Baby Carrier Market Size 2025-2029

The baby carrier market size is forecast to increase by USD 181 million at a CAGR of 3.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards active parenting and the desire for convenient, hands-free solutions for childcare. Innovation and portfolio extension are key drivers in the market, with companies introducing premiumized products that offer advanced features and improved ergonomics. The emergence of innovative baby carriers, such as those with adjustable fits and multiple carrying positions, is further fueling market growth. However, the market is not without challenges. The limited life cycle of baby carriers, as children outgrow them quickly, necessitates frequent replacements.

- Additionally, safety concerns, such as hip dysplasia and spine development issues, remain a significant challenge for manufacturers. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on product innovation, safety standards, and effective marketing strategies to reach and retain customers.

What will be the Size of the Baby Carrier Market during the forecast period?

- The market in the United States is experiencing significant growth due to the increasing number of nuclear households and the rising demand for hands-free options for parents. Wearable carriers, including baby slings, wraps, backpack carriers, and buckled carriers, are popular choices for parents seeking comfort and convenience while caring for their infants. The market's sizeable growth can be attributed to the emphasis on infant safety and security, as well as the desire for self-comfort and mobility for both parents and babies.

- Ergonomic designs and durability are essential factors driving market trends, with a focus on ensuring optimal baby positioning and parental comfort. The e-commerce sector plays a crucial role in the market's expansion, enabling easy access to a wide range of carrier options for consumers. Overall, the market is expected to continue growing as parents prioritize their babies' comfort and their own mobility and efficiency in managing household chores.

How is this Baby Carrier Industry segmented?

The baby carrier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Channel

- Online

- Offline

- Product

- Buckled baby carrier

- Baby wrap carrier

- Baby sling carrier

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

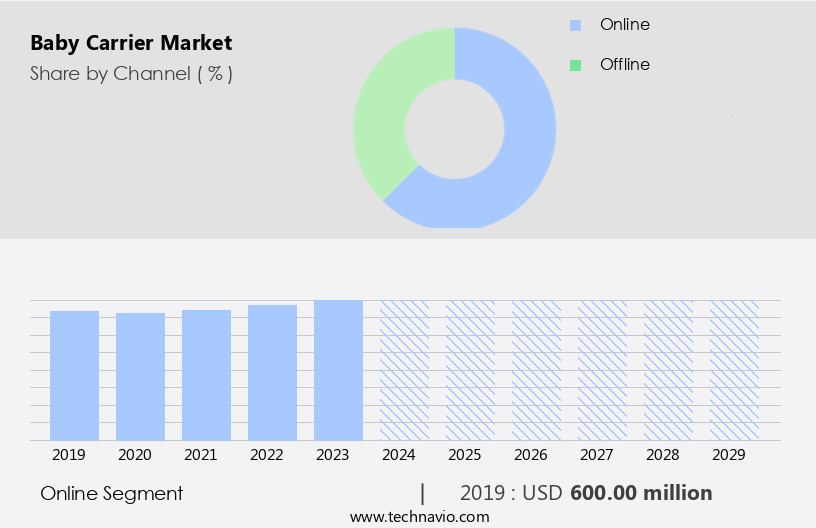

By Channel Insights

The online segment is estimated to witness significant growth during the forecast period.

The market is experiencing a significant shift towards online shopping as consumers increasingly prefer the convenience and wide selection offered by e-retailers. Major baby care product categories, including Mei-Tai carriers, Pouch slings, Ring slings, and customizable options like Backpack carriers and Hip seat carriers, are accessible through online retailers such as Amazon.Com and Alibaba Group. This trend is driven by advancements in Internet technology and the widespread adoption of smart gadgets. The online retail segment, a part of the e-commerce sector, is expected to significantly impact the market landscape in the future. This shift towards online retailing presents growth opportunities for existing companies in the baby carrier category, as they can reach a larger customer base and offer hands-free convenience, comfort, and baby safety features, such as adjustable shoulder straps, lumbar support systems, and aerial buckle carriers.

Parents value the emotional development and physical development benefits of babywearing, and health-conscious parents prioritize baby safety and durability. Social media influencers and parenting blogs also play a crucial role in promoting baby sling carriers and other babywearing options. Overall, the market is witnessing a in demand for hands-free, comfortable, and secure baby holding solutions.

Get a glance at the market report of share of various segments Request Free Sample

The Online segment was valued at USD 600.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

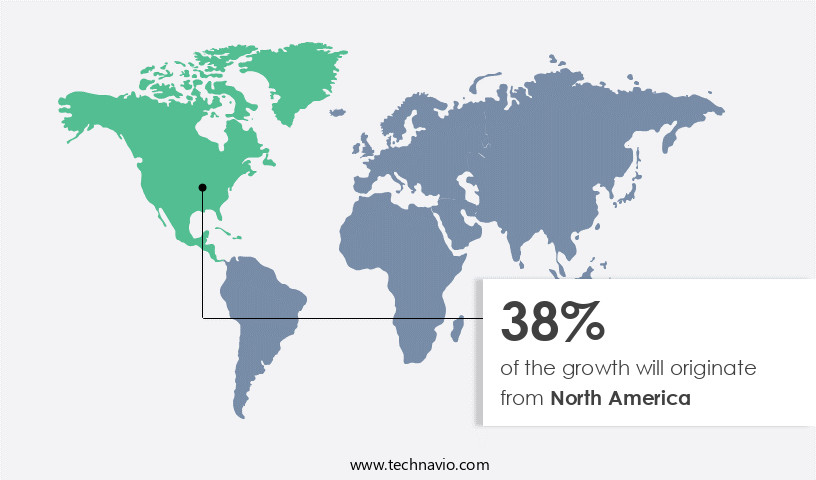

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by the prioritization of baby comfort and hands-free convenience for working mothers and parents handling household chores. This market is primarily influenced by government regulations that ensure the safety and well-being of infants. Baby safety is a significant concern, particularly during travel, where the use of approved baby carriers is mandatory in most states. Mei-Tai carriers, pouch slings, ring slings, shoulder straps, hip seat carriers, and other wearable carriers cater to various parental needs. Customizable options, ergonomic designs, and adjustable waist belts enhance the user experience. Influencers, celebrities, and parenting blogs promote the benefits of babywearing, contributing to the market's growth.

The online retail segment, including e-commerce platforms, is a significant contributor to the market's expansion. Eco-friendly materials and fashion-forward designs further boost consumer expenditure on baby care products. The market offers a range of baby sling carriers, backpack carriers, and buckled baby carriers, ensuring that parents have various options to meet their individual requirements. Babywearing provides numerous benefits, such as promoting emotional development, improving bonding between parents and babies, and enabling parents to multitask effectively. Pediatricians and health-conscious parents advocate for the use of baby carriers, emphasizing their role in supporting physical development. The market's durability and security features cater to the demands of modern parents, making baby carriers an essential baby care product.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Baby Carrier Industry?

- Innovation and portfolio extension leading to product premiumization is the key driver of the market.

- The market has witnessed significant advancements, with innovative features driving the demand for premium carriers. Manufacturers have responded by integrating ergonomic designs and add-on features, making parenting more convenient. For example, Ergobaby offers a range of collections such as Adapt, Omni 360, original, Cool Air Mesh, Baby Wrap, and Bundle of Joy. Each collection caters to specific criteria, with the Omni 360 Baby Carrier All-In-One being a notable product. This carrier is adjustable in various positions, including front carry (facing parent), front carry (facing out), hip carry, and back carries, offering versatility and comfort for parents and infants alike.

- The integration of such features has led to product premiumization as companies aim to cater to the evolving needs of modern parents.

What are the market trends shaping the Baby Carrier Industry?

- Emergence of innovative baby carriers is the upcoming market trend.

- In The market, companies have differentiated themselves by introducing technologically advanced and innovative products. For instance, Britax and Ergobaby offer ergonomically designed baby carriers that prioritize safety and comfort. Ergobaby's Adapt Baby Carrier line is an example, featuring adjustable and easy-to-use carriers for infants and young children. This product boasts crossable shoulder straps for improved comfort and a personalized fit, is machine washable, and offers three carry positions: front-inward, hip, and back carry.

- The advanced features of these baby carriers cater to the evolving needs of modern parents, making them a preferred choice. companies continue to invest in research and development to introduce more innovative solutions, ensuring the market remains dynamic.

What challenges does the Baby Carrier Industry face during its growth?

- Limited life cycle of baby carriers is a key challenge affecting the industry growth.

- The market faces a significant challenge due to the short life cycle of these products. As babies grow, they require carriers that cater to their changing age, weight, and size. Established brands often offer expensive baby carriers, making it an unfavorable financial decision for parents who need to frequently purchase new carriers. This circumstance may deter potential customers, potentially limiting sales during the forecast period. Safety concerns also play a crucial role in the market. Using inappropriate baby carriers for a baby's weight can pose risks. Adhering to safety guidelines is essential to ensure the well-being of the child.

- This requirement adds to the importance of selecting the right baby carrier and may influence purchasing decisions. In , the market faces challenges due to the short life cycle and the cost of established brands, as well as the necessity for safety and appropriately sized carriers for growing infants. These factors may impact sales volume during the forecast period.

Exclusive Customer Landscape

The baby carrier market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the baby carrier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, baby carrier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baby K tan LLC - The company showcases a range of baby carriers, including the active oasis model in black, catering to parents seeking ergonomic and versatile solutions for carrying their infants. These carriers prioritize comfort for both parent and baby, enabling on-the-go convenience and fostering a close bond. The active oasis model, in particular, is designed with an adjustable fit and breathable fabric, making it an ideal choice for active parents. This selection of baby carriers aligns with our commitment to providing high-quality, functional products for families.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baby K tan LLC

- BabyBjorn AB

- Beachfront Baby LLC

- Bitybean LLC

- Blue Box

- Boba Inc.

- BREVI MILANO Spa

- BRITAX ROMER Kindersicherheit GmbH

- Chicco

- Combi Corp.

- Kol Kol

- L echarpe Porte-bonheur Inc.

- Lalabu LLC

- lillebaby LLC

- Mothers Lounge LLC

- R for Rabbit Baby Products Pvt. Ltd.

- Soul Slings

- Tetra Clothing

- The ERGObaby Carrier Inc.

- Twingo LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the growing demand for hands-free and ergonomic solutions for infant care. This segment encompasses a range of products, including Mei-Tai carriers, pouch slings, ring slings, and backpack carriers. These carriers offer parents the convenience of keeping their babies close while allowing them to manage household chores and work responsibilities. Baby comfort and physical development are key considerations in the design of these carriers. Pediatricians often recommend babywearing as it promotes self-comfort and emotional development in infants. Customizable options, such as adjustable shoulder straps and waist belts, ensure a comfortable fit for both parent and baby.

The market is driven by the increasing number of working mothers and nuclear households. Parents value the mobility and flexibility that these carriers provide, enabling them to care for their babies while managing their daily routines. The online retail segment and the e-commerce sector have seen significant growth in this market due to their convenience and accessibility. Consumer expenditure on baby care products continues to rise, with baby carriers being a popular choice. The market offers a variety of options, from budget-friendly stretchy wraps and slings to more expensive, ergonomically designed carriers with lumbar support systems and aerial buckle carriers.

Social media influencers and parenting blogs have played a significant role in popularizing babywearing. Fashion-forward designs and eco-friendly materials have also become important factors in the market. The market caters to health-conscious parents who prioritize their babies' safety and well-being. The market is highly competitive, with numerous players offering a range of products. Durability and security are crucial factors that differentiate one brand from another. Offline retail stores continue to coexist with online retailers, offering consumers a choice between trying out products in person and purchasing them online. In , the market is a dynamic and growing industry that caters to the evolving needs of modern parents.

The market offers a range of products, from traditional slings to advanced, ergonomically designed carriers, with a focus on comfort, convenience, and safety. The market is driven by factors such as the increasing number of working mothers, the growing popularity of babywearing, and the rise of e-commerce.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 181 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, France, Canada, UK, India, Japan, Brazil, Germany, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Baby Carrier Market Research and Growth Report?

- CAGR of the Baby Carrier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the baby carrier market growth of industry companies

We can help! Our analysts can customize this baby carrier market research report to meet your requirements.