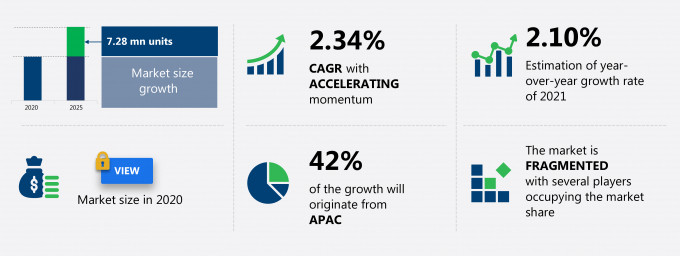

The automotive navigation systems market share is expected to increase by 7.28 million units from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 2.34%.

This automotive navigation systems market research report extensively covers automotive navigation systems market segmentation by product (IVS and PND), type (passenger cars and commercial vehicles), and geography (APAC, North America, Europe, South America, and MEA). The automotive navigation systems market report also offers information on several market vendors, including Aisin Corp, Alpine Electronics Inc., Continental AG, DENSO Corp., Garmin Ltd., Panasonic Corp., Pioneer Corp., Robert Bosch GmbH, Samsung Electronics Co. Ltd., and TomTom International BV among others.

What will the Automotive Navigation Systems Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive Navigation Systems Market Size for the Forecast Period and Other Important Statistics

"Vehicle speed, vehicle type, gradient speed changes, road surface, and curvature are some of the major factors that directly contribute to the operating cost of vehicles."

Automotive Navigation Systems Market: Key Drivers, Trends, and Challenges

The minimization of vehicle operating costs is notably driving the automotive navigation systems market growth, although factors such as the complexities associated with customization may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive navigation systems industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive Navigation Systems Market Driver

Minimization of vehicle operating costs is one of the key drivers of the automotive navigation systems market growth. The operating cost of a vehicle is majorly associated with its usage. It includes maintenance, repairs, and mileage-dependent depreciation costs. Vehicle speed, vehicle type, gradient speed changes, road surface, and curvature are some of the major factors that directly contribute to the operating cost of vehicles. To maintain the operational efficiency and condition of a vehicle for the long run, preventive measures can be taken by providing extensive diagnostics to it. The navigation system helps users in driving less distance by showing the best shortest route, which saves fuel. It also provides warnings related to speed limits and helps fleet operators and drivers to avoid damage to tires and reduce the chances of paying penalties for overspeeding or wrong turns. Moreover, fleet tracking navigation solutions help reduce fleet maintenance costs. Such advantages associated with automotive navigation systems are increasing their adoption among consumers. This, in turn, is boosting the growth of the global automotive navigation systems market.

Key Automotive Navigation Systems Market Trend

Complexities associated with customization are one of the key trends in the automotive navigation systems market growth. Traditionally, competition among automotive manufacturers was limited to towing capacity, acceleration, and horsepower of the vehicle. But, recently, there has been a shift in the focus of consumers and OEMs from what is under the hood to what is behind the vehicle's dashboard. A growing area of competition between both automobile manufacturers and automotive infotainment/navigation system manufacturers is the software or OS used in the vehicle's infotainment systems. Manufacturers of automotive navigation systems are shifting toward the PC-like architectural concept. In this, the functionality of the system is dependent on the main CPU. As a result, the software or the OS used in systems act as the product differentiator among the brands. Currently, the platforms for vehicles OS are Windows CE, QNX, Android, Apple OS, and custom-built Linux-based OS. However, Android (a Linux-based OS) offers tons of features to vehicle infotainment systems, such as application support, touch, and notifications. As a result, automobile manufacturers want to control the OS on which their products run, in turn using it as a product differentiator or as a competitive edge over their competitors.

Key Automotive Navigation Systems Market Challenge

Fleet management system for commercial vehicles is one of the key challenges for the automotive navigation systems market growth. The competition between PNDs, IVS, and smartphone-based navigation systems has encouraged manufacturers to include more and more functions to offer a unique driving experience and improve safety. The integration of numerous applications, such as internet connectivity, ADAS, and telematics in a single navigation system is complicated and hinders the adoption of these actual systems in vehicles. The presence of different application program interfaces (APIs) and software development kits (SDKs), and non-standardized platforms further lead to complexities, as software and content developers have to customize solutions for every platform. In addition, enabling the use of connected services in line with designing and developing a non-distracting user interface increases production costs for OEMs and tier-1 suppliers.

This automotive navigation systems market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global automotive navigation systems market as a part of the global automotive components and accessories market. The growth in the global automotive components and accessories market will be driven by factors such as an increase in electronic components in automobiles, integration of safety systems, increasing safety regulations, and technological improvements to reduce downtime of electric buses. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive navigation systems market during the forecast period.

Market Overview

The market has seen an influx of various non-automotive players with connected technologies. Subsequently, traditional automotive OEMs have also embraced this structural paradigm. A navigation system is aided by global positioning services (GPS) that provide riders with real-time maps and directions on the road is one such technology that has gained widespread adoption. Most luxury and mid-luxury vehicles entering the market have installed a navigation system as a standard unit. These units are known as intelligent vehicle system (IVS) or in-dash systems. Based on the vehicle option, it can be factory-fitted (by OEMs) or aftermarket-fitted. Cheaper navigation systems are available for entry and mid-level vehicles, such as smartphone/tablet-based navigation systems. All these types of systems form the global automotive navigation systems market.

Who are the Major Automotive Navigation Systems Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Aisin Corp

- Alpine Electronics Inc.

- Continental AG

- DENSO Corp.

- Garmin Ltd.

- Panasonic Corp.

- Pioneer Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- TomTom International BV

This statistical study of the automotive navigation systems market encompasses successful business strategies deployed by the key vendors. The automotive navigation systems market is fragmented and the vendors are deploying growth strategies such as differentiating their product offerings through a clear and unique value proposition to compete in the market.

Product Insights and News

- Aisin Corp - The company offers a line of automotive navigation systems such as Smart eco-drive function equipped car navigation system, Voice Car Navigation System (Audi), and NAVIelite.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive navigation systems market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Navigation Systems Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive navigation systems market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Automotive Navigation Systems Market?

For more insights on the market share of various regions Request for a FREE sample now!

42% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for automotive navigation systems in APAC. Market growth in this region will be faster than the growth of the market in Europe, MEA, and North America.

The increasing urbanization, high disposable income, growing demand for cars among consumers, increasing car-sharing activities, rising adoption of smartphones associated with growing internet connectivity, and the presence of global and local vendors will facilitate the automotive navigation systems market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

Globally integrated automotive supply chains were disrupted due to COVID-19 during the first quarter of 2020. The majority of automotive OEMs and tier-1 and tier-2 manufacturers halted the production of vehicles and components completely. COVID-19 created a supply-demand imbalance of automotive components such as vehicle navigation systems, which continued till the last quarter of 2020 when there was a surge in sales of passenger vehicles and EVs.

What are the Revenue-generating Product Segments in the Automotive Navigation Systems Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive navigation systems market share growth by the IVS segment will be significant during the forecast period. Even though the PND market is heading toward a declining phase, the IVS market will likely gain traction during the forecast period with the introduction of low-cost IVS in entry-level vehicles (factory-fitted and aftermarket). The drop in the average price of navigation systems should give a positive impetus to the growth of the IVS market by entry into mid-premium and entry-level vehicles. The market for global automotive navigation systems is expected to grow at an accelerated rate during the forecast period, as more OEMs are expected to offer this system in their offerings, and also due to the rapid adoption of smartphone integrated systems, such as Android Auto, HERE, and Apple CarPlay.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive navigation systems market size and actionable market insights on post COVID-19 impact on each segment.

Similar Reports:

|

Automotive Navigation Systems Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.34% |

|

Market growth 2021-2025 |

7.28 mn units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

2.10 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 42% |

|

Key consumer countries |

China, US, Germany, and Japan |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Aisin Corp, Alpine Electronics Inc., Continental AG, DENSO Corp., Garmin Ltd., Panasonic Corp., Pioneer Corp., Robert Bosch GmbH, Samsung Electronics Co. Ltd., and TomTom International BV |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Navigation Systems Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive automotive navigation systems market growth during the next five years

- Precise estimation of the automotive navigation systems market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive navigation systems industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive navigation systems market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch