Automotive Steel Wheels Market 2024-2028

The automotive steel wheels market size is estimated to grow at a CAGR of 3.68% between 2023 and 2028. The market size is forecast to increase by USD 1.91 billion. The accelerated growth of the market is due to various factors, including the growth of the automotive industry in emerging economies, low development costs and advantages of steel wheels and the rise in demand for construction and mining vehicles globally.

The report includes a comprehensive outlook on the automotive steel wheels market offering forecasts for the industry segmented by Application, which comprises passenger cars, LCVs, M and HCVs. Additionally, it categorizes End-user into OEM and aftermarket, and covers Geography regions, including North America, APAC, Europe, Middle East and Africa, and South America. The report provides market size, historical data spanning from 2018 to 2022, and future projections, all presented in terms of value in USD billion for each of the mentioned segments.

What will be the Size of the Automotive Steel Wheels Market During the Forecast Period?

For More Highlights About this Report, Download Free Sample in a Minute

Automotive Steel Wheels Market: Key Drivers, Trends and Challenges

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Automotive Steel Wheels Market Driver

Low development costs and advantages of steel wheels are notably driving the market growth. When compared to aluminium alloy wheels, the cost of manufacturing steel wheels is low. This is one of the major advantages of steel wheels. In addition, steel wheels are exceptionally durable; they seldom crack or bend. They are also not prone to cosmetic damage, as they are naturally tough and do not have a paint finish. On average, an automotive steel wheel costs around USD 40- USD 60. Therefore, the average price of a set of four steel wheels is between USD 200 and USD 250. Using high-strength materials to manufacture steel wheels makes them robust and lightweight and enhances their performance.

However, over the years, the manufacturing duration of steel wheels has steadily reduced, and the quality has increased. Thus, the entire process has become cost-effective, which has led to low manufacturing costs. This will aid the growth of the automotive steel wheels market during the forecast period.

Key Automotive Steel Wheels Market Trends

The development of ultra-lightweight steel wheels for CVs is an emerging trend shaping the market growth. The automotive industry is witnessing developments in the form of the construction of ultra-light yet rigid steel wheels. Such developments are further enhancing the performance capabilities of steel wheels, thereby challenging the growth of the market in focus. Companies are increasingly launching lightweight steel wheels with improved wheel designs. Similarly, other companies are also working on the development of high-strength steel wheels with lightweight designs. Vehicle light-weighting has been a key focus for automotive OEMs for many years. Therefore, the development of lightweight steel wheels is proving to be highly beneficial.

In addition to the reduction of carbon emissions, such steel wheel designs improve the fuel efficiency of vehicles, which further leads to improved energy efficiency. The trend in the development and adoption of ultra-lightweight steel wheels is expected to have a positive impact on the adoption of automotive steel wheels, which will drive the growth of the automotive steel wheels market during the forecast period.

Major Automotive Steel Wheels Market Challenge

Increasing penetration of aluminium alloy wheels is a significant challenge hindering the market growth. Steel wheels have been used on automobiles for several years. However, aluminium alloy wheels are rapidly gaining traction in the global automotive market. Automobiles are undergoing a transformation not only in terms of functionalities but also in terms of their looks, and steel wheels do not have the sophisticated aesthetics that are expected by vehicle enthusiasts. Further developments in alloy wheel manufacturing technology have resulted in machine-cut or diamond-cut alloy wheels, which have enhanced the functional aspects and appearance of vehicles. These advantages of aluminium alloy wheels have resulted in their increased penetration in the global automotive market.

However, owing to the increasing demand for alloy wheels, manufacturers have achieved economies of scale in production. This has led to a reduction in the cost of alloy wheels, which has boosted their adoption. Hence, the growth of the aluminium alloy wheels market will negatively impact the growth of the automotive steel wheels market during the forecast period.

Automotive Steel Wheels Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Automotive Steel Wheels Market Customer Landscape

Who are the Major Automotive Steel Wheels Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accuride Corp. - The company offers automotive steel wheels such as Accu lite steel wheels, Extra service wheels, and DupleX one wheels.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- ALCAR HOLDING GMBH

- Automotive Wheels Ltd.

- Bharat Wheel Pvt. Ltd.

- Central Motor Wheel of America Inc.

- CLN Coils Lamiere Nastri Spa

- ENKEI WHEELS India Ltd.

- Fastco Canada

- Jantsa Jant Sanayi ve Tic AS

- JS Wheels

- Klassic Wheels Ltd.

- MAXION Wheels

- Munjal Auto Industries Ltd.

- Steel Strips Wheels Ltd.

- The Carlstar Group LLC

- thyssenkrupp AG

- Topy Industries Ltd.

- Weller Wheels Ltd.

- WIL Car Wheels Ltd.

- Kenda Rubber Industrial Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What are the Largest-Growing Segments in the Automotive Steel Wheels Market?

The passenger cars segment is estimated to witness significant growth during the forecast period. The automakers of entry-level PCs are increasing the adoption of steel wheels due to their cost-effectiveness. Further, the market growth is also characterized by the growing popularity of electric cars. For instance, according to the International Energy Agency, more than 350 electric models, primarily small-to-medium versions, are planned by automakers by 2025

Get a glance at the market contribution of various segments Download the PDF Sample

The passenger car segment was the largest and valued at USD 5.55 billion in 2018. Alloy wheels provide improved acceleration and handling and are lightweight, along with being visually appealing. Thus, alloy wheels are gaining more popularity than steel wheels. The global automotive steel wheels market is expected to gain momentum in emerging countries like China, India, Brazil, South Korea, Indonesia, and parts of Eastern Europe. As the consumers in these regions are price-sensitive, entry-level PCs are equipped with steel wheels to maintain minimum costs. Various companies have established new facilities to cater to the growing demand from vehicle manufacturers. Such developments will drive the growth of the PC segment, which in turn will drive the growth of the global automotive steel wheels market moderately during the forecast period.

Which are the Key Regions for the Automotive Steel Wheels Market?

For more insights on the market share of various regions Download PDF Sample now!

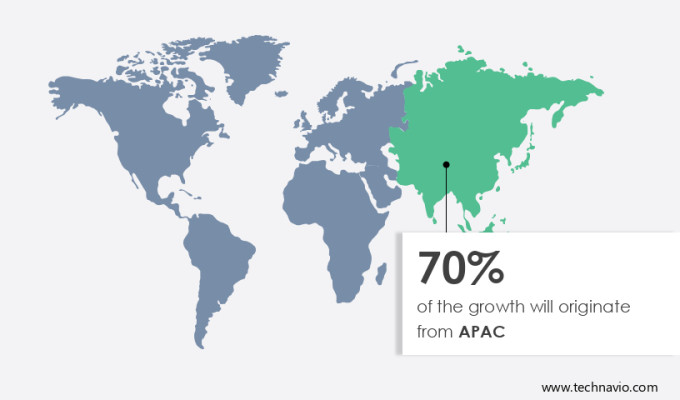

APAC is estimated to contribute 70% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The automotive steel wheels market in APAC is expected to register one of the fastest growth rates during the forecast period. China is a major contributor and represents the largest market for automotive steel wheels in APAC. The primary factor for the growth of the market is the growing adoption of PCs and CVs in China. In addition, China, Japan, and India are crucial contributors to the demand for steel wheels due to high-volume automotive production. APAC economies are also witnessing growing infrastructural, shipping, and mining activities. This has led to an increase in the production of CVs.

In addition, improving road network has also led to the growing demand for both LCVs and M and HCVs, which is supplementing the growth of the automotive steel wheels market in APAC. The demand for CVs is expected to increase in emerging economies, which will be a positive factor for the growth of the automotive steel wheels market in APAC during the forecast period.

Segment Overview

The automotive steel wheels market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Application Outlook

- Passenger cars

- LCVs

- M and HCVs

- End-user Outlook

- OEM

- Aftermarket

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Automotive Steel Wheels Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.68% |

|

Market Growth 2024-2028 |

USD 1.91 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.12 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 70% |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accuride Corp., ALCAR HOLDING GMBH, Automotive Wheels Ltd., Bharat Wheel Pvt. Ltd., Central Motor Wheel of America Inc., CLN Coils Lamiere Nastri Spa, ENKEI WHEELS India Ltd., Fastco Canada, Jantsa Jant Sanayi ve Tic AS, JS Wheels, Klassic Wheels Ltd., MAXION Wheels, Munjal Auto Industries Ltd., Steel Strips Wheels Ltd., The Carlstar Group LLC, thyssenkrupp AG, Topy Industries Ltd., Weller Wheels Ltd., WIL Car Wheels Ltd., and Kenda Rubber Industrial Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Steel Wheels Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.