Butyraldehyde Market Size 2025-2029

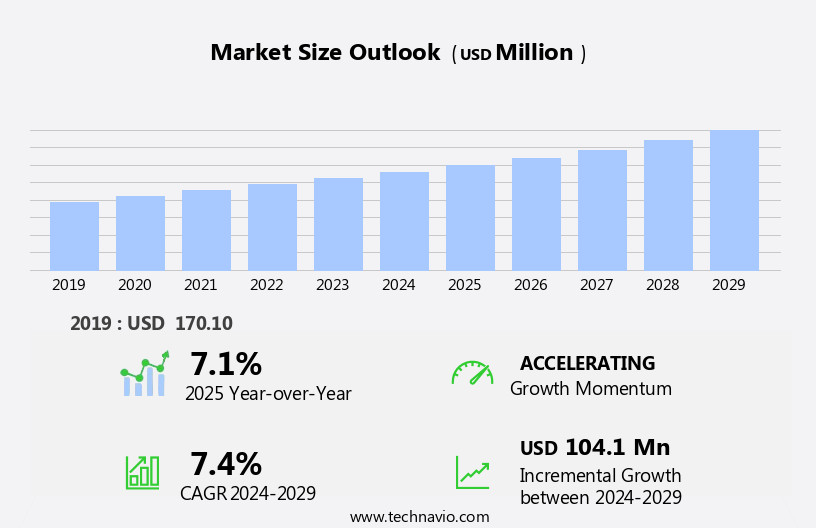

The butyraldehyde market size is forecast to increase by USD 104.1 million, at a CAGR of 7.4% between 2024 and 2029.

- The market is driven by the expanding automotive industry, where the demand for paints and coatings is surging. Butyraldehyde is a crucial ingredient in the production of these coatings, making it an essential component in this sector's growth. Furthermore, the fragrance industry's increasing utilization of butyraldehyde as a key intermediate adds to the market's momentum. However, the market faces challenges due to health concerns associated with high exposure to this chemical. Regulations and safety measures are being implemented to mitigate these risks, necessitating companies to invest in research and development of safer alternatives or production methods.

- To capitalize on the market's growth opportunities and navigate the challenges effectively, industry players must stay informed of regulatory changes and invest in innovative solutions to ensure consumer safety while maintaining competitiveness.

What will be the Size of the Butyraldehyde Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse applications of this versatile chemical across various sectors. Carboxylic acids, such as acrylic acid, methacrylic acid, valeric acid, caproic acid, and propionic acid, serve as essential raw materials in the production of butyraldehyde. The chemical's role extends to rubber chemicals, synthetic lubricants, plasticizer production, and resin manufacturing. The supply chain of butyraldehyde is influenced by global trade dynamics, with ethylene glycol and propylene glycol acting as significant intermediates. Market demand for butyraldehyde remains robust due to its use in various industries, including textile finishing and pharmaceutical intermediates. Butyraldehyde production processes undergo continuous optimization to enhance efficiency and reduce environmental impact.

Aldol condensation and other methods are employed to produce this essential chemical. The market's cost analysis is influenced by price volatility, driven by fluctuations in raw material prices and production costs. Renewable resources are increasingly being explored as alternatives to traditional butyraldehyde production methods, offering potential for sustainable and eco-friendly solutions. The ongoing unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptable in the ever-changing market landscape.

How is this Butyraldehyde Industry segmented?

The butyraldehyde industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- N-butanol

- 2-ethylhexanol

- Polyvinyl butyral

- Others

- Application

- Chemical intermediate

- Rubber accelerator

- Synthetic resins

- Others

- End-user

- Paints and coatings

- Pharmaceuticals

- Agrochemicals

- Polymers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

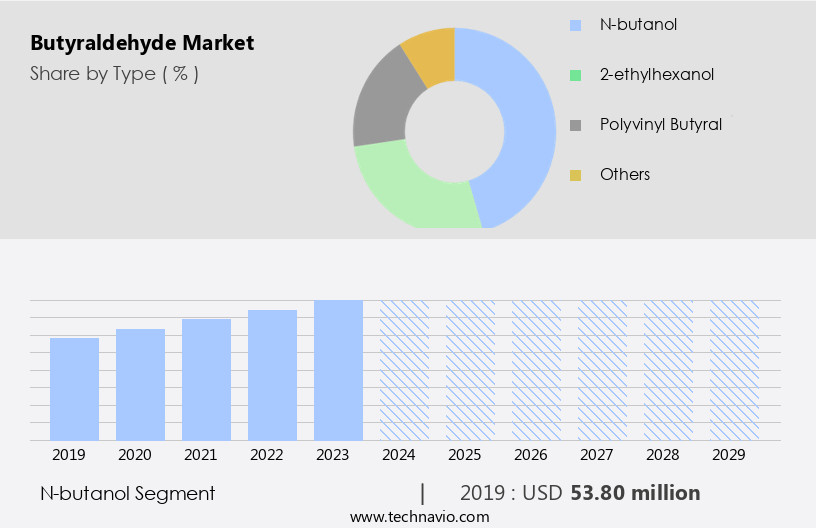

The n-butanol segment is estimated to witness significant growth during the forecast period.

N-butyraldehyde, a chemical compound with the molecular formula C4H8O, is an essential intermediate in various industries, including rubber chemicals, synthetic lubricants, and plasticizer production. In the production of polyvinyl butyral (PVB), a key component in adhesives and coatings, n-butyraldehyde undergoes aldol condensation to form butyldehyde resins. Methacrylic acid and valeric acid are crucial raw materials in the synthesis of n-butyraldehyde. The cost analysis of these raw materials significantly influences the overall production cost. Price volatility in the market for these raw materials can impact the profitability of n-butyraldehyde manufacturers. The supply chain for n-butyraldehyde involves the production of propylene glycol, which undergoes oxidation to produce n-butyraldehyde.

This process can be optimized to improve efficiency and reduce waste. N-butyraldehyde is also used as a building block in the production of various carboxylic acids, such as butyric acid, acetic acid, and caproic acid. These acids have applications in various industries, including pharmaceuticals and textile finishing. The environmental impact of n-butyraldehyde production is a concern due to the release of volatile organic compounds (VOCs) during the production process. Renewable resources, such as bio-based butyraldehyde, are being explored as alternatives to mitigate this issue. N-butyraldehyde is also used as a solvent in various applications, including textile finishing and solvent applications.

Its use as a solvent in the production of polybutylene terephthalate (PBT) is noteworthy, as PBT is a widely used thermoplastic polyester in the global trade of plastics. In conclusion, the market for n-butyraldehyde is dynamic, with various applications in industries such as rubber chemicals, synthetic lubricants, plasticizer production, and pharmaceutical intermediates. The production process involves the use of raw materials such as methacrylic acid, valeric acid, and propylene glycol. The environmental impact of n-butyraldehyde production is a concern, and renewable resources are being explored as alternatives. The price volatility of raw materials and the optimization of production processes are key challenges for manufacturers in this market.

The N-butanol segment was valued at USD 53.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

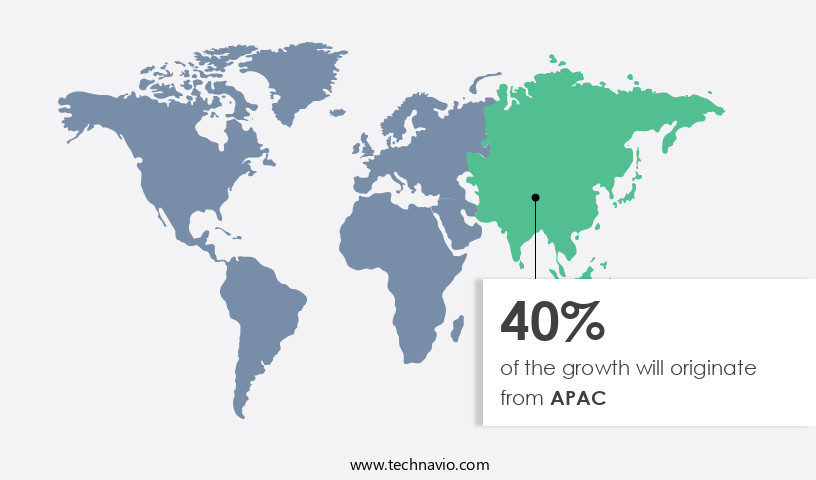

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the region is experiencing notable growth due to the increasing demand for paints and coatings in the construction and automobile industries. Major contributors to the market in the Asia Pacific (APAC) region include China, India, and Japan. In India, the construction sector is poised for strong growth, with government-led projects driving the economy forward after the pandemic's impact. Despite current challenges, there is optimism about the future as initiatives and processes are coordinated to advance large-scale projects, such as the construction of the Jewar airport. Significant government investment in India's infrastructure leads to increased spending in the construction sector, further fueling market demand.

Butyraldehyde is a crucial intermediate in the production of polyvinyl butyral (PVB), rubber chemicals, and synthetic lubricants. It is also used in plasticizer production and as a solvent in resin production. Methacrylic acid, valeric acid, cost analysis, butyric acid, acetic acid, and price volatility are essential factors influencing the market's dynamics. The environmental impact of butyraldehyde production is a growing concern, and efforts are being made to develop bio-based alternatives. Butyraldehyde is also used as a pharmaceutical intermediate, particularly in the production of propionic acid, caproic acid, and acrylic acid. It is used in textile finishing and in the production of polybutylene terephthalate (PBT).

Global trade plays a significant role in the market, with ethylene glycol and propylene glycol used as raw materials in the production process. The market demand for butyraldehyde is expected to continue growing due to its versatile applications and the increasing demand for sustainable and eco-friendly alternatives. Process optimization and the use of renewable resources are key trends in the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Butyraldehyde, a crucial organic compound, plays a significant role in various industries, including chemicals, pharmaceuticals, and food processing. Its production is derived from the fermentation of maize or from the oxidation of butane. Butyraldehyde's versatility is evident in its applications, which range from the manufacturing of synthetic resins and polymers to the production of perfumes and flavors. Moreover, butyraldehyde acts as an essential intermediate in the synthesis of several pharmaceuticals. Its antimicrobial and antifungal properties make it a valuable component in the production of pharmaceutical formulations. In the food industry, butyraldehyde is used as a flavoring agent and a preservative. The market is driven by the increasing demand for its applications in various sectors. The market's growth is further fueled by the rising awareness of its health benefits and the expanding pharmaceutical and food industries. Additionally, the ongoing research and development in the field of butyraldehyde derivatives are expected to provide significant opportunities for market growth. Butyraldehyde's production methods, including fermentation and oxidation, are continuously being optimized to improve efficiency and reduce costs. The market's competitive landscape is characterized by the presence of several key players, who are investing in research and development to expand their product offerings and maintain their market position. In conclusion, the market is a dynamic and growing sector, driven by its diverse applications and the expanding industries that rely on it. Its versatility and importance in various industries make it a valuable commodity, and the ongoing research and development in the field are expected to provide significant opportunities for market growth.

What are the key market drivers leading to the rise in the adoption of Butyraldehyde Industry?

- The automotive industry's growing demand for paints and coatings serves as the primary market driver.

- Butyraldehyde, a chemical compound with the formula CH3CH2CH2CH2CHO, is an important intermediate used in various industries, including resin production and the manufacturing of pharmaceutical intermediates such as butyric acid, acetic acid, and propionic acid. The demand for butyraldehyde is primarily driven by the automotive industry, where it is used in the production of paints and coatings. Economic growth in emerging markets and increasing consumer purchasing power have led to an increase in automobile sales, thereby fueling the demand for butyraldehyde. In addition, the trend towards producing lightweight and fuel-efficient vehicles has increased the demand for butyraldehyde in Europe, North America, China, Germany, Japan, and the US.

- Moreover, butyraldehyde is also used in the production of propylene glycol, which is used as a solvent and as a raw material in various industries, including food and beverages, pharmaceuticals, and cosmetics. The environmental impact of butyraldehyde production is a concern, and efforts are being made to reduce its production through the use of renewable feedstocks and other sustainable production methods. Price volatility in raw materials and the availability of substitutes can impact the demand for butyraldehyde. However, the versatility of butyraldehyde and its wide range of applications in various industries are expected to drive its demand during the forecast period.

What are the market trends shaping the Butyraldehyde Industry?

- The fragrance industry is witnessing an increasing trend towards the utilization of butyraldehyde. This chemical compound is gaining popularity due to its distinctive odor and versatility in fragrance creation.

- Butyraldehyde is a vital organic compound in the fragrance industry, serving as a fragrance intermediate. Its strong, pungent odor transforms into a clear fragrance when diluted. Butyraldehyde is an essential chemical component in the production of various essential oils derived from flowers, leaves, fruits, grass, and dairy products. The global fragrance industry is projected to expand due to increasing demand from end-users, primarily manufacturers of fine fragrances. Consumers' growing focus on grooming and lifestyle trends are significant factors fueling the industry's growth.

- As a key raw material in the production of carboxylic acids like acrylic acid and polybutylene terephthalate (PBT), butyraldehyde plays a crucial role in various industrial applications. Process optimization techniques are being employed to enhance butyraldehyde production efficiency and reduce costs.

What challenges does the Butyraldehyde Industry face during its growth?

- The growth of the industry is constrained by the health concerns linked to elevated exposures to butyraldehyde, a significant challenge that necessitates continued research and implementation of mitigation strategies.

- Butyraldehyde, a colorless, highly flammable liquid, is utilized extensively in various industries due to its unique properties. However, its use is constrained by significant health risks. Exposure to butyraldehyde can lead to respiratory issues, such as lung irritation, coughing, and shortness of breath. Prolonged exposure can result in more serious conditions, including pulmonary edema. Additionally, contact with butyraldehyde can cause skin and eye irritation. These health hazards necessitate stringent safety measures and regulations, increasing production costs and limiting applications. Butyraldehyde is produced through aldol condensation of two molecules of acetaldehyde or through the oxidation of butane.

- Raw materials for butyraldehyde production include acetaldehyde, butane, and other chemicals. In industry, butyraldehyde is employed in various applications, including solvent applications and textile finishing. Bio-based butyraldehyde, derived from renewable resources, is gaining traction due to its eco-friendly nature. Despite its benefits, the market growth is hindered by the health risks associated with its production and use.

Exclusive Customer Landscape

The butyraldehyde market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the butyraldehyde market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, butyraldehyde market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aurochemicals - Butyraldehyde serves as a vital chemical intermediate in the synthesis of numerous organic compounds.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurochemicals

- BASF SE

- Beijing Yunbang Biosciences Co.Ltd.

- The Dow Chemical Co.

- Eastman Chemical Co.

- KH Neochem Co. Ltd.

- Loba Chemie Pvt. Ltd.

- Merck KGaA

- Mitsubishi Chemical Corp.

- National Analytical Corp.

- OQ SAOC

- Otto Chemie Pvt. Ltd.

- Perstorp Holding AB

- Santa Cruz Biotechnology Inc.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co. Ltd.

- Toronto Research Chemicals Inc.

- Xiamen Hisunny Chemical Co. Ltd.

- Yixing Jinlan Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Butyraldehyde Market

- In January 2024, LG Chem and SABIC announced a strategic collaboration to produce butyraldehyde at LG Chem's South Korean facility. The partnership aimed to expand their butyraldehyde production capacity and strengthen their position in the global market (LG Chem Press Release, 2024).

- In March 2024, INEOS Styrolution, the world's leading styrenics supplier, acquired a butyraldehyde production site from Celanese in Germany. This acquisition enabled INEOS Styrolution to vertically integrate its production chain and improve its butyraldehyde supply security (INEOS Styrolution Press Release, 2024).

- In May 2024, DuPont announced the completion of its new butyraldehyde production facility in the United States. The USD 300 million investment expanded DuPont's butyraldehyde production capacity by 50% and enhanced its ability to serve the North American market (DuPont Press Release, 2024).

- In February 2025, the European Chemicals Agency (ECHA) approved the renewal of the registration of butyraldehyde under REACH. This approval ensured the continued production and use of butyraldehyde in Europe, maintaining the industry's compliance with regulatory requirements (ECHA Press Release, 2025).

Research Analyst Overview

- Butyraldehyde, a crucial intermediate chemical in the production of plastics, resins, and synthetic rubber, experiences continuous evolution in its market landscape. Technological disruptions, such as advances in reactor design and catalytic processes, drive innovation in the industry, enabling higher quality control and improved health and safety standards. Intellectual property rights and industry standards play a significant role in shaping market penetration and competition. Distribution channels and strategic alliances expand the reach of market players, while market intelligence informs pricing strategies and consumer behavior analysis. Reaction kinetics and competitor analysis are essential for economic viability and process control in the market.

- Sustainability initiatives and environmental regulations are increasingly influencing industry trends, with waste management and best practices becoming essential considerations. Joint ventures and innovation pipelines foster collaboration and growth, while economic forecasts and risk assessment help businesses navigate market fluctuations. Marketing strategies and pricing strategies remain crucial elements in the competitive landscape, with an emphasis on meeting evolving consumer demands and staying compliant with regulations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Butyraldehyde Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 104.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.1 |

|

Key countries |

China, US, Japan, Canada, Germany, India, France, UK, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Butyraldehyde Market Research and Growth Report?

- CAGR of the Butyraldehyde industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the butyraldehyde market growth of industry companies

We can help! Our analysts can customize this butyraldehyde market research report to meet your requirements.