Clean Label Ingredients Market Size 2024-2028

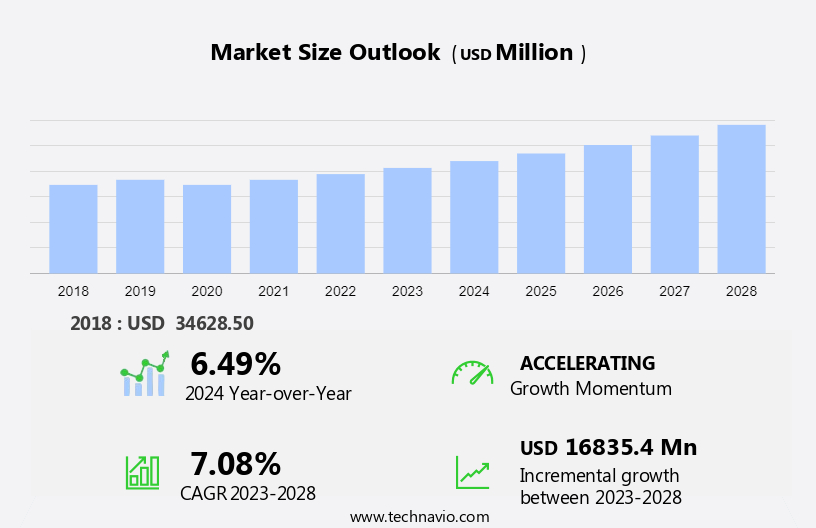

The clean label ingredients market size is forecast to increase by USD 16.84 billion, at a CAGR of 7.08% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for herbs, spices, natural extracts, and plant-based ingredients in the food industry. Health-conscious consumers are increasingly preferring clean-label products made from organically sourced ingredients, driving market growth. The trend towards organic food and vegan foods is further fueling market expansion. However, challenges such as maintaining product stability and the shelf life of these ingredients remain a concern. Ready-to-eat meals, in particular, require effective solutions to ensure the longevity of natural and plant-based ingredients without compromising their nutritional value. The market is expected to continue its growth trajectory, with new product launches and innovations in clean-label solutions playing a key role.

The market is witnessing significant growth due to increasing consumer preferences for natural and minimally processed food products. This trend is driving the demand for clean label ingredients, which are free from artificial additives and preservatives. Companies like Ingredion (US) are responding to this trend by offering a wide range of clean label ingredients, including plant-based additives and fiber-rich additives. Consumers, particularly parents, are increasingly seeking natural alternatives to artificial ingredients. Natural ingredients such as herbs, spices, and natural extracts are gaining popularity as clean label replacements for artificial flavors and colors. The demand for clean label ingredients is not limited to the B2C sector alone, but is also growing in the B2B sector, with food manufacturers and processors seeking to offer clean label options to their customers.

Clean energy and plant-based ingredients are also gaining traction in the market. Vegen Foods, for instance, offers a range of clean label plant-based protein powders, while Honest Organic Kids caters to the growing demand for clean label ingredients in the children's food market. The focus on shelf-life and functionalities of clean label ingredients is also a key consideration for manufacturers, as they strive to offer products that meet consumer expectations for taste, texture, and convenience.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Beverages

- Bakery and confectionery

- Sauce and condiment

- Dairy products

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- France

- South America

- Middle East and Africa

- North America

By Application Insights

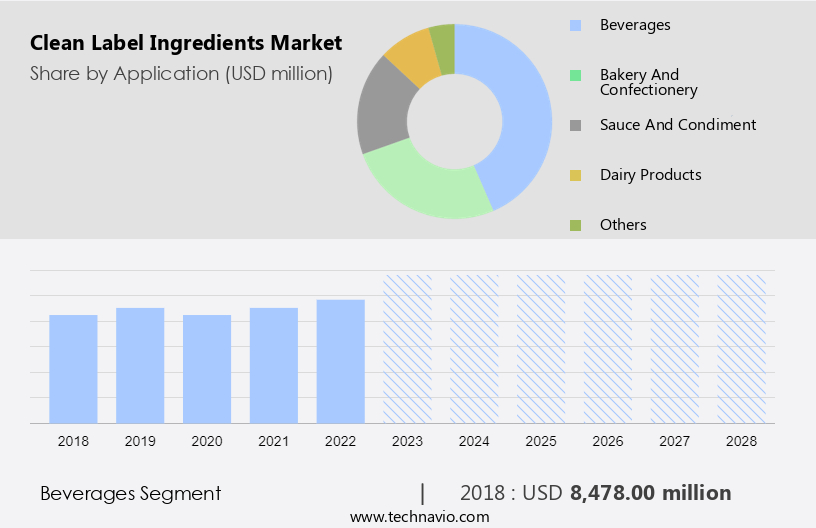

The beverages segment is estimated to witness significant growth during the forecast period. The market has experienced significant growth as consumers prioritize transparency and natural alternatives in their food choices. This trend is particularly noticeable in the beverage industry, where concerns over high sugar content and artificial ingredients in carbonated beverages and juices have led to decreased consumption among health-conscious individuals. In response, brands are focusing on revitalizing product formulations with natural and nutritious ingredients. Acerola powder, for instance, is a popular clean label ingredient due to its high vitamin C content and natural sour taste. Middle class consumers, in particular, are driving this demand for clean label ingredients as they prioritize food safety and seek out food technology that aligns with their values.

Companies like Ingredion are capitalizing on this trend by offering B2B and B2C solutions that cater to this market. The agricultural abundance of natural ingredients also supports the growth of this market, as food producers seek to meet the increasing demand for clean label products. As consumers become more attuned to food formulation, the demand for clean label ingredients is expected to continue growing. Clean energy and sustainable production methods are also becoming important considerations for consumers, further expanding the scope of the market. Overall, the market for clean label ingredients is poised for continued growth as consumers prioritize transparency, natural alternatives, and food safety in their food choices.

Get a glance at the market share of various segments Request Free Sample

The beverages segment was valued at USD 8.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

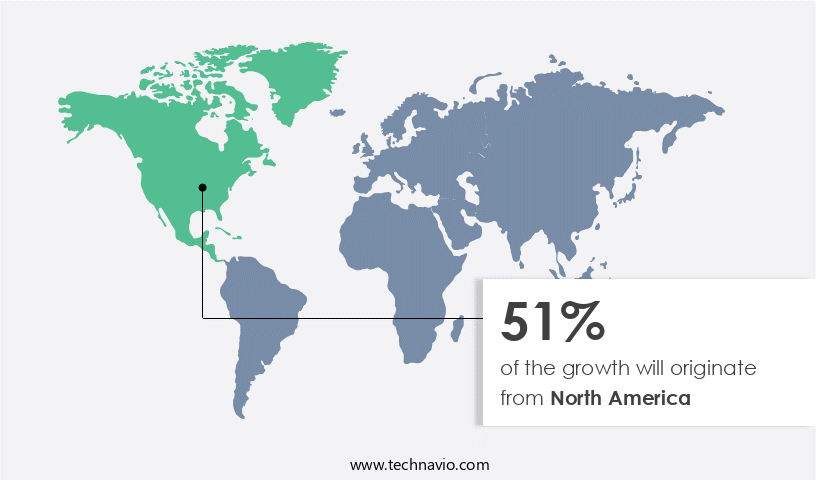

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to the convenience factor and increasing preference for natural alternatives in food products. In 2023, North America held the largest market share in this sector, driven by the region's substantial functional food industry and rising health consciousness among consumers. The demand for clean-label ingredients, including Acerola powder, vitamins, minerals, proteins, and organic and plant-based ingredients, is on the rise in North America. This trend is attributed to the increasing incidence of obesity and chronic diseases, leading consumers to seek out food products with clean-label ingredients. Key players in the market include Ingredion and others, catering to both B2B and B2C segments.

Food safety and food technology are crucial factors driving the market's growth, with agricultural abundance ensuring a steady supply of raw materials. Clean Energy, a natural sweetener, is also gaining popularity in the market due to its clean-label status. The market is expected to grow steadily during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

New product launches is the key driver of the market. The market has experienced significant growth due to increasing consumer preferences for natural and plant-based additives over artificial ingredients. Companies like Ingredion (US) are responding to this trend by launching new products that cater to these preferences. For instance, in September 2021, Divi Nutraceuticals introduced CaroNat, a naturally-sourced food ingredient that imparts a dark yellow to orange color to various food and beverage products. This organic food coloring agent is derived from concentrated carrot juice and contains a good amount of beta-carotene. The use of natural ingredients not only aligns with consumer preferences but also ensures nutritional integrity and regulatory compliance.

However, it is essential to avoid greenwashing, a marketing tactic that misleads consumers by implying that a product is more natural or healthier than it actually is. Shelf-life and functionalities are critical considerations in the development of clean label ingredients, and fiber-rich additives are gaining popularity due to their nutritional benefits. Regulatory requirements continue to evolve, making it essential for companies to stay informed and adapt to changing regulations to maintain consumer trust.

Market Trends

Growing demand for natural ingredients is the upcoming trend in the market. Consumer preferences are evolving towards clean label ingredients as health consciousness grows, driven by increasing awareness of the potential health risks associated with artificial additives. This trend is influencing the food processing industry, with manufacturers prioritizing the use of natural ingredients in their products. Natural ingredients offer various functionalities, including fiber-rich additives and plant-based alternatives, which contribute to nutritional integrity and extended shelf-life. The demand for clean label ingredients extends to various food and beverage categories, including functional foods, sports drinks, nutritional supplements, and medically formulated foods. Ingredion (US), a leading provider of ingredient solutions, is one of the companies responding to this trend by offering natural and clean label ingredient solutions.

However, regulatory requirements and the need to avoid greenwashing necessitate transparency and accuracy in marketing tactics when promoting clean label products.

Market Challenge

Low awareness level is a key challenge affecting the market growth. Consumer preferences for clean label ingredients continue to shape the global market landscape. Ingredient providers, such as Ingredion (US), are responding to this trend by focusing on natural and plant-based additives, which offer functionalities desirable to health-conscious consumers. However, the use of these ingredients presents challenges, including maintaining shelf-life and ensuring nutritional integrity. companies must navigate regulatory requirements and avoid greenwashing, a marketing tactic that misleads consumers about the naturalness or health benefits of a product.

Further, the lack of consumer awareness about the benefits of certain clean label ingredients, particularly newly developed ones, can hinder their adoption. Without sufficient scientific evidence to prove the health benefits, manufacturers may be hesitant to incorporate these ingredients into their food and beverage offerings. Consequently, the market growth for these ingredients may be slower than anticipated.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co. - The company offer clean label ingredients such as tapioca starches which helps in thickening of soups, stews and gravies for gluten-free baking to provide superior taste.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brisan Group

- Cargill Inc.

- Chr Hansen Holding AS

- Corbion nv

- DuPont de Nemours Inc.

- Givaudan SA

- Groupe Limagrain

- Handary SA

- Ingredion Inc.

- International Flavors and Fragrances Inc.

- Kerry Group Plc

- Koninklijke DSM NV

- Nestle SA

- ROHA Dyechem Pvt. Ltd.

- Sensient Technologies Corp.

- SMS Corp. Co. Ltd.

- Tate and Lyle PLC

- The Hershey Co.

- Tiba Starch and Glucose Manufacturing Co.

- Ulrick and Short Ltd.

- VIVESCIA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to increasing consumer preferences for natural and minimally processed foods. This trend is driven by health-conscious consumers, particularly the middle class, who seek products with nutritional integrity and free from artificial ingredients, synthetic food additives, and preservatives. The demand for clean-label products extends to various food categories, including plant-based additives, fiber-rich additives, natural extracts, herbs, and spices. Food technology and agricultural abundance enable the production of clean label alternatives to synthetic chemicals, such as texturizers, citrus limes, and citrus lemons, in plant-based foods, beverages, sauces, bakery fillings, and ready-to-eat meals. The convenience factor also plays a crucial role in the market's growth, with clean label options available in B2B and B2C channels, including specialty stores.

In addition, regulatory requirements and food safety concerns necessitate transparency in ingredient lists, leading to a focus on organically sourced ingredients, vegan foods, and vegan diets. The market also caters to dietary restrictions, such as gluten-free baked goods and allergen-free products. Sustainability and regenerative sources are essential considerations, with clean energy and plant-based ingredients gaining popularity. Greenwashing and marketing tactics are under scrutiny, as consumers demand authenticity and honesty.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market Growth 2024-2028 |

USD 16.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 51% |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Archer Daniels Midland Co., Brisan Group, Cargill Inc., Chr Hansen Holding AS, Corbion nv, DuPont de Nemours Inc., Givaudan SA, Groupe Limagrain, Handary SA, Ingredion Inc., International Flavors and Fragrances Inc., Kerry Group Plc, Koninklijke DSM NV, Nestle SA, ROHA Dyechem Pvt. Ltd., Sensient Technologies Corp., SMS Corp. Co. Ltd., Tate and Lyle PLC, The Hershey Co., Tiba Starch and Glucose Manufacturing Co., Ulrick and Short Ltd., and VIVESCIA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.