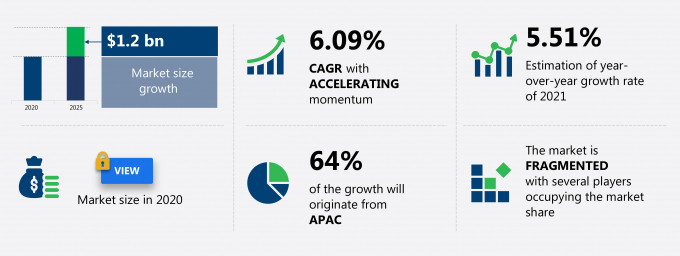

The bicycle OEM market share is expected to increase by USD 1.2 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 6.09%.

This bicycle OEM market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers bicycle OEM market segmentations by application (manual bicycles and e-Bikes) and geography (APAC, North America, Europe, MEA, and South America). The bicycle OEM market report also offers information on several market vendors, including Cheng Shin Rubber Ind. Co. Ltd., Continental AG, Derby Cycle Holding GmbH, Dorel Industries Inc., Kenda Rubber Industrial Co. Ltd., Merida Industry Co. Ltd., Michelin Group, Schwalbe Tires North America Inc., THE GOODYEAR TIRE & RUBBER Co., and Trek Bicycle Corp. among others.

What will the Bicycle OEM Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Bicycle OEM Market Size for the Forecast Period and Other Important Statistics

Bicycle OEM Market: Key Drivers, Trends, and Challenges

The increasing demand for premium bicycles is notably driving the bicycle OEM market growth, although factors such as low demand for high-end mountain bicycles in emerging countries may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the bicycle OEM industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Bicycle OEM Market Driver

The increasing demand for premium bicycles is a major factor driving the global bicycle OEM tires market share growth. The growing popularity of premium bicycles around the world is attributable to the increasing acceptance of premium bicycles that provide better riding and safety features. These premium bicycles are built using advanced technologies and modern designs by incorporating high-end materials to offer comfort and durability. Bicycles in the premium segment usually cost over $1,000 and have a target segment that comprises cycling enthusiasts, adventure seekers, and urban commuters. With the launch of e-bicycles, which are pedal-assisted, the average cost of premium bicycles is increasing. The major reason for the growth of premium bicycles is increasing average disposable income and increasing dual-household income. In addition, consumers prefer premium bicycles for recreational activities such as pursuing a hobby, healthy living, fun and fitness, outdoor activities, and hassle-free commuting. This has also led to the development of cycling clubs in cities. Therefore, the growing demand for premium bicycles is expected to be one of the driving factors for the global bicycle OEM tires market during the forecast period.

Key Bicycle OEM Market Trend

The emergence of eco-friendly bicycle OEM tires is another factor supporting the global bicycle OEM tires market share growth. The products used in manufacturing rubber compounds are polluting the environment. The tires use rubber, which is polluting the environment and also increasing the pressure on automobile and bicycle OEM tires manufacturers to reduce their carbon footprint. Thus, such environmental concerns have paved the way for innovation in terms of eco-friendly tires that are manufactured using pure rubber compounds and low-aromatic oils. High-aromatic oils, the by-products of the oil-refining process, are used in tire production to soften the rubber surface and make it easier to modify and refine. Also, high-aromatic oils have a positive impact on the durability, traction, and friction of the tires. However, they have a harmful impact on the environment due to the harmful levels of PAH compounds that are also carcinogenic. Thus, high aromatic oils are being replaced with low-aromatic oils that have low levels of harmful compounds, which makes them non-carcinogenic. Therefore, the trend of using eco-friendly bicycle OEM tires is expected to have a positive impact on the global bicycle OEM tires in the near future.

Key Bicycle OEM Market Challenge

The low demand for high-end mountain bicycles in emerging countries will be a major challenge for the global bicycle OEM tires market share growth during the forecast period. Mountain bicycles are expensive and designed to travel on uneven terrains such as log piles, fire roads, single trails, and others to reach the destination. Therefore, it is essential for such mountain bicycles to be sturdy and reliable at all times to ensure a safe journey. As these bicycles are manufactured based on ISO-4210 standard, the mountain bicycles are heavy and expensive, which makes them unaffordable for most biking enthusiasts, especially in emerging regions such as APAC. Furthermore, the high risk of injuries associated with mountain bicycles further reduces their preference in these regions. In addition, the high cost of bicycles, as well as protection and safety equipment required along with them, also pose a major challenge for the adoption of mountain bicycles in the countries in APAC and other developing economies. Therefore, the slow adoption of mountain bicycles in emerging countries will pose a considerable challenge to the vendors operating in the global bicycle OEM tires market during the forecast period.

This bicycle OEM market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global bicycle OEM tires market as a part of the global tires and rubber market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the bicycle OEM market during the forecast period.

Who are the Major Bicycle OEM Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Cheng Shin Rubber Ind. Co. Ltd.

- Continental AG

- Derby Cycle Holding GmbH

- Dorel Industries Inc.

- Kenda Rubber Industrial Co. Ltd.

- Merida Industry Co. Ltd.

- Michelin Group

- Schwalbe Tires North America Inc.

- THE GOODYEAR TIRE & RUBBER Co.

- Trek Bicycle Corp.

This statistical study of the bicycle OEM market encompasses successful business strategies deployed by the key vendors. The bicycle OEM market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Cheng Shin Rubber Ind. Co. Ltd.- The company offers bicycle tires under two brand names CST tires and Maxxis tires. It offers bicycle tires for various types of bicycles such as standard, mountain bike, BMX, Road bicycles, among others.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The bicycle oem market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Bicycle OEM Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the bicycle OEM market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global tires and rubber market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Bicycle OEM Market?

For more insights on the market share of various regions Request for a FREE sample now!

64% of the market’s growth will originate from APAC during the forecast period. China and Taiwan are the key markets for the bicycle OEM market in APAC. Market growth in this region will be faster than the growth of the market in all other regions.

The growing bicycle market due to urbanization and increasing fuel prices will facilitate the bicycle OEM market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Application Segments in the Bicycle OEM Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The bicycle OEM market share growth by the manual bicycle segment will be significant during the forecast period. Manual bicycles are human-powered and, therefore, do not require any external power. The different types of bicycles include pedal bicycles, hand-cranked bicycles, treadle bicycles, bucking bicycles, and balancing bicycles, among others. Under the manual bicycles segment, the tires used for pedal bicycles are considered for sizing. The growing demand for these bicycles is attributable to their affordable prices and easy-to-use functionalities.

This report provides an accurate prediction of the contribution of all the segments to the growth of the bicycle OEM market size and actionable market insights on post COVID-19 impact on each segment.

|

Bicycle OEM Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.09% |

|

Market growth 2021-2025 |

$ 1.2 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.51 |

|

Regional analysis |

APAC, North America, Europe, MEA and South America |

|

Performing market contribution |

APAC at 64% |

|

Key consumer countries |

China, Taiwan, The Netherlands, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Cheng Shin Rubber Ind. Co. Ltd., Continental AG, Derby Cycle Holding GmbH, Dorel Industries Inc., Kenda Rubber Industrial Co. Ltd., Merida Industry Co. Ltd., Michelin Group, Schwalbe Tires North America Inc., THE GOODYEAR TIRE & RUBBER Co., and Trek Bicycle Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Bicycle OEM Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive bicycle OEM market growth during the next five years

- Precise estimation of the bicycle OEM market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the bicycle OEM industry across APAC, North America, Europe, MEA and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of bicycle OEM market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch