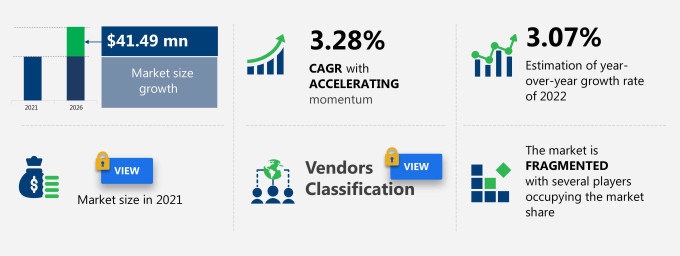

The bakery products market share in Europe is expected to surge to USD 41.49 million by 2026 at an accelerating CAGR of 3.28%.

The bakery products market in Europe research report extensively covers market segmentation by product (bread and rolls, cakes and pastries, cookies, and others) and type (fresh bakery products and frozen bakery products).

The bakery products market in Europe report also offers information on several market vendors, including AGROFERT AS, Alpha Baking Co. Inc., Associated British Foods plc, Bakers Delight Holdings Ltd., Britannia Industries Ltd., Dr. Schar AG Spa, European Gourmet Bakery, Finsbury Food Group Plc, Flowers Foods Inc., General Mills Inc., Grupo Bimbo SAB de CV, Harry Brot GmbH, Jubilant Bhartia Group, Lantmannen Unibake International, Mondelez International Inc., Premier Foods Plc, Ulker Biskuvi Sanayi AS, and Warburtons Ltd. among others. One of the key highlights of this report is the valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches.

What will the Bakery Products Market Size in Europe be During the Forecast Period?

Download the Free Report Sample to Unlock the Bakery Products Market Size in Europe for the Forecast Period and Other Important Statistics

Bakery Products Market in Europe: Key Drivers, Trends, and Challenges

The rising prominence of in-store bakeries in supermarkets is notably driving the bakery products market growth in Europe, although factors such as impact of the Russia-Ukraine conflict may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the bakery products industry in Europe. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Bakery Products Market Driver in Europe

One of the key factors driving the bakery products market growth in Europe is the rising prominence of in-store bakeries in supermarkets. Such bakeries are becoming popular because they also offer smaller sizes, such as half loaves, a package of two buns, etc., to keep all the natural products from spoiling because they do not contain any type of preservative. In addition, the par-baked, pre-baked, or bake-off range of products is increasingly making a mark in recent years. These products are also convenient for consumers as they require little labor and can be prepared in a short time. In-store bakeries in supercenters and clubhouses are among the most preferred one-stop destinations for fresh baked products owing to their freshness and quality. These bakeries are also popular for their specialty items, which will further propel the market growth in the coming years.

Key Bakery Products Market Trend in Europe

Emergence of hybrid bakery products is one of the key Europe bakery products market trends that is expected to impact the industry positively in the forecast period. Bakery food manufacturers in the region have introduced the concept of hybrid baking, where they merge two styles and varieties of baked goods to create a new variant. Consumers in most of the developed markets such as the UK, Germany, France, and others have shown interest in hybrid products. For instance, Pladis Global, which is a UK-based confectionery and snack foods company, launched the first-to-market fusion of its bestselling McVitie Jaffa cakes with a doughnut. Some of the recent hybrid bakery products include:

- Scuffin: Scone-like dough with a dense, crumbly texture, formed into a muffin shape and filled with a treat of fruit preserves

- Cruffin: The cruffin is a crossover between a croissant and a muffin.

Key Bakery Products Market Challenge in Europe

One of the key challenges to the bakery products market growth in Europe is the impact of the Russia-Ukraine conflict. The Ukraine-Russia conflict is severely impacting food sectors such as bakery and cereals and is further expected to deteriorate in the coming few months of 2022. Ukraine is a producer of wheat, corn, barley, and rye, which are major ingredients used in manufacturing bakery products. The already disrupted supply chains because of COVID-19 and poor wheat harvest in Russia surged the price of wheat by 55% since the start of the war. Russia's invasion of Ukraine and Russia's own high export taxes as the world's largest wheat exporter threaten the bakery products market in Europe. The high prices of basic ingredients are leading to the high prices for bakery products in the region, which may limit the market growth in the forecast years.

This bakery products market in Europe analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the bakery products market in Europe as a part of the global packaged foods and meats market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the bakery products market in Europe during the forecast period.

Who are the Major Bakery Products Market Vendors in Europe?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AGROFERT AS

- Alpha Baking Co. Inc.

- Associated British Foods plc

- Bakers Delight Holdings Ltd.

- Britannia Industries Ltd.

- Dr. Schar AG Spa

- European Gourmet Bakery

- Finsbury Food Group Plc

- Flowers Foods Inc.

- General Mills Inc.

- Grupo Bimbo SAB de CV

- Harry Brot GmbH

- Jubilant Bhartia Group

- Lantmannen Unibake International

- Mondelez International Inc.

- Premier Foods Plc

- Ulker Biskuvi Sanayi AS

- Warburtons Ltd.

This statistical study of the bakery products market in Europe encompasses successful business strategies deployed by the key vendors. The bakery products market in Europe is fragmented and the vendors are deploying growth strategies such as product innovation to compete in the market.

Product Insights and News

- AGROFERT AS - Under the chemistry segment, the company offers qualified chemicals, fertilizers, agrochemicals, and plastics.

- AGROFERT AS - The company offers bakery products such as fresh bread and bread products, toast bread, and fresh rolls.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The bakery products market in Europe forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Bakery Products Market in Europe Value Chain Analysis

Our report provides extensive information on the value chain analysis for the bakery products market in Europe, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

What are the Revenue-generating Product Segments in the Bakery Products Market in Europe?

To gain further insights on the market contribution of various segments Request for a FREE sample

The bakery products market share growth in Europe by the bread and rolls segment will be significant during the forecast period. The significant increase in demand for free-from products is expected to encourage other major vendors to offer such products which will drive the market growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the bakery products market size in Europe and actionable market insights on the post-COVID-19 impact on each segment.

|

Bakery Products Market Scope in Europe |

|

|

Report Coverage |

Details |

|

Page number |

114 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.28% |

|

Market growth 2022-2026 |

USD41.49 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.07 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AGROFERT AS, Alpha Baking Co. Inc., Associated British Foods plc, Bakers Delight Holdings Ltd., Britannia Industries Ltd., Dr. Schar AG Spa, European Gourmet Bakery, Finsbury Food Group Plc, Flowers Foods Inc., General Mills Inc., Grupo Bimbo SAB de CV, Harry Brot GmbH, Jubilant Bhartia Group, Lantmannen Unibake International, Mondelez International Inc., Premier Foods Plc, Ulker Biskuvi Sanayi AS, and Warburtons Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Bakery Products Market in Europe Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive bakery products market growth in Europe during the next five years

- Precise estimation of the bakery products market size in Europe and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the bakery products industry in Europe

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of bakery products market vendors in Europe

We can help! Our analysts can customize this report to meet your requirements. Get in touch