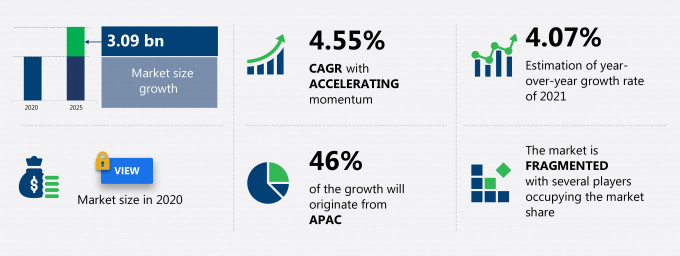

The ceramic tableware market share is expected to increase by USD 3.09 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.55%.

This ceramic tableware market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers ceramic tableware market segmentations by product (ceramic dinnerware, ceramic beverageware, and ceramic flatware) and geography (North America, Europe, APAC, South America, and MEA). The ceramic tableware market report also offers information on several market vendors, including Certine, Corelle Brands LLC, Fiskars Corp., Groupe SEB, Lenox Corp., Libbey Inc., Lifetime Brands Inc., RAK Ceramics PJSC, Tognana Porcellane, and Villeroy and Boch AG among others.

What will the Ceramic Tableware Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Ceramic Tableware Market Size for the Forecast Period and Other Important Statistics

Ceramic Tableware Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The increasing number of households is notably driving the ceramic tableware market growth, although factors such as may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the ceramic tableware industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Ceramic Tableware Market Driver

The growth of the hospitality sector is the key driver of the growth of the ceramic tableware market. The global food service sector is driven by the factors such as growth in food consumption in terms of the frequency of eating out, increasing awareness and trends among the youth of experimenting with new cuisines, and brand consciousness among consumers. Rapid urbanization and increasing disposable incomes, coupled with hectic lifestyles, have led to an increase in the frequency of eating out. Furthermore, due to globalization, there is increasing awareness and craving among the youth for different cuisines from around the world. This has resulted in the growth of the hotel sector worldwide, which, in turn, has a positive impact on market growth.In addition, growth in investments by international hotel brands in developing countries, such as China and India, has led to the expansion of the food services industry in these countries. As this sector is among the prominent buyer of ceramic tableware, the growth of the hotel sector across the world is expected to drive the growth of the global ceramic tableware market.

Key Ceramic Tableware Market Trend

The increase in home renovation and kitchen renovation projects are expected to be one of the significant driving trends in the US market for ceramic tableware.The United States has one of the highest home renovation projects in the world. In addition, the average spending on dining renovation is also increasing.The trend in dining renovation is anticipated to continue to grow during the forecast period. Furthermore, a considerable amount of revenue from dining renovation projects is expected to flow into ceramic tableware products, which may boost the market growth.Apart from the increasing home renovation and modular kitchen projects, the strong distribution network between manufacturers and retailers, coupled with the rapid increase of online retail sales, are some other factors that may fuel the market growth further during the forecast period.

Key Ceramic Tableware Market Challenge

Threat from unorganized market players is the major hindrance to the ceramic tableware market growth. The global ceramic tableware market is highly fragmented with the presence of few global and numerous regional vendors. The market also faces stiff competition from unorganized players, especially from China and India. The entry of these unorganized players in the ceramic tableware market is quite prevalent in the countries because of low labor costs and the abundant availability of raw materials. Unorganized Chinese players have a huge impact on the revenues of the global ceramic tableware market. For instance, unorganized players from China account for a significant share of the ceramic tableware market in Europe. In response, the EU in 2019 began the process of reviewing anti-dumping policies for ceramic tableware in the region. Moreover, unorganized players target the low-end product range and offer products at very low prices, at levels below competitive standards. This situation forces the established players to reduce prices of their products in the global market. This can lead to price wars among established competitors in the global ceramic tableware market. Therefore, the strong presence of unorganized market players will be a key challenge to the global ceramic tableware market in terms of price during the forecast period.

This ceramic tableware market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes global ceramic tableware market as a part of the global household products market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the ceramic tableware market during the forecast period.

Who are the Major Ceramic Tableware Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Certine

- Corelle Brands LLC

- Fiskars Corp.

- Groupe SEB

- Lenox Corp.

- Libbey Inc.

- Lifetime Brands Inc.

- RAK Ceramics PJSC

- Tognana Porcellane

- Villeroy and Boch AG

This statistical study of the ceramic tableware market encompasses successful business strategies deployed by the key vendors. The ceramic tableware market is fragmented and the vendors are deploying growth strategies such as organic and inorganic strategies to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The ceramic tableware market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Ceramic Tableware Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the ceramic tableware market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global household products market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Ceramic Tableware Market?

For more insights on the market share of various regions Request for a FREE sample now!

46% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for ceramic tableware market in APAC. Market growth in this region will be faster than the growth of the market in regions.

Factors such as growing online sales will facilitate the ceramic tableware market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Product Segments in the Ceramic Tableware Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The ceramic tableware market share growth by the ceramic dinnerware segment will be significant during the forecast period. Ceramic dinnerware generally includes dishes such as plates, serving bowls, platters, and other utensils used for serving meals at home. Factors such as cost benefits and high heat resistance are fueling demand for ceramic dinnerware products. This report provides an accurate prediction of the contribution of all the segments to the growth of the ceramic tableware market size.

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the ceramic tableware market size and actionable market insights on post COVID-19 impact on each segment.

|

Ceramic Tableware Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.55% |

|

Market growth 2021-2025 |

USD 3.09 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.07 |

|

Regional analysis |

North America, Europe, APAC, South America, and MEA |

|

Performing market contribution |

APAC at 46% |

|

Key consumer countries |

China, US, Italy, Germany, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Certine, Corelle Brands LLC, Fiskars Corp., Groupe SEB, Lenox Corp., Libbey Inc., Lifetime Brands Inc., RAK Ceramics PJSC, Tognana Porcellane, and Villeroy and Boch AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Ceramic Tableware Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive ceramic tableware market growth during the next five years

- Precise estimation of the ceramic tableware market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the ceramic tableware industry across North America, Europe, APAC, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of ceramic tableware market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch