Baby Puffs And Snacks Market Size and Trends

The baby puffs and snacks market size is forecast to increase by USD 1.06 billion, at a CAGR of 5.36% between 2023 and 2028. The baby puffs and snacks market is experiencing significant growth, driven by several key factors. The increasing participation of women in the workforce has led to a higher demand for convenient and nutritious snack options for infants and toddlers. Moreover, packaging innovation continues to be a major trend in the market, with companies focusing on producing eco-friendly and reusable packaging to reduce waste and appeal to environmentally-conscious consumers. This makes baby food products an appealing option as they can combine health and nutrition with convenience. Organic baby foods and homemade alternatives are increasingly popular, offering pureed forms of vegetables and fruits free from chemicals and preservatives. However, the market faces challenges such as the declining birth rate and fertility rate in some regions, which may limit the size of the consumer base. Despite these challenges, the market is expected to continue growing due to the rising demand for healthy and convenient snack options for young children.

The market is evolving to meet the growing demand for nutritious and convenient food options. With more women joining the workforce, parents seek ready-made puréed baby food and nutritious snacks that support toddler nutrition. As transitioning to solid foods becomes a crucial milestone, products like teething biscuits, yogurt melts, and rice cakes are designed to address allergen fears and supply chain disruptions. The rise of the Internet of Things (IoT) is also enhancing the market by improving supply chain efficiency and ensuring non-GMO ingredients. Nutritional snacks, such as baby puffs, are crafted to be both convenient and healthful, catering to busy families who prioritize child health. This shift towards organic and allergen-free options reflects broader trends in consumer preferences for clean and wholesome foods.

Market Segmentation

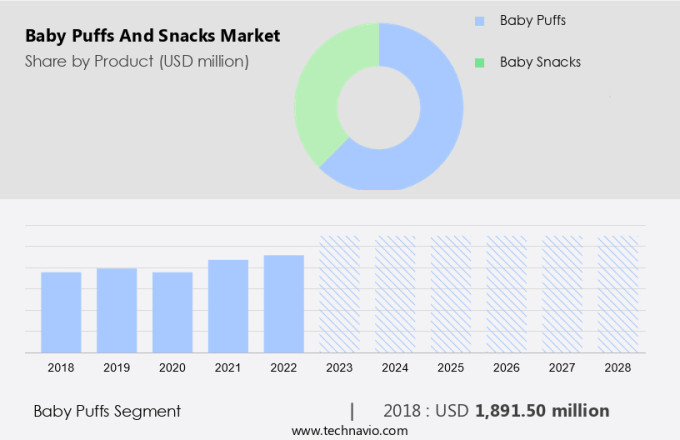

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product Outlook

- Baby puffs

- Baby snacks

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

By Product Insights

The baby puffs segment is estimated to witness significant growth during the forecast period. The Baby Puffs and Snacks market caters to the nutritional needs of toddlers transitioning from liquid to solid food. With an increasing number of women in the workforce, the demand for ready-made baby food, including puffs and snacks, has surged. These products offer essential nutrients such as proteins, calcium, iron, and vitamin D, crucial for a toddler's growth. Packaging innovations, including leakage protection and extended shelf-life, have been instrumental in the growth of this market.

Get a glance at the market share of various regions Download the PDF Sample

The baby puffs segment accounted for USD 1.89 billion in 2018. Online sales have also gained popularity due to their convenience, especially among nuclear families with limited time for grocery shopping. Parental awareness regarding hygiene and food safety has led to the preference for high-quality, organic options. The baby products industry, including baby foods and infant snacks, has seen a trend towards nutritious, gluten-free, and advertising-free offerings. Regulatory restrictions ensure the safety and quality of these products. Parenting trends have shifted towards providing nutrient-rich snacks for babysitters to feed toddlers, making the market increasingly competitive. Family planning and the rise of nuclear families have further fueled the demand for convenient, nutritious snack options for toddlers.

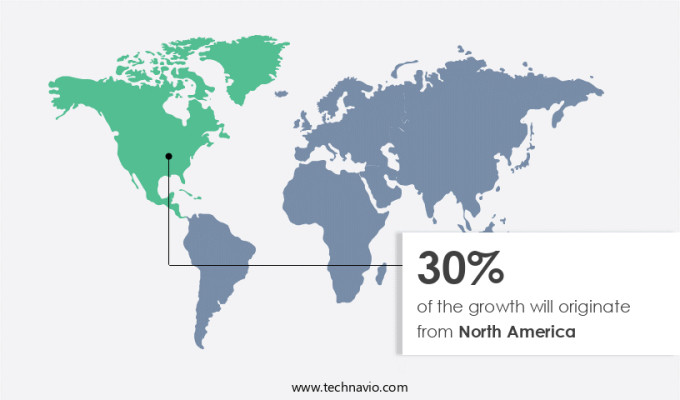

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The baby puffs and snacks market caters to the nutritional needs of toddlers transitioning from liquid to solid food. As more women join the workforce, the demand for ready-made, nutritious baby food has surged. Innovations in packaging, such as leakage protection and extended shelf-life, have made these products convenient for busy parents. The baby puffs and snacks market offers a variety of options, including pureed forms and infant snacks, ensuring the intake of essential nutrients like proteins, calcium, iron, and vitamin D. Parental awareness towards health and wellness, organic options, and gluten-free alternatives have influenced the market. Online sales have become increasingly popular due to the convenience they offer. Hygiene and food safety are crucial considerations in the baby products industry, leading to the use of high-quality packaging materials and regulatory restrictions. With family planning and the rise of nuclear families, the market for baby foods, including puffs and snacks, is expected to grow. Advertising and health concerns continue to shape parenting trends in this sector.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Increasing women's participation in the workforce is one of the key drivers fueling the baby puffs and snacks market growth. Urbanization and the growth of the middle-class population have encouraged consumers to adopt convenience-oriented lifestyles, which is likely to make baby food products a necessary option among working women.

Further, a majority of working mothers return to their jobs shortly after childbirth and are, therefore, on the lookout for healthy and convenient food options for their babies. Such factors are anticipated to drive market growth in the forecast period.

Significant Market Trends

Growing packaging innovation is one of the key baby puffs and snacks market trends propelling the market growth. Packaging is often considered to be an extension of a brand's value. The packaging of any brand or product, therefore, is crucial for generating interest and curiosity among consumers. Good packaging not only provides better protection and tamper resistance but it can also be used for marketing.

Therefore, baby food manufacturers are adopting innovative packaging strategies to increase the shelf-life of their products and attract consumers. In view of this, companies operating in the market continue to experiment with novel packaging concepts and invest heavily in the development of innovative, eco-friendly, and recyclable alternatives to conventional packaging. Such investments will propel market growth in the near future.

Major Market Challenge

The declining birth and fertility rates are one of the factors hindering the baby puffs and snacks market growth. Rapid growth in urbanization, increased awareness about family planning, and changing lifestyles are the major factors for the decline in fertility rates worldwide. Women across the world are now more liberated and are actively participating in the workforce.

Furthermore, with growing awareness about family planning, parents want a small family with one or two children. Hence, the number of nuclear families is increasing. For instance, in 2021, there were an estimated 37 million single-person households in the US. This, in turn, will further limit the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. The market forecast report focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Amara Organic Foods.: The company offers baby puffs and snacks that includes carrot raspberry, Mango carrots, Root veggie yogurt smoothie and berry fun yogurt smoothie.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Danone SA

- Every Bite Counts Pty Ltd

- Hero AG

- HiPP GmbH and Co. Vertrieb KG

- Holle baby food AG

- LesserEvil

- Little Blossom

- Mission MightyMe

- My Serenity Kids

- Neptune Wellness Solutions Inc.

- Nestle SA

- Organix Brands Ltd.

- Puffworks

- SpoonfulOne

- Sun Maid Growers of California

- The Hain Celestial Group Inc.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

Baby puffs and snacks have become a popular choice for toddlers as they transition from liquid-based foods to solid food. These snacks are not only convenient but also provide essential nutrients for growing toddlers. Nutritional elements such as proteins, calcium, iron, and vitamin D are crucial for a toddler's development. With the increasing number of women in the workforce, the demand for ready-made baby food, including puffs and snacks, has surged. Packaging innovations have played a significant role in the baby puffs and snacks market. Parents look for packaging that ensures hygiene, shelf-life, and leakage protection. The use of organic options, gluten-free, and high-quality food has become a parenting trend, with many brands emphasizing food safety and nutrition. Nuclear families and busy schedules have led to an increase in online sales of baby products, including puffs and snacks. Parental awareness regarding the importance of proper nutrition for toddlers has also influenced the market. Baby Foods, Puffs, and Infant Snacks are now available in various forms, including pureed and ready-made, catering to different family planning needs. Advertising and marketing strategies have been key in promoting baby puffs and snacks. Brands emphasize the health and wellness benefits of their products, addressing health concerns and regulatory restrictions. The baby products industry continues to evolve, with new innovations and trends shaping the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.36% |

|

Market growth 2024-2028 |

USD 1.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.03 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 30% |

|

Key countries |

US, China, Germany, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amara Organic Foods., Danone SA, Every Bite Counts Pty Ltd, Hero AG, HiPP GmbH and Co. Vertrieb KG, Holle baby food AG, LesserEvil, Little Blossom, Mission MightyMe, My Serenity Kids, Neptune Wellness Solutions Inc., Nestle SA, Organix Brands Ltd., Puffworks, SpoonfulOne, Sun Maid Growers of California, The Hain Celestial Group Inc., and The Kraft Heinz Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch