Canada Pallet Market Size 2024-2028

The Canada pallet market size is forecast to increase by USD 1.81 billion, at a CAGR of 5.97% between 2023 and 2028. The e-commerce industry in Canada is experiencing significant growth and this surge in online shopping has led to a corresponding increase in the demand for efficient and reliable shipping solutions. One such solution is the use of pallets in load-handling and shipping sectors. Pallets are essential for securely transporting and storing large quantities of goods. In particular, there is a rising trend towards the use of recyclable plastic pallets, which offer numerous benefits over traditional wooden pallets. These pallets are more durable, lighter, and easier to clean, making them an ideal choice for the e-commerce industry's increasing demand for streamlined and sustainable logistics solutions. Additionally, the use of recyclable plastic pallets reduces waste and contributes to a more eco-friendly supply chain.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics

The market is a significant sector in the logistics and transportation industry, encompassing various types of pallets made from wood, plastic, corrugated paper, metal, and other materials. These pallets play a crucial role in the transportation and warehousing of goods, particularly in industries such as food and beverages, chemicals and pharmaceuticals, construction, and retail. Wood pallets continue to dominate the market due to their durability and cost-effectiveness. However, plastic pallets are gaining popularity due to their lightweight and reusable nature. Corrugated pallets and molded pulp pallets are also gaining traction as sustainable alternatives to traditional pallets.

Pallet tracking technologies have become increasingly important in ensuring efficient supply chain management and reducing losses. Five-year intervals and macroeconomic indicators significantly impact the pallet market, particularly in industries such as logistics & transportation, food & beverage, chemical, and pharmaceutical. The transportation equipment segment is a major consumer of pallets, followed by warehousing. The construction industry also utilizes pallets extensively for the transportation and handling of building materials. The market for pallets is expected to grow steadily in the coming years, driven by the increasing demand for efficient and sustainable logistics solutions.

Key Market Driver

One of the key factors driving the market growth is the high applications of pallets in the shipping and load-handling sectors. Pallets are referred to as goods or material or load-handling equipment that offers the required support during their transportation. Pallets are extensively used for various tasks including the storage, loading, and unloading of goods, and have become an important part of supply chain management in different industries.

Moreover, services, automotive, food processing, and electrical and electronics are some of the common end-user industries of the pallets. The increasing demand for material handling coupled with shipping and load-handling across various industries is expected to positively impact the market. Hence, such factors are expected to drive the market during the forecast period.

SIgnificant Market Trends

A key factor shaping the market growth is the rising popularity of pallet tracking technologies. The main factor which determines the material handling and transportation costs in any supply chain is the efficiency of logistics and warehousing operations. Many market players in the manufacturing of pallets are increasingly focusing on customizing the pallets as per the needs of the customers to stay ahead of the competition.

Additionally, several factors such as the use of cost-effective and time-saving material handling equipment are vital for enhancing the operational efficiency of logistics operations. Furthermore, many logistics companies are integrating new and advanced tracking technologies such as radio-frequency identification (RFID), sensors, and tags in pallets in order to monitor the entire supply chain process. Hence, such factors are expected to drive market growth during the forecast period.

Major Market Challenge

Fluctuating lumber prices and shortage of raw materials are one of the key challenges hindering the market growth. The price volatility of lumber is significantly impacting the market growth in Canada. There is an increase in lumber prices in Canada, especially in June 2023, due to wildfires which have raised concerns about disruptions in the supply chain. This market fluctuation of lumber has become unpredictable and is negatively affecting retailers and consumers alike.

Furthermore, factors such as scarcity in the availability of wood and lumber due to the increased demand for wood products across various industries resulted in competition for timber resources which fuelled the fluctuation of lumber prices in the market. In addition, several environmental regulations and sustainable forest management practices may hamper the supply of lumber. Hence, such factors will hinder the market growth during the forecast period.

Customer Landscape

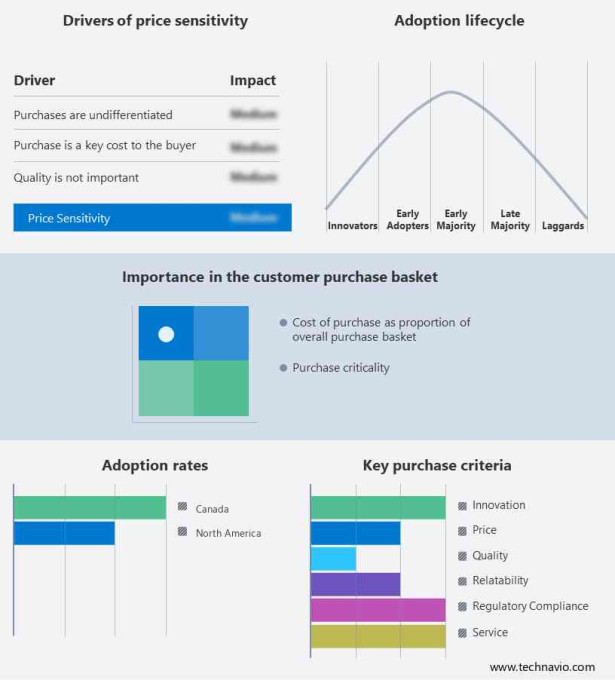

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alberta Pallet Co. Ltd: The company offers pallets such as custom pallets, recycled pallets, new pallets, heat-treated pallets, and combination pallets.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- 204 Pallet and Packaging Inc

- Bluewater Pallet Inc.

- Canada Pallet Source

- Dominion Pallet and Crate Ltd.

- EASTERN ONTARIO PALLETS LTD.

- Enviro Pallet Recovery Ltd.

- Niagara Pallet

- Pallet Management Group Inc.

- Pallet Renew

- Paramount Pallet

- S and B PALLETS LTD.

- Trican Packaging Inc.

- UFP Industries Inc.

- United Pallets and Crates INC.

- Universal Pallets

- Verbeek Pallet Supply Co. Ltd.

- Weston Forest

- Windsor Pallet Ltd.

- Woodbridge Pallet

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Largest Growing Segments in the Market?

The wood segment is estimated to witness significant growth during the forecast period. There is an increasing adoption of the wood pallet segment across various industries due to its several advantages such as higher price performance, reliability, and easy availability. Additionally, the main advantage of wood is that it is stiffer and more affordable and can be easily fabricated into different sizes as per the end-users requirement. Composite wood pallet segments are extensively used as it facilitates transportation and storage of goods and they are available in different shapes but are comparatively expensive when compared to other segments.

Get a glance at the market contribution of various segments View the PDF Sample

The wood segment was the largest segment and was valued at USD 4.54 billion in 2018. There is increasing adoption of the wood pallet segment across production units, distribution centers, and manufacturing units due to their cost-effectiveness. Additionally, this segment is extensively used in several industries including agriculture, food and beverage, pharmaceuticals, manufacturing, and logistics, for storing and transporting goods. Furthermore, wood pallets are mainly utilized for packing, transporting, and delivering food products such as fruits and vegetables, fish and seafood, oil, cheese, and dairy and bakery products. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the market growth during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Wood

- Plastic

- Corrugated paper

- Metal

- End-user Outlook

- Food and beverages

- Chemicals and pharmaceuticals

- Retail

- Transportation and warehousing

- Others

You may also interested in below market reports:

- India Pallet Market by Application, End-user and Material - Forecast and Analysis

- Pallets Market Analysis APAC, Europe, North America, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

- Europe - Pallet Market Analysis Europe - Germany, France, UK, Spain, Rest of Europe - Size and Forecast

Market Analyst Overview

In Canada, the pallet market caters to diverse industries such as food and beverage manufacturing, electrical and electronic equipment, and military transportation and storage. Pallet pooling and the use of reusable pallets like softwood, hardwood, Block wooden pallet, Stringer wooden pallet, and Engineered molded wood pallet are common practices. Different types, such as Europallet Wooden Pallet, plastic pallets, metal pallets, and even cardboard pallet are utilized based on specific needs, including forklift compatibility and handling of temperature-sensitive products. Warehousing companies implement various pallet storage systems like single-deep, double-deep, drive-in, pallet flow, and push back racks, enhancing operational efficiency. Automated identification technologies streamline logistics while addressing environmental concerns through sustainable pallet solutions. The Canadian pallet market thrives on innovation to meet stringent trade regulations and ensure reliable transportation and storage solutions nationwide.

Further, the market is diverse and essential across various industries such as logistics, warehousing, and transportation. It encompasses a wide range of pallet types including block wooden pallets, stringer wooden pallets, and engineered molded wood pallets. These pallets cater to different needs, from heavy-duty industrial applications to food and beverage sectors, supported by standardized options like Europallets, wooden pallets, plastic pallets, metal pallets, and cardboard pallets. The market also offers specialized designs such as reversible pallet, closed pallet, and wing pallet, facilitating efficient handling and storage solutions. Various storage systems like block stacking, stacking frames, single-deep pallet racks, double-deep pallet racks, drive-in racks, pallet flow racks, and push back racks optimize warehouse space and operational efficiency. These solutions are integral to managing inventory, ensuring product safety, and meeting the stringent demands of modern supply chains in Canada.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.97% |

|

Market growth 2024-2028 |

USD 1.81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.27 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

204 Pallet and Packaging Inc., Alberta Pallet Co. Ltd., Bluewater Pallet Inc., Canada Pallet Source, Dominion Pallet and Crate Ltd., EASTERN ONTARIO PALLETS LTD., Enviro Pallet Recovery Ltd., Niagara Pallet, Pallet Management Group Inc., Pallet Renew, Paramount Pallet, S and B PALLETS LTD., Trican Packaging Inc., UFP Industries Inc., United Pallets and Crates INC., Universal Pallets, Verbeek Pallet Supply Co. Ltd., Weston Forest, Windsor Pallet Ltd., and Woodbridge Pallet |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Canada

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.