Cbd-Infused Cosmetics Market Size 2024-2028

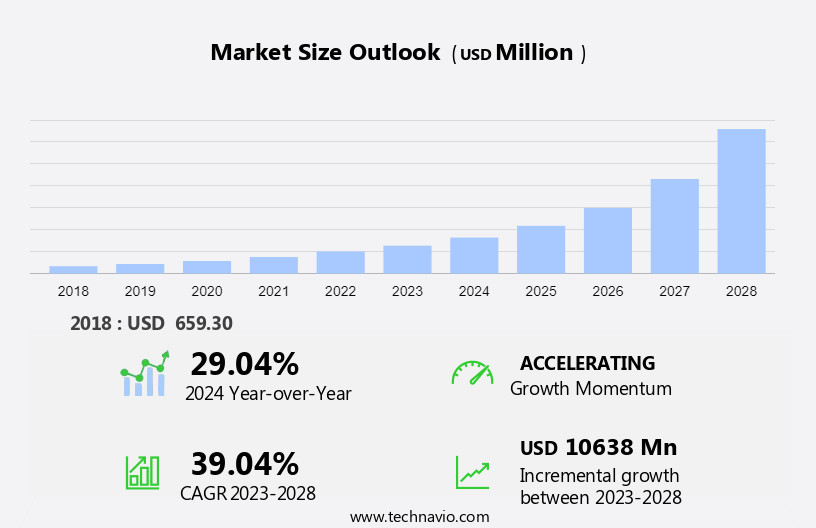

The cbd-infused cosmetics market size is forecast to increase by USD 10.64 billion at a CAGR of 39.04% between 2023 and 2028.

- The market is experiencing significant growth, driven by trends such as innovation and portfolio expansion leading to product premiumization. The introduction of organic CBD-infused cosmetics is gaining popularity, particularly in mature markets. However, challenges persist, including the lack of awareness of CBD-infused cosmetics and limited market penetration in developing countries. As consumer interest in natural and organic beauty products continues to rise, companies are expanding their offerings to include CBD-infused options.

- This trend is expected to continue, with new product launches and collaborations between beauty brands and CBD producers. Despite these opportunities, the market faces challenges in terms of regulatory compliance and education around the benefits and safety of CBD-infused cosmetics. Overall, the market is poised for continued growth, driven by consumer demand for natural and effective beauty solutions.

What will be the Size of the Cbd-Infused Cosmetics Market During the Forecast Period?

- The market has experienced significant growth in recent years, fueled by the increasing popularity of cannabidiol (CBD) for its calming properties and ability to address common skin issues such as inflammation and irritation. With both hemp-derived and marijuana-derived CBD options available, this segment of the skincare industry caters to various consumer preferences and needs. The market encompasses a range of products, including masks, oils, and skin-lightening solutions, appealing to both working professionals and those with sensitivity. The anti-inflammatory and antioxidant properties of CBD contribute to its appeal, making it a valuable addition to various Cannabidiol (CBD) Skin Care offerings. The market's expansion is evident through the proliferation of e-commerce platforms and the integration of CBD-infused cosmetics into department stores and hemp-based product segments. The cannabis cultivation industry continues to support the growth of this market, ensuring a steady supply of raw materials for the production of these cannabis-based products.

How is this Cbd-Infused Cosmetics Industry segmented and which is the largest segment?

The cbd-infused cosmetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Hemp

- Marijuana

- Product

- Skincare

- Make up and haircare

- Fragrances

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

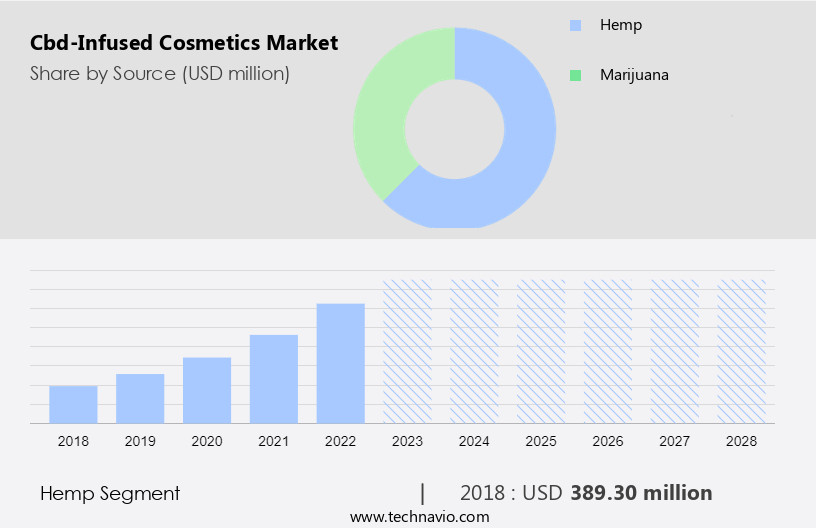

By Source Insights

The hemp segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, with hemp as a leading source due to increasing consumer demand for natural and sustainable beauty solutions. Hemp-derived CBD offers skincare benefits, such as anti-inflammatory and antioxidant properties, making it a valuable addition to various skincare products like creams, lotions, serums, oils, balms, and masks. This market expansion is fueled by the growing trend of clean and green beauty, as consumers prioritize holistic wellness and environmental concerns. Regulatory developments and legalization of hemp-derived products further boost market growth. CBD's calming benefits address common skin issues, including acne, eczema, and psoriasis, while its antioxidant effects combat free radicals and environmental damage, contributing to a youthful and radiant complexion.

Hemp-based CBD is gaining popularity among personal care brands, often replacing synthetic alternatives with natural ingredients. Despite the absence of psychoactive effects, THC, or marijuana-based CBD oil, the market continues to evolve, with distribution channels expanding to departmental stores, e-commerce platforms, hypermarkets, and retail pharmacies.

Get a glance at the market report of various segments Request Free Sample

The Hemp segment was valued at USD 389.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

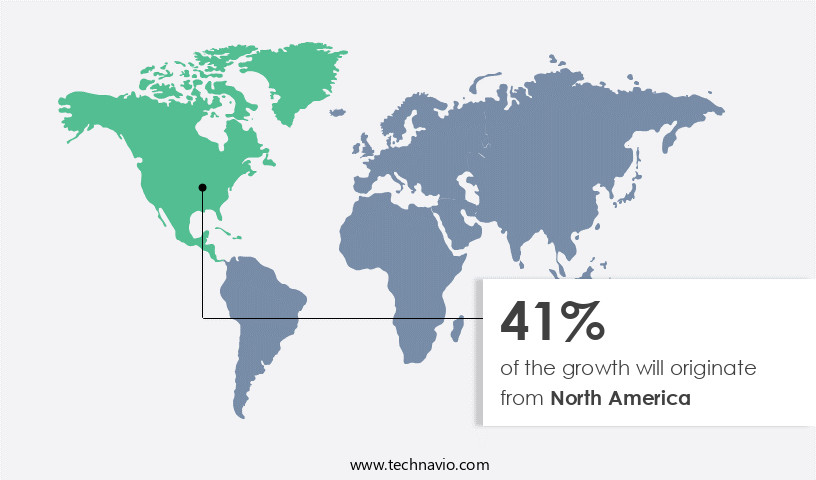

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America, primarily In the US, is experiencing growth due to the introduction of innovative products, increasing online sales channels, and the rising preference for organic and natural cosmetics. CBD, a non-intoxicating component derived from hemp plants, is known for its calming and anti-inflammatory benefits. These properties make CBD-infused cosmetics effective in addressing common skin issues such as acne, eczema, and psoriasis. Moreover, CBD's antioxidant effects help combat free radicals, environmental damage, and premature aging, contributing to a youthful and radiant complexion. The skincare industry is embracing CBD as an essential ingredient in various forms, including creams, lotions, serums, oils, balms, and bath and soap products. Personal care brands are increasingly incorporating CBD into their offerings, replacing synthetic alternatives with natural ingredients. Despite the growing popularity, concerns regarding production and availability, preservatives, and bacterial contamination persist. The market is expected to continue expanding as more consumers seek CBD's health benefits for their overall well-being and appearance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cbd-Infused Cosmetics Industry?

- Innovation and portfolio expansion leading to CBD-infused product premiumization is the key driver of the market.The skincare industry is witnessing a significant trend towards the use of cannabidiol (CBD) as an active ingredient in cosmetics. CBD, a non-psychoactive component derived from hemp plants, is known for its calming properties, making it an ideal ingredient for addressing common skin issues such as acne, eczema, and psoriasis. The anti-inflammatory and antioxidant properties of CBD help protect the skin from environmental damage, premature aging, and oxidative stress, contributing to a youthful and radiant complexion. CBD-infused skincare products come in various forms, including creams, lotions, serums, oils, balms, masks, baths, and soaps. These natural cosmetics offer consumers an alternative to synthetic alternatives and are increasingly preferred due to their natural ingredients and sustainable production methods.

Personal care brands are incorporating essential oils, natural ingredients, and aromatherapy ingredients to enhance the overall health and appearance benefits of these products. Despite the numerous benefits, the production and availability of CBD-infused cosmetics can be a challenge due to the regulatory landscape and distribution channels. These challenges include the obstructive sleep apnea caused by the psychoactive compound THC found in marijuana-based CBD and the need for preservatives to prevent bacterial contamination. However, the trend-savvy consumers and beauty bloggers continue to drive demand for these innovative products, with masks, creams, and moisturizers being the most popular choices. The oils segment is expected to dominate the market due to its ease of use and versatility.

The hemp-based products segment is also gaining popularity due to its anti-inflammatory benefits and calming effects. Companies are investing in research and development to create innovative CBD-infused skincare products that cater to the diverse needs of consumers. Packaging developers are also focusing on airless pumps and online presence to enhance the consumer experience. In conclusion, the market is witnessing significant growth due to the increasing demand for natural and innovative skincare products. The market dynamics are driven by consumer preferences for natural ingredients, sustainability, and effectiveness. companies are investing in research and development to create innovative products that cater to the diverse needs of consumers while addressing the regulatory and production challenges.

What are the market trends shaping the Cbd-Infused Cosmetics market?

- Increase in introduction of organic CBD-infused cosmetic products is the upcoming market trend.The skincare industry has witnessed a significant shift towards organic and natural cosmetic products, with CBD-infused skincare gaining popularity due to their calming properties and ability to address common skin issues. These products, derived from cannabidiol, a non-psychoactive component of hemp plants, offer anti-inflammatory and antioxidant benefits. They help combat environmental damage, premature aging, dullness, and oxidative stress, contributing to a youthful and radiant complexion. CBD-infused cosmetics encompass a range of products, including creams, lotions, serums, oils, balms, masks, baths, and soaps. Natural ingredients, such as Aloe Vera, sea salt, charcoal, coconut oil, shea butter, olive oil, and various essential oils, are often used in conjunction with CBD.

The market for CBD-infused cosmetics is driven by the increasing awareness of the potential health risks associated with synthetic cosmetic products and the desire for overall health and wellness. This trend is particularly prevalent among trend-savvy consumers, beauty bloggers, and working professionals. Despite the growing popularity of CBD-infused cosmetics, concerns regarding distribution channels, production and availability, preservatives, and bacterial contamination persist. However, with the increasing internet penetration and the availability of online platforms, the accessibility of these products has significantly improved. CBD oil, in particular, is a popular ingredient in skincare products due to its anti-inflammatory and calming benefits.

It can help alleviate skin irritation and sensitivity, making it an ideal solution for individuals with conditions such as acne, eczema, and psoriasis. The market for CBD-infused cosmetics is segmented into lotions and creams, masks and serums, baths and soaps, and natural oils. Key players In the market include various personal care brands, both large and small, that offer a range of CBD-infused products. In conclusion, the demand for CBD-infused cosmetics is on the rise, driven by the growing awareness of the potential health benefits of organic and natural ingredients. These products offer a range of benefits, from addressing common skin issues to promoting overall health and wellness.

Despite the challenges, the market for CBD-infused cosmetics is expected to continue growing, as more consumers seek out sustainable and natural alternatives to synthetic cosmetic products.

What challenges does the Cbd-Infused Cosmetics Industry face during its growth?

- Lack of awareness of CBD-infused cosmetics and market penetration in developing countries is a key challenge affecting the industry growth.CBD-infused cosmetics, derived from cannabidiol, a non-psychoactive component of cannabis plants, have gained popularity In the skincare industry due to their calming and anti-inflammatory properties. These benefits make CBD-infused cosmetics effective in addressing common skin issues such as acne, eczema, and psoriasis. Additionally, CBD's antioxidant properties help protect against free radicals, environmental damage, and premature aging, contributing to a radiant and youthful complexion. Despite the potential benefits, the market for CBD-infused cosmetics faces challenges, particularly in developing countries where price consciousness and a greater preference for traditional cosmetic products hinder growth. In these regions, personal care brands are increasingly incorporating natural ingredients, such as essential oils, into their offerings, and sustainability is a key consideration.

However, CBD-infused cosmetics may face production and availability challenges due to the complex regulatory environment surrounding cannabis-based cosmetics. The market includes lotions and creams, masks and serums, baths and soaps, natural oils, and other forms. Hemp-derived CBD is a popular source due to its anti-inflammatory and calming benefits. The market is segmented into lotions and creams, masks and serums, baths and soaps, natural oils, and oils. Key distribution channels include departmental stores, e-commerce platforms, hypermarkets, and retail pharmacies. CBD oil, in particular, is gaining traction due to its versatility and ability to address various skin irritations and sensitivities.

Working professionals and those seeking skin-lightening products are among the trend-savvy consumers driving demand for cannabis-based products. Beauty bloggers and influencers are also promoting the use of CBD-infused cosmetics, contributing to their growing popularity. The wellness beauty movement is a significant trend In the beauty industry, with consumers increasingly seeking natural and green cosmetic products. Preservatives and bacterial contamination are concerns for some consumers, leading to a preference for natural alternatives. Packaging developers are responding with innovative solutions, such as airless pumps and sustainable materials. The cannabis cultivation industry is evolving to meet the growing demand for CBD-infused cosmetics, with e-commerce platforms playing a crucial role in distribution.

The oils segment is expected to dominate the market due to its versatility and ease of use. However, marijuana-based products face regulatory challenges and may not be suitable for all consumers due to their psychoactive effects. In conclusion, the market is driven by the growing awareness of the calming and anti-inflammatory properties of CBD and the increasing preference for natural and sustainable personal care products. However, the market faces challenges related to regulatory environments, consumer preferences, and production and availability. Companies In the industry must navigate these challenges to meet the growing demand for CBD-infused cosmetics and capitalize on the opportunities presented by the wellness beauty movement.

Exclusive Customer Landscape

The cbd-infused cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cbd-infused cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cbd-infused cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Blueberries Medical Corp - The CBD infused cosmetics market encompasses a range of products, including harmonizing face creams, cleansing body bars, and skin balms infused with cannabidiol (CBD). This non-psychoactive compound derived from the cannabis plant is gaining popularity for its potential skincare benefits, such as reducing inflammation and promoting skin health. The market for CBD cosmetics is projected to grow significantly due to increasing consumer demand for natural and holistic skincare solutions. These products are formulated to provide various benefits, such as soothing and hydrating the skin, and may be suitable for individuals seeking alternative options to traditional cosmetics. The use of CBD in cosmetics is subject to regulatory compliance with the Food and Drug Administration (FDA) and other relevant authorities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blueberries Medical Corp

- Cannuka LLC

- CBD For Life

- De La Beuh

- Earthly Body Inc.

- Endoca BV

- Herbivore Botanicals

- Imbue Botanicals LLC

- Isodiol International Inc.

- Josie Maran Cosmetics LLC

- Joy Organics LLC

- Kana Skincare

- LOreal SA

- MALIN GOETZ

- Manuka Pharm

- Medical Marijuana Inc.

- The CBD Skincare Co

- The Estee Lauder Companies Inc.

- Unilever PLC

- Vertly LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for CBD-infused cosmetics has experienced significant growth in recent years, driven by the increasing awareness of the potential benefits of Cannabidiol (CBD) for overall health and appearance. CBD, a non-intoxicating component derived from hemp plants, is known for its calming properties, anti-inflammatory benefits, and antioxidant effects. These properties make CBD an attractive ingredient for addressing common skin issues such as acne, eczema, psoriasis, and premature aging. CBD's anti-inflammatory properties help soothe skin irritation and sensitivity, making it an ideal ingredient for skincare products. The antioxidant effects of CBD protect the skin from environmental damage and free radicals, contributing to a more youthful and radiant complexion.

The skincare industry has embraced CBD, with a wide range of products including creams, lotions, serums, oils, balms, masks, baths, and soaps. CBD's calming benefits extend beyond the skin, making it an attractive ingredient for aromatherapy and sleep specialists. It has been shown to help alleviate symptoms of obstructive sleep apnea, making it an appealing addition to personal care brands' product lines. The popularity of natural and sustainable products has fueled the growth of CBD-infused cosmetics. Consumers are increasingly seeking out natural ingredients as alternatives to synthetic alternatives, and CBD fits perfectly into this trend. However, the production and availability of CBD-infused cosmetics can be a challenge due to the complex regulatory environment and internet penetration.

Online platforms have emerged as a key distribution channel for CBD-infused cosmetics, allowing brands to reach a wider audience and offer convenience to working professionals. E-commerce, departmental stores, hypermarkets, and retail pharmacies are all important distribution channels for these products. The oils segment is a significant contributor to the market, with popular oils including olive, hemp, and coconut. These oils are rich in essential fatty acids and antioxidants, making them ideal for nourishing and protecting the skin. The trend-savvy consumers and beauty bloggers have played a crucial role in popularizing CBD-infused cosmetics. The wellness beauty movement has brought CBD into the mainstream, with an increasing number of beauty brands incorporating it into their product lines.

Despite the growing popularity of CBD-infused cosmetics, there are challenges that need to be addressed. These include ensuring the purity and quality of CBD, addressing concerns around THC and psychoactive effects, and addressing the issue of preservatives and bacterial contamination. In conclusion, the market is poised for continued growth, driven by the increasing awareness of CBD's potential health and beauty benefits. The market is dynamic, with a wide range of products and distribution channels, and is subject to regulatory and production challenges. Brands that can navigate these challenges and offer high-quality, effective CBD-infused cosmetics are well-positioned to succeed in this exciting market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.04% |

|

Market growth 2024-2028 |

USD 10638 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.04 |

|

Key countries |

US, Germany, China, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cbd-Infused Cosmetics Market Research and Growth Report?

- CAGR of the Cbd-Infused Cosmetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cbd-infused cosmetics market growth of industry companies

We can help! Our analysts can customize this cbd-infused cosmetics market research report to meet your requirements.