Chemoinformatics Market Size 2024-2028

The chemoinformatics market size is forecast to increase by USD 4.57 billion at a CAGR of 13.63% between 2023 and 2028.

What will be the Size of the Chemoinformatics Market During the Forecast Period?

How is this Chemoinformatics Industry segmented and which is the largest segment?

The chemoinformatics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Chemical analysis

- Drug discovery and validation

- Virtual screening

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

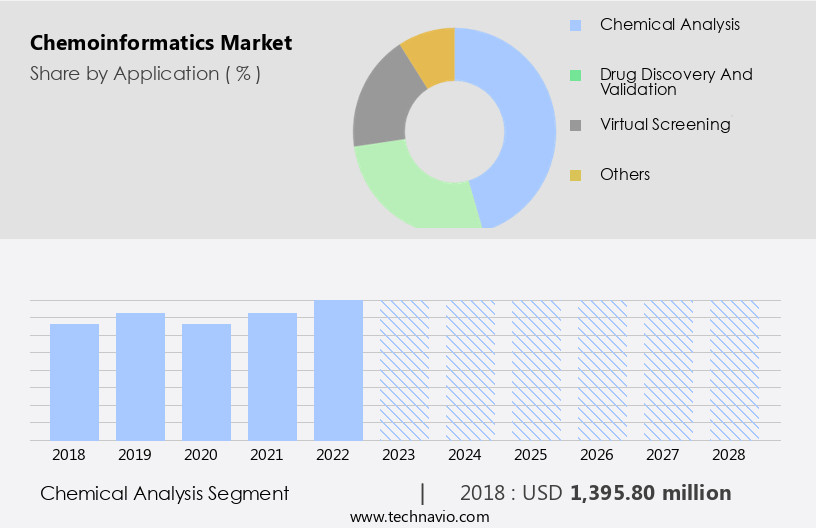

- The chemical analysis segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2023, with chemical analysis as the largest segment. The expansion was driven by increasing R&D expenditures In the healthcare sector, estimated at USD140-150 billion annually, and the comparatively low success rate of drug molecule leads. The pharmaceutical sector in countries like the US, Japan, Canada, and India saw growth due to the high prevalence of chronic diseases. In addition, the biotechnology industry's focus on drug discovery, material science applications, and computational chemistry fueled market growth. Machine learning techniques, molecular design, and predictive modeling were key areas of investment, with applications in drug discovery, rare diseases, and agrochemical research.

The chemoinformatics industry provided software solutions for drug design, lead targets, and data mining, while consultancy and training services ensured interoperability and standardized formats. Precision farming and sustainable agrochemical development were also significant areas of application. The market's growth was further boosted by the integration of artificial intelligence, user-friendly interfaces, and healthcare cloud computing. The chemoinformatics industry catered to pharmaceutical and biotechnology companies, academic institutes, and research institutes, with a focus on intellectual property management and personalized medicine. The market's future direction included the development of 3D structures, drug manufacturing, and healthcare services.

Get a glance at the Chemoinformatics Industry report of share of various segments Request Free Sample

The Chemical analysis segment was valued at USD 1.4 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market experienced significant growth in North America due to advancements in healthcare infrastructure, increased funding for research and development, and technological innovations In the US and Canada. The region is home to numerous software providers offering advanced, cloud-based solutions for managing chemical data, such as LifeSphere Intake and Triage, and LifeSphere MultiVigilance by Altoris. These companies prioritize affordability and cutting-edge technology, contributing to the market's expansion. Furthermore, the pharmaceutical industry in North America has seen several product recalls, necessitating the adoption of chemoinformatics tools for improved drug discovery, safety, and regulatory compliance. Key applications include drug discovery, materials science, computational methods, drug repurposing, and machine learning for rare diseases, genomic and proteomic research, agrochemical research, and precision farming.

The market's growth is driven by the biotechnology sector, pharmaceutical firms, and academic institutes, with a focus on interoperability, standardized formats, and data integration. Additionally, artificial intelligence, user-friendly interfaces, consultancy, training, chemical analysis, molecular modeling, predictive modeling, and computational chemistry applications are integral to the industry. The chemoinformatics industry encompasses drug design, lead targets, big data analytics, data mining, and statistical analysis, with a focus on structure-activity relationship modeling, 3D structure development, and drug manufacturing sector integration. The market's future lies in healthcare services, pharmaceuticals, and sustainable agrochemical development, with continued advancements in computer technology, cloud computing, and precision healthcare.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Chemoinformatics Industry?

Increasing approvals of new molecules and biosimilars is the key driver of the market.

What are the market trends shaping the Chemoinformatics Industry?

Extensive adoption of cloud technology in pharmaceutical manufacturing and testing is the upcoming market trend.

What challenges does the Chemoinformatics Industry face during its growth?

Concerns related to data safety is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The chemoinformatics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chemoinformatics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chemoinformatics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advanced Chemistry Development Inc. - The ACD Spectrus Platform in chemoinformatics facilitates the connection between analytical data and chemical context, fostering collaborative research and expediting decision-making processes. This solution empowers scientists to efficiently manage and analyze complex chemical data, enhancing overall productivity and innovation withIn the research and development sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Chemistry Development Inc.

- Altoris

- BioSolveIT GmbH

- Certara Inc.

- ChemAxon Ltd.

- Chemical Computing Group ULC

- Collaborative Drug Discovery Inc.

- Danaher Corp.

- Dassault Systemes SE

- Daylight Chemical Information Systems Inc.

- EPAM Systems Inc.

- Genedata AG

- Modgraph Consultants Ltd.

- Molinspiration Cheminformatics

- Molsoft LLC

- OpenEye Scientific Software Inc.

- Perkin Elmer Inc.

- Scilligence Corp.

- Tecan Trading AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the application of computational methods and techniques In the fields of chemistry, computer science, and information science. This market plays a significant role in various sectors, including drug discovery, materials science, and biotechnology. Computational methods have revolutionized the way researchers approach problems In these fields. In drug discovery, chemoinformatics is used for target identification, target validation, and lead target screening. Machine learning techniques, such as regression analysis and support vector machines, are employed to analyze molecular structures, reactions, and interactions to identify potential drug candidates. The use of chemoinformatics in materials science leads to the discovery and design of new materials with improved properties.

Computational chemistry applications, such as molecular modeling and predictive modeling, enable the optimization of molecular structures and reactions to create materials with desired characteristics. In the biotechnology sector, chemoinformatics is used for genomic and proteomic analysis, as well as drug repurposing. Open-source platforms facilitate data integration and interoperability, allowing for standardized formats and protocols. This leads to more efficient and accurate research and development. The agriculture sector also benefits from chemoinformatics through the application of computational techniques in agrochemical research. Precision farming and sustainable agrochemical development are made possible through the use of data mining and big data analytics.

Artificial intelligence and user-friendly interfaces are increasingly being used In the chemoinformatics industry to improve the efficiency and accuracy of drug design and discovery. Consultancy and training services provide expertise and knowledge to organizations looking to implement chemoinformatics solutions. Chemoinformatics is also used In the pharmaceutical industry for drug validation, pharmaceutical product development, and intellectual property management. The healthcare cloud computing sector utilizes chemoinformatics for drug screening, virtual screening, and molecular dynamics simulations. Despite the numerous benefits of chemoinformatics, challenges remain. Interoperability and standardization of data formats and protocols are ongoing issues. Health risks associated with pharmaceutical products and the regulatory environment also impact the market.

In conclusion, the market is a dynamic and evolving field that plays a crucial role in various industries. The application of computational methods and techniques in chemistry, computer science, and information science leads to advancements in drug discovery, materials science, and biotechnology, among others. The use of artificial intelligence and user-friendly interfaces is driving innovation and improving efficiency and accuracy. However, challenges remain, including interoperability and standardization, health risks, and regulatory issues.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.63% |

|

Market growth 2024-2028 |

USD 4574.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.14 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chemoinformatics Market Research and Growth Report?

- CAGR of the Chemoinformatics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chemoinformatics market growth of industry companies

We can help! Our analysts can customize this chemoinformatics market research report to meet your requirements.