Car And Truck Wash Market Size 2025-2029

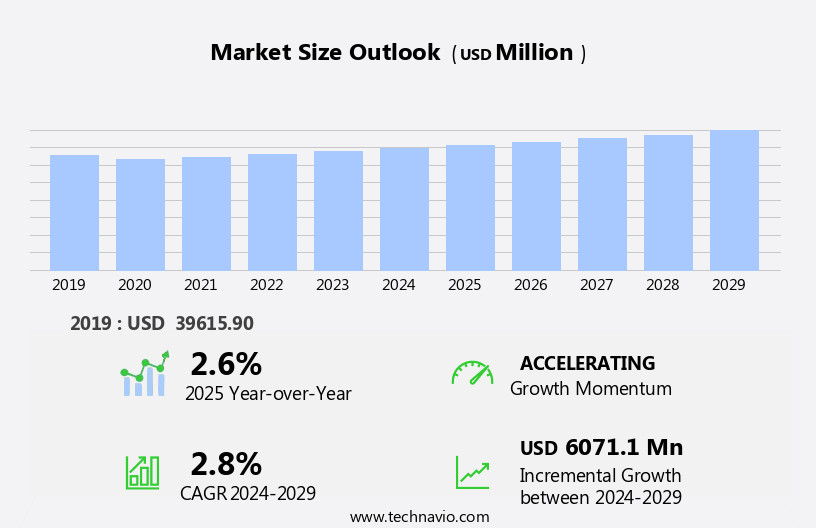

The car and truck wash market size is forecast to increase by USD 6.07 billion, at a CAGR of 2.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of car wash services in untapped regions and the rising demand for automated systems. The untapped regions represent a vast opportunity for market expansion, as more consumers in these areas recognize the benefits of regular car washing. Additionally, the preference for automated car wash systems is on the rise due to their efficiency, convenience, and consistency. However, the high initial investments required for setting up car wash machine equipment pose a considerable challenge for market entrants.

- Companies seeking to capitalize on market opportunities must carefully consider these dynamics and devise strategies to mitigate the high investment costs while effectively addressing the growing demand for automated car wash services. In navigating this market, strategic partnerships, technology innovation, and operational efficiency will be key factors in successfully capturing market share and maintaining a competitive edge.

What will be the Size of the Car And Truck Wash Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Tire cleaning remains a crucial aspect, as high-performance tire shine solutions enhance vehicle aesthetics and prolong tire life. High-pressure washers, an essential tool for effective cleaning, are increasingly being integrated with energy efficiency technologies to minimize operational costs. Parts and accessories, including water filters and brush car washes, contribute to improved wash quality and customer satisfaction. Safety regulations mandate the use of advanced safety features in automated car washes, ensuring both employee safety and customer well-being. Water conservation and environmental impact are growing concerns, leading to the adoption of water reclamation systems and eco-friendly cleaning solutions.

Fleet washing and commercial car washes benefit significantly from these innovations, as they often require large volumes of water. Inventory management, pricing strategies, and supply chain management are crucial components of a successful car wash business. Training programs for employees ensure high-quality services and customer retention. Truck wash bays, with their larger dimensions, require specialized equipment and techniques for effective cleaning. Interior cleaning, including detailing services and UV protection, complement exterior cleaning to provide a complete vehicle makeover. Self-service car washes and mobile apps offer convenience for customers, while maintenance contracts and marketing strategies ensure repeat business.

Undercarriage cleaning, wheel cleaning, foam cannons, and drying systems are essential components of a comprehensive car wash service. Wash time optimization, customer feedback, and online booking systems further enhance the customer experience. Continuous innovation and adaptation to market trends are key to success in the car and truck wash industry. From energy efficiency and water conservation to customer loyalty programs and advanced cleaning technologies, the market's evolution is ongoing and multifaceted.

How is this Car And Truck Wash Industry segmented?

The car and truck wash industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Exterior

- Interior

- Method

- Cloth friction washing

- Touch less washing

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

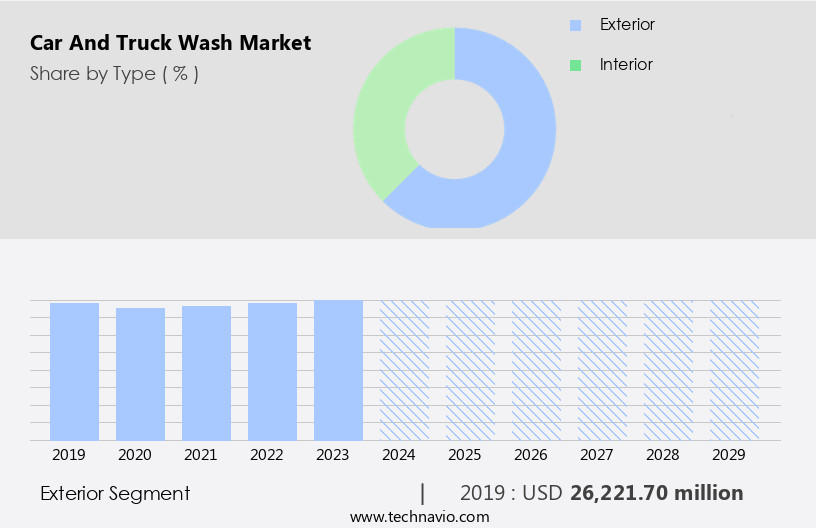

The exterior segment is estimated to witness significant growth during the forecast period.

The exterior segment in The market encompasses washing and cleaning services focused on the outer surfaces of cars and trucks. This segment aims to remove dirt, grime, and contaminants, enhancing vehicles' cleanliness and appearance. Offerings within this segment include handwashing and automated washing. Handwashing involves the use of water, soap, and brushes for manual cleaning, considered more thorough than automated methods. Conversely, automated washing systems employ brushes, high-pressure water jets, and detergents to clean exterior surfaces efficiently in car and truck wash facilities. Moreover, the exterior segment incorporates other services such as touchless car washes, which utilize water and cleaning solutions without brushes, ensuring a gentler cleaning process for sensitive vehicle surfaces.

Safety regulations play a crucial role in the market, ensuring the proper use of vacuum systems, water filters, and chemical dispensing systems to maintain environmental standards and customer safety. Customer retention is a significant focus, with fleet washing, detailing services, and customer loyalty programs catering to repeat clients. Wastewater treatment and water conservation are essential aspects of the market, with water reclamation systems and water softeners employed to minimize water usage and reduce environmental impact. Energy efficiency, tire cleaning, and undercarriage cleaning are other services that cater to the evolving needs of the market. The commercial car wash sector includes commercial car washes, truck wash bays, mobile car washes, and self-service car washes, catering to various customer segments.

Marketing strategies, maintenance contracts, and pricing strategies are essential components of the market, ensuring customer satisfaction and operational efficiency. Inventory management and supply chain management are also crucial for maintaining a consistent supply of cleaning solutions, parts, and accessories. The market is continually evolving, with innovations in technology, such as mobile apps, foam cannons, and online booking systems, streamlining the customer experience. Drying systems, tire shine, and wheel cleaning are additional services that enhance the overall car washing experience. Operational costs, including equipment repair and maintenance, are ongoing considerations for car and truck wash businesses.

The Exterior segment was valued at USD 26.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

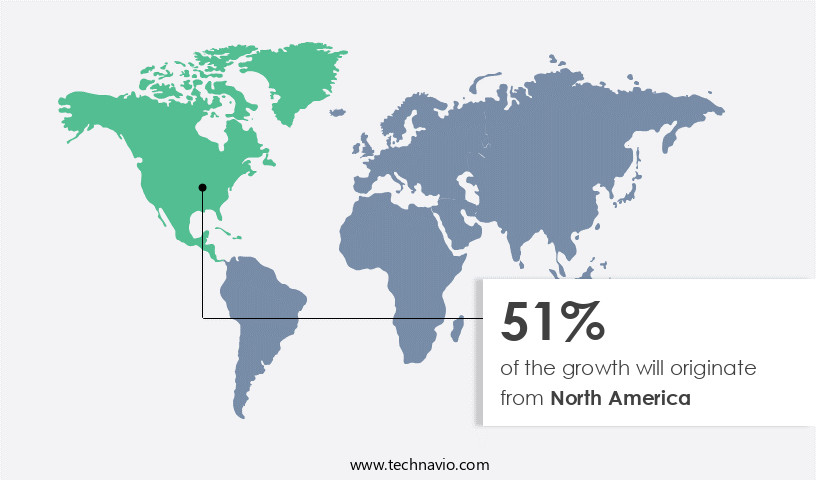

North America is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is a significant industry, with an estimated 8 million vehicles undergoing washing daily at professional facilities. According to the US Census Bureau, Americans spend approximately USD5.8 billion annually on car washes, making it a substantial market. Over 70% of US car owners utilize professional car wash services, and this trend is projected to continue. With the surge in automotive sales, particularly light trucks accounting for 80% of new vehicle purchases in 2023, the demand for car and truck wash services is poised for growth. Employee training, water filters, and safety regulations are essential components of the car wash process.

Vacuum systems and high-pressure washers ensure thorough cleaning, while touchless and brush car washes cater to varying customer preferences. Automated car washes offer convenience, while fleet washing and truck wash bays cater to commercial clients. Wastewater treatment and water conservation are critical aspects of the industry's environmental impact. Customer retention is a key focus, with customer loyalty programs, detailing services, and self-service car washes enhancing the overall experience. Wash quality, pricing strategies, and inventory management are essential for operational efficiency. Mobile car washes, foam cannons, and online booking systems cater to evolving customer demands. Energy efficiency, tire cleaning, and undercarriage cleaning are essential services, while maintenance contracts and marketing strategies ensure customer satisfaction.

Water reclamation systems, corrosion inhibitors, and tire shine are essential add-on services. Training programs for employees, truck wash bays, and equipment repair ensure the highest standards. The industry's environmental impact and water conservation are essential considerations, with water softeners and UV protection addressing these concerns. Subscription models and wash time optimization contribute to customer convenience. In conclusion, the market in North America is a dynamic and evolving industry, with a focus on customer satisfaction, operational efficiency, and environmental sustainability. The integration of technology, training, and innovative services ensures the industry remains responsive to customer needs and preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global car and truck wash market size and forecast projects growth, driven by car and truck wash market trends 2025-2029. B2B car wash solutions leverage automated wash technologies for efficiency. Car and truck wash market growth opportunities 2025 include car wash for fleets and eco-friendly car wash systems, meeting demand. Car wash management software optimizes operations, while car and truck wash market competitive analysis highlights key providers. Sustainable car wash practices align with eco-friendly wash trends. Car and truck wash regulations 2025-2029 shapes car wash demand in North America 2025. Touchless wash solutions and premium car wash insights boost adoption. Car wash for commercial vehicles and customized wash systems target niches. Car and truck wash market challenges and solutions address water use, with direct procurement strategies for wash systems and car wash pricing optimization enhancing profitability. Data-driven car wash analytics and smart wash trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Car And Truck Wash Industry?

- The significant expansion of markets in underutilized regions serves as the primary catalyst for market growth.

- The market is experiencing significant growth in untapped regions due to the expanding auto industry and increasing disposable income. With more cars on the road, the demand for effective and efficient cleaning solutions becomes essential. Environmental concerns, such as water conservation and minimizing the environmental impact, are also driving the market. Mobile car washes and self-service car washes offer convenience and flexibility, while detailing services and UV protection add value. Wash time efficiency and customer feedback are crucial factors in maintaining customer loyalty.

- Subscription models and wash quality are other key market dynamics. Water softeners are used to improve wash quality and reduce water hardness. The market is continuously evolving, with innovations in cleaning solutions, technology, and customer experience. Companies are focusing on sustainable practices, such as using eco-friendly cleaning agents and reducing water usage, to meet the growing demand for environmentally-friendly car and truck wash services.

What are the market trends shaping the Car And Truck Wash Industry?

- The trend in the car wash industry is shifting towards automated systems due to rising demand. The market is witnessing a growing demand for automated washing systems due to the convenience they offer to customers with busy schedules. These systems utilize advanced technologies such as high-pressure water jets, spinning brushes, and chemical solutions to ensure thorough exterior cleaning. Additionally, tire cleaning and tire shine have become essential services in demand, leading to the integration of specialized equipment in automated wash systems. Interior cleaning is also gaining traction, with vacuuming, air freshening, and glass cleaning becoming standard offerings. Energy efficiency is a crucial factor in the market, with water reclamation systems and inventory management solutions being implemented to minimize water usage and optimize resource utilization.

- Pricing strategies and supply chain management are essential aspects of the car and truck wash business. Training programs for staff ensure consistent quality and customer satisfaction. Truck wash bays are increasingly adopting automated systems to cater to the growing demand for commercial vehicle cleaning services. Overall, the market is driven by the need for convenience, time savings, and effective cleaning solutions.

What challenges does the Car And Truck Wash Industry face during its growth?

- The car wash industry faces significant growth impediments due to the substantial upfront investments required for acquiring and installing car wash equipment.

- Car and truck wash systems offer convenience and time savings for vehicle owners. However, the high upfront costs can hinder potential buyers. The choice between self-service or fully automatic systems depends on the size and type of the vehicle. While automatic systems provide a more thorough clean with undercarriage washing, wheel cleaning, and the use of foam cannons, they come with higher operational costs due to the need for soaps, detergents, and other chemicals. In contrast, residential car washes and regular service station equipment have lower initial investments but may not offer the same level of cleaning.

- To attract customers and increase satisfaction, commercial car washes employ marketing strategies such as mobile apps, online booking systems, and drying systems. Despite the additional expenses, the returns from car and truck wash equipment can be worthwhile, particularly for businesses catering to commercial vehicles. Overall, the decision to invest in car and truck wash systems requires careful consideration of the specific needs and budget of the buyer.

Exclusive Customer Landscape

The car and truck wash market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the car and truck wash market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, car and truck wash market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfred Karcher SE and Co. KG - The company specializes in providing a range of car and truck washing solutions, including the TB 50, TB 46, and RBS 6012 models. These offerings cater to various market demands with advanced technology and efficient design, contributing to the industry's growth and innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfred Karcher SE and Co. KG

- American Carwash Co.

- Clean Vaccum Technologies

- Get Spiffy Inc.

- GoWashMyCar Ltd.

- InterClean Equipment LLC

- Istobal SA

- KKE Wash Systems

- Motor City Wash Works Inc.

- Mr. Wash

- Nissan Clean India Private Limited

- Otto Christ AG

- PECO Car Wash Systems

- Prestige Car Wash Equipment

- Splash Car Wash

- The Ultimate Car Wash and Detail

- TOP WASH Autopflege GmbH

- Washtec AG

- ZIPS CAR WASH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Car And Truck Wash Market

- In January 2024, CarWash Co. Introduced an innovative touchless car wash system, named "Eco-Pure," in collaboration with Waterless Car Wash Tech, LLC (WCWT) (CarWash Co. Press release). This system reduces water usage by up to 90% compared to traditional methods, addressing growing water scarcity concerns.

- In March 2024, TruckWash Industries, Inc. Announced a strategic partnership with SoapTech Solutions, a leading provider of automated truck washing systems (TruckWash Industries, Inc. Press release). This collaboration aims to enhance TruckWash Industries' offerings and cater to the increasing demand for efficient and eco-friendly truck washing solutions.

- In May 2024, Express Car Wash, a major player in the car wash market, completed the acquisition of QuickWash, Inc., expanding its presence in the NorthEastern US (Express Car Wash press release). This acquisition added 50 new locations to Express Car Wash's network, increasing its market share and enhancing its geographic reach.

- In April 2025, the Environmental Protection Agency (EPA) approved the use of biodegradable, plant-based cleaning agents in commercial car and truck washes (EPA press release). This approval is expected to drive the adoption of eco-friendly cleaning solutions, addressing environmental concerns and meeting growing consumer demand for sustainable practices.

Research Analyst Overview

- In the market, drying efficiency and water usage are critical factors influencing business profitability. Chemical concentration plays a role in cleaning efficacy and cost management, while loyalty programs help retain customers and ensure repeat business. Employee safety is a top priority, with water pressure and brush wear key considerations. Automation systems, business intelligence, and energy consumption are driving technological innovation, improving operational efficiency and sustainability initiatives. Cost management is essential, with strategic planning required for equipment lifespan, inventory control, marketing campaigns, and supply chain optimization. Risk management, insurance coverage, and waste management are also crucial elements. Payment systems and employee safety training are important for customer acquisition and retention.

- Brand reputation is key, with noise levels, customer experience, and service speed shaping perceptions. Technological advancements, such as data analytics and vacuum power, offer competitive advantages. Cleaning technology and equipment maintenance are ongoing concerns, with chemical compatibility a critical factor in ensuring optimal performance. Market trends include a focus on energy efficiency, sustainability initiatives, and improved customer experience through automation and data analytics. Effective risk management, cost control, and employee safety training are essential for long-term success.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Car And Truck Wash Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.8% |

|

Market growth 2025-2029 |

USD 6071.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

US, Canada, China, Germany, UK, Japan, Saudi Arabia, Italy, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Car And Truck Wash Market Research and Growth Report?

- CAGR of the Car And Truck Wash industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the car and truck wash market growth of industry companies

We can help! Our analysts can customize this car and truck wash market research report to meet your requirements.