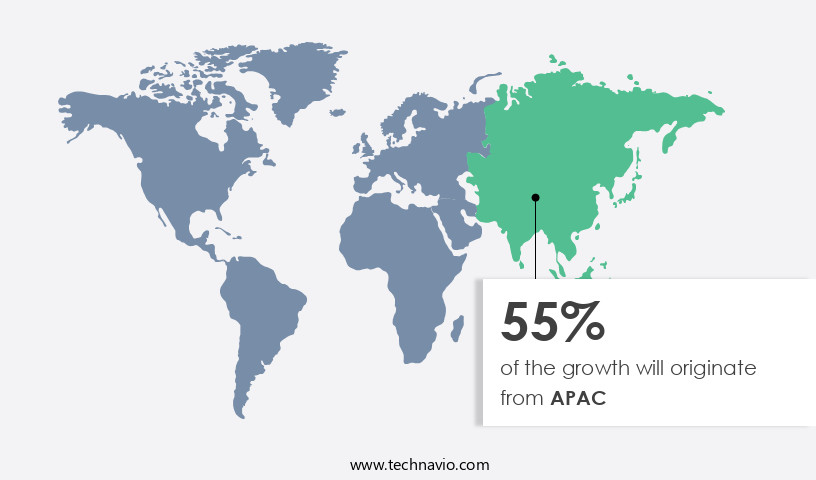

- APAC is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia-Pacific (APAC) is experiencing significant growth due to the region's advanced information communication and technology (ICT) capabilities. Knock sensors, which are essential components of internal combustion engines, are integrated into vehicles without compromising their fundamental functions. APAC's automotive industry has been a major contributor to the global market, with the region leading in vehicle production and sales. Economic growth and regulatory advancements have further fueled the market's expansion in APAC. Knock sensors play a crucial role in engine performance, fuel efficiency, fleet efficiency, emissions management, and engine life. They detect knocking or pinging sounds caused by detonation in the combustion chamber.

Knock sensors are used in both passenger cars and commercial vehicles, including medium commercial vehicles and electric and hybrid vehicles. Advanced sensor technology, such as multi-frequency detection and digital signal processing, is integrated into knock sensors, enabling AI algorithms to analyze engine data and prevent potential system malfunctions. Knock sensors are also used in advanced driver assistance systems and are integrated with engine control units to optimize ignition timing and maintain a leaner air-fuel mixture in gasoline engines. The market's growth is expected to continue due to the increasing demand for improved engine performance, fuel economy, and emissions management In the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Knock Sensor Industry?

Stringent regulations regarding emission, driving adoption of powertrain sensors is the key driver of the market.

- The market is experiencing significant growth due to increasing regulations aimed at reducing emissions and improving fuel efficiency in both passenger cars and commercial vehicles. Strict emission norms, such as Euro VI and Japan's upgraded standards, mandate the use of powertrain sensors, including knock sensors, to optimize engine performance and prevent detonation. These regulations limit nitrogen oxides (Nox) emissions to below 0.4 g/KWh and particulate matter (PM) emissions to below 0.01 g/KWh. Knock sensors monitor the combustion processes withIn the engine by detecting vibrations caused by detonation or spark knock In the combustion chamber. This data is then transmitted to the engine control unit, allowing for adjustments to ignition timing and fuel mixture to maintain optimal engine performance and prolong engine life.

- The adoption of advanced sensor technology, including digital signal processing, AI algorithms, multi-frequency detection, and piezoelectric elements, is also driving market growth. Electric and hybrid vehicles are also incorporating knock sensors to improve fuel economy and emissions management. Overall, the market is expected to continue growing as governments and production houses prioritize vehicle efficiency and emissions reduction.

What are the market trends shaping the Automotive Knock Sensor Industry?

Flat response knock sensor is the upcoming market trend.

- Automotive knock sensors are essential components in internal combustion engines, specifically mounted on the engine block or cylinder head. These self-generating piezoelectric sensors detect knocking sounds, caused by detonation In the combustion chamber. Unlike other sensors, they do not require external power for operation. Instead, they generate an electric signal in response to engine vibrations. The knock sensor's output is analyzed by the engine control unit (ECU), which adjusts ignition timing or diesel injection timing to mitigate knocking. This sensor plays a crucial role in maintaining engine performance, fuel efficiency, fleet efficiency, emissions management, and overall engine life. It is applicable to various types of IC engines, including gasoline, diesel, alternative fuel, and flexible fuel engines.

- Advanced sensor technology, such as multi-frequency detection, digital signal processing, and AI algorithms, enhances knock sensor capabilities. These sensors are not only essential for passenger cars but also for commercial vehicles and autonomous cars, acting as an autonomous car detector for LiDAR companies. The knock sensor's importance extends to production houses, where system malfunctions can lead to significant vehicle & infrastructure costs. In the context of electric and hybrid vehicles, knock sensors continue to play a role in monitoring combustion processes in gasoline engines and ensuring efficient engine performance. In summary, the knock sensor is a vital component in internal combustion engines, enabling optimal engine performance, fuel efficiency, fleet efficiency, and emissions management across various vehicle types.

What challenges does the Automotive Knock Sensor Industry face during its growth?

Rising demand for electrification of powertrains is a key challenge affecting the industry growth.

- The automotive industry's shift towards electrification and advanced safety features, such as driver assistance systems (DAS), has led to a significant increase In the use of sensors in internal combustion engine (ICE) vehicles. This trend is driven by government regulations aimed at reducing greenhouse gas (GHG) emissions, consumer demand for fuel efficiency and reduced carbon footprints, and fluctuating fuel prices. Knock sensors, which detect detonation In the combustion chamber, are crucial components in this regard. These sensors, typically piezoelectric or inductive, convert mechanical energy into electrical signals, which the engine control unit (ECU) uses to adjust ignition timing and maintain a leaner air-fuel mixture for optimal engine performance and fuel economy.

- In the context of commercial vehicles, medium and heavy-duty fleets stand to benefit significantly from the implementation of knock sensors, as they help reduce nitrogen oxide (NOx) emissions and improve fleet efficiency. The integration of knock sensors in advanced driver-assistance systems (ADAS) and autonomous car detection systems is also gaining traction, with LiDAR companies and radar sensors playing key roles in this development. Digital signal processing, AI algorithms, and multi-frequency detection techniques are some of the advanced sensor technologies being employed to enhance knock sensor performance and functionality. Electric and hybrid vehicles, while not reliant on knock sensors for combustion processes, still utilize sensors for emissions management and overall vehicle health monitoring.

- The automotive industry's ongoing evolution towards cleaner, more efficient, and safer transportation solutions underscores the importance of sensors, including knock sensors, In the automotive landscape.

Exclusive Customer Landscape

The automotive knock sensor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive knock sensor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive knock sensor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Allegro MicroSystems Inc. - The company provides advanced automotive knock sensor technology, incorporating Accelerometers and Condition-based Monitoring Development Platforms. These components ensure precise detection of engine knocking by measuring acceleration, tilt, shock, and vibration in high-performance applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegro MicroSystems Inc.

- Analog Devices Inc.

- Aptiv Plc

- Continental AG

- CTS Corp.

- DENSO Corp.

- Elmos Semiconductor AG

- HELLA GmbH and Co. KGaA

- Hitachi Ltd.

- Infineon Technologies AG

- INZI Controls Co. Ltd.

- NGK Spark Plugs USA, Inc.

- Robert Bosch GmbH

- Ruian Chenho Auto Electronic Co. Ltd

- Ruian Kabang Automobile Electronics Co. Ltd.

- Sensata Technologies Inc.

- Vitesco Technologies Group AG

- Walker Products Inc.

- WenZhou Credit Parts Co Ltd.

- Wenzhou Xinya Automotive Electronics Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital component In the internal combustion engine (ICE) system, designed to monitor and mitigate detonation or knocking sounds withIn the engine. These sounds, also known as spark knock or piezoelectric knock, occur when the fuel-air mixture In the combustion chamber ignites prematurely, leading to inefficient combustion processes and potential engine damage. Knock sensors, typically located near the cylinder head or engine block, utilize piezoelectric components to detect the vibrations generated by the knocking sounds. The sensor converts these vibrations into an electric signal, which is then processed by the engine control unit (ECU) to adjust ignition timing and fuel injection accordingly.

This ensures optimal engine performance, improved fuel efficiency, and reduced emissions. The application of knock sensors extends beyond passenger cars to medium commercial vehicles, where engine life and fleet efficiency are crucial factors. In commercial applications, knock sensors play a significant role in emissions management, helping to minimize nitrogen oxides (NOx) and hydrocarbon emissions. Advanced sensor technology, such as multi-frequency detection and digital signal processing, has led to the development of more sophisticated knock sensors. These sensors employ AI algorithms to analyze the electric signal and distinguish between knock and other engine vibrations, ensuring accurate detection and minimizing false positives.

The integration of knock sensors in advanced driver-assistance systems (ADAS) further enhances their importance in modern vehicles. For instance, in autonomous car detection, knock sensors can act as a reliable indicator of engine health, enabling real-time monitoring and potential system malfunction alerts. The adoption of knock sensors is not limited to gasoline engines. They are also essential in electric and hybrid vehicles, where precise control of the electric motor's operation is crucial for optimal performance and efficiency. The knock sensor market is driven by the growing demand for improved engine performance, fuel economy, and emissions reduction. As governments worldwide implement stricter emission regulations, the need for advanced sensor technology, such as knock sensors, becomes increasingly important.

The integration of knock sensors with other sensor types, such as Lidar and radar sensors, further expands their application scope. These sensors provide valuable data for vehicle & infrastructure costs, enabling fleet managers to optimize their operations and reduce overall costs. Despite their importance, knock sensors are susceptible to system malfunctions, which can lead to increased vehicle downtime and repair and replacement costs. Continuous advancements in sensor technology and digital signal processing aim to minimize these issues and ensure reliable, long-lasting performance. In conclusion, the market plays a pivotal role in the ICE system, ensuring optimal engine performance, improved fuel efficiency, and reduced emissions. With the increasing demand for advanced sensor technology and stricter emission regulations, the market is expected to grow significantly in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 841.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

China, US, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Knock Sensor Market Research and Growth Report?

- CAGR of the Automotive Knock Sensor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive knock sensor market growth of industry companies

We can help! Our analysts can customize this automotive knock sensor market research report to meet your requirements.