Bactericide Market Size 2024-2028

The bactericide market size is forecast to increase by USD 1.83 billion at a CAGR of 4.6% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for effective solutions to protect crop production from bacteria, fungi, and other pathogens. Bactericides are essential for maintaining crop health and ensuring optimal crop growth, as well as enhancing the nutritional value of crops. The use of bactericides is not limited to conventional farming but is also gaining popularity in organic farming practices. However, the market faces challenges due to the potential side effects associated with the use of bactericides, particularly in terms of health and environmental concerns. Prosodic agricultural fungicides, a type of bactericide, are increasingly being adopted for disease control in various applications, including ornamental plants and food crops. As health awareness continues to rise, there is a growing focus on developing eco-friendly and non-toxic bactericides to address these concerns. Synthetics continue to dominate the market, but there is a growing trend towards the use of natural and biological alternatives.

The market is a significant segment within the crop protection chemicals industry, focusing on the production and distribution of chemicals used to eliminate bacteria that pose threats to crops. Copper-based, dithiocarbamate, amide, and other bactericides are widely used in various forms, including liquid, water dispersible granule, wettable powder, foliar sprays, and soil treatments. These bactericides play a crucial role in protecting crops from various pathogens, such as bacteria, fungi, and other microorganisms that can cause diseases. In the agricultural sector, the use of bactericides is essential for ensuring the nutrition and overall health of crops, including cereals and grains, as well as nutrition enhancers and plant growth regulators.

Market Segmentation

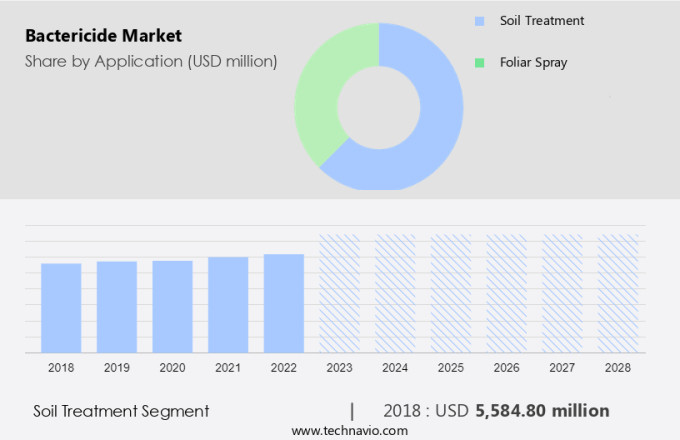

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Soil treatment

- Foliar spray

- Type

- Dry

- Liquid

- Geography

- APAC

- China

- Europe

- France

- Italy

- Spain

- North America

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

The soil treatment segment is estimated to witness significant growth during the forecast period. In agriculture, soil treatment with bactericides plays a significant role in preventing bacterial infections that can lead to diseases in various crops. These bactericides are designed to combat bacteria causing issues such as galls and overgrowths, wilts, leaf spots, specks and blights, soft rots, scabs, and canker diseases. Additionally, they are essential in preventing food spoilage. Bactericides come in various forms, including liquids and granules, with the latter available as water dispersible granules and wettable powders. Foliar sprays are also an application method. Natural bactericides, such as lemon juice and vinegar, have long been used. However, synthetic bactericides like Copper-based, Dithiocarbamate, and Amide compounds have gained popularity due to their efficacy and long-lasting impact.

Antibiotics, although primarily used in human and animal health, also find application as bactericides in agriculture. The choice of bactericide depends on the crop type. For instance, cereals and grains, oilseeds and pulses, fruits, and vegetables all have specific bactericides that work best for them. Microorganisms, the root cause of bacterial infections, are effectively targeted and controlled by these bactericides. Germicides and antibiotics are other terms used interchangeably with bactericides. The application method and frequency vary based on the bactericide type and the crop's specific requirements. Soil treatment with bactericides typically remains effective for several weeks or months. This proactive approach to agriculture ensures healthy crops and reduces the need for extensive remediation efforts later.

Get a glance at the market share of various segments Request Free Sample

The soil treatment segment accounted for USD 5.58 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

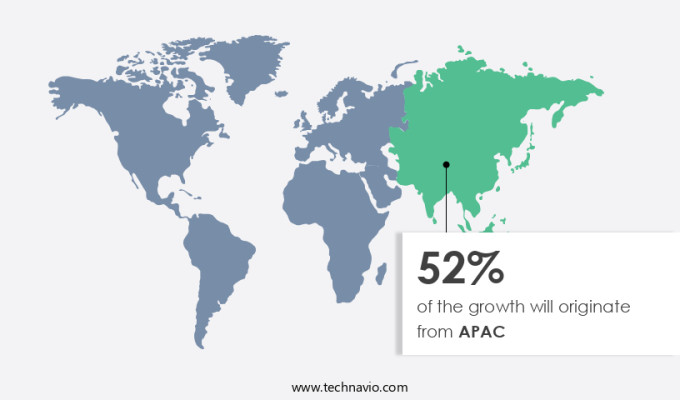

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the agricultural sector of Asia Pacific (APAC) countries like India, China, Nepal, Sri Lanka, and the Maldives, the expansion of the industry is fueling the growth of the market. With rising consumer spending on agricultural products in India projected to reach USD24 billion by 2025, the demand for bactericides will increase due to their role in eliminating pathogen attacks in agricultural fields. The agricultural sector in India is anticipated to produce 355 million tons of food and high-value commodities by 2030, necessitating the use of effective crop protection chemicals, including bactericides. Technological advancements, such as e-distribution, listing platforms, and market linkage models, are transforming the agricultural sector in India and will further boost the demand for bactericides during the forecast period.

Further, the use of bactericides is essential for soil protection, ensuring cleaner and safer crops, securing crops from blight diseases, and maintaining optimal nutrient levels for higher crop yield and output distribution. Insects pose a significant threat to crops, and bactericides play a crucial role in controlling their populations, contributing to the overall growth of the market in APAC.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for bactericide in agriculture sector is the key driver of the market. In the agricultural sector, the significance of bactericides has grown as farmers strive to safeguard their crops from detrimental bacteria. Bactericides are substances that eliminate or impede bacterial growth, and they can be administered to seeds, soil, or plants. A diverse range of bactericides exists in the market, with ongoing innovation to cater to farmers' requirements. These products are indispensable for several crops, as bacteria can cause detrimental diseases.

For instance, early blight in cherry production or fire blight in apple trees can severely impact yields. Bio rational fungicides, a subset of bactericides, have gained popularity due to their eco-friendly nature and minimal impact on human health and the environment. Farmers rely on these products to maintain farm balance and cultivate high-quality food and horticulture crops, cash crops, and plantation crops on agricultural land.

Market Trends

Increasing use of bactericides in organic farming is the upcoming trend in the market. Organic farming techniques have seen an uptick in the use of bactericides to manage pest populations and prevent disease outbreaks in modern farming practices. Initially, organic farmers shied away from synthetic materials. However, the growing demand for organic food and the increasing prevalence of bacterial diseases have led many to reconsider this stance. Bactericides play a crucial role in protecting crops from diseases, especially in the context of the global trade in fresh agricultural produce, which facilitates the spread of pests and diseases. Agrochemical companies and crop protection specialists offer a range of bactericides for use in various farming applications, including fruits & vegetables, cereals & grains, oilseeds & pulses.

Further, biodegradable and biocompatible bactericides are gaining popularity due to their environmental friendliness and compatibility with organic farming standards. Local agricultural associations also promote the use of these products to ensure food safety and improve crop yield.

Market Challenge

Side effects associated with bactericides is a key challenge affecting the market growth. Bactericides are essential chemicals employed to eliminate bacteria that pose a significant risk to crop production. Manufacturers of bactericides cater to various sectors, including agriculture, where the preservation of crop growth is crucial. However, the application of these chemicals can impact the health and wellbeing of those involved in their use, such as farmers. Common side effects of bactericides on farmers include skin irritation, gastrointestinal issues, and allergic reactions. In some instances, severe side effects, including liver and kidney damage, have been reported. These health concerns may hinder the expansion of the market in the coming years. Bactericides are instrumental in controlling bacterial infections in crops, which can significantly impact their nutritional value and overall health.

Additionally, the presence of bacteria, fungi, and other pathogens can lead to crop diseases, reducing yields and negatively affecting food quality. Agricultural fungicides are a subcategory of bactericides that are widely used for disease control. Ornamental plants also benefit from bactericide use, ensuring their health and maintaining their aesthetic value. Despite the advantages of bactericides, their potential side effects on farmers necessitate ongoing research and development of safer alternatives. Synthetic bactericides have been the primary choice for farmers due to their effectiveness, but there is growing awareness of the need for more eco-friendly options. This trend is expected to influence the future of bactericide manufacturing and usage in farming culture.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BioSafe Systems LLC: The company offers bactericides such as Guarda, Oxidate 2.0. Also, this segment focuses on the manufacturing of biodegradable crop protection, sanitation, and water treatment products.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMVAC Chemical Corp.

- BASF SE

- Bayer AG

- Biostadt India Ltd.

- Dhanuka Agritech Ltd.

- FMC Corp.

- Hawthorne Gardening Co.

- MBBT CHEMICAL Co.

- Nikki Universal Co. Ltd.

- Nippon Soda Co. Ltd.

- Nufarm Ltd.

- OmniLytics Inc.

- PI Industries Ltd.

- SePRO Corp.

- Sharda Cropchem Ltd.

- Sibbiopharm Ltd.

- Sumitomo Chemical Co. Ltd.

- SupplyTrade Ltd.

- Syngenta Crop Protection AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products used to combat bacterial infections in various crops and agricultural land. Copper-based, dithiocarbamate, amide, triazole, benzamide, and dicarboximide are among the commonly used bactericides in this market. These bactericides come in various forms, including antibiotic liquids, water dispersible granules, wettable powders, and foliar sprays. Soil treatment is a significant application area for bactericides, particularly in cereals and grains such as corn, wheat, rice, barley, sorghum, oats, and oilseeds and pulses like soybean, cotton, lentils, alfalfa, and others. Fruits and vegetables, including citrus fruits, cucurbits, leafy vegetables, apples, berries, stone fruits, spices, and bulb crops, also benefit from bactericides to ensure cleaner and safer crops.

Additionally, bactericides play a crucial role in protecting arable land from microorganisms, pests, and diseases, ensuring food security and higher crop yield. The agricultural sector relies on bactericides to combat blight diseases, pest attacks, and environmental toxicology issues. The pesticide industry offers a wide range of crop protection chemicals, including bactericides, to help farmers produce high-quality crops under various climatic conditions. Bio rational fungicides, which are bactericides derived from natural sources, are gaining popularity due to their eco-friendly nature and minimal impact on human health and the environment. Organic farming techniques and the increasing demand for organic food further fuel the growth of the market.

Further, precision farming techniques and modern farming practices also contribute to the market's expansion. Bactericides are essential for disease control in various plantation crops, cash crops, horticulture crops, and ornamental plants. They improve crop growth, nutritional value, and overall crop production. Despite their benefits, bactericides must be used responsibly to minimize potential risks to human health and the environment. Local agricultural associations and crop protection companies play a vital role in educating farmers about the safe and effective use of bactericides.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 1.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 52% |

|

Key countries |

China, Brazil, France, Spain, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AMVAC Chemical Corp., BASF SE, Bayer AG, BioSafe Systems LLC, Biostadt India Ltd., Dhanuka Agritech Ltd., FMC Corp., Hawthorne Gardening Co., MBBT CHEMICAL Co., Nikki Universal Co. Ltd., Nippon Soda Co. Ltd., Nufarm Ltd., OmniLytics Inc., PI Industries Ltd., SePRO Corp., Sharda Cropchem Ltd., Sibbiopharm Ltd., Sumitomo Chemical Co. Ltd., SupplyTrade Ltd., and Syngenta Crop Protection AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch