Barcode Label Printer Market Size 2024-2028

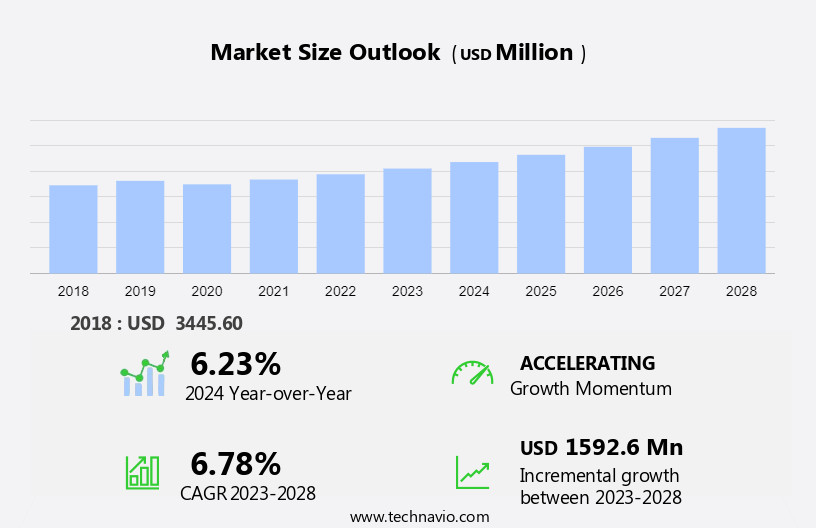

The barcode label printer market size is forecast to increase by USD 1.59 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of advanced barcode technologies such as two-dimensional (2D) barcodes. These codes offer greater data capacity and improved scanning capabilities, making them ideal for various industries, including logistics, healthcare, and manufacturing. Additionally, recent developments in barcode label printers have led to the emergence of more efficient and cost-effective solutions, catering to the evolving needs of businesses. Another key trend shaping the market is the increasing adoption of Radio Frequency Identification (RFID) printers.

- RFID technology enables contactless data transfer, offering benefits such as faster processing times, improved accuracy, and enhanced security. However, challenges such as high implementation costs and the need for standardization remain, necessitating strategic planning and investment from market participants. Companies seeking to capitalize on these opportunities and navigate challenges effectively should focus on innovation, cost reduction, and strategic partnerships.

What will be the Size of the Barcode Label Printer Market during the forecast period?

- The label printing market encompasses various offerings, including reporting, services, exhibitions, design tools, solutions, and support. Quality and compliance are paramount, with auditing and traceability ensuring accuracy and security. Label printing speed and automation drive efficiency, while upgrades and troubleshooting address technical challenges. Integration of data, synchronization, and cost-effective solutions are essential. Printhead technology and ribbon cartridges support optimal performance, and accessories cater to specific labeling needs.

- Communities, consulting, webinars, and training foster knowledge sharing. Label printing conferences and events provide opportunities for industry insights, while analytics and workflow solutions enhance productivity. Durability and resolution are crucial factors in selecting label printing solutions for businesses.

How is this Barcode Label Printer Industry segmented?

The barcode label printer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Industrial printers

- Desktop printers

- Mobile printers

- Application

- Manufacturing

- Transportation and logistics

- Retail

- Healthcare

- Others

- Geography

- North America

- US

- Europe

- Germany

- Middle East and Africa

- APAC

- China

- India

- Japan

- South America

- Rest of World (ROW)

- North America

By Product Insights

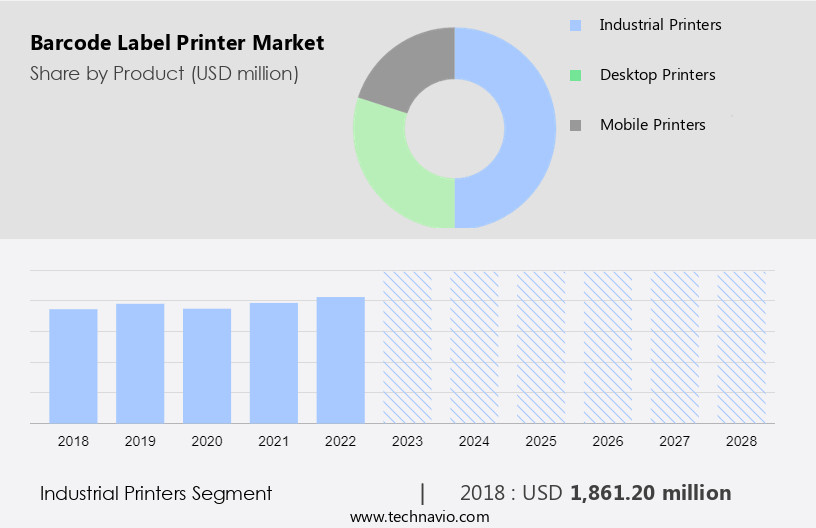

The industrial printers segment is estimated to witness significant growth during the forecast period.

Industrial printers play a crucial role in various industries for high-volume labeling applications, including manufacturing, transportation and logistics, and retail. Zebra Technologies Corporation's ZT600 Series and Honeywell International Inc.'s PXie Series, PX940, PM43, PM43c, PM23c, and M-Class Mark II printers are popular choices. These printers offer features such as error-proof labeling, easy programmability, and advanced networking connectivity and security. Industrial printers are essential for asset management, compliance labeling, cross-docking, lab sample tracking, receiving and shipping, reverse logistics, work-in-process tracking, inventory management, information labels, order labeling, and quality control. Warehouse management relies on these printers for efficient organization and tracking of stock.

Desktop label printers, on the other hand, cater to lower-volume labeling needs. Label design templates ensure consistency and compliance with regulations. Compliance labeling, label serialization, and regulatory labeling are critical applications in industries like pharmaceuticals and healthcare. Label analytics, reporting, and integration software help streamline the labeling process and maintain accurate records. Label materials, durability, and security are essential factors in selecting the right labeling solution. RFID printers offer advanced tracking capabilities, while label applicators and dispensers facilitate efficient application. Mobile label printers provide flexibility for on-the-go labeling needs. Connectivity options, including network and wireless printing, enable seamless integration with supply chain management systems and other applications.

Label validation, verification, and database management systems ensure label accuracy and traceability. Thermal transfer printers and barcode scanners are often used for industrial labeling applications, enhancing productivity and efficiency.

Get a glance at the market report of share of various segments Request Free Sample

The Industrial printers segment was valued at USD 1.86 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

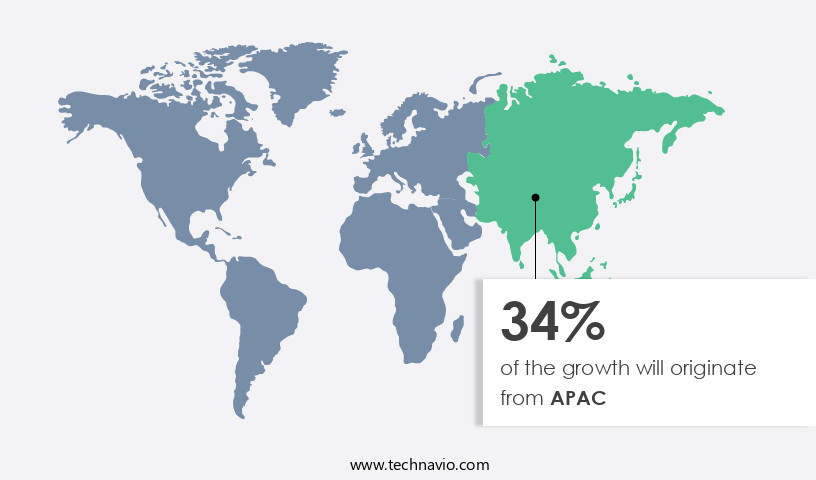

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the global labeling market, various industries rely on advanced labeling solutions to ensure product identification, regulatory compliance, and efficient supply chain management. Labeling applications span from manufacturing and inventory management to healthcare and retail sectors. Warehouse management and shipping and logistics require robust labeling systems to streamline operations and improve productivity. Label design software and reporting tools enable customization and automation, while label analytics provide valuable insights for label performance and optimization. Desktop label printers and industrial label printers cater to diverse labeling needs, with direct thermal printers and thermal transfer printers offering different benefits. Compliance labeling and regulatory labeling are essential for industries such as pharmaceuticals and healthcare, necessitating label durability and security features.

Label materials, including waterproof and temperature-resistant options, ensure label longevity. Label applicators and label dispensers facilitate efficient label application, while RFID printers and barcode scanners enable asset tracking and inventory management. Connectivity options, such as network printing and cloud printing, enhance labeling flexibility and accessibility. Label management systems and supply chain management software integrate labeling processes into broader operations, ensuring label consistency and accuracy. In the Asia Pacific region, the growing manufacturing and logistics sectors have fueled the demand for labeling solutions. Countries like China, India, Japan, and South Korea have witnessed significant growth in their industries, necessitating advanced labeling technologies to maintain regulatory compliance and improve operational efficiency.

The healthcare and retail sectors, in particular, have adopted automated labeling solutions to streamline their processes and enhance patient safety and customer experience.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Barcode Label Printer Industry?

- Increasing adoption of two-dimensional (2D) barcodes is the key driver of the market.

- The market is experiencing significant growth due to the increasing adoption of 2D barcode technology. QR codes, Data Matrix, and PDF417 are the most commonly used 2D barcodes in various industries, including retail, healthcare, and transportation and logistics. Among these, QR codes are the most popular, enabling scanning by mobile devices such as smartphones and tablets. PDF417, which consists of four bars with each pattern being 17 units long, is primarily used for inventory management. Data Matrix barcodes, recognized by their square or rectangle pattern known as the matrix, are typically used to mark small items.

- These 2D barcodes offer advantages such as increased data capacity, faster scanning, and improved error correction, making them increasingly preferred over traditional 1D barcodes.

What are the market trends shaping the Barcode Label Printer Industry?

- Recent developments in barcode label printer is the upcoming market trend.

- The market is experiencing a significant influx of new product launches, driving consumer demand for a diverse range of printers based on their specific needs. This trend intensifies competition within the industry, leading to innovation and differentiation among companies. For instance, in January 2023, Citizen Systems America Corp. Introduced the CL-H300SV, the latest addition to its desktop barcode printer series, at the National Retail Federation (NRF) event in New York City.

- This continuous focus on new product developments is a strategic move to cater to the evolving demands of consumers and maintain a competitive edge in the market.

What challenges does the Barcode Label Printer Industry face during its growth?

- Increased adoption of RFID printers is a key challenge affecting the industry growth.

- RFID label printers are essential devices for producing labels containing unique IDs or electronic product codes, marked with both a barcode and human-readable text. These printers combine a reader and a printer into one machine for mass printing and encoding applications. While barcodes can only store limited data, RFID tags offer non-volatile memory, capable of storing up to 8 kb of information. With the increasing adoption of RFID technology, manufacturers respond by integrating customized solutions to cater to diverse business requirements.

- RFID printer market dynamics reflect this trend, as businesses seek advanced features to optimize their operations. These devices offer significant benefits, such as increased efficiency, enhanced security, and improved inventory management. As RFID technology continues to evolve, it is expected that the market will expand, offering new opportunities for businesses to streamline their processes and gain a competitive edge.

Exclusive Customer Landscape

The barcode label printer market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the barcode label printer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, barcode label printer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avery Dennison Corp. - The company provides advanced barcode label printing solutions, such as the Avery Dennison Pathfinder 6059 series. These printers deliver high-quality, durable labels, ensuring efficient and accurate inventory management. With a focus on innovation and reliability, this offering caters to diverse industries, streamlining their supply chain operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avery Dennison Corp.

- Barcodes Inc.

- Brady Corp.

- Brother Industries Ltd.

- cab Produkttechnik GmbH and Co. KG

- Citizen Watch Co. Ltd.

- Datalogic SpA

- Fujitsu Ltd.

- GAINSCHA TECHNOLOGY GROUP Co.

- Honeywell International Inc.

- Newell Brands Inc.

- Panth Enterprise

- Postek Technologies Inc.

- SATO Holdings Corp.

- Seiko Epson Corp.

- Shandong New Beiyang Information Technology Co. Ltd.

- Toshiba Corp.

- TSC Auto ID Technology Co. Ltd.

- WINCODE Technology Co. Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for efficient and accurate labeling solutions across various industries. Warehouses, manufacturing facilities, and shipping and logistics companies are among the major consumers of barcode label printers, as they rely on these technologies to optimize their inventory management and streamline their supply chain operations. Desktop label printers are a popular choice for small to medium-sized businesses due to their affordability and ease of use. These printers offer label design templates, enabling users to create custom labels without requiring extensive graphic design skills. Compliance labeling and label serialization are crucial applications for barcode label printers, ensuring regulatory requirements are met and products are traceable throughout the supply chain.

Manufacturing labeling applications require high print speed and durability to withstand harsh environments. RFID printers are gaining traction in this sector due to their ability to print and encode RFID tags, providing real-time inventory tracking and automating various manufacturing processes. Regulatory labeling, patient identification, and pharmaceutical labeling are other essential applications where barcode label printers play a significant role in ensuring compliance and maintaining data integrity. Label design software and label reporting tools help businesses streamline their labeling processes and gain valuable insights into their operations. Network printing and cloud printing capabilities enable remote access to labeling systems, enhancing flexibility and productivity.

Label analytics and label archiving are emerging trends, providing businesses with data-driven insights to optimize their labeling strategies and maintain historical records. Direct thermal printers are widely used due to their affordability and simplicity, while thermal transfer printers offer higher print resolution and durability for more demanding applications. Label personalization and label security features are becoming increasingly important, as businesses look to differentiate their products and protect their brand reputation. Label materials, label dispensers, and label applicators are essential components of a comprehensive labeling solution. Label compliance and label durability are critical factors in selecting the appropriate label materials, while label applicators ensure accurate and consistent label application.

Label lifespan and label authentication are essential considerations for businesses seeking long-term reliability and security. Packaging labeling and industrial label printers cater to large-scale labeling requirements, offering high print speeds, connectivity options, and label automation capabilities. Barcode scanners and asset tracking systems further enhance the functionality of labeling solutions, enabling businesses to automate various processes and improve overall efficiency. In conclusion, the market is a dynamic and evolving landscape, driven by the increasing demand for efficient and accurate labeling solutions across various industries. The market offers a diverse range of products and solutions, catering to the unique requirements of different applications and environments.

From desktop label printers to industrial label printers, label design software to label analytics, the market continues to innovate and adapt to meet the changing needs of businesses worldwide.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 1592.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, China, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Barcode Label Printer Market Research and Growth Report?

- CAGR of the Barcode Label Printer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the barcode label printer market growth of industry companies

We can help! Our analysts can customize this barcode label printer market research report to meet your requirements.