Automotive Usage-Based Insurance Market Size 2024-2028

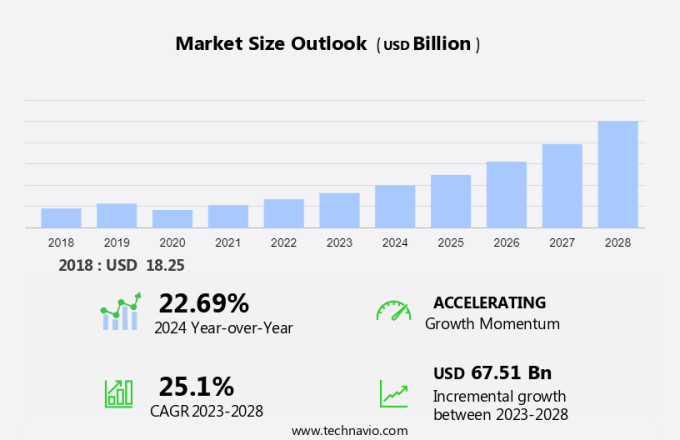

The automotive usage-based insurance market size is expected to grow by USD 67.51 billion at a CAGR of 25.1% from 2023 to 2028. Market growth is driven by flexible pricing models offering personalized coverage, government regulations mandating motor vehicle insurance, and advancements in telematics and data analytics. These factors enable innovative UBI programs and foster an environment of innovation and advancement. Trends indicate a shift towards smartphone-based UBI and mobility-as-a-service, revolutionizing traditional insurance models. However, challenges such as data security issues and fraudulent claims persist, requiring continuous advancements in telematics and state regulations to ensure the integrity of the automotive insurance ecosystem. As insurers and OEMs develop new solutions, the industry adapts to evolving consumer needs and embraces technological advancements.

What will be the Size of the Automotive Usage-Based Insurance Market During the Forecast Period?

For more highlights about this market report, Download Free Sample in a Minute

Automotive Usage-Based Insurance Market Segmentation

The automotive usage-based insurance market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Application Outlook

- Embedded UBI

- App-based UBI

- Pricing Scheme Outlook

- PHYD

- PAYD

- MHYD

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

The market is revolutionizing the insurance industry with its focus on telematic devices and connected cars. This innovative approach to insurance relies on on-road vehicles equipped with car telematics to track automotive usage and consumer driving behavior. Insurance companies leverage telematics data gathered from smartphones and black box devices to offer personalized insurance premiums based on factors like location tracking and fuel consumption. This shift from traditional insurance models to UBI and specialty insurance creates an automotive usage-based insurance ecosystem, enhancing data security and enabling vehicle recovery while addressing concerns such as fraudulent claims. With the integration of advanced technology and hybrid-based UBI, the market continues to expand, catering to both passenger cars and commercial vehicles in the mobility-as-a-service landscape.

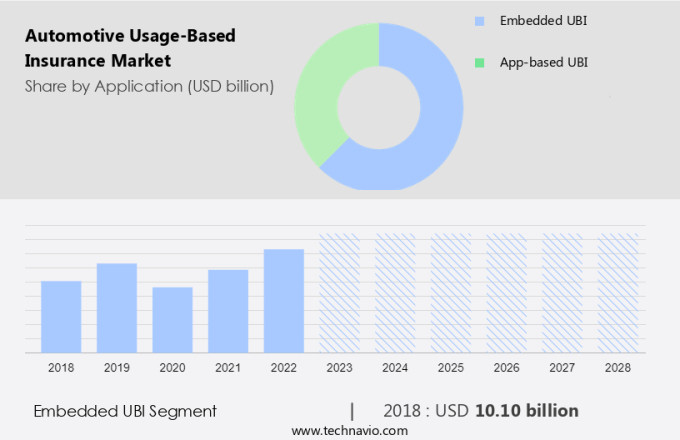

By Application

The embedded UBI segment is estimated to witness significant growth during the forecast period. Embedded UBI solutions use external devices fitted into vehicles onboard diagnostics (OBD) to collect data about driving behavior. The data is transmitted to the insurer for optimum premium pricing. As the requirement of an external device posed a challenge for the adoption of embedded UBI and on-board diagnostics telematics, app-based UBI saw high adoption in the last 2-3 years.

Get a glance at the market contribution of various segments. Download PDF Sample

The embedded UBI was the largest segment and was valued at USD 10.10 billion in 2018. Additionally, governments around the world have established various committees to ensure safety during road transportation. Russia, Brazil, and many countries in Europe have mandated automotive telematics, such as emergency calls and stolen vehicle assistance, in vehicles. This trend will likely be followed by developing nations like India and China during the forecast period, thereby increasing the market share of embedded solutions. Additionally, it is expected that higher adoption of embedded solutions from luxury OEMs as they are ready to invest heavily in differentiating their products in the market. Therefore, the adoption of embedded UBI solutions in the automotive market will witness a continuous rise. This, in turn, is expected to drive automotive usage-based insurance market growth during the forecast period.

Key Regions

For more insights on the market share of various regions, Download PDF Sample now!

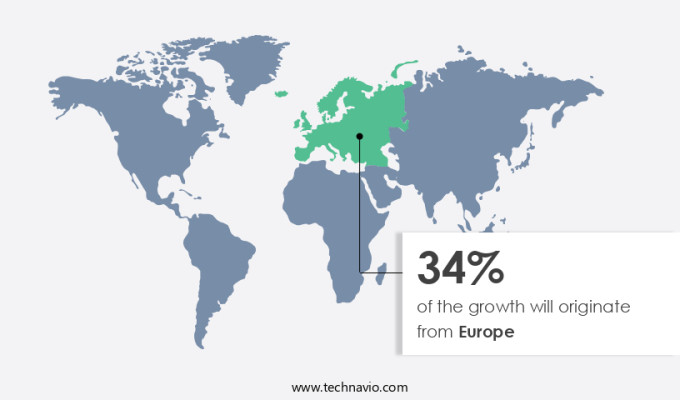

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Europe dominates the automotive market. Factors such as pricing play an important role in the adoption of automotive UBI in this region. The largest distribution channel in Europe is through price comparison websites. These websites allow users to compare and choose among the various offerings provided by insurers. Additionally, customers in Europe make decisions purely based on pricing owing to less product differentiation among insurers. Continuous advancements in technologies and services have contributed to the dynamism of the persistently developing in-vehicle telematics systems in the market. The market in Europe responded positively to the developments in telematics systems and witnessed high adoption in the last few years.

However, Europe is expected to witness slower growth than other regions owing to the preference for alternative transport and smartphone-enabled GPS navigation in the region. Additionally, luxury electric cars are witnessing high adoption in Europe. The region is expected to witness a high demand for luxury cars and create a new avenue for embedded UBI solutions during the forecast period, accelerating the growth momentum of the automotive usage-based insurance market in the region during the forecast period.

Automotive Usage-Based Insurance Market Dynamics

The market is driven by the increasing adoption of telematic devices in connected cars, enabling insurance companies to offer usage-based insurance. This technology tracks consumer driving behavior and provides personalized premiums based on factors like location tracking and fuel consumption. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Increasing government regulations for insurance coverage is notably driving automotive usage-based insurance market growth. In most countries worldwide, it is mandatory for a vehicle that runs on public roads to have motor insurance. In some countries, such as India, third-party motor insurance is compulsory for vehicles that run on public roads. Anyone who owns or operates a vehicle in Maine, US, must carry at least the minimum amount of insurance required by the law. The law requires uninsured/underinsured motorist coverage at a minimum of USD 50,000 per person or USD 100,000 per accident.

Also, the Insurance Regulatory and Development Authority of India (IRDAI) seems to support usage-based auto insurance. Major auto insurance providers are likely to start to offer such plans in the future, as the nation's top insurance authority encourages insurers. Furthermore, with insurance becoming mandatory for citizens, the market is expected to experience significant growth during the forecast period.

Significant Market Trends

The growing application of automotive UBI in accident investigation and recovery of stolen vehicles is an emerging trend shaping market growth. The tracking and telemetry information gathered by usage-based insurance programs can also be applied to accident investigations. When GPS data is available before an event, it can make forensic analysis of the vehicle involved in the collision much simpler. Details like how quickly the driver was driving and to what extent they applied brake can all aid in accident investigations to determine which party was more at fault. The gathering of this information may also aid in identifying false claims and preventing payouts.

However, many UBI systems depend on tracking devices that are installed in cars, when a car is reported stolen, customers can get in touch with their insurance and ask them to send them the GPS tracking data for the vehicle. This can assist law enforcement and drivers in locating the stolen car precisely. Thus, the application of automotive UBI in accident investigation and recovery of stolen vehicles is expected to positively impact automotive usage-based insurance market growth during the forecast period.

Major Market Challenge

The high complexity of automotive UBI solutions is a significant challenge hindering market growth. Automotive UBI solutions are very complex as they require extensive data management and analytics capabilities. In addition, embedded UBI solutions require an external device to be integrated into the vehicle, the cost of which cannot be passed on to customers. Insurers struggle to design a system that is best suited to the needs of end-users. Also, as telematics is a highly technical process, its cost is expected to increase during the forecast period, which will increase the operating cost of automotive UBI and restrain market growth.

Moreover, the effective penetration of automotive UBI would require data pooling. However, leading players keep their data confidential and do not share it with other players, thereby restricting data availability. Such limitations force new players to run pilot programs for primary data collection and incorporate the findings into their UBI product designs. This complexity increases the time of new product development and will hinder automotive usage-based insurance market growth during the forecast period.

Customer Landscape

The automotive usage-based insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive usage-based insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Who are the Major Automotive Usage-Based Insurance Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AXA Group - The company offers automotive usage based insurance namely Pay As You Grab for private hire car drivers in partnership with GRAB.

The automotive usage-based insurance market research and growth report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- ACKO General Insurance Ltd.

- Allianz SE

- Aviva insurance Ltd.

- Desjardins Group

- Discovery Ltd.

- Direct Line Insurance Group Plc

- GEICO

- HDFC Bank Ltd.

- Lemonade Inc.

- Liberty Mutual Insurance Co.

- Mile Auto Inc.

- Nationwide Mutual Insurance Co.

- Root Inc.

- The Allstate Corp.

- The Progressive Corp.

- The Travelers Co. Inc.

- USAA

- Verizon Communications Inc.

- Zurich Insurance Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The market is witnessing rapid growth, driven by the convergence of the automotive industry and insurance businesses. This synergy leverages connected car services and telematics companies to collect data on driver's safety and vehicle usage patterns. Utilizing machine learning and predictive modeling technologies, insurers offer personalized premiums through pay-as-you-drive insurance (PAYD), pay-how-you-drive insurance (PHYD) and manage-how-you-drive insurance (MHYD) models. These programs, including OBD-II-based and smartphone-based UBI, cater to both new and used vehicles, spanning light-duty to heavy-duty vehicles. Amidst privacy concerns, data privacy regulations, and the emergence of blockchain technology, the market focuses on financial protection and data-driven solutions to address uncertainties and safeguard policyholders and businesses alike.

Moreover, in the market, data platform and analytics firms, alongside big data companies and cloud service providers, play pivotal roles in processing and analyzing vast amounts of data. OEMs (original equipment manufacturers) integrate telematics systems into vehicles, enabling telematics insurance and innovative UBI programs like PAYD, PHYD, and MHYD. These solutions, including OBD-II-based, smartphone-based, and hybrid-based UBI programs, cater to diverse vehicle types, from new to used, including light-duty and heavy-duty vehicles. By focusing on policyholder needs and leveraging smartphone-centric solutions, insurers aim to mitigate risks associated with uncertain events while safeguarding assets and providing personalized coverage.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.1% |

|

Market Growth 2024-2028 |

USD 67.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

22.69 |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, Canada, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AXA Group, ACKO General Insurance Ltd., Allianz SE, Aviva insurance Ltd., Desjardins Group, Discovery Ltd., Direct Line Insurance Group Plc, GEICO, HDFC Bank Ltd., Lemonade Inc., Liberty Mutual Insurance Co., Mile Auto Inc., Nationwide Mutual Insurance Co., Root Inc., The Allstate Corp., The Progressive Corp., The Travelers Co. Inc., USAA, Verizon Communications Inc., and Zurich Insurance Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our automotive usage-based insurance market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Usage-Based Insurance Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market industry across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this automotive usage-based insurance market research report to meet your requirements.