Canned Vegetables Market Size 2024-2028

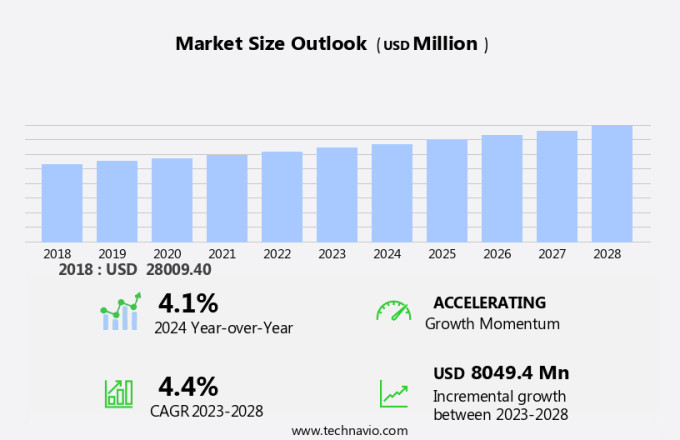

The canned vegetables market size is forecast to increase by USD 8.05 billion at a CAGR of 4.4% between 2023 and 2028. The market exhibits significant growth due to several factors. Increasing disposable income enables consumers to spend more on nutritious food options, leading to a rise in demand for canned vegetables. Additionally, there is a growing trend towards plant-based diets, making canned vegetables an attractive choice for those seeking protein sources. However, challenges persist in the form of food decomposition and environmental factors. Canned vegetables may lose some nutrients during the preservation process, which could impact their appeal. The market is poised for growth, driven by these trends and the increasing demand for natural and convenient food options. Furthermore, concerns regarding the impact of canned food production on the environment may deter some consumers. Despite these challenges, the market for canned vegetables continues to expand, driven by consumer preferences for convenience and affordability.

What will the size of the market be during the forecast period?

The market is witnessing significant growth due to several factors. With the increasing preference for convenient and nutritious meal options, canned vegetables have gained popularity among the working population in the US. The fast-paced lifestyle of consumers has led to an increased demand for ready-to-eat and easy-to-prepare food items. Canned vegetables offer several advantages over fresh vegetables. They are processed using advanced techniques such as peeling, chopping, and cooking, ensuring consumers get consistent quality and taste. The use of air-tight tins and aluminum cans maintains the nutritional qualities of the vegetables, preserving their nutrients, protein, fiber, vitamins, and omega-3 fatty acids. Moreover, the trend towards organic food, clean-label foods, and chemical-free food products has also positively impacted the market. Consumers are increasingly seeking label knowledge and understanding the nutritional benefits of the food they consume. Canned vegetables provide a convenient solution for those looking for nutritious options without compromising on taste or convenience.

Further, the canning process ensures that vegetables retain their natural color, texture, and flavor, making them a popular choice for consumers. Canned fruits also follow the same trend, offering consumers a wide range of options for their daily nutritional needs. The global production of canned vegetables is expected to grow due to the increasing demand for protein-rich and fiber-rich food items. Consumers are becoming more health-conscious and are looking for food options that provide essential nutrients for a balanced diet. Canned vegetables offer a cost-effective and convenient solution for meeting these dietary requirements. In conclusion, the market is experiencing growth due to the changing consumer preferences towards convenient, nutritious, and chemical-free food options. The trend towards organic and clean-label foods, coupled with the convenience and long shelf life of canned vegetables, is expected to drive the growth of this market in the coming years.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Canned tomatoes

- Canned beans

- Canned peas

- Canned corn

- Others

- Type

- Conventional

- Organic

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Spain

- North America

- Canada

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Product Insights

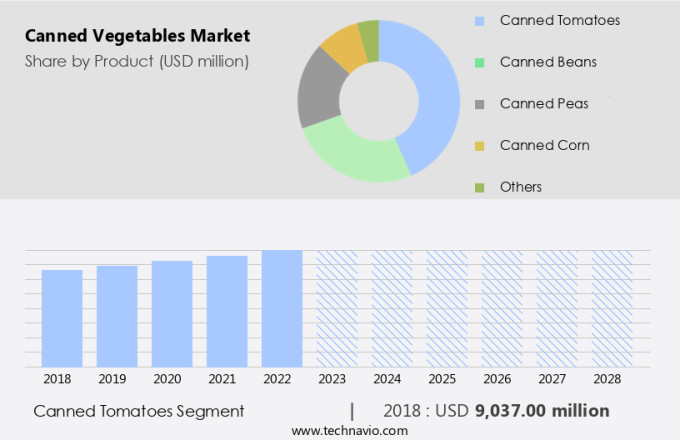

The canned tomatoes segment is estimated to witness significant growth during the forecast period. Canned vegetables, including tomatoes, play a significant role in the global market due to their convenience and nutritional value. Canned tomatoes, in particular, are widely used in various dishes such as sauces, soups, stews, and casseroles, adding depth of flavor and rich color. These vegetables are a valuable source of essential vitamins, including vitamin C and vitamin K, and the antioxidant lycopene. Canned fruits also fall under this category and offer similar benefits.

Moreover, product labels provide consumers with important information regarding fiber, vitamins, and other nutrients present in these canned goods. Organic vegetables are increasingly popular, reflecting a growing trend towards healthier food choices. The global production of canned vegetables continues to expand, catering to the demand for convenient meals that do not compromise nutrition.

Get a glance at the market share of various segments Request Free Sample

The canned tomatoes segment accounted for USD 9.04 billion in 2018 and showed a gradual increase during the forecast period.

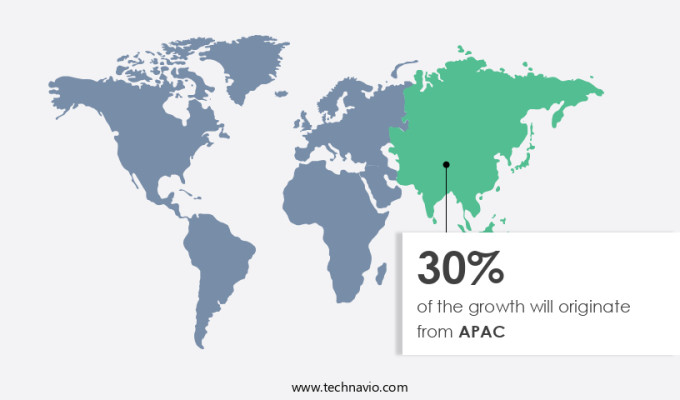

Regional Insights

APAC is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market is a notable segment within the global industry, characterized by substantial consumption of packaged food products, including canned vegetables and beverages. Germany, France, and Spain are major contributors to this market, each bringing unique aspects to the overall dynamics. Germany is the leading importer of canned vegetables in Europe, with approximately 1.8 million tons imported in 2022. Although there was a slight decrease in 2021, the import volume has consistently increased with an average growth rate of 2.4%. In terms of value, German imports have risen by an average of 9% annually, reaching USD 3 billion. Processing techniques, such as peeling, chopping, and cooking, are essential in the production of canned vegetables, ensuring convenience for consumers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

A rise in disposable income is the key driver of the market. The market in the US is witnessing notable expansion due to the escalating fast-paced lifestyle and increasing working population. This trend is fueled by the growing preference for convenient and nutritious food alternatives, such as canned vegetables. For instance, according to the US Census Bureau, the median household income in the US was reported at USD 68,703 in 2023, marking a 3.5% increase compared to 2022 and a 6.4% increase compared to 2019. This income growth is empowering consumers to invest more in healthier food options, including canned vegetables, which are not only convenient but also offer numerous health benefits.

Moreover, the rising demand for organic food and clean-label foods is further propelling the market growth. These food choices are free from chemicals and preservatives, making canned vegetables an attractive option for health-conscious consumers. The market is expected to continue its upward trajectory, driven by these consumer trends and preferences.

Market Trends

Rising interest in plant-based diets is the upcoming trend in the market. The market in North America is experiencing notable growth due to the rising preference for nutritious and plant-based food options. Environmental factors, such as the increasing awareness of the health benefits of consuming vegetables and the shift towards sustainable agriculture, are also contributing to this trend. In the United States, the number of vegetarians and vegans is estimated to be around 10.7 million in 2023, representing approximately 5%-8% of the population.

Further, this demographic shift is driving demand for canned vegetables, which offer convenience and a rich source of essential nutrients, including protein, fiber, and vitamins. Similarly, in Canada, the vegan population was reported to be around 2 million in 2022. The market is expected to continue growing as more consumers seek convenient and nutritious alternatives to meat-based food products.

Market Challenge

Growing cases of product recalls is a key challenge affecting the market growth. Canned vegetables have become a staple in American households due to their extended shelf life and nutritional qualities. However, the market for these natural food products faces challenges, particularly in ensuring product safety and maintaining consumer trust. Instances of product recalls, such as the one involving Princes Group's canned bean products in December 2023, can lead to significant financial and reputational damage for manufacturers. These recalls underscore the importance of rigorous quality control measures during the canning and preserving process to prevent contamination and maintain product safety.

For example, in May 2024, Goya Foods had to recall certain lots of Red Kidney Beans due to potential contamination. As consumers increasingly demand transparency in food labeling, manufacturers must prioritize safety and quality to meet these expectations and maintain a strong market position. Ensuring product safety not only protects consumers but also safeguards the long-term success of businesses in the market.

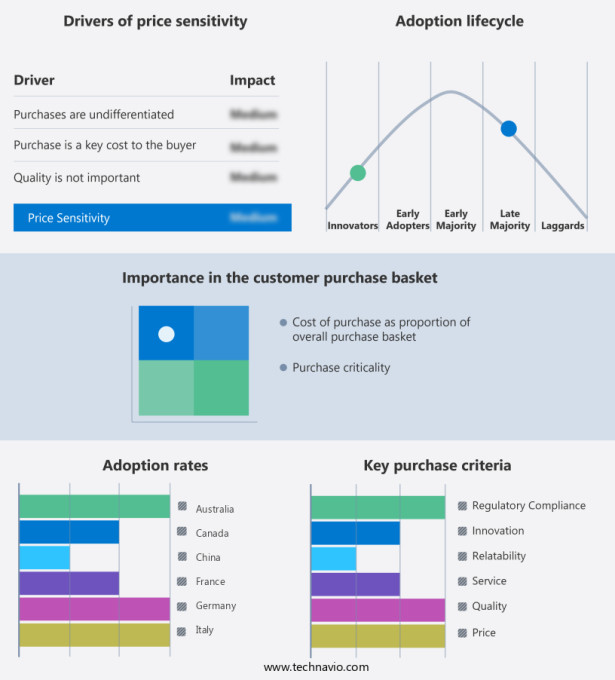

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aditi Foods (India) Pvt. Ltd. - The company offers a wide variety of canned vegetables such as baby corn, sweetcorn, baked beans, tomato, and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acroyali Holdings Qingdao Co Ltd.

- Ayam Sarl

- B and G Foods Inc.

- Baxters Food Group Ltd.

- BONDUELLE SA

- Conagra Brands Inc.

- Del Monte Foods Inc.

- Dole plc

- General Mills Inc.

- Goya Foods Inc.

- Greenyard NV

- Hirzel Canning Company and Farms, Inc

- J Sainsbury plc

- KYKNOS S.A

- LA DORIA S.P.A.

- Princes Ltd.

- SATKO

- Seneca Foods Corp.

- Tesco Plc

- The Kraft Heinz Co.

- Waitrose and Partners

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for packaged food products, beverages, and convenience food items in the fast-paced lifestyle of the working population. Canning is an essential preservation technique used to extend the shelf life of food products, preventing food decomposition caused by environmental factors. The market for canned vegetables caters to health-conscious consumers who prefer organic food, clean-label foods, and chemical-free, natural food products. The canning process involves peeling, chopping, and cooking vegetables before packing them in air-tight tins or aluminum can. This preservation method maintains the nutritional qualities of the vegetables, including essential nutrients like protein, fiber, vitamins, omega-3 fatty acids, and antioxidants.

Canned fruits, vegetables, meats, and seafood, such as tuna, salmon, sardines, and anchovies, offer nutritional profiles that contribute to heart health, blood pressure regulation, and overall well-being. Consumers are increasingly seeking convenient meals and healthier alternatives, making the canned food market a lucrative business opportunity. The global production of canned fruits and vegetables is expected to grow, driven by the increasing demand for nutritious options that cater to the changing dietary preferences and lifestyles of consumers. Product labels play a crucial role in the market, with consumers seeking information on the nutritional profile, organic certification, and production methods of canned food items.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2024-2028 |

USD 8.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.1 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 30% |

|

Key countries |

US, Germany, Canada, China, France, UK, Italy, Japan, Spain, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acroyali Holdings Qingdao Co Ltd., Aditi Foods (India) Pvt. Ltd., Ayam Sarl, B and G Foods Inc., Baxters Food Group Ltd., BONDUELLE SA, Conagra Brands Inc., Del Monte Foods Inc., Dole plc, General Mills Inc., Goya Foods Inc., Greenyard NV, Hirzel Canning Company and Farms, Inc, J Sainsbury plc, KYKNOS S.A, LA DORIA S.P.A., Princes Ltd., SATKO, Seneca Foods Corp., Tesco Plc, The Kraft Heinz Co., and Waitrose and Partners |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch