Cashew Milk Market Size 2024-2028

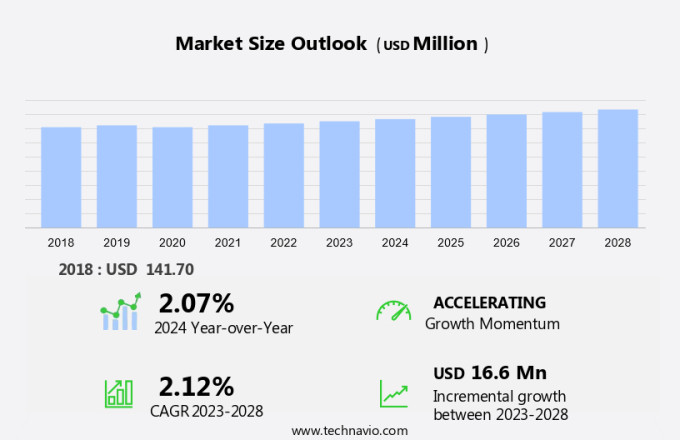

The cashew milk market size is forecast to increase by USD 16.6 million at a CAGR of 2.12% between 2023 and 2028. The market is experiencing significant growth due to rising cases of lactose intolerance and allergies associated with traditional dairy and alternative milk sources like soy, hazelnut, and almond. Consumers are increasingly opting for plant-based milk options, leading to a swell in demand for cashew milk. Additionally, the preference for sugar-free and organic cashew milk is on the rise, as health-conscious consumers seek out clean-label, natural beverages. Innovation is a key trend in the market, with companies introducing new flavors and functional additives to cater to diverse consumer preferences.

Protein shakes and healthy beverages infused with cashew milk are gaining popularity, particularly among fitness enthusiasts. The manufacturers are responding to this trend by adopting sustainable packaging solutions. Furthermore, functional additives like collagen peptides, probiotics, and adaptogens are being added to enhance its nutritional value and appeal to health-conscious consumers.

Market Analysis

Cashew milk, a plant-based beverage derived from cashews, has gained significant popularity in the US market due to its health benefits and suitability for individuals with lactose intolerance and dairy allergies. This alternative milk source is free from cholesterol and saturated fats, making it an ideal choice for those conscious about heart health. Cashew milk is rich in unsaturated fats, primarily oleic acid, which contributes to its creamy texture and heart-healthy properties. Additionally, it is a good source of essential B vitamins, including thiamine, riboflavin, and niacin. The production process involves soaking cashews, grinding them into a paste, and separating the milk from the nut meal using a press.

The remaining by-products, such as cashew shell oil and cashew bagasse, can be utilized for various purposes, including technology applications in the food industry. Cashew milk is increasingly used in commercial settings, such as vegan eateries, cafes, and bakeries, and has gained popularity among the growing vegan population. Its versatility in various applications, from cooking to baking, makes it a valuable ingredient in the food industry. Iron deficiency anemia patients can also benefit from cashew milk as it contains iron, making it a healthier alternative to traditional milk. With the increasing awareness of health and wellness, the demand for cashew milk is expected to grow in the US market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Supermarkets/hypermarkets

- Convenience stores

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Distribution Channel Insights

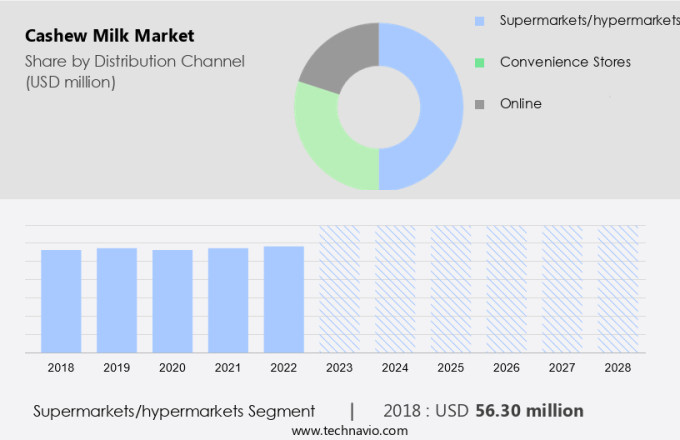

The supermarkets/hypermarkets segment is estimated to witness significant growth during the forecast period. Cashew milk, a popular plant-based alternative to dairy, has been gaining traction in the global market due to its unique taste and nutritional benefits. In 2023, traditional distribution channels, including supermarkets and hypermarkets, accounted for the largest market share in the cashew milk industry. This is primarily due to the convenience and reliability of these establishments, allowing consumers to examine product packaging and check expiration dates before purchasing.

In developing countries like India and China, where cashew milk sales are significant, the presence of numerous supermarkets and hypermarkets is driving market growth. Product innovation and social media campaigns are also contributing to the increasing popularity of cashew milk, making it a viable option for those managing diabetes due to its low glycemic index and antioxidant activity. Cashew milk can be found in various formats, including online and in convenience stores, catering to diverse culinary applications.

Get a glance at the market share of various segments Request Free Sample

The supermarkets/hypermarkets segment accounted for USD 56.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

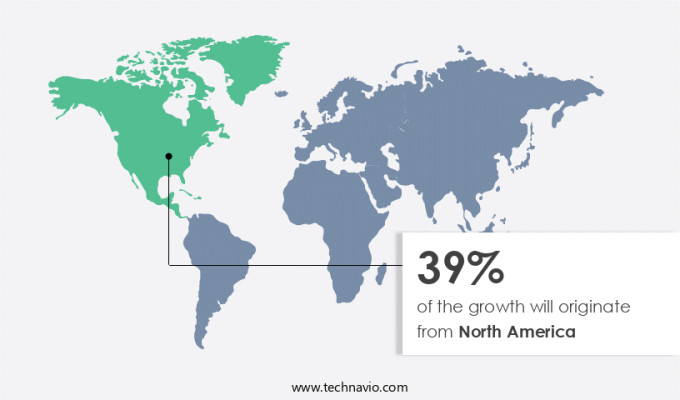

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America, specifically in the US and Canada, has experienced significant growth due to the rising preference for plant-based milk substitutes. Consumers are increasingly opting for dairy-free alternatives, such as cashew milk, due to health concerns and the growing vegan population. Major regional and international brands offer a variety of options, including flavored, sugar-free, and organic versions, which are widely available in convenience stores, online platforms, and culinary applications. companies prioritize the production of these free from preservatives and artificial colors to cater to health-conscious consumers. The antioxidant activity of cashew milk makes it an attractive choice for individuals managing diabetes. As product innovation continues, social media campaigns and marketing efforts will further boost the popularity in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising cases of lactose intolerance and allergies associated with soy, hazelnut, and almond milk is the key driver of the market. This has emerged as a popular alternative to cow's milk for individuals with lactose intolerance or dairy allergies. Lactose intolerance is a condition where the body is unable to digest lactose, a sugar found in milk and dairy products. Symptoms include bloating, cramps, diarrhea, and nausea. The prevalence of lactose intolerance is on the rise in European countries such as Italy, Germany, Spain, Turkey, Poland, France, and the UK. In response to this growing trend, the demand for plant-based milk, including cashew milk, is surging. Cashew milk is rich in unsaturated fats, particularly oleic acid, and contains essential B vitamins like thiamine, riboflavin, and niacin. It also contains copper, magnesium, and is cholesterol-free. These health benefits, coupled with its ability to cater to those with lactose intolerance and dairy allergies, make them an attractive option for consumers. As a result, the market is projected to grow significantly during the forecast period.

Market Trends

Growing demand for sugar-free and organic cashew milk is the upcoming trend in the market. The prevalence of lactose intolerance and dairy allergies among the population has led to a ripple in demand for plant-based milk alternatives. Cashew milk, a popular dairy-free option, offers several health benefits, making it an attractive choice for consumers. Unlike traditional milk, cashew milk is free from cholesterol and saturated fats, making it a heart-healthy option. It is rich in unsaturated fats, particularly oleic acid, which is beneficial for heart health. Additionally, cashew milk is a good source of B vitamins, including thiamine, riboflavin, and niacin, as well as essential minerals like copper, magnesium, and zinc. With the increasing awareness of health and wellness, the demand for sugar-free cashew milk is on the rise. As a result, numerous companies are introducing sugar-free variants to cater to this growing consumer base. The trend toward sugar-free and healthier food choices is expected to continue during the forecast period.

Market Challenge

Availability of substitutes is a key challenge affecting the market growth. This has gained popularity as a dairy alternative for individuals with lactose intolerance or dairy allergies. Brands offer various alternatives, including functional beverages and plant-based milk options like almond milk. The increasing consumer preference for functional beverages rich in nutrients such as protein, calcium, vitamin D, vitamin A, vitamin B12, potassium, phosphorus, riboflavin, and niacin has fueled the demand for these products. They contain unsaturated fats, oleic acid, B vitamins, copper, magnesium, and other essential minerals. However, the presence of these alternatives may impact the growth of the market. Consumers seeking functional beverages with specific nutritional benefits may opt for these alternatives instead.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Blue Diamond Growers - The company offers cashew milk which can be unsweetened milk and sweetened vegan milk.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Britvic plc

- Califia Farms LLC

- Campbell Soup Co.

- Danone SA

- Earths Own Food Co. Inc.

- Elmhurst Milked Direct LLC

- Goodmylk

- Nayagreens

- Nutriops S.L

- Nutty life LLC

- PureHarvest

- RITA Food and Drink Co. Ltd.

- Riverford Organic Farmers Ltd.

- SunOpta Inc.

- The Hain Celestial Group Inc.

- Village Juicery

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cashew milk, a popular plant-based milk substitute, gains traction in the US market due to its versatility and health benefits. Individuals with lactose intolerance and dairy allergies find relief in this alternative, as it is free from these common allergens. This is rich in unsaturated fats, particularly oleic acid, and is a good source of essential B vitamins, including thiamine, riboflavin, and niacin. It also contains minerals like copper and magnesium. Compared to dairy milk, cashew milk is lower in cholesterol and saturated fats. It offers antioxidant activity, making it beneficial for diabetes management. Cashew milk is available in various forms, including plain and flavored, and can be found in convenience stores, online, and even in eateries and cafes. The plant-based milk market is witnessing innovation, with cashew milk gaining popularity due to its nutty taste and creamy texture.

Further, companies are focusing on product development, using technologies like cold press and freeze-drying to enhance the nutritional value and shelf life of cashew milk. This is also used in various culinary applications, including baking, cooking, and as a base for sauces and soups. Its versatility and health benefits make it a preferred choice for those following a vegan diet or seeking plant-based alternatives. The market is expected to grow further, driven by increasing health consciousness, personalized nutrition, and the availability of various flavors and functional additives like collagen peptides, probiotics, and adaptogens. Eco-conscious packaging solutions, such as plant-based plastic bottles, biodegradable cartons, and reusable glass containers, are also gaining popularity in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.12% |

|

Market Growth 2024-2028 |

USD 16.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.07 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 39% |

|

Key countries |

China, US, Germany, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Blue Diamond Growers, Britvic plc, Califia Farms LLC, Campbell Soup Co., Danone SA, Earths Own Food Co. Inc., Elmhurst Milked Direct LLC, Goodmylk, Nayagreens, Nutriops S.L, Nutty life LLC, PureHarvest, RITA Food and Drink Co. Ltd., Riverford Organic Farmers Ltd., SunOpta Inc., The Hain Celestial Group Inc., and Village Juicery |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch