Europe Pallet Market Size 2025-2029

The Europe pallet market size is valued to increase USD 7.14 billion, at a CAGR of 5.1% from 2024 to 2029. High applications of pallets in shipping and load-handling sectors will drive the Europe pallet market.

Major Market Trends & Insights

- By End-user - Food and beverages segment accounted for the largest market revenue share in 2022

- CAGR : 5.1%

Market Summary

- The market is a dynamic and evolving business landscape, driven by the continuous demand for efficient and reliable shipping and load-handling solutions. This market encompasses a range of core technologies and applications, including the increasing adoption of IoT integration in pallets for enhanced tracking and monitoring. With the emergence of smart pallets, European businesses are leveraging real-time data to optimize their supply chain operations. However, the market is not without challenges. Rising material costs, driven by increasing raw material prices, pose a significant hurdle for market participants.

- Despite these challenges, the market remains a significant growth area, with an estimated 35% of the global pallet market share. The market's ongoing evolution reflects the industry's commitment to innovation and the evolving needs of European businesses.

What will be the Size of the Europe Pallet Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pallet in Europe Market Segmented and what are the key trends of market segmentation?

The pallet in Europe industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

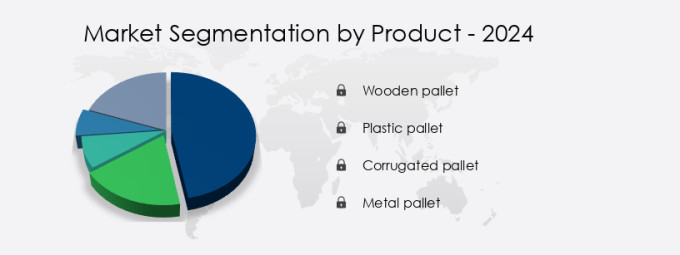

- Product

- Wooden pallet

- Plastic pallet

- Corrugated pallet

- Metal pallet

- End-user

- Food and beverages

- Transportation and warehousing

- Retail

- Pharmaceutical

- Others

- Geography

- Europe

- France

- Germany

- Spain

- UK

- Europe

By Product Insights

The wooden pallet segment is estimated to witness significant growth during the forecast period.

In the European market, pallets play a pivotal role in logistics and supply chain operations. Wooden pallets, with their cost-effectiveness, reliability, and ease of availability, dominate the scene. Wooden composite pallets, available in various shapes, offer enhanced transportation and storage capabilities. These pallets are increasingly adopted by production units, distribution centers, and manufacturing units due to their affordability and recyclability. Recycled wooden pallets, though drier than new ones, exhibit comparable durability. Pallet repair services and durability testing ensure longevity, while pallet traceability systems maintain transparency in the supply chain. Pallet lifespan extension and efficient pallet handling contribute to significant warehouse space utilization.

Sustainable pallet solutions, such as reusable pallet systems and plastic pallet recycling, are gaining traction. Pallet inspection protocols, standardization of dimensions, and optimization of design and racking efficiency facilitate streamlined warehouse management. Pallet labeling standards, exchange programs, and inventory management systems further enhance supply chain optimization. Pallet handling equipment and logistics solutions cater to efficient pallet transportation and automated handling. The market for pallets in Europe is expanding, with a projected increase of 15% in pallet manufacturing processes. Meanwhile, pallet distribution networks are expected to grow by 18%, driven by the rising demand for efficient logistics solutions. Pallet weight capacity and transportation costs are key considerations for businesses, with pallet load optimization and return logistics playing essential roles.

In the realm of pallets, innovation never ceases. From optimizing pallet design and material sourcing to improving pallet racking efficiency and stacking methods, the market is continuously evolving to meet the demands of various industries. Pallet damage prevention and quality control are paramount, ensuring the secure transportation and handling of goods.

The Wooden pallet segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The European pallet market is a critical component of the logistics and supply chain sectors, with optimizing pallet handling processes being a key priority for businesses seeking to reduce transportation costs and improve sustainability. The design of pallets significantly impacts the overall efficiency of the supply chain, with advanced pallet tracking technologies enabling real-time monitoring and reducing pallet damage through improved handling. Measuring pallet lifespan is another essential aspect of the market, as extended durability leads to cost savings and improved sustainability. Pallet material properties and their impact on durability are subject to ongoing analysis. Efficient pallet storage is another critical factor, with warehouse space utilization being a significant concern for businesses seeking to minimize costs and maximize productivity.

Pallet standardization plays a crucial role in supply chain efficiency, with pallet pooling programs reducing environmental impact by promoting the reuse of pallets. Comparing different pallet handling automation systems can lead to substantial cost savings, with efficient pallet return logistics systems further optimizing the supply chain. Pallet inspection protocols are essential for maintaining quality standards, while effective pallet repair techniques extend the lifespan of pallets and reduce the need for replacement. Implementing sustainable pallet sourcing strategies is becoming increasingly important, with many businesses turning to recycled or renewable materials to minimize their environmental footprint. The dimensions of pallets also impact warehouse storage, with cost analysis of pallet transportation over various distances being a critical consideration for businesses.

Pallet design optimization using advanced simulation tools is a growing trend, enabling businesses to create pallets that are optimally designed for their specific needs. Measuring pallet recycling rates and analyzing their environmental impact is a significant focus for the market, with more than 70% of European pallets being reused or recycled, compared to less than 50% in other regions. These insights provide valuable data for businesses seeking to optimize their pallet usage and reduce their environmental impact.

What are the key market drivers leading to the rise in the adoption of Pallet in Europe Industry?

- The significant utilization of pallets in shipping and load-handling industries serves as the primary growth driver for the market.

- Plastic pallets serve as essential equipment in the transportation of various goods and materials across numerous industries, including industrial goods and services, automotive, food processing, and electrical and electronics. The expansion of these sectors drives the growth of the European pallet market. Socio-economic advancements worldwide fuel developments across industries, thereby influencing the demand for plastic pallets. In the industrial sector, plastic pallets' durability and versatility make them a preferred choice for handling heavy loads. In the automotive industry, they facilitate the efficient movement of automobile parts during manufacturing and logistics. Plastic pallets' usage in food processing ensures food safety and hygiene due to their easy-to-clean nature.

- In the electrical and electronics sector, their resistance to moisture and chemicals is a significant advantage. The plastic pallet market's evolution reflects the continuous advancements in technology and the changing industry dynamics. The ongoing innovations in material science and manufacturing processes contribute to the development of more robust and cost-effective pallet solutions. This dynamic market landscape underscores the importance of staying informed about the latest trends and applications in the plastic pallet industry.

What are the market trends shaping the Pallet in Europe Industry?

- The integration of the Internet of Things (IoT) into pallets is an emerging market trend. This innovation in pallet technology is gaining significant attention and adoption.

- IoT technology is revolutionizing the logistics industry by integrating sensors, communication devices, and data processing capabilities into pallets. These IoT-enabled pallets provide real-time data on pallet location, movement, and condition throughout the supply chain. This data-driven approach enhances supply chain visibility and optimizes logistics operations. Sensors embedded in pallets monitor environmental conditions, such as temperature, humidity, and shock, which is essential for industries like pharmaceuticals and food. Real-time data from IoT-equipped pallets enables businesses to manage inventory more effectively, preventing stockouts and overstock situations. Moreover, the data generated by IoT-enabled pallets can be analyzed to identify trends, bottlenecks, and opportunities for process optimization.

- This data-driven approach improves supply chain efficiency and reduces operational costs. The use of IoT technology in pallets is a game-changer for businesses, providing valuable insights and real-time information to streamline logistics operations. In conclusion, IoT-enabled pallets offer numerous benefits, including enhanced visibility, improved inventory management, and process optimization. The data generated by these pallets is a valuable resource for businesses looking to streamline their logistics operations and gain a competitive edge.

What challenges does the Pallet in Europe Industry face during its growth?

- The escalating costs of pallet materials pose a significant challenge to the expansion and growth of the industry.

- The European pallet market faces significant material cost challenges, which can impact industry dynamics and operations during the forecast period. Material costs, a critical determinant of pallet production profitability, can influence pricing strategies, supply chain management, and overall competitiveness. These rising costs can squeeze manufacturers' profit margins, making it difficult to pass on the increases to customers without sacrificing competitiveness.

- Balancing pricing strategies to maintain profitability is a complex task, as manufacturers must navigate the evolving market landscape and address the ongoing pressure of increasing material costs.

Exclusive Customer Landscape

The Europe pallet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Europe pallet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pallet in Europe Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, Europe pallet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AUER GmbH - This company specializes in providing a range of high-quality plastic pallets for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AUER GmbH

- CABKA Group GmbH

- Cargopak Ltd.

- Casadei Pallets Srl

- CHEP

- Craemer GmbH

- De Vierhouten Groep BV

- Dolav

- Falkenhahn AG

- HG Timber Ltd.

- Imbal Legno Snc

- NEFAB GROUP

- Palettenwerk Kozik Sp. z o.o.

- Pallets Bertini Group Srl

- PGS Group

- Sacchi Pallets Srl

- Sartorilegno Srl

- Schoeller Allibert

- TESER SNC

- Toscana Pallets Srl

- Van Leyen Pallets

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pallet Market In Europe

- In January 2024, Danish pallet manufacturer, Dinesen, announced the launch of their new EcoPal line, a fully recyclable and biodegradable pallet, made from sustainably sourced wood (Dinesen press release).

- In March 2024, German logistics provider, DB Schenker, and Dutch pallet pooling company, Palletpool, entered into a strategic partnership to optimize their pallet management and reduce logistics costs (DB Schenker press release).

- In May 2024, French pallet manufacturer, SCA, completed the acquisition of UK-based competitor, WWP Pallets, significantly expanding their market presence in Europe (SCA press release).

- In February 2025, the European Commission approved the new EU Timber Regulation, strengthening the control system for ensuring that all imported and domestically produced pallets comply with legal requirements for sustainable forest management and traceability (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rurope Pallet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 7.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

Germany, France, UK, Spain, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In Europe's dynamic pallet market, various trends and advancements continue to shape the industry's landscape. One significant area of focus is enhancing pallet durability and longevity. Pallet repair services have gained prominence as businesses seek to extend the life of their pallets, thereby reducing replacement costs. Pallet durability testing plays a crucial role in ensuring product quality and reliability. Advanced testing methods enable manufacturers to assess pallet strength, stability, and resistance to wear and tear, leading to improved pallet performance and increased efficiency in pallet handling and storage. Another evolving trend is the implementation of pallet traceability systems.

- These systems allow for real-time monitoring of pallets throughout the supply chain, enhancing transparency and accountability. Additionally, pallet dimensions standardization is gaining momentum, streamlining warehouse operations and promoting efficient pallet handling and space utilization. Sustainability is another key consideration in the European pallet market. Sustainable pallet solutions, such as reusable pallet systems and plastic pallet recycling, are increasingly popular as businesses seek to minimize their environmental footprint. Furthermore, pallet pooling systems and pallet exchange programs enable the sharing of resources, reducing the need for new pallets and contributing to cost savings. The market also prioritizes pallet inspection protocols and quality control measures to prevent damage and ensure consistent product quality.

- Pallet labeling standards and inventory management systems further optimize supply chain logistics and facilitate seamless pallet transportation and distribution networks. Innovations in pallet manufacturing processes, such as pallet design optimization and automated pallet handling, continue to drive efficiency and productivity in the European pallet market. As the industry continues to evolve, businesses will continue to explore new solutions for pallet lifespan extension, pallet racking efficiency, and pallet stacking methods, among others.

What are the Key Data Covered in this Europe Pallet Market Research and Growth Report?

-

What is the expected growth of the Europe Pallet Market between 2025 and 2029?

-

USD 7.14 billion, at a CAGR of 5.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Wooden pallet, Plastic pallet, Corrugated pallet, and Metal pallet), End-user (Food and beverages, Transportation and warehousing, Retail, Pharmaceutical, and Others), and Geography (Europe)

-

-

Which regions are analyzed in the report?

-

Europe

-

-

What are the key growth drivers and market challenges?

-

High applications of pallets in shipping and load-handling sectors, Rising material costs of pallets

-

-

Who are the major players in the Pallet Market in Europe?

-

Key Companies AUER GmbH, CABKA Group GmbH, Cargopak Ltd., Casadei Pallets Srl, CHEP, Craemer GmbH, De Vierhouten Groep BV, Dolav, Falkenhahn AG, HG Timber Ltd., Imbal Legno Snc, NEFAB GROUP, Palettenwerk Kozik Sp. z o.o., Pallets Bertini Group Srl, PGS Group, Sacchi Pallets Srl, Sartorilegno Srl, Schoeller Allibert, TESER SNC, Toscana Pallets Srl, and Van Leyen Pallets

-

Market Research Insights

- The European pallet market is a dynamic and complex industry, encompassing various aspects such as pallet load stability, quality assessment, material properties, safety regulations, warehouse layout design, transport efficiency, pallet sharing models, maintenance programs, disposal methods, improved handling, integrated systems, sustainable sourcing, damage assessment, cleaning processes, storage density, weight distribution, standardization benefits, life cycle, design standards, handling automation, tracking technology, racking systems, efficient pallet flow, inventory tracking, handling safety, repair techniques, and material selection. Two significant data points illustrate the market's evolution: In 2020, the European pallet market size was estimated at €15 billion, with a growth rate of 3% yearly.

- This expansion is driven by the increasing demand for efficient pallet logistics and the implementation of advanced pallet technologies, such as automated handling and tracking systems. Additionally, the market's focus on sustainability, with the rise of recycled and reusable pallets, has contributed to the growth. Pallet weight distribution and standardization have become crucial factors in optimizing warehouse operations and reducing handling costs.

We can help! Our analysts can customize this Europe pallet market research report to meet your requirements.