Coal Tar Market Size 2025-2029

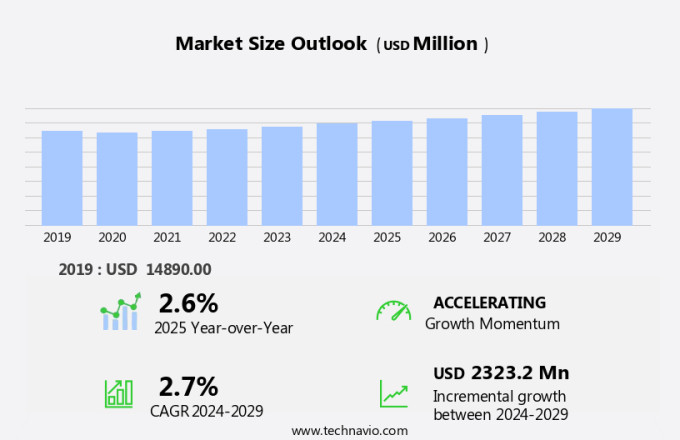

The coal tar market size is forecast to increase by USD 2.32 billion at a CAGR of 2.7% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for products in the healthcare sector, particularly in the treatment of various skin conditions. Additionally, the adoption of advanced types pitch, such as creosote and tar pitch, is driving market growth. It consists of a complex mixture of aromatic and polyaromatic hydrocarbons, including creosote.

- However, the market faces challenges from regulatory restrictions on the use of coal tar-based products due to their potential health hazards and environmental concerns. These factors are shaping the future of the market, with a focus on innovation and sustainability to meet the evolving demands of consumers and regulatory bodies.

What will be the Coal Tar Market Size During the Forecast Period?

- Coal tar is a thick, viscous liquid obtained as a byproduct during the destructive distillation of coal. This finds extensive applications in various industries due to its unique properties. In the healthcare sector, it is used to treat skin conditions like psoriasis and dermatitis. In the personal care industry, it is used to manufacture shampoos and other hair care products to address issues such as dandruff. It is another important derivative, used as a binder and impregnating material in the production of aluminum and steel products, carbon electrodes, and carbon black.

- Coal is also used as a coating material in paints and coatings. This pitch is available in different grades, including binder & impregnating grade, special grade, and aluminum grade, to cater to diverse industrial applications. However, the use and its derivatives, including creosote, have raised concerns due to their potential carcinogenic properties. Despite this, it continues to be in demand in various industries, including paint and coatings, paving roads with asphalt products, and manufacturing carbon anodes.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Low temperature coal tar

- Medium temperature coal tar

- High temperature coal tar

- Application

- Coal tar pitch processing

- Carbon black

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

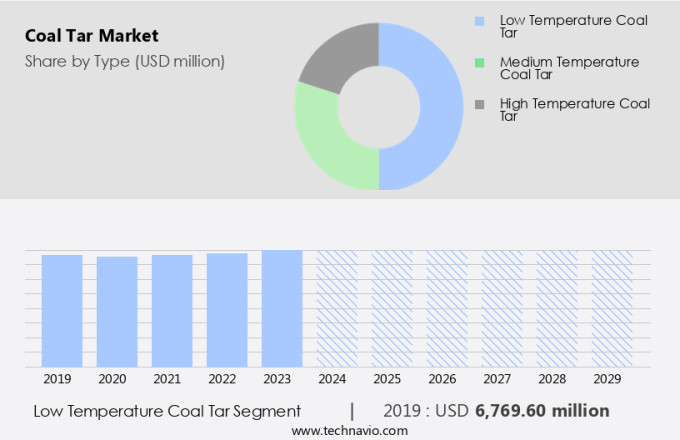

- The low temperature coal tar segment is estimated to witness significant growth during the forecast period.

Low-temperature coal tar is a valuable byproduct of coal pyrolysis, produced through distillation at temperatures below 600 degrees Celsius. This sticky, liquid mixture contains various value-added chemicals and is primarily utilized in the production of pavement sealants and coatings for asphalt surfaces. These coatings offer protection against water infiltration, UV radiation, and chemical damage, thereby extending the life of asphalt pavements and reducing maintenance costs. Additionally, low-temperature coal tar is a crucial component in the manufacture of roofing materials, such as coal tar pitch. Coal tar-based roofing materials provide superior waterproofing and weatherproofing properties, making them ideal for flat roofs and other applications requiring reliable protection from the elements.

Further, coal tar is also used in the production of solid fuels, carbon anodes, coal gas, and tar oil, while coal-tar pitch is employed in the space industry for insulation purposes. Despite some concerns regarding the presence of carcinogenic compounds naturally occurring in coal tar, its demand remains strong due to its unique properties and applications.

Get a glance at the market report of share of various segments Request Free Sample

The low temperature coal tar segment was valued at USD 6.77 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

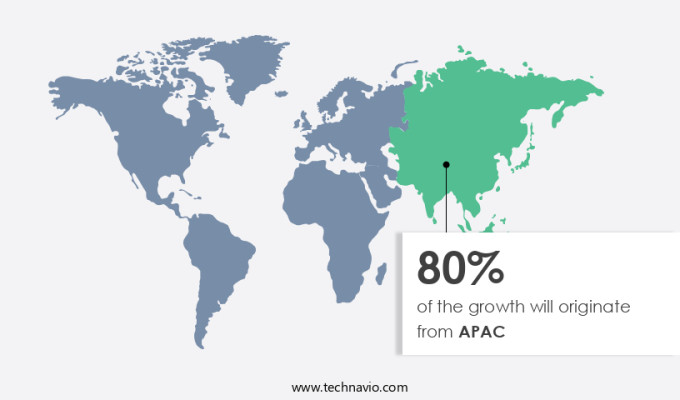

- APAC is estimated to contribute 80% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Coal tar is a byproduct of coal distillation, which is experiencing increased demand due to its applications in various industries. In the construction sector, coal tar is utilized as a binder in asphalt production for road construction and maintenance projects in APAC countries, where urbanization and infrastructure development are rapidly expanding. Additionally, the growing steel industry in China and India, driven by the construction sector, will lead to an increase in coal tar production for carbon black production. In the chemical industry, coal tar is used in the production of creosote for wood preservation and pitch for coating materials and paints. Furthermore, coal tar's therapeutic properties treat psoriasis and hair problems, including dandruff. Due to its versatile applications and the growth in industries that utilize it, the demand for coal tar is expected to remain strong.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Coal Tar Market?

Increasing demand for coal tar products from healthcare sector is the key driver of the market.

- Coal tar, a byproduct of coal distillation, holds significant value in various industries and applications. In the healthcare sector, it is primarily utilized for treating skin conditions, including psoriasis, seborrheic dermatitis, eczema, and dandruff. Coal tar's medicinal properties stem from its anti-scaling, anti-inflammatory, and antipruritic effects, which help manage plaque psoriasis and alleviate itching associated with various skin diseases. Beyond healthcare, coal tar finds extensive use as a binder and impregnating material in asphalt products for paving and roofing. It serves as a crucial component in the production of creosote, a wood preservative used in railroad ties and utility poles.

- Coal tar pitch is employed as a solid fuel and coke in coal gasification and coke production, while carbon fiber and carbon composites utilize coal tar pitch as a raw material. Coal tar is also a vital ingredient in paints and coatings, providing durability and resistance to weathering. In the energy sector, coal tar pitch is used in the production of carbon anodes, graphite electrodes, and aluminum electrodes for electric arc furnaces. The aerospace and space industries rely on coal tar pitch as a raw material for producing refractory bricks, graphite electrodes, and aluminum grade binder & impregnating grade pitch for spacecraft insulation.

What are the Coal Tar Market trends ?

Growing use of advanced types of coal tar pitch is the upcoming trend in the market.

- Coal tar pitches continue to experience notable demand growth in 2024, primarily driven by their application in producing graphite and carbon electrodes for primary aluminum production. Each 100 lbs. of aluminum requires approximately 10 lbs. of coal tar pitch. With global annual primary aluminum production reaching 5,744 thousand metric tons in May 2021, led by China with 3,344 thousand metric tons, the expanding aluminum market fuels the demand for coal tar pitches. Advancements in coal tar pitches, such as Zero QI impregnation pitches, further contribute to market growth. Derived from high-temperature coal tar, Zero QI pitches enhance the density and strength of electrodes, improving electrical conductance and reducing porosity.

- Coal tar pitches are also used in various industries, including asphalt products for paving and roofing, paints and coatings, and binder and impregnating materials for refractory bricks and carbon fiber composites. Moreover, coal tar pitches play a crucial role in energy storage, water treatment, and chemical production. In the space industry, coal tar pitches are used as solid fuels, coke, and coal gas for carcinogenic by-product reduction during coal gasification and coke production. Additionally, coal tar pitches are essential raw materials for aluminum production, aluminum grade manufacturing, and the production of carbon anodes, cathodes, and secondary aluminum. In the automobile industry, coal tar pitches are used in vehicle emissions control and in the production of carbon black, a key component in tires.

What challenges does Coal Tar Market face during the growth?

Restrictions on use of coal tar-based products is a key challenge affecting the market growth.

- Coal tar, a byproduct of coal distillation, is a complex mixture of organic compounds, including creosote, pitch, and various oils. Coal tar contains carcinogenic polycyclic aromatic hydrocarbons (PAHs), posing health risks when humans come into contact with it. Exposure to coal tar can occur during production processes such as coke production at foundries, aluminum production, and coal gasification. Additionally, coal tar is used in various industries, including paints and coatings, paving roads, steel and aluminum production, and energy storage. Those working with roofing tar, coal-tar enamels, pavement tar, refractory bricks, and other coal-tar coatings are at risk of skin absorption and inhalation of chemical vapors.

- Coal tar pitch is also used as a binder and impregnating material in asphalt products, paving, roofing, and coating materials. In the chemical industry, coal tar pitch is used as a solid fuel, carbon raw material, and feedstock for carbon fiber, carbon composites, activated carbon, and graphite electrodes. The use of coal tar in various industries raises concerns regarding potential health hazards, particularly the presence of carcinogens such as benzene. Coal tar providers offer various grades, including Anthracene Oil Fraction, Tar Oil, and Wash Oil, for different applications. The market for coal tar and coal tar products is diverse, with applications ranging from industrial development to the space industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Coopers Creek Chemical Corp. - The company specializes in the production and supply of coal tar and related products, including Coal Tar, Coal Tar Pitches, and Coal Tar Pitch Cutbacks.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Epsilon Carbon Pvt. Ltd.

- Ganga Rasayanie Pvt. Ltd.

- Himadri Speciality Chemical Ltd.

- Indian Tarcoal Co.

- Italiana Coke Srl

- Jalan Carbons and Chemicals

- Koppers Holdings Inc.

- Metinvest BV

- Mitsubishi Chemical Group Corp.

- National Aluminium Co. Ltd.

- Nippon Steel Corp.

- Palriwal Industries Pvt. Ltd.

- POSCO Holdings Inc.

- Rain Carbon Inc.

- Shree Shyam Chemicals

- Spectrum Laboratory Products Inc.

- Tata Steel Ltd.

- Thyssenkrupp AG

- Voestalpine AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Development and News

-

In July 2023, Indian Oil Corporation Limited (IOCL) began commercial production of coal tar pitch at its Barauni refinery, enhancing its product offerings in the sector.

-

In 2023, the global coal tar market was valued at approximately USD 12.3 billion and is projected to reach around USD 18.4 billion by 2032, indicating a compound annual growth rate (CAGR) of 4.5%.

-

In 2020, the coal tar market size was USD 14.38 billion and is expected to reach USD 18.64 billion by 2028, registering a CAGR of 3.2%.

-

In 2024, the coal tar market is estimated to grow by USD 2.32 billion from 2025 to 2029, with a CAGR of 2.7%.

Research Analyst Overview

Coal tar, derived from the destructive distillation of coal, is a vital industrial material used across multiple sectors. Its fractions, including Coal Tar Creosote, Binders and Impregnating Grades, Special Grade Coal Tar, and Coal Tar for Roofing, support applications in aluminum production, road construction, and industrial coatings.

Coal tar pitch is a key binder in asphalt paving and refractory materials, while coal tar-based products play a crucial role in carbon composites, activated carbon, and graphite coatings. The rising demand for carbon black further boosts its significance in the rubber and chemical industries. Additionally, coal tar is widely used in medicinal formulations and hair care products.

With growing industrial needs, the demand for high-performance coal tar derivatives continues to rise, reinforcing its importance in construction, manufacturing, and energy applications.

Further, coal tar pitch is used as a binder in the production of roofing sealants and graphite electrodes. It is also used as a raw material in the production of non-ferrous and steel metals, carbon electrodes, and various chemical production processes. Coal tar is also used in the production of carbon raw materials for various industries. Petroleum coke, a byproduct of petroleum refining, is sometimes used as a substitute for coal tar in the production of anodes and cathodes for electric arc furnaces. Coal tar is also used as a raw material in the production of carbon black, a key component in the production of tires. Despite its widespread use, coal tar and its derivatives have been the subject of controversy due to the presence of carcinogens, such as benzene, in the production process. However, advancements in technology and production methods have led to the development of safer and more efficient processes for the production and use of coal tar and its derivatives. In conclusion, coal tar is a versatile chemical derivative with a wide range of applications in various industries.

|

Coal Tar Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.7% |

|

Market growth 2025-2029 |

USD 2.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

China, India, Japan, South Korea, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch