Automotive Torque Converter Market Size 2024-2028

The automotive torque converter market size is forecast to increase by USD 1.26 billion at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Automotive Torque Converter Market During the Forecast Period?

How is this Automotive Torque Converter Industry segmented and which is the largest segment?

The automotive torque converter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for automatic transmission vehicles, particularly passenger cars. In 2023, passenger cars accounted for the largest market share, driven by their widespread use for average transportation needs. Automatic hydraulic transmissions and continuously variable transmissions (CVTs) in passenger cars are key contributors to market growth. Commercial vehicles, including light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs), hold smaller market shares as they are primarily used for commercial purposes. The market is influenced by various factors, including vehicle performance, fuel efficiency, pollution regulations, and government mandates. Electric vehicle integration, hybrid systems, and autonomous driving technology are also emerging trends.

Automotive original equipment manufacturers (OEMs) are continuously innovating to meet the evolving demands of vehicle owners and fleet operators, focusing on automated manufacturing processes and advanced transmission technologies, such as clutch plates, dampers, impellers, turbines, and stators.

Get a glance at the Automotive Torque Converter Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 3.04 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

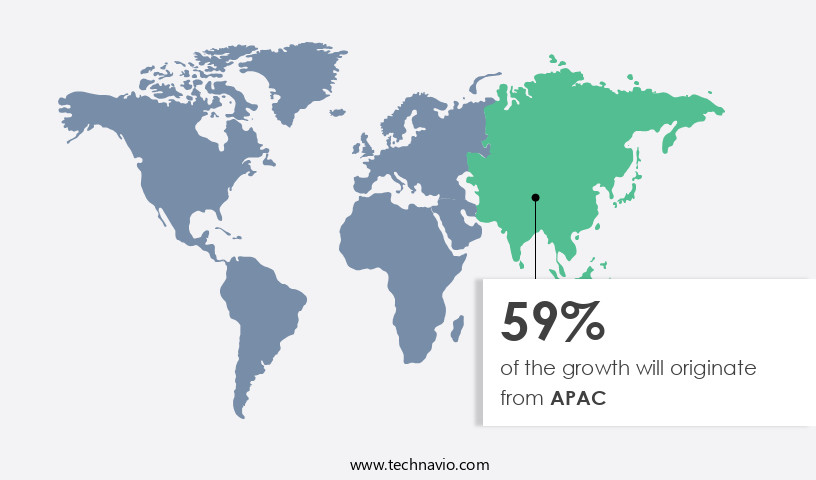

- APAC is estimated to contribute 59% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American automotive market is experiencing technological advancements, particularly in automotive electronics and electricals, driving the demand for torque converters. North American automobile manufacturers are at the forefront of technology adoption due to increasing consumer preferences and higher per capita income. The regional torque converter market growth in North America is attributed to technological innovations and evolving consumer demands. Key applications include luxury vehicles, passenger cars, and commercial vehicles. Automatic transmission systems, such as continuously variable transmissions and dual-clutch transmissions, are major end-users. Fuel consumption and pollution regulations, as well as government mandates, are influencing market trends. Electric vehicle integration, hybrid systems, and autonomous driving technology are emerging areas of opportunity.

Automotive OEMs, vehicle owners, fleet operators, and automated manufacturing processes are key stakeholders. The torque converter components include the clutch plate, damper, impeller, turbine, and stator. The market is expected to grow significantly due to the need for smooth acceleration, seamless gear shifting, and engine torque efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Torque Converter Industry?

Globalization of auto industry to increase demand for automatic transmission vehicles in APAC is the key driver of the market.

What are the market trends shaping the Automotive Torque Converter Industry?

Increasing number of gears covering wider ratios for higher power and torque performance is the upcoming market trend.

What challenges does the Automotive Torque Converter Industry face during its growth?

Preference for cars with manual transmissions in European economies is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The automotive torque converter market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive torque converter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive torque converter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AISIN CORP. - The automotive industry witnesses the emergence of advanced torque converter technologies, including 1 Motor Hybrid Transmission and RWD Multi Stage Hybrid Transmission. These innovations cater to the evolving market demands for improved fuel efficiency, enhanced performance, and seamless power transfer in various vehicle applications. The 1 Motor Hybrid Transmission integrates an electric motor into the torque converter, allowing for energy recovery during overrun conditions and boosting overall system efficiency. Conversely, the RWD Multi Stage Hybrid Transmission employs multiple stages to optimize torque conversion and provide a more responsive driving experience. These developments underscore the industry's commitment to delivering cutting-edge solutions that cater to the ever-evolving automotive landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN CORP.

- BorgWarner Inc.

- Continental AG

- Dynamic Manufacturing Inc.

- EXEDY Corp.

- Robert Bosch GmbH

- Schaeffler AG

- Sonnax Transmission Co. Inc.

- SUBARU Corp.

- Transtar Industries Inc.

- Valeo SA

- Voith GmbH and Co. KGaA

- Yutaka Giken Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The torque converter market encompasses power train mechanisms that transmit engine torque to the transmission in automotive applications. These mechanisms play a crucial role in enabling smooth acceleration and seamless gear shifting in both passenger vehicles and commercial vehicles. The demand for torque converters is driven by several factors, including the increasing popularity of automatic transmissions and the integration of electric vehicle technology. Automatic transmissions have gained significant traction in recent years, particularly In the luxury vehicle segment. These transmissions offer enhanced vehicle performance and improved fuel efficiency, making them a preferred choice among consumers. Torque converters are an essential component of automatic transmissions, facilitating the transfer of engine torque to the transmission without the need for manual gear shifts.

Moreover, the integration of electric vehicle technology and hybrid systems in automobiles has led to the evolution of torque converters. In electric vehicles, torque converters function as fluid coupling devices, enabling the seamless integration of internal combustion engines and electric motors. In hybrid systems, they facilitate the transfer of torque between the engine and electric motor, ensuring optimal vehicle performance. The automotive industry's shift towards autonomous driving technology is another factor driving the growth of the torque converter market. Autonomous vehicles require advanced power train mechanisms to ensure optimal performance and efficiency. Torque converters play a vital role in enabling smooth acceleration and seamless gear shifting In these vehicles, making them an essential component of the power train.

Fleet operators and vehicle owners also prioritize fuel efficiency and reduced pollution In their purchasing decisions. Torque converters contribute to improved fuel efficiency by facilitating optimal power transfer between the engine and transmission. Additionally, the integration of torque converters in advanced automatic transmissions helps reduce pollution by minimizing gear shifts and optimizing engine performance. The production of torque converters involves complex manufacturing processes, including the use of clutches, damper assemblies, impellers, turbines, and stators. Automated manufacturing processes have become increasingly prevalent In the industry, enabling the mass production of high-quality torque converters with consistent performance. In conclusion, the torque converter market is driven by several factors, including the increasing popularity of automatic transmissions, the integration of electric vehicle technology, and the demand for improved vehicle performance and fuel efficiency.

The market is expected to continue growing as the automotive industry evolves towards advanced power train mechanisms and autonomous driving technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1263.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Torque Converter Market Research and Growth Report?

- CAGR of the Automotive Torque Converter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive torque converter market growth of industry companies

We can help! Our analysts can customize this automotive torque converter market research report to meet your requirements.