Cement Additives Market Size 2025-2029

The cement additives market size is forecast to increase by USD 11.52 billion at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for plasticizers in cement production. The market encompasses a diverse range of products, including water reduction agents, chemical additives, mineral additives, and fiber additives, which are employed to enhance the performance, strength, and sustainability of cement and stone in various applications. These additives play a crucial role in reducing water consumption during cement production, improving workability, and increasing the overall efficiency of the manufacturing process. Key additives in the market include water reducers, such as fly ash and silica slag, which facilitate the production of high-strength concrete. Additionally, mineral additives, like rice husk ash and sodium gluconate, serve as grinding aids and strength enhancers, while fiber additives provide improved durability and crack resistance.

- Plasticizers enhance the workability and durability of cement, leading to cost savings and improved product quality for manufacturers. Another key trend is the shift toward sustainable practices in the cement industry, with additives playing a crucial role in reducing carbon emissions and improving energy efficiency. However, the market faces challenges such as rising construction costs and a lack of skilled workforce, which can impact the affordability and availability of cement additives. Companies seeking to capitalize on market opportunities must focus on innovation, sustainability, and cost-effective solutions to meet the evolving needs of the cement industry.

What will be the Size of the Cement Additives Market during the forecast period?

- Furthermore, strength enhancers are additives that increase the compressive strength of concrete. They can be chemical or mineral in nature and work by reacting with the cement hydration process to form additional calcium silicate hydrate (C-S-H) gel, which is the primary binder in concrete. Performance enhancers are additives that improve the overall performance of concrete in various applications. Hybrids buildings are incorporating strength enhancer and hydroxyethyl cellulose to improve the building floor durability, while the onshore segment is focusing on concrete enhancement to meet the growing demand for more resilient structure

- The market is experiencing strong growth, driven by the increasing demand for sustainable and high-performance building materials in the construction sector. The exportation of cement and its associated products is also contributing to the market's expansion. Overall, the market is expected to continue its upward trajectory, offering significant opportunities for industry participants and innovators. The rise in global oil demand has led to an increase in drilling projects, while lockdown restrictions have slowed oil production, contributing to fluid loss; in parallel, the housing shortage has prompted the use of die casting tools in hybrid buildings, where strength enhancers are added to building floors in residential construction.

How is the Cement Additives Industry segmented?

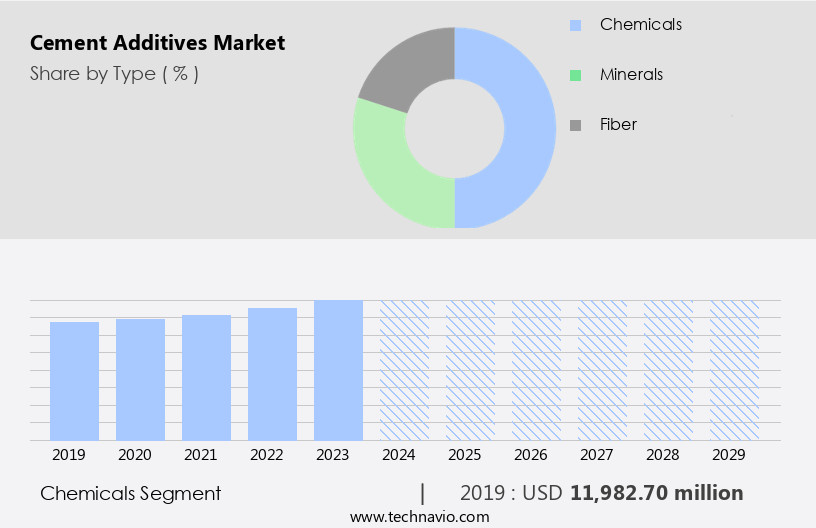

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Chemicals

- Minerals

- Fiber

- End-user

- Residential

- Non-residential

- Geography

- APAC

- China

- India

- Indonesia

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- Middle East and Africa

- South America

- APAC

By Type Insights

The chemicals segment is estimated to witness significant growth during the forecast period. Cement additives, primarily chemicals, play a crucial role in the global construction industry by reducing construction costs and ensuring consistent concrete quality. Water reducers, such as calcium aluminate and naphthalene sulfonate, are widely used in high-performance, self-consolidating concrete. Acrylic copolymer emulsion is employed as a waterproofing additive, while calcium chloride serves as a cement accelerator. The market for these additives is driven by the increasing acceptance of plasticizers and the growing demand for sustainable, high-performance buildings.

Additionally, the use of cement additives in hybrid buildings and infrastructure projects addressing climate change contributes to market growth. Chemicals, including water reducers, waterproofing agents, and strength enhancers, are expected to dominate the market, with a moderate growth rate.

Get a glance at the market report of share of various segments Request Free Sample

The Chemicals segment was valued at USD 11.98 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 65% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC was the largest consumer in 2023, driven by the construction industry's growth for residential and non-residential buildings. India, China, and Japan are significant consumers in the region, with China dominating due to the increasing use of advanced water reducers. The demand for cost-effective solutions, such as mineral additives, is high in countries like China, South Korea, Malaysia, and India, fueling business expansion. APAC's innovations and product development in cement additives include water reducers, strength enhancers, performance enhancers, grinding aids, waterproofing agents, and cement production enhancements.

The region's market growth is influenced by the federal budget for infrastructure development, hybrid buildings, and climate change mitigation efforts. Key cement types include Portland cement and white cement. The market in APAC is expected to continue growing due to the onshore segment's expansion in oil and gas industries, oilfield cement, and the exportation of cement.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cement Additives Industry?

- Increasing demand for plasticizers is the key driver of the market. Cement additives, specifically plasticizers such as sulfonated naphthalene formaldehyde, polycarboxylic acids, sulfonated melamine formaldehyde, and lignosulfonates, play a crucial role in enhancing the properties of concrete. By reducing the water content required for concrete production, these additives improve the workability of the mixture, leading to better paste quality. This, in turn, increases the compressive and flexural strength of the concrete, enhances its resistance to weathering, and lowers volume change from drying. Furthermore, plasticizers improve the bond between concrete and reinforcement, reduce shrinkage-induced cracking tendencies, and minimize permeability.

- The demand for cement additives, particularly plasticizers, has been on the rise, especially in the Asia Pacific region. This growth can be attributed to the presence of large consumers like China, which significantly contributes to the global market's volume consumption. The increase in the urban population will increase the need for infrastructure development. To meet the needs for amenities and housing spurred by large-scale migration, countries around the world are focusing on developing infrastructure. For instance, the government of India has planned to invest USD650 billion over the next 20 years in developing urban infrastructure in the country, while the government of China has planned to invest about USD1 trillion in urban infrastructure projects by 2030. This will create immense demand for cement in these countries, thereby fostering market growth during the forecast period.

What are the market trends shaping the Cement Additives Industry?

- A shift toward sustainable practices in the cement industry is the upcoming market trend. Cement kilns have adopted alternative fuels as a sustainable solution for energy consumption, reducing CO2 emissions during cement production. Waste materials like oil, plastics, industrial and municipal wastes, textiles, paper residues, construction and demolition wastes, and wood are successfully utilized as low-carbon alternatives.

- These wastes offer a higher calorific value when burned in cement kilns compared to individual waste incinerators. The implementation of alternative fuels in cement production results in a substantial reduction of CO2 emissions, minimizing the environmental impact and the release of greenhouse gases. By making efficient use of waste materials, cement kilns contribute to a greener and more sustainable cement industry. The trend of slow payments in the industry leaves these companies with less spare capital to invest in skills training for the workforce. In countries such as China, the US, India, and Japan, the cost of construction fluctuates, but it has a direct impact on building or real estate prices. Thus, the increase in construction costs and the lack of a skilled workforce are some of the major challenges to the growth of the global cement additives market during the forecast period.

What challenges does the Cement Additives Industry face during its growth?

- An increase in construction costs and a lack of skilled workforce is a key challenge affecting the industry's growth. The construction industry relies on various materials, including cement, steel, and aggregates for building projects. Cement comprises 1%-15% of the total construction costs, while steel accounts for 8%-10%. The remaining 25%-30% is attributed to other materials. Fluctuations in the demand and availability of these materials create a pricing cycle, with the increase in the cost of one material leading to an overall rise in construction expenses.

- Economically volatile countries, such as Nigeria and Namibia in Africa, struggle to control these price hikes. The construction sector's reliance on these materials and the resulting cost dynamics underscore the importance of effective material sourcing and pricing strategies. Recycling such wastes and using these materials in construction is a solution that not only addresses the problems associated with pollution but also becomes an economic factor in the construction industry. The use of wastepaper pulp to partially replace cement in concrete mixtures is one such approach. The cement mixture can be replaced by wastepaper sludge in the range of 5%-20% by weight in M20 and M30 grades of concrete. Different industrial wastes, such as fly ash and others, are being used as additives in cement to improve their properties. Moreover, manufacturers can limit the amount of trash being disposed of in landfills and also reduce the need for virgin resources by utilizing industrial waste as cement additives.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashland Inc.: The company offers cement additives such as Aqualon starch ethers and Silipon air-entraining agent.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Compagnie de Saint-Gobain SA

- Elkem ASA

- European Concrete Additives

- Fosroc International Ltd.

- Global Drilling Fluids and Chemicals Ltd.

- Halliburton Co.

- Knauf Digital GmbH

- Mapei SpA

- MR Bond Polychem

- Nan Pao Resins Chemical Co. Ltd.

- OMNOVA Solutions Inc.

- Oscrete UK Ltd.

- Sika AG

- Solvay SA

- Sterling Auxiliaries Pvt. Ltd.

- The Dow Chemical Co.

- UNISOL Inc.

- Universal Drilling Fluids

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cement additives play a crucial role in enhancing the performance and sustainability of cement and stone in various applications. These additives, which include water reducers, grinding aids, strength enhancers, and performance enhancers, contribute significantly to the overall quality and durability of cement products. Water reducers, also known as water-reducing agents or water-reducing admixtures, are essential additives that allow the use of less water in cement production without compromising the strength and workability of the final product. They reduce the amount of water required for hydration, thereby decreasing the cement content and increasing the efficiency of cement production. The market is witnessing significant growth due to the increasing demand for extenders such as bentonite, cellulose derivatives, and organic polymers in oilfield cement applications.

Moreover, they improve the flow properties of concrete, making it easier to transport and place, while also increasing its strength and durability. Mineral additives, including fly ash and silica fume, can also function as water reducers and provide additional benefits, such as improved workability, increased strength, and reduced heat of hydration. Fiber additives are another type of cement additive that provides several advantages. They enhance the toughness and ductility of concrete, making it more resistant to cracking and improving its overall durability. Cellulose derivatives and organic polymers are commonly used fiber additives, providing excellent bonding and reinforcement properties. Grinding aids are additives that are added to cement during grinding to improve the grinding efficiency and reduce the energy consumption of the process.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 11.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

China, Japan, India, US, South Korea, Germany, Indonesia, UK, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cement Additives Market Research and Growth Report?

- CAGR of the Cement Additives industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cement additives market growth of industry companies

We can help! Our analysts can customize this cement additives market research report to meet your requirements.