Bottled Water Market Size 2025-2029

The bottled water market size is valued to increase USD 118.5 billion, at a CAGR of 6.1% from 2024 to 2029. Increasing premiumization of bottled water will drive the bottled water market.

Major Market Trends & Insights

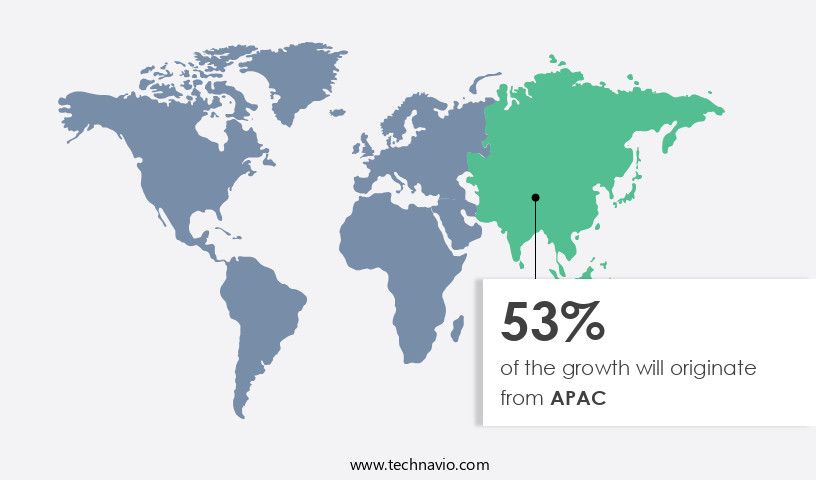

- APAC dominated the market and accounted for a 51% growth during the forecast period.

- By Product - Still drinking water segment was valued at USD 130.20 billion in 2023

- By Distribution Channel - Off-trade segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 70.46 billion

- Market Future Opportunities: USD 118.50 billion

- CAGR from 2024 to 2029 : 6.1%

Market Summary

- The market represents a dynamic and continually evolving industry, driven by consumer preferences for convenience, health, and taste. Core technologies, such as reverse osmosis and ultraviolet disinfection, are advancing to ensure product purity and safety. Applications span various sectors, including sports, healthcare, and education, with growing adoption in developing economies. Service types include home and office delivery, self-service kiosks, and e-commerce. Regulations, such as the European Union's Plastics Strategy, pose challenges in terms of sustainability and packaging innovation. In fact, according to a recent study, the global market for bottled water reached a 19.3% share in the beverage industry in 2020, underscoring its increasing importance.

- However, the market faces competition from alternative products like tap water filtration systems and reusable bottles. Despite these challenges, opportunities exist for companies that can offer premium products, innovative packaging solutions, and sustainable business models.

What will be the Size of the Bottled Water Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Bottled Water Market Segmented?

The bottled water industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Still drinking water

- Sparkling water

- Bottled spring water

- Distribution Channel

- Off-trade

- On-trade

- Packaging

- PET bottles

- Glass bottles

- Cans

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- China

- India

- Indonesia

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The still drinking water segment is estimated to witness significant growth during the forecast period.

The market experiences significant expansion, with still drinking water holding a substantial share. This trend is driven by various factors, including increasing urbanization, growing health consciousness, consumer preference for on-the-go bottled water, and innovative packaging solutions. Rising health consciousness has led consumers to opt for non-carbonated still drinking water, contributing positively to market growth. The contamination of water sources due to environmental pollution intensifies the demand for pure drinking water. Moreover, the bottled water industry anticipates continuous growth, with several developments shaping its future. Water purification methods, such as filtration membrane types and reverse osmosis processes, are becoming increasingly sophisticated to meet the evolving consumer needs.

The Still drinking water segment was valued at USD 130.20 billion in 2019 and showed a gradual increase during the forecast period.

Ozonation disinfection and chlorination processes ensure consumer safety, while microbial contamination control and quality control systems maintain high product standards. Water bottling equipment, including bottling lines and wastewater treatment plants, are essential components of the industry. Energy consumption metrics and water hardness reduction techniques are crucial for optimizing bottling line efficiency. Spring water sourcing and mineral analysis methods cater to diverse consumer preferences. Sustainable packaging options, such as UV sterilization systems and carbonated water production, are gaining popularity to minimize environmental impact. Mineral water content and plastic bottle production are essential considerations for manufacturers. Water filtration techniques and environmental impact assessments are essential for ensuring water quality standards.

The industry's future growth is expected to be influenced by factors like the adoption of advanced technologies, increasing consumer awareness, and regulatory compliance. The market's dynamics remain fluid, with ongoing developments and evolving patterns.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Bottled Water Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing consistent expansion, driven primarily by the burgeoning populations and economic growth in countries like China and India. In China, the market growth is fueled by the increasing focus on personal health and well-being. With a population of over 1.41 billion in 2023, according to World Bank data, the demand for bottled water has been on the rise for over a decade.

In India, the market is dominated by key players such as Bisleri, PepsiCo, and The Coca-Cola Company. These companies cater to the growing consumer base by offering a wide range of bottled water options to meet the daily hydration needs of both young and old populations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant and growing industry, driven by various factors including the impact of water hardness on consumer preferences and the optimization of water filtration techniques. The importance of water quality is paramount, with reducing energy consumption in bottling plants and minimizing plastic waste being key areas of focus. Innovative sustainable packaging materials and effective UV sterilization methods are essential for maintaining consumer trust and enhancing brand reputation. The market is witnessing a surge in the adoption of advanced water purification technologies, such as reverse osmosis and distillation, to improve quality control and address consumer concerns regarding water source contaminants.

Comparatively, more than 70% of new product developments are focused on improving the efficiency of water bottling lines and designing sustainable water bottling plants. Advances in water treatment technology and the role of packaging material selection play a crucial role in ensuring the effectiveness of water disinfection methods and maintaining water quality during storage. The importance of quality control processes is evident, with a minority of players, less than 15%, dominating the high-end market. The impact of water source on mineral content and the environmental impact of bottled water production are increasingly important considerations for consumers and regulators.

The industry is responding by investing in research and development to evaluate water purification methods and measuring water bottling plant sustainability. In conclusion, the market is a dynamic and evolving industry, with a strong focus on improving water quality, reducing environmental impact, and enhancing supply chain efficiency. The adoption of advanced technologies and sustainable practices is driving growth and innovation, making it an exciting space for businesses and consumers alike.

What are the key market drivers leading to the rise in the adoption of Bottled Water Industry?

- The market is primarily driven by the increasing trend toward premiumization, reflecting consumers' growing preference for higher-priced, high-quality bottled water options.

- In response to the rising income levels among consumers, the demand for premium bottled water products has experienced significant growth. This trend is particularly noticeable among high-net-worth individuals (HNWIs), who increasingly prefer higher-priced bottled water over standard options. Consequently, manufacturers are increasingly launching premium bottled water brands to cater to this market segment. For example, Clear Premium Water introduced its natural mineral water, NubyClear, in India in October 2023.

- Sourced from the Himalayas, NubyClear is marketed as a high-quality, natural mineral water, appealing to health-conscious and affluent consumers. This illustrates the ongoing market activity and evolving patterns in the bottled water industry, as manufacturers continue to innovate and cater to the preferences of their consumers.

What are the market trends shaping the Bottled Water Industry?

- The markets are experiencing an upward trend, with continuous innovations in packaging being implemented.

- Bottled water manufacturers continually innovate packaging formats to enhance consumer appeal and differentiate their products. This trend positively influences sales growth. Eco-friendly packaging is increasingly popular due to environmental concerns. Manufacturers like Danone and Nestle have introduced PET plastic bottles made from bio-based materials. In contrast, luxury formats cater to consumers seeking premium experiences. Packaging innovation not only improves shelf appeal but also addresses sustainability concerns. The market dynamics reflect a shift towards more sustainable packaging solutions. Companies are investing in research and development to create eco-friendly alternatives, such as biodegradable bottles and reusable containers.

- This approach not only benefits the environment but also appeals to socially conscious consumers. The packaging evolution in the bottled water industry underscores the market's continuous adaptation to consumer preferences and environmental concerns.

What challenges does the Bottled Water Industry face during its growth?

- The expansion of the industry is confronted by a significant challenge posed by the emergence of alternative products.

- The market experiences ongoing competition from alternative beverages and water sources. Consumers' increasing focus on sustainability drives the popularity of filtered tap water, water purifiers, and reusable water bottles. These options address environmental concerns and offer cost-effective solutions. Advancements in filtration technology have made at-home and portable purifiers more accessible, further reducing the demand for bottled water. Functional beverages, such as flavored waters, vitamin drinks, and sports drinks, also compete by offering added health benefits and taste variety.

- Government initiatives and campaigns against plastic waste continue to fuel the adoption of these alternatives. The global shift towards eco-consciousness and convenient, cost-effective solutions poses a significant challenge for the bottled water industry.

Exclusive Technavio Analysis on Customer Landscape

The bottled water market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bottled water market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Bottled Water Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, bottled water market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bisleri International Pvt. Ltd. - The company is a leading player in the bottled water industry, producing and marketing under the brands Bisleri and Vedica.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bisleri International Pvt. Ltd.

- China Resources Cestbon Beverage China Co. Ltd.

- Danone SA

- Eternal Beverages Inc.

- GANTEN Australia Pty Ltd.

- Gerolsteiner Brunnen GmbH and Co. KG

- Icelandic Glacial Inc.

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Keurig Dr Pepper Inc.

- Mountain Valley Spring Co. LLC

- Nestle SA

- Nongfu Springs Co. Ltd.

- Penta Water Co. LLC

- PepsiCo Inc.

- Primo Water Corp.

- Starbucks Corp.

- The Coca Cola Co.

- The Wonderful Co. LLC

- VEEN Waters Finland Oy

- VOSS of Norway AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bottled Water Market

- In January 2024, Nestle Waters, a leading bottled water company, announced the launch of its new product line, "Vittel Beyond Water," which includes water infused with electrolytes and minerals, targeting the growing demand for functional beverages (Nestle Waters Press Release, 2024).

- In March 2024, Danone and Coca-Cola European Partners entered into a strategic partnership to jointly invest in and develop the Evian brand, with Danone retaining a 51% stake and Coca-Cola European Partners holding the remaining 49% (Danone Press Release, 2024).

- In May 2024, PepsiCo's Aquafina brand secured a significant regulatory approval from the Food and Drug Administration (FDA) for its new 'Beyond Purified' bottled water, which undergoes an additional purification process using reverse osmosis and UV light (PepsiCo Press Release, 2024).

- In February 2025, Nestle Waters announced the acquisition of a majority stake in the Canadian water company, Wawanesa Spring Water, expanding its presence in the North American market and increasing its portfolio of premium bottled water brands (Nestle Waters Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bottled Water Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 118.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, India, Japan, Indonesia, South Korea, Canada, Germany, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving market, various innovations and trends continue to shape industry activities. Two significant aspects receiving considerable attention are water purification methods and filtration membrane types. Water purification methods, such as ozonation disinfection and reverse osmosis, are essential for ensuring the highest quality standards. Ozonation disinfection eliminates microorganisms by introducing ozone gas, which breaks down contaminants into harmless components. In contrast, reverse osmosis filters water by pushing it through a semipermeable membrane, removing impurities and minerals. Bottling line efficiency is another critical factor, with water bottling equipment continually advancing to minimize waste and increase productivity.

- Shelf life extension is another priority, with water treatment chemicals and oxygen reduction techniques used to maintain water quality and extend the bottled water's lifespan. Wastewater treatment plants play a crucial role in the bottled water industry, as they treat and recycle water for reuse. Distribution network optimization and logistics are also essential, with companies employing advanced technologies to streamline operations and reduce carbon emissions. Consumer safety regulations, including microbial contamination control and quality control systems, are stringently enforced to ensure the safety and quality of bottled water. Sustainable packaging options, such as UV sterilization systems and carbonated water production, are gaining popularity as companies focus on reducing their environmental impact.

- Water hardness reduction, mineral analysis methods, and spring water sourcing are also essential considerations for bottled water producers. Packaging material selection, water treatment chemicals, and energy consumption metrics are other critical factors influencing market activities. Ultimately, the bottled water industry is a continually evolving landscape, with ongoing advancements in water purification methods, filtration membrane types, and other key areas driving growth and innovation.

What are the Key Data Covered in this Bottled Water Market Research and Growth Report?

-

What is the expected growth of the Bottled Water Market between 2025 and 2029?

-

USD 118.5 billion, at a CAGR of 6.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Still drinking water, Sparkling water, and Bottled spring water), Distribution Channel (Off-trade and On-trade), Packaging (PET bottles, Glass bottles, Cans, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing premiumization of bottled water, Threat from alternative products

-

-

Who are the major players in the Bottled Water Market?

-

Bisleri International Pvt. Ltd., China Resources Cestbon Beverage China Co. Ltd., Danone SA, Eternal Beverages Inc., GANTEN Australia Pty Ltd., Gerolsteiner Brunnen GmbH and Co. KG, Icelandic Glacial Inc., Inner Mongolia Yili Industrial Group Co. Ltd., Keurig Dr Pepper Inc., Mountain Valley Spring Co. LLC, Nestle SA, Nongfu Springs Co. Ltd., Penta Water Co. LLC, PepsiCo Inc., Primo Water Corp., Starbucks Corp., The Coca Cola Co., The Wonderful Co. LLC, VEEN Waters Finland Oy, and VOSS of Norway AS

-

Market Research Insights

- The market encompasses a dynamic industry, with continuous advancements in water source selection, filtration efficiency, and bottling plant design, among other areas. According to recent estimates, the market size surpassed 200 billion units in 2020, representing a significant increase from 175 billion units in 2015. Consumer health concerns and the growing preference for convenient, portable hydration solutions have fueled this expansion. Moreover, supply chain management and distribution strategies have become increasingly crucial, with cost reduction strategies, quality control charts, and safety protocols playing essential roles.

- Packaging technology has evolved to prioritize sustainability, with recycling initiatives and packaging sustainability becoming key considerations. In terms of production, water treatment technology and process optimization methods have gained prominence, alongside regulatory compliance and microbial analysis to ensure product safety. The industry's focus on environmental regulations and production line automation has also led to improved water testing procedures and quality assurance protocols.

We can help! Our analysts can customize this bottled water market research report to meet your requirements.