Clinical Trial Imaging Market Size 2024-2028

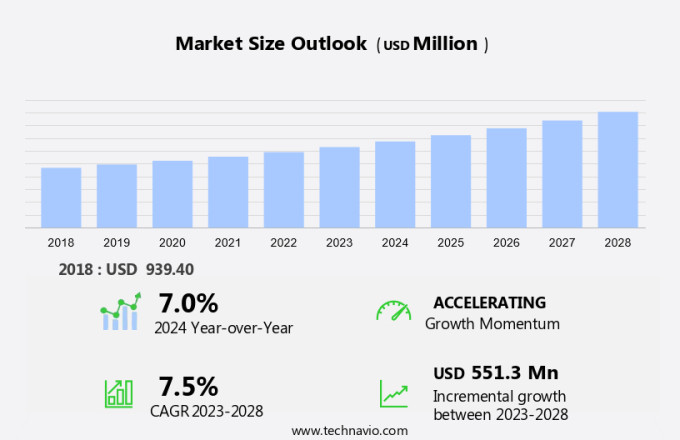

The clinical trial imaging market size is forecast to increase by USD 551.3 million at a CAGR of 7.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing investment in drug development for chronic diseases. Imaging techniques, such as Computed Tomography (CT), play a crucial role in clinical trials by providing valuable data for drug efficacy and safety assessments. Patient comfort is a key trend in this market, as Breast imaging technologies are being developed to minimize patient discomfort and improve the overall trial experience. Data management services are also gaining importance to ensure accurate and efficient handling of imaging data. Strict regulations, however, pose a challenge to market growth, requiring strong data security and compliance measures. Overall, the market is expected to continue its expansion, driven by the need for advanced imaging technologies to support the development of new treatments.

What will be the Size of the Market During the Forecast Period?

- The integration of medical imaging technologies in clinical trials has revolutionized the biotechnology and pharmaceutical industries. By providing valuable insights into various health conditions, these advanced imaging techniques contribute significantly to the development of new therapeutics and treatments. In the realm of clinical trials, imaging technologies play a pivotal role in assessing the efficacy and safety of new drugs and therapies. Biotechnology and pharmaceutical companies increasingly rely on these technologies to gather data on disease progression, treatment response, and potential side effects. Image analysis software, fueled by artificial intelligence (AI) and machine learning algorithms, is a crucial component of this process.

- These advanced technologies enable the automated detection, measurement, and analysis of various health conditions, including oncology, non-alcoholic steatohepatitis (NASH), neurology, endocrinology, and cardiology. Virtual imaging trials, which utilize AI and machine learning, have gained considerable attention in recent years. These trials allow for remote patient monitoring and data collection, streamlining the clinical trial process and reducing costs. Imaging modalities, such as computed tomography (CT), magnetic resonance imaging (MRI), echocardiography, nuclear medicine (positron emission tomography â PET), x-ray, ultrasound, and optical coherence tomography, are essential tools in the clinical trial landscape.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Modality

- Computed tomography

- Magnetic resonance imaging

- Ultrasound

- Positron emission tomography

- Others

- End-user

- Contract research organization

- Pharmaceutical and biotechnology companies

- Research and academic institutes

- Medical device manufacturers

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Modality Insights

- The computed tomography segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable progressions, with a notable focus on the computed tomography (CT) segment. CT imaging is a vital imaging modality in clinical trials due to its ability to generate detailed cross-sectional images of the body, which are crucial for precise diagnosis and tracking of various medical conditions, including cancer. The rising prevalence of chronic diseases and the demand for early and precise diagnosis have boosted the importance of high-resolution imaging technologies. CT scans are indispensable in evaluating disease progression and treatment effectiveness in clinical trials.

Furthermore, technological innovations in CT imaging, such as photon counting computed tomography (PCCT), are expanding the capabilities of clinical trial imaging. Magnetic Resonance Imaging (MRI), Echocardiography, Nuclear Medicine, Positron Emission Tomography (PET), and X-ray are other significant imaging modalities in clinical trials. MRI offers superior soft tissue contrast and is widely used in neurology, oncology, and cardiology trials. Hence, such factors are fuelling the growth of this segment during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The computed tomography segment was valued at USD 317.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is a significant contributor to the global industry, fueled by substantial investments from both private and public sectors. This region's market dynamics are shaped by strategic investments, technological advancements, and a strong focus on innovation in the therapeutic area of chronic conditions. In June 2024, Zynext Ventures, the venture capital arm of Zydus Lifesciences, made a strategic investment in Promaxo, a company specializing in low-field MRI systems. This investment underscores the regional commitment to advancing medical imaging technology for clinical trials. The US and Canada's advanced healthcare infrastructure and strong research ecosystem further bolster the market's growth. Key players in the North American market are driving initiatives to enhance clinical trial diversity and improve imaging technologies, making this region a hub for clinical trial imaging.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Clinical Trial Imaging Market?

Growing investment in drug discovery is the key driver of the market.

- The market is driven by the escalating investment in pharmaceutical research and development. These funds are vital for advancing research and development efforts in the biopharmaceutical sector, enabling companies to execute extensive clinical trials.

- Furthermore, clinical trials are indispensable for assessing the safety and efficacy of new drugs and therapies. Imaging technologies, including medical imaging and image analysis software, play a pivotal role in clinical trials. These advanced tools facilitate the monitoring of disease progression, treatment response, and adverse effects. The increasing adoption of virtual imaging trials further enhances the efficiency and accuracy of clinical trials, ultimately leading to the development of innovative treatments for various medical conditions. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Clinical Trial Imaging Market?

Partnerships and collaborations is the upcoming trend in the market.

- The market in is experiencing a notable trend towards collaborative partnerships, which are fostering innovation and streamlining the clinical trial process. These strategic alliances are essential for merging expertise, broadening capabilities, and delivering comprehensive imaging solutions tailored to the dynamic requirements of drug development for chronic diseases.

- This collaboration aims to heighten the precision and productivity of clinical trials in the pulmonary domain, offering more accurate imaging data and ultimately enhancing overall trial success. By combining their respective strengths, these partners can effectively address the complexities of clinical research and contribute to the advancement of healthcare solutions. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Clinical Trial Imaging Market face during the growth?

Strict regulations is a key challenge affecting the market growth.

- The market faces significant regulatory challenges, including the US Food and Drug Administration's (FDA) recent call for increased diversity in clinical trials. In June 2024, the FDA proposed measures for pharmaceutical and medical device companies to expand the representation of racial, ethnic, and other diverse populations in their studies. While this initiative aims to ensure clinical trial results reflect the general population, it introduces additional intricacies for trial sponsors.

- Despite these challenges, the market's growth is expected to continue, fueled by the potential of AI and ML to improve clinical trial efficiency and reduce costs. As Imaging Solutions become more sophisticated, they will play a crucial role in advancing healthcare and facilitating the development of new treatments. Key players in the market include companies specializing in Imaging Modalities, AI and ML algorithms, and operational Imaging Services. However, regulatory challenges, particularly the FDA's call for greater diversity in clinical trials, present complexities for trial sponsors. Despite these challenges, the market's future looks promising, with AI and ML set to revolutionize Oncology imaging solutions and improve patient care.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alimentiv Inc

- ARANZ Medical Ltd

- Aster Medical Imaging LLC

- Charles River Laboratories International Inc.

- Clario

- ICON plc

- Image Core Lab Pvt Ltd

- IXICO plc

- Median Technologies SA

- Medidata

- Medpace Holdings Inc.

- Navitas Life Sciences

- Octalsoft

- QMENTA Imaging SL

- QUANTIFICARE

- THIRONA

- Vista Diagnostics Ltd

- Voiant

- WCG Clinical Inc.

- Yunu, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The clinical trials market for medical imaging in the biotechnology and pharmaceutical industries is experiencing significant growth due to the increasing role of imaging technologies in drug development. Image analysis software and virtual imaging trials are becoming essential tools in this process, with advancements in artificial intelligence and machine learning enabling more accurate and efficient analysis. Imaging modalities such as computed tomography (CT), magnetic resonance imaging (MRI, echocardiography, nuclear medicine, positron emission tomography (PET), x-ray, ultrasound, optical coherence tomography, and various imaging techniques are used extensively in clinical trials for therapeutic areas like oncology, neurology, endocrinology, cardiology, dermatology, hematology, and others.

Moreover, patient comfort and safety are key considerations, with imaging solutions providing operational imaging services to ensure optimal conditions. Data management services are also crucial in managing the large volumes of imaging data generated during clinical trials. Medical device companies and healthcare providers are collaborating to provide therapeutic expertise and imaging technology to support the development of new treatments for chronic conditions. Molecular imaging and diffusion-weighted imaging (DWI) are also gaining popularity in clinical trials for their ability to provide valuable insights into the biological processes underlying various diseases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2024-2028 |

USD 551.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.0 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch