Saudi Arabia Cement Market Size 2025-2029

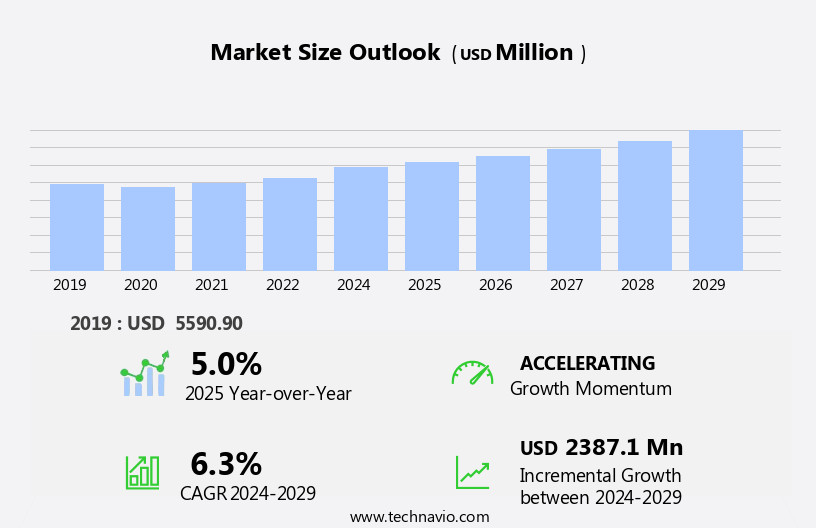

The saudi arabia cement market size is forecast to increase by USD 2.39 billion billion at a CAGR of 6.3% between 2024 and 2029.

- The market presents significant growth opportunities for global investors and businesses, driven by the Saudi Arabian government's ambitious Vision 2030 initiative. This comprehensive plan focuses on diversifying the economy, increasing private sector participation In the construction industry, and promoting energy efficiency. One key component of this strategy is the launch of low-power-consuming cement plants, which aligns with the government's goal of reducing carbon emissions and promoting sustainable development. Another significant factor fueling market growth is the expat levy on foreign nationals, which has led to an increase in local labor force participation In the cement industry. This trend is expected to continue, as the government encourages the hiring of Saudi nationals and provides incentives for companies that comply with local labor laws.

- However, challenges remain, including intense competition from established players and the volatility of raw material prices, particularly for limestone and gypsum. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on innovation, cost competitiveness, and strategic partnerships with local suppliers and distributors. By staying abreast of market trends and government policies, businesses can position themselves for long-term success In the Saudi Arabian cement market.

What will be the size of the Saudi Arabia Cement Market during the forecast period?

- The market exhibits growth, driven by the country's expanding construction sector. Infrastructure projects, including transportation and utilities, account for a significant portion of this demand. Residential, commercial, industrial, and institutional buildings also contribute to the market's sizeable growth. Cement is a crucial construction material In these projects, with applications ranging from foundations to insulation. Saudi Arabia's cement industry includes both domestic production and imports. The presence of numerous cement plants In the kingdom ensures a steady supply. The market trends include the increasing use of white cement and hydraulic cement in various applications. Supplementary cementitious materials, such as fly ash and slag, are gaining popularity due to their environmental benefits.

- Despite the market's positive outlook, natural disasters and geopolitical risks pose challenges. The industry remains resilient, with ongoing investments in new projects and expansions. The future of the market remains promising, underpinned by the country's economic development and infrastructure investment plans.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Residential

- Commercial

- Type

- Blended

- Portland

- Others

- Location

- Central

- Western

- Southern

- Eastern

- Northern

- Geography

- Saudi Arabia

By Application Insights

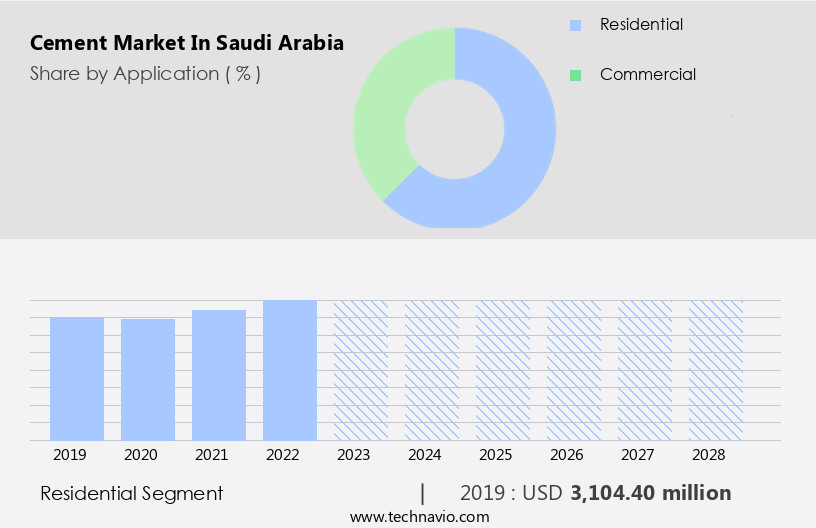

The residential segment is estimated to witness significant growth during the forecast period.

The Saudi Arabian cement market is experiencing growth due to the government's housing initiatives, particularly In the residential application segment. Notable developments include ROSHN's Warefa Project in Riyadh, which will provide 2,000 housing units and contribute to the Vision 2030 goal of increasing homeownership rates and offering diverse housing options. The construction sector, including infrastructure projects, residential, commercial, industrial, and residential construction projects, is a significant consumer of cement. Key applications include ready-mix concrete, transit mix concrete, central mix concrete, share mix concrete, pre-cast products, pre-cast elements, paving stones, reinforced concrete, and non-reinforced concrete. Cement plants produce various types of cement, such as white cement and hydraulic cement, to cater to these applications.

The infrastructure sector's focus on roads and highways, petrochemicals, lightweight blocks, thermal insulation, and renewable energy infrastructure also drives cement demand. Cement is essential for various projects, including urban apartments, single-family dwellings, retail spaces, mixed-use developments, e-commerce fulfillment centers, and water treatment facilities. Oil price movements can impact the cement industry due to the energy-intensive production process. The precast industry, architectural facades, and decorative applications are additional growth areas. The cement market's future growth may be influenced by factors like forward and backward integration, infrastructure projects, and non-residential construction projects.

Get a glance at the market share of various segments Request Free Sample

The Residential segment was valued at USD 3104.40 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Saudi Arabia Cement Market?

- Launch of Saudi Vision 2030 is the key driver of the market.

- Saudi Arabia's cement market is poised for growth due to the implementation of Vision 2030, a national development plan announced in 2016. This initiative aims to diversify the economy and reduce reliance on oil resources. Notable construction projects, such as Al Wadiyan, Amaala, Mall of Saudi, The Avenues Mall, King Abdullah Financial District, and others, are part of this plan and are expected to be completed by 2030.

- These projects will contribute significantly to the cement market's expansion during the forecast period.

What are the market trends shaping the Saudi Arabia Cement Market?

- Construction of low-power-consuming cement plants is the upcoming trend In the market.

- The cement industry is a significant energy consumer, with fuel and energy expenses accounting for approximately 30-40% of total production costs. The specific electrical energy consumption for cement production ranges between 90 and 130 kWh per ton. With impending energy subsidy cuts during the forecast period, cement companies in Saudi Arabia are seeking cost-effective solutions to mitigate the anticipated increase in production expenses. Major industry players, including Yamama Cement and Saudi Cement, are investing in advanced infrastructure to enhance production efficiency and minimize power consumption.

- This strategic move is aimed at maintaining competitiveness and ensuring sustainable business operations In the face of energy cost fluctuations.

What challenges does Saudi Arabia Cement Market face during the growth?

- Expat levy on foreign nationals is a key challenge affecting the market growth.

- The market faces a significant challenge due to the implementation of an expat levy by the government. This levy, which is payable monthly by companies sponsoring foreign workers and their dependents, is set to increase gradually over a four-year period. The impact of this levy is particularly pronounced on companies with a large foreign workforce, as the cement industry relies heavily on manpower.

- As a result, the reduced inflow of blue-collar workers into the country is expected to impede the growth of the market during the forecast period. This economic development will likely influence the market dynamics and may necessitate adjustments from industry players.

Exclusive Saudi Arabia Cement Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Madina Cement Co.

- Al Rashed Cement Co.

- Al Safwa Ltd.

- Epcco Publishing Group Ltd.

- Hail Cement Co.

- Najran Cement Co.

- Northern Region Cement Co.

- Qassim Cement Co.

- Saudi Cement Co.

- Tabuk Cement Co.

- Umm Al Qura Cement Co.

- United Cement Industrial Co.

- Yamama Saudi Cement Co.

- Yanbu Cement Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth over the past decade, driven by the country's construction sector. Infrastructure projects, including roads and highways, have been a major contributor to this growth, as the Saudi Arabian government invests heavily in modernizing the country's transportation network. Construction projects in residential, commercial, and industrial sectors have also fueled the demand for cement. Residential construction projects, which include both housing and residential buildings, have been a significant driver of demand due to the country's growing population and increasing urbanization. Commercial construction, including retail spaces, offices, and mixed-use developments, has also seen strong growth, driven by the private sector's investment in real estate.

The industrial sector has also been a significant consumer of cement, with the petrochemicals industry being a major contributor. The production of petrochemicals requires large amounts of cement for the construction of plants and facilities. Cement is an essential component in various construction applications, including ready-mix concrete, transit mix concrete, central mix concrete, share mix concrete, pre-cast products, and pre-cast elements. Pre-cast products, such as paving stones, reinforced concrete, and non-reinforced concrete, are increasingly popular due to their durability and cost-effectiveness. The market is influenced by several factors, including oil price movements and natural disasters. The country's economy is heavily reliant on the oil industry, and fluctuations in oil prices can impact the construction sector's demand for cement.

Natural disasters, such as earthquakes and sandstorms, can also disrupt cement production and transportation, leading to supply chain disruptions. To mitigate supply chain risks, some cement producers in Saudi Arabia have adopted forward and backward integration strategies. Forward integration involves owning and operating downstream activities, such as ready-mix concrete plants, to ensure a steady supply of cement to customers. Backward integration involves owning and operating upstream activities, such as limestone quarries and cement plants, to secure a reliable supply of raw materials. The cement industry in Saudi Arabia is diverse, with players producing various types of cement, including white cement and hydraulic cement.

White cement is used in applications where a high level of whiteness is required, such as architectural facades and decorative applications. Hydraulic cement is used in applications where high strength and durability are essential, such as high-rises and industrial structures. The precast industry is also a significant player In the Saudi Arabian cement market, producing various precast products, such as light weight blocks and thermal insulation, for use in construction projects. These products offer several advantages, including improved insulation, reduced construction time, and lower transportation costs. In , the market is driven by the country's construction sector, with infrastructure projects and residential, commercial, and industrial construction being major contributors.

The market is influenced by several factors, including oil price movements, natural disasters, and government policies. Producers are adopting integration strategies to mitigate supply chain risks and meet the growing demand for cement. The industry is diverse, with players producing various types of cement and precast products for use in various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 2387.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Saudi Arabia

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch