Building Automation And Control Systems Market Size 2025-2029

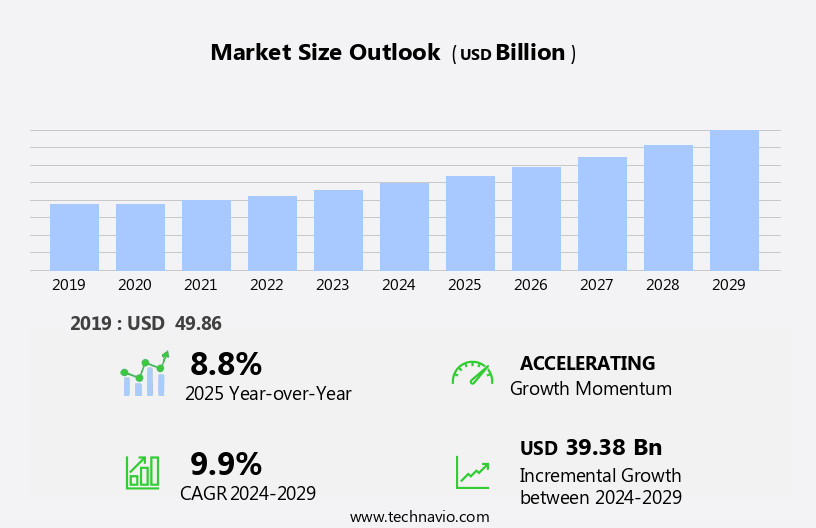

The building automation and control systems market size is forecast to increase by USD 39.38 billion, at a CAGR of 9.9% between 2024 and 2029.

- The market is driven by the growing demand for energy efficiency and the increasing adoption of personnel assistants in residential buildings. Energy efficiency is a significant concern for building owners and managers, leading to a surge in demand for automation systems that optimize energy usage. These systems enable the efficient management of heating, ventilation, and air conditioning (HVAC) systems, lighting, and other energy-consuming devices. Moreover, the integration of personnel assistants, such as virtual assistants and smart home systems, in residential buildings is a burgeoning trend. These systems offer convenience and enhanced comfort, making them increasingly popular among homeowners.

- However, the high installation cost of building automation and control systems poses a significant challenge. Despite this, the market's potential is vast, with numerous opportunities for companies to capitalize on the demand for energy efficiency and the integration of personnel assistants in both residential and commercial buildings. Companies can differentiate themselves by offering cost-effective solutions, providing excellent customer service, and continuously innovating to meet evolving market needs.

What will be the Size of the Building Automation And Control Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the integration of advanced technologies and the increasing demand for energy efficiency and sustainability. Systems are being seamlessly integrated to manage HVAC, lighting, security, and access control, among other functions, in both commercial and residential buildings. New construction projects and retrofit initiatives are adopting these solutions to optimize building performance and reduce operational costs. Ethernet communication and cloud-based platforms are becoming standard for remote monitoring and maintenance, enabling real-time data analytics and machine learning algorithms to improve system performance and predict maintenance needs. LEED certification and green building standards are driving the adoption of smart buildings, which utilize AI and cybersecurity threats are a growing concern to ensure data privacy and system reliability.

Hardware platforms are evolving to support open source software and edge computing, allowing for greater system scalability and flexibility. Demand response programs and network infrastructure upgrades are also key market trends, as buildings increasingly function as active participants in the energy grid. User interfaces and mobile apps are enhancing the user experience, providing building occupants with greater control and visibility over their environment. Cost savings, energy efficiency, and system reliability remain top priorities for building owners and operators, making the market a dynamic and evolving space.

How is this Building Automation And Control Systems Industry segmented?

The building automation and control systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial buildings

- Residential buildings

- Government buildings

- Others

- Type

- Integration

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By End-user Insights

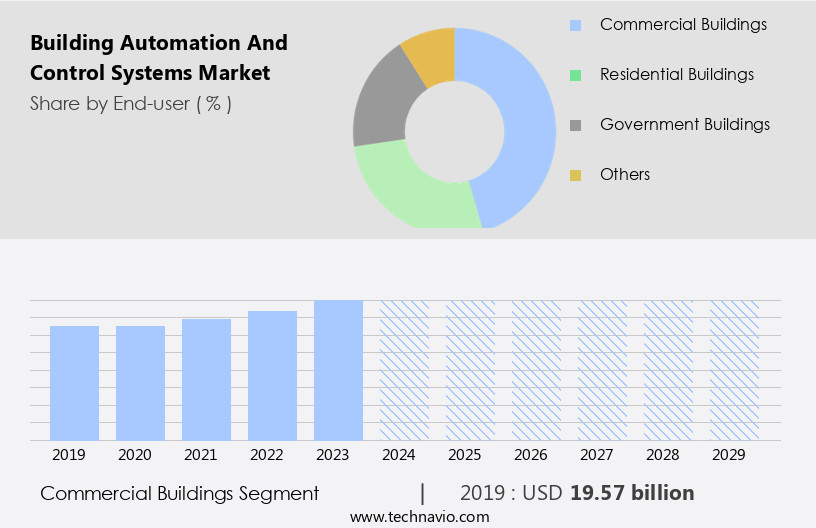

The commercial buildings segment is estimated to witness significant growth during the forecast period.

The Building Automation and Control Systems (BACS) market is experiencing significant growth due to the increasing emphasis on energy efficiency in commercial buildings, particularly in emerging economies. Government regulations and heightened awareness of energy conservation are driving this trend. Commercial buildings in various countries are implementing stage-1 automation solutions to meet regulatory compliance and enhance overall operational efficiency. These solutions integrate multiple building operations through customizable automation software, tailored to the unique requirements of each building. BACS also encompasses advanced technologies such as edge computing, data analytics, and machine learning, which contribute to building performance optimization. User experience (UX) and data privacy are key considerations in the design of these systems.

HVAC control systems, lighting control systems, and access control systems are essential components of BACS, ensuring occupancy sensing, system reliability, and security. Infrastructure projects, such as new construction and retrofit initiatives, present opportunities for the implementation of BACS. LEED certification and energy star rating are driving the adoption of these systems in both commercial and residential buildings, including educational institutions, healthcare facilities, retail spaces, and industrial facilities. Cloud-based platforms and mobile apps facilitate remote monitoring, maintenance, and support, while open source software and system scalability offer cost savings and flexibility. However, cybersecurity threats pose a challenge to the market, necessitating robust security measures and system reliability.

Building performance optimization and demand response systems help reduce energy consumption and improve cost savings. Ethernet communication and wireless communication technologies enable seamless integration and scalability of BACS. In conclusion, the market is witnessing continuous evolution, driven by the need for energy efficiency, advanced technologies, and regulatory compliance. The integration of various building operations and components, such as fire alarm systems, security systems, and HVAC control systems, results in optimized building performance and cost savings.

The Commercial buildings segment was valued at USD 19.57 billion in 2019 and showed a gradual increase during the forecast period.

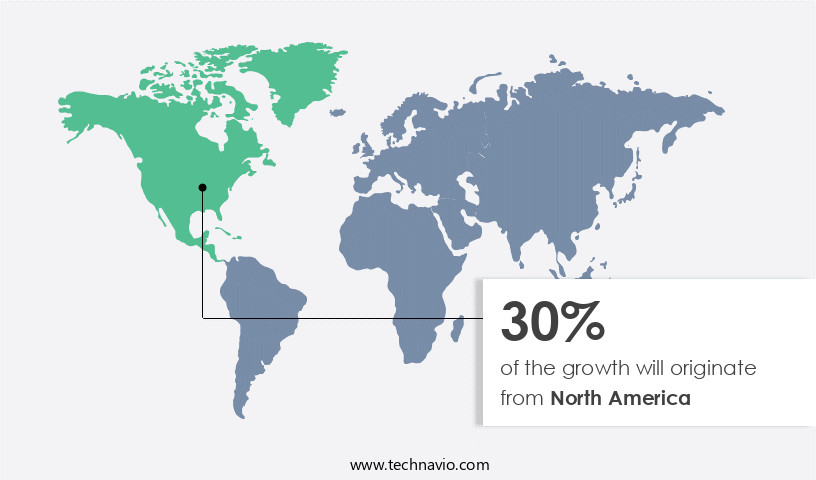

Regional Analysis

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Building Automation and Control Systems (BACS) market in Europe is experiencing significant growth due to the implementation of the revised Energy Performance of Buildings Directive (EU) 2018/844. This directive mandates that all EU member states equip their non-residential buildings with BACS by March 10, 2020. Innovative approaches are being adopted to address market inefficiencies and realize the full potential of BACS. These developments are expected to lead to substantial energy and CO2 savings, as well as improved user comfort and health. BACS technologies encompass various systems such as fire alarm systems, security systems, infrastructure projects, energy star rating, automated scheduling, training and education, access control systems, edge computing, data privacy, user experience (UX), occupancy sensing, HVAC control systems, system integration, system scalability, data analytics, hardware platforms, cybersecurity threats, LEED certification, artificial intelligence (AI), new construction projects, demand response, ethernet communication, proprietary software, smart buildings, machine learning, commercial buildings, user interfaces (UI), remote monitoring, maintenance and support, residential buildings, educational institutions, cost savings, network infrastructure, open source software, lighting control systems, retrofit projects, retail spaces, building performance optimization, mobile apps, cloud-based platforms, system reliability, green building standards, healthcare facilities, cloud computing, wireless communication, energy efficiency, and industrial facilities.

Key components of BACS include energy efficiency, system integration, data analytics, cybersecurity threats, and user experience (UX). Energy efficiency is a significant factor as BACS help optimize energy consumption, reduce costs, and minimize environmental impact. System integration ensures seamless communication between various building systems, while data analytics provide valuable insights for building performance optimization. Cybersecurity threats are a growing concern, and BACS must prioritize data privacy and security to protect against potential breaches. User experience (UX) is essential for user satisfaction and engagement, with mobile apps, cloud-based platforms, and user interfaces (UI) playing a crucial role.

The European BACS market is expected to witness robust growth due to the increasing adoption of smart buildings, demand for energy efficiency, and the integration of AI and machine learning technologies. The market is also driven by the need for system reliability, scalability, and cost savings. Green building standards, such as LEED certification, are becoming increasingly popular, and BACS are essential for compliance. The market is also witnessing the emergence of new construction projects and retrofit projects, as well as the integration of demand response and wireless communication technologies. Overall, the European BACS market is poised for significant growth, driven by the need for energy efficiency, cost savings, and user comfort and health.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Building Automation And Control Systems Industry?

- The demand for energy efficiency serves as the primary market driver, as industries and consumers prioritize reducing energy consumption for cost savings and minimizing environmental impact.

- Commercial and office buildings, as well as residential complexes, are increasingly investing in Building Automation and Control Systems (BACS) to optimize energy usage, enhance safety and security, and improve operational efficiency. With rising infrastructure projects and the construction of new buildings, the demand for fire alarm systems, security systems, access control, and HVAC control systems is surging. These systems enable users to automate scheduling, manage occupancy sensing, and implement edge computing for data privacy. Moreover, energy star ratings and user experience (UX) are becoming essential considerations for building owners and residents.

- BACS solutions offer control over room temperature, lighting, and other systems, reducing utility bills and improving overall comfort. By implementing these systems, businesses and residents can save on operational costs while ensuring safety, security, and energy efficiency.

What are the market trends shaping the Building Automation And Control Systems Industry?

- The use of personnel assistants is becoming increasingly common in residential buildings, representing a notable market trend. This trend reflects the growing demand for enhanced services and convenience in modern living.

- The integration of technology in buildings is becoming increasingly popular, with system scalability and data analytics at the forefront. Hardware platforms, such as personnel assistant devices from Amazon and Google, enable system integration, making buildings more efficient and user-friendly. These devices facilitate the connection of various smart electronic appliances within a building, allowing for centralized control of lighting systems, thermostats, and more. Cybersecurity threats are a concern in the market. With the increasing use of Ethernet communication and the Internet of Things (IoT), ensuring data security is crucial. LEED certification, a recognized standard for green buildings, is driving demand for energy-efficient systems.

- Artificial Intelligence (AI) and demand response systems are emerging trends in the market. AI allows for predictive maintenance and optimization of building operations, while demand response systems enable buildings to interact with the power grid, reducing energy consumption and costs. In new construction projects, system scalability is essential, allowing for the addition of new features and devices as needed. Proprietary software and open communication protocols ensure compatibility and ease of integration. In conclusion, the market is experiencing significant growth due to the increasing trend of converting buildings into smart structures. The integration of technology, data analytics, and AI is transforming the way buildings are managed and operated, making them more efficient, secure, and user-friendly.

What challenges does the Building Automation And Control Systems Industry face during its growth?

- The high installation cost poses a significant challenge to the expansion and growth of the industry.

- Building automation and control systems (BACS) have gained significant traction in managing energy usage and optimizing operational functionalities in commercial buildings. Companies continue to innovate by integrating machine learning algorithms, user interfaces, and remote monitoring capabilities to enhance efficiency. However, the implementation of these advanced systems requires substantial investment in network infrastructure and potential retrofits. Cost savings are a primary motivation for end-users, particularly in large commercial buildings and educational institutions. BACS solutions offer significant energy savings through optimized lighting control systems and HVAC management. Open source software and networked systems provide cost-effective alternatives for smaller commercial buildings and residential applications.

- Despite the benefits, the high cost of installation and variability in pricing deter some end-users from adopting these systems. The complexity of integrating these systems with existing infrastructure necessitates professional maintenance and support services, adding to the overall cost. In conclusion, the potential for cost savings and improved operational efficiency make building automation and control systems an attractive investment for businesses, but the high upfront costs and ongoing maintenance requirements necessitate careful consideration.

Exclusive Customer Landscape

The building automation and control systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the building automation and control systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, building automation and control systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd - This company specializes in advanced energy-efficient systems, encompassing security and building control for residential and commercial structures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd

- Bajaj Electricals Ltd.

- BuildingLogiX

- Emerson Electric Co.

- Evon Technologies Pvt. Ltd.

- Forescout Technologies Inc.

- Honeywell International Inc.

- IoEnergy Inc.

- Itron Inc.

- Johnson Controls International Plc

- KMC Controls Inc.

- Legrand SA

- Lutron Electronics Co. Inc.

- Mode Green Integrated Building Technology

- Optergy

- PointGrab Inc.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Building Automation And Control Systems Market

- In February 2023, Schneider Electric, a leading energy management and automation company, announced the launch of its new EcoStruxure Building Advisor, an AI-driven energy management solution designed to optimize energy efficiency in commercial buildings. This innovative system uses real-time data analysis to identify energy savings opportunities and automate energy management tasks (Schneider Electric Press Release, 2023).

- In March 2024, Honeywell International and Microsoft Corporation entered into a strategic partnership to integrate Microsoft Azure IoT and Honeywell Forge, a cloud-based building operations platform. This collaboration aims to provide advanced analytics and automation capabilities to commercial and industrial building owners, enhancing operational efficiency and sustainability (Microsoft News Center, 2024).

- In July 2024, Johnson Controls, a global leader in building technologies and solutions, completed the acquisition of Quirks & Company, a leading provider of building automation and control systems in the Asia Pacific region. This strategic move expands Johnson Controls' presence in the APAC market and strengthens its position as a major player in the building automation industry (Johnson Controls Press Release, 2024).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of emerging technologies and compliance with stringent regulations. Human-machine interface (HMI) plays a crucial role in enhancing user experience, while building automation standards ensure interoperability and efficiency. Augmented reality (AR) and virtual reality (VR) are revolutionizing facility management by offering immersive experiences for building envelope optimization and thermal comfort management. Compliance regulations, such as cybersecurity standards, drive the adoption of secure communication protocols and smart metering. Smart grid integration, renewable energy integration, water conservation, and waste management are key trends in sustainable building operations.

- Building performance simulation and industry certifications help in evaluating energy efficiency and ensuring optimal building operations. Distributed control systems, natural ventilation, and voice control are emerging technologies that offer flexibility and convenience. Energy storage solutions are gaining traction to ensure an uninterrupted power supply and optimize energy usage.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Building Automation And Control Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 39.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.8 |

|

Key countries |

US, UK, China, Japan, Germany, Canada, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Building Automation And Control Systems Market Research and Growth Report?

- CAGR of the Building Automation And Control Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the building automation and control systems market growth of industry companies

We can help! Our analysts can customize this building automation and control systems market research report to meet your requirements.