Baby Clothing Market Size 2025-2029

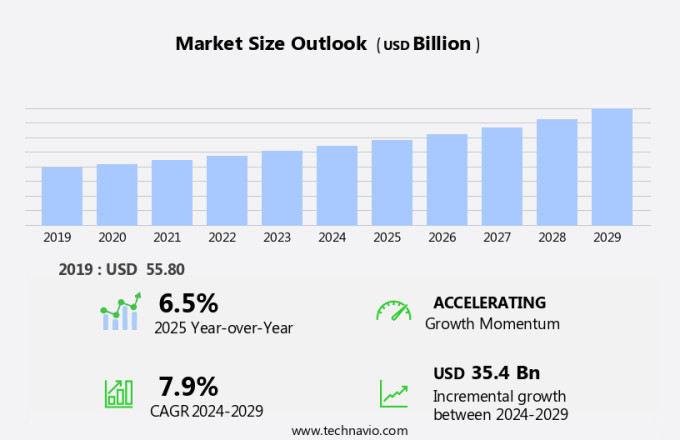

The baby clothing market size is forecast to increase by USD 35.4 billion, at a CAGR of 7.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing awareness towards the safety and comfort of babies. Parents are increasingly prioritizing clothing that ensures the well-being of their infants. This trend is further bolstered by the advent of biosensors-integrated baby apparels, which offer real-time monitoring of vital signs, temperature, and other essential parameters. However, the market faces challenges, including the growing prevalence of leasing practices for online baby products. This trend, while beneficial for cost-conscious parents, poses challenges for clothing manufacturers and retailers. As leased items are returned and resold, maintaining consistency in quality and ensuring authenticity becomes a significant challenge.

- Companies must navigate this landscape by focusing on innovation, quality, and transparency to build trust and loyalty among consumers. By addressing these challenges and capitalizing on the growing demand for safe and comfortable baby clothing, market participants can seize opportunities and stay competitive in the evolving market landscape.

What will be the Size of the Baby Clothing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic trends shaping its landscape. Bamboo fabric, known for its breathability and softness, gains popularity among parents seeking eco-friendly options. Dry clean and machine washable clothing cater to the busy lifestyles of modern families. Weight ranges and sizing charts ensure proper fit for various age groups, from newborns to toddlers. Product photography showcases the latest designs, while influencer marketing and social media campaigns boost brand visibility. High chairs and car seats necessitate coordinating outfits, leading to increased demand for matching clothing lines. Brand storytelling resonates with consumers, emphasizing ethical sourcing, fair trade practices, and sustainable materials.

Online sales and e-commerce platforms dominate the market, influencing retail displays and gender-neutral designs. Safety standards, such as flammability and dye migration, are crucial considerations. Burp cloths, diaper bags, and baby monitors are essential accessories, often marketed with content marketing strategies. Brand loyalty is fostered through customer reviews and word-of-mouth recommendations. Hand wash and tumble dry options cater to parents' convenience. Cotton blends and organic cotton offer affordability and sustainability. Baby carriers and play mats complete the range of must-have baby essentials. The market's continuous unfolding reflects the ever-changing needs and preferences of parents and families.

How is this Baby Clothing Industry segmented?

The baby clothing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Outerwear

- Underwear

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

. By Product Insights

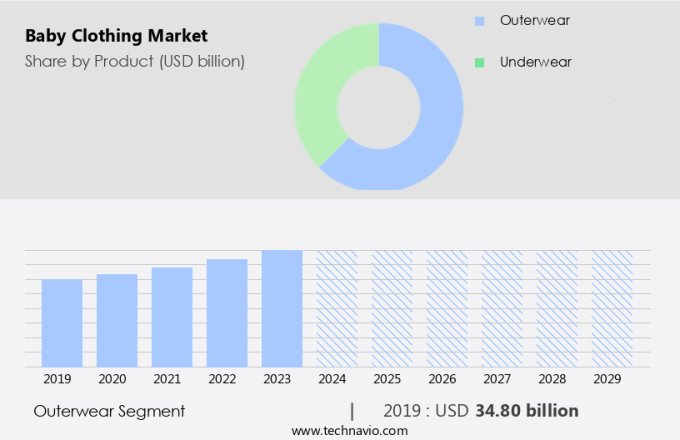

The outerwear segment is estimated to witness significant growth during the forecast period.

The market encompasses apparel for infants and toddlers, aged between 0 to 36 months. This market is segmented into outerwear and innerwear. Outerwear, which includes dresses, pajamas, bodysuits, socks, cardigans, sweatshirts, and others, was the largest segment in 2024. Comfortable and suitable for outdoor use, outerwear is popular among parents. Meanwhile, bottom wear, such as trousers and leggings, holds a significant share due to their unisex nature and high consumer demand. Product photography plays a crucial role in marketing baby clothing, showcasing the softness and quality of fabrics like bamboo and cotton blend. Social media and influencer marketing are effective strategies, reaching vast audiences and generating buzz around new collections.

E-commerce platforms dominate sales, offering convenience and a wide range of options. Age-appropriate retail displays and gender-neutral or gender-specific designs cater to diverse consumer preferences. Safety standards, sizing charts, and flammability standards are essential considerations in manufacturing. Eco-friendly practices, including fair trade and ethical sourcing, are increasingly important to consumers. Diaper bags, burp cloths, and car seats are essential accessories. Content marketing and customer reviews help build brand storytelling and trust. Machine washable, hand wash, and tumble dry options ensure practicality for parents. Sustainable materials, such as organic cotton and bamboo, are preferred for their environmental benefits. Play mats provide a safe and comfortable space for babies to play.

The Outerwear segment was valued at USD 34.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with a focus on sustainable and eco-friendly manufacturing becoming increasingly prominent. Bamboo fabric, known for its softness and breathability, is a popular choice for parents seeking sustainable options. Dry cleaning and machine washable items cater to the convenience of modern families. Product photography and influencer marketing are essential strategies for brands to showcase their offerings on social media platforms. High chairs, diaper bags, and car seats are essential baby items, with safety standards and ethical sourcing being key considerations. Age ranges from newborn to toddler are catered to, with sizing charts and safety certifications ensuring a perfect fit.

Online sales and e-commerce platforms dominate the market, with retail displays also featuring prominently in brick-and-mortar stores. Gender-neutral and organic cotton options are gaining popularity, as are fair trade practices and content marketing to engage consumers. Weight ranges from light to heavy are accommodated, with hand wash and tumble dry options available for those seeking convenience. Safety standards and flammability regulations are strictly adhered to, and baby monitors provide peace of mind for parents. Burp cloths, play mats, and baby carriers are essential accessories, with customer reviews playing a crucial role in purchasing decisions. Eco-friendly manufacturing, including the use of sustainable materials, is a growing trend.

Cotton blend and gender-neutral options cater to diverse consumer preferences, ensuring a broad market reach.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Baby Clothing Industry?

- The increasing prioritization of baby safety and comfort is the primary market motivator. Parents prioritize convenience and safety when selecting baby clothing, opting for designs without intricate adornments such as buttons or laces. The sensitivity and delicacy of a baby's skin necessitates soft and gentle materials for their clothing. These considerations have led to an increased demand for baby clothing made from sustainable materials, including organic cotton. Customer reviews play a significant role in purchasing decisions, with positive feedback influencing parents' choices. Baby carriers, play mats, and clothing that are machine washable and tumble dryer-friendly are highly sought after for their ease of care.

- Parents appreciate the convenience of being able to clean these items quickly and efficiently, ensuring that their baby's clothing remains fresh and hygienic. As the market for baby clothing continues to grow, manufacturers are focusing on producing high-quality, comfortable, and safe products that cater to the unique needs of parents and babies alike.

What are the market trends shaping the Baby Clothing Industry?

- The emerging trend in the market involves the advent of biosensors integrated into baby apparels. This innovative technology is set to revolutionize infant care and monitoring.

- The market experiences significant growth due to the continuous demand for innovative and smart apparel from consumers. One such innovation is the use of biosensors in baby clothes, which has gained popularity in the global market. Manufacturers integrate sensors into the baby clothing, allowing parents to monitor their infants' activities via their smartphones. This technology provides peace of mind and enhances the overall safety and convenience for parents. Product photography and influencer marketing are essential strategies employed by brands to showcase their offerings on social media platforms. Age ranges and weight ranges are crucial considerations in the design and production of baby clothing to cater to various stages of childhood.

- Brand storytelling is also an essential aspect of marketing in the baby clothing industry, as parents seek to connect with the values and mission of the brands they choose. High chairs and other baby gear often complement baby clothing, creating opportunities for cross-promotion and bundled sales.

What challenges does the Baby Clothing Industry face during its growth?

- The leasing practice poses a significant challenge to the growth of the baby products industry. This business model, which allows consumers to rent or lease baby items instead of purchasing them outright, has gained popularity in recent years. However, it presents several challenges for industry players. For instance, it can lead to decreased sales of new baby products as consumers opt for leasing instead. Additionally, it may impact the pricing strategy of companies, as they may need to adjust their prices to remain competitive in the leasing market. Furthermore, the logistics of managing a leasing program, including inventory management and maintenance, can be complex and costly. Overall, while the leasing practice offers some benefits to consumers, it presents unique challenges that industry players must navigate to ensure long-term growth.

- The market is driven by the rapid growth and development of infants and toddlers, who require frequent clothing updates due to their outgrown garments. Parents typically purchase new clothes every two to three months, leading to a significant demand for baby apparel. This demand has given rise to alternative solutions such as leasing or renting out baby clothing. Renting clothes not only benefits parents by reducing their financial burden but also contributes to a more sustainable environment. The constant need for new clothes can lead to a large amount of textile waste. By renting or leasing, parents can reduce their carbon footprint and contribute to a more circular economy.

- Gender-specific clothing is a significant segment in the market. Retail displays and e-commerce platforms cater to the preferences of parents, offering a wide range of options for both boys and girls. However, it is essential to ensure that the clothing items are free from harmful substances such as dye migration. Fair trade practices are increasingly gaining importance in the baby clothing industry. Parents are becoming more conscious of the working conditions and ethical standards of the brands they purchase from. Therefore, companies that prioritize fair labor practices and sustainable production methods are likely to gain a competitive edge in the market.

- Diaper bags and burp cloths are essential accessories for new parents. These items are often purchased alongside clothing and contribute to the overall demand in the market. As the market evolves, e-commerce platforms are making it easier for parents to access a wide range of baby clothing options, making the shopping experience more convenient and efficient.

Exclusive Customer Landscape

The baby clothing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the baby clothing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, baby clothing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in providing high-quality, comfortable baby clothing for infants and toddlers aged 0-4 years. Our product range includes onesies, tracksuits, and hoodies, all designed to offer both comfort and style. By prioritizing originality and innovative design, we aim to elevate our offerings in the competitive the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Bed Bath and Beyond Inc.

- Brainbees Solutions Pvt. Ltd.

- Burberry Group Plc

- Capri Holdings Ltd.

- Carters Inc.

- Cotton on group

- Gerber Childrenswear

- Hanesbrands Inc.

- Hennes and Mauritz AB

- Katif Apparel

- Mothercare Plc

- NG Apparels

- Nike Inc.

- Ralph Lauren Corp.

- Royal Apparel

- Sudarshaan Impex

- The Childrens Place Inc.

- The Walt Disney Co.

- Truworths

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Baby Clothing Market

- In February 2024, H&M, the global fashion retailer, introduced a new line of sustainable baby clothing made from recycled materials, marking a significant stride in eco-conscious fashion for infants (H&M Press Release, 2024).

- In May 2024, Amazon and Walmart, two major retail giants, announced a strategic partnership to merge their baby product offerings, aiming to provide customers with a more comprehensive selection and competitive pricing (Amazon-Walmart Partnership Press Release, 2024).

- In November 2024, Carter's, the leading American brand of baby clothing, successfully completed a USD500 million stock offering to fund its international expansion and digital transformation initiatives (Carter's Securities and Exchange Commission Filing, 2024).

- In March 2025, the European Union passed new regulations requiring baby clothing to meet stringent safety standards, including flame retardancy and chemical content restrictions, to ensure consumer protection (European Parliament Press Release, 2025).

Research Analyst Overview

- The market encompasses a wide range of products, from preemie clothing to toddler apparel, seasonal wear, and layette sets. Consumers prioritize fit and comfort, leading to an increased demand for sizing guides and care instructions. Baby gear and nursery decor often include monogrammed and personalized clothing, while subscription boxes offer convenience and variety. Baby care products, such as baby formula, skincare, and washing tips, are essential complements to clothing. Accessories like ironing instructions and fit guides ensure a perfect fit for holiday wear and special occasions.

- The market for baby clothing and gear continues to evolve, with style guides and custom embroidery adding personal touches to this essential category. Children's clothing, including baby food and gift sets, completes the comprehensive offering for parents and caregivers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Baby Clothing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2025-2029 |

USD 35.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, India, Germany, Japan, South Korea, Canada, France, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Baby Clothing Market Research and Growth Report?

- CAGR of the Baby Clothing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the baby clothing market growth of industry companies

We can help! Our analysts can customize this baby clothing market research report to meet your requirements.